Depot review September 2023 - September presents itself as always as a spoilsport and delivers the 4th negative September in a row for my portfolio

September is

is statistically the worst stock market month and also in the September 2023 this statistic proves to be true again.

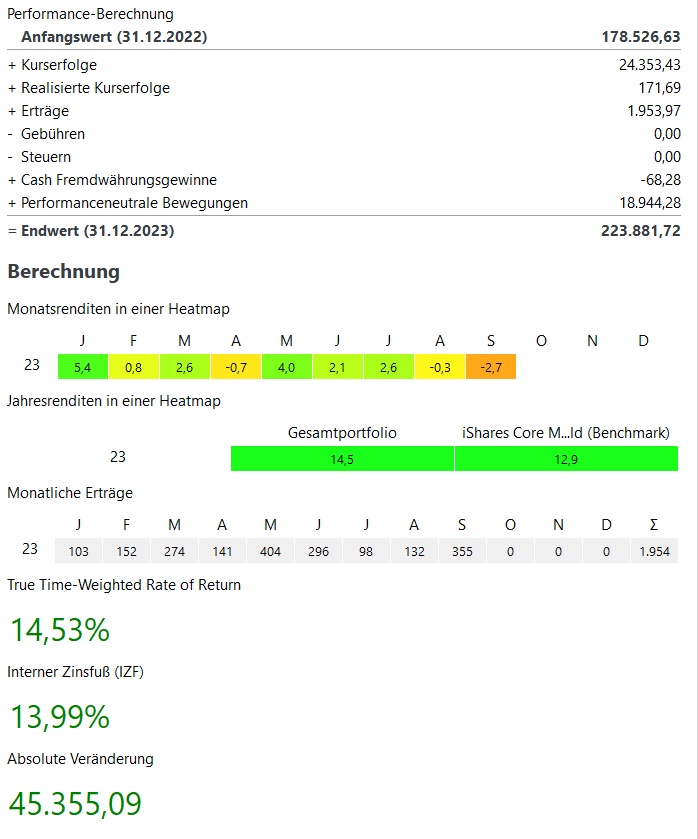

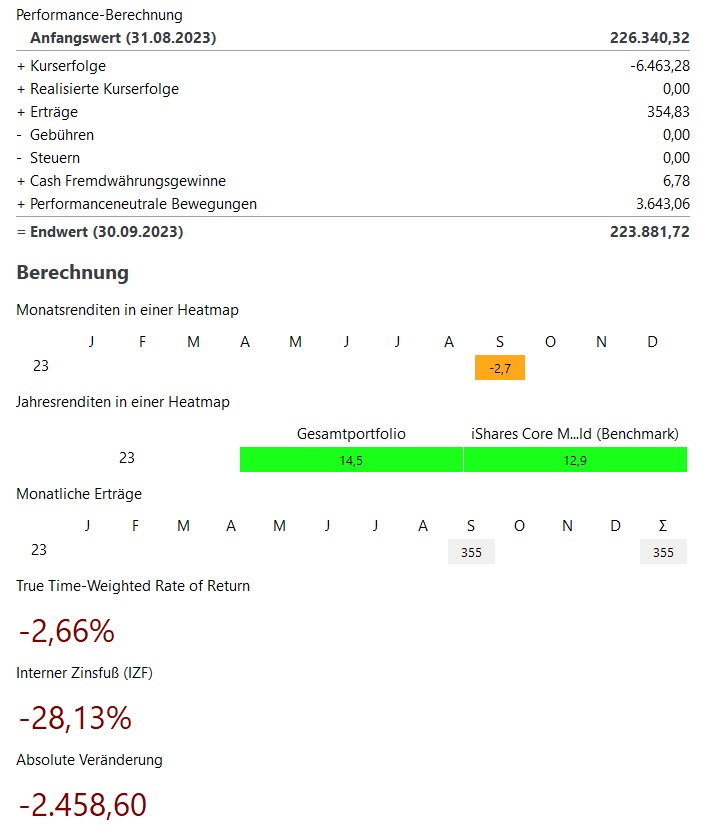

In September my portfolio with -2.7%, my portfolio had a clearly negative performance. In contrast to September 2022 with -6.0% but a less bad development.

In the current year, my performance is thus only +14,5%but still above my benchmark (MSCI World +12.9%).

Nevertheless, this beats losses in the amount of ~6.500€ in September. in September. The biggest loser in September was NVIDIA $NVDA (-0,03%) with over €1,100. Also Sartorius $SRT (-3,3%) and ASML $ASML (-0,38%) with a negative development.

On the plus side, there is not much positive in September, the best performance was still Amgen $AMGN (+2,01%) with almost +8% and ~400€ price gains.

In total, I bought again in September for ~€2,500. In addition, there was a premium refund of over € 2,000 from my private health insurance for the year 2022 (this will be followed soon by a separate article including my investment strategy in relation to the private health insurance).

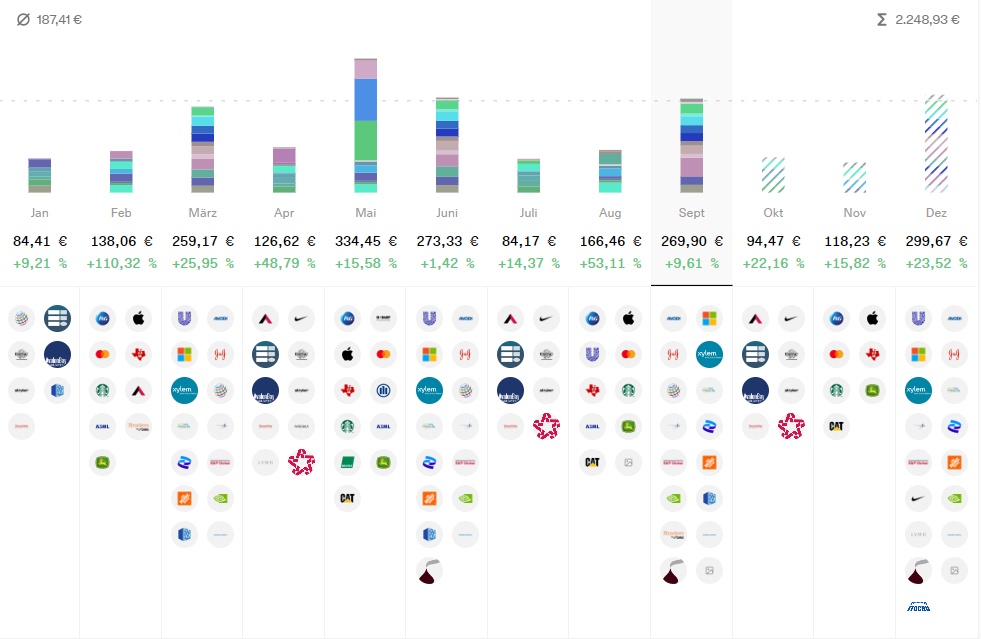

In total, my deposit thus stands slightly below the previous month at ~224.000€. This corresponds to an absolute increase of ~45.000€. in the current year 2023. ~24.000€ come from price increases, ~1.950€ from dividends / interest and ~19.000€ from additional investments.

Nevertheless, there is a shortfall of almost 15,000€ in price gains to make up for the ~38,000€ in price losses from 2022.

Dividend:

- The dividend comparison to the previous year is slightly more difficult this month, as Unilever paid out in August instead of September as usual and my Japan ETF will pay out in September instead of August.

- Thus the dividend is +10% above the previous year. Including the Unilever dividend, it would be approx. +28% and +20%, respectively, if my Japan ETF had paid out in August as before

- In the current year, dividends are up +26% after 9 months over the first 8 months of 2022 at ~€2,000

Purchases & Sales:

- Bought in May for ~2.500€

- Executed mainly my savings plans:

- Blue ChipsDeere $DE (-2,8%) NVIDIA $NVDA (-0,03%) ASML $ASML (-0,38%) MasterCard $MA (+0,88%) Republic Services $RSG (+2,48%) Lockheed Martin $LMT (+3,53%) Thermo Fisher $TOM2 (-1,7%) Itochu $8001 (+0,85%) Northrop Grumman $NOC (+1,36%)

- GrowthSartorius $SRT (-3,3%) Synopsys $SNPS (-2,03%)

- ETFsMSCI World $XDWD Nikkei 225 $XDJP and the Invesco MSCI China All-Shares $MCHS

- Crypto: Bitcoin $BTC and Ethereum $ETH

- Sales there were none in August

With October now follows a statistically positive stock market month, which, however, can also tend to very strong downward swings (1987, 2008)

On average, however, October is about +0.5%. In my portfolio, October was positive in 2022 and 2021, but negative in the 3 years before (2018-2020).

What do you guys expect for October and especially the 4th quarter? Year-end rally, sideways trend or yet again significantly lower prices?