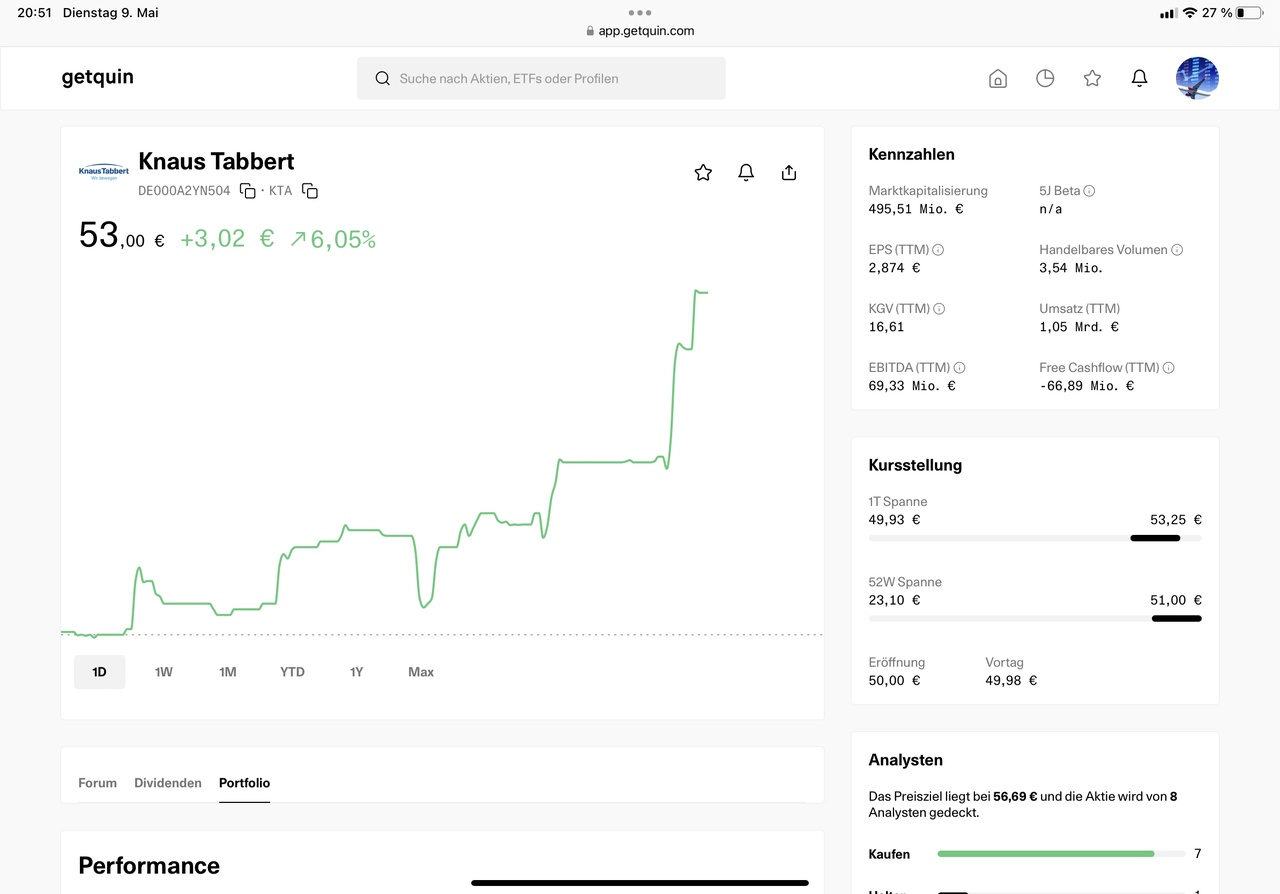

Massive dividend raise from Knaus Tabbert $KTA (+7,27%)

very happy I accumulated a lot of stocks earlier this year. Very nice growth of my yearly dividend income.

Messaggi

10Massive dividend raise from Knaus Tabbert $KTA (+7,27%)

very happy I accumulated a lot of stocks earlier this year. Very nice growth of my yearly dividend income.

The $KTA (+7,27%) AG successfully closed the 2023 financial year with an increase in consolidated sales of 37.3% to EUR 1,441 million. The company's adjusted EBITDA rose by 76.4% to 123.8 million euros. Knaus Tabbert is proposing a significant increase in the dividend to 2.90 euros per share. For 2024, the company expects stable development at a high level. The strong growth was largely driven by the high availability of chassis and the multi-brand strategy. The Group generated sales of EUR 1,274.3 million in the premium segment and EUR 166.8 million in the luxury segment. The Knaus Tabbert share price was EUR 40.08 at the time of publication of the news and has not changed compared to the previous day. 24 minutes after the article was published, the price stood at EUR 40.28, which corresponds to an increase of +0.50% since publication.

Knaus Tabbert $KTA (+7,27%) Ends the 2023 financial year with the strongest sales growth in the company's history

Consolidated financial statements for 2023 including the forecast for the 2024 financial year will be published on March 28, 2024

Current development in Q3 of $KTA (+7,27%)

As every Sunday, the most important news and dates of the coming week. Either as text or the dates of the coming week as video: https://youtube.com/shorts/JEoKwvPYoGQ?feature=share

Monday:

New CEO Blume plans to restructure the $VOW3 (-2,26%) Group. The focus of the restructuring will be on the volume brands Skoda, VW and Seat as well as the subsidiary Audi. Development work is to be consolidated more closely in order to leverage synergies. At the same time, production is to be better utilized. This means that Skodas could also be produced at VW's main plant. Savings are also to be made in purchasing, which is likely to put further pressure on suppliers. In addition, fewer models are to be offered overall. The aim is to achieve savings of around EUR 5 billion and use the money to reposition the company in the important markets of China and North America.

https://goldesel.de/Artikel/volkswagen-vor-konzernumbau

Direct investments in #china 🇨🇳 increased again in May compared with a year earlier. By 2.2% to around EUR 70 billion.

https://tradingeconomics.com/china/foreign-direct-investment

Tuesday:

The #inflation in Germany 🇩🇪 declines by 0.2% in May compared with the previous month. This had been expected. On an annual basis, the HICP (EU-wide comparable) falls to 6.3%, which was also in line with expectations.

dpa-AFX ProFeed

Inflation day, consumer prices from the U.S. 🇺🇸 looked like this: Inflation drops to just 4.0%. Analysts had expected 4.1%.

Wednesday:

$SHEL (-1,61%) Raises dividend by 15%, buys back shares for $5 billion (if approved), and invests more in low-emissions business. What is clear is that profits are unlikely to be as high as last year for a while.

https://goldesel.de/Artikel/hier-gibt-es-eine-deutlich-hoehere-dividende

The U.S. Federal Reserve 🇺🇸 is leaving the #leitzins unchanged at 5.00 - 5.25%. However, the key interest rate projections were increased. In an initial reaction, this did not go down well on the stock market.

dpa-AFX ProFeed

Thursday:

For the first time in two years, producer prices in agriculture are falling again. In particular, grain and fruit is significantly cheaper than a year ago. Overall, producer prices for agricultural products fell by 6.5%. Food prices could therefore soon fall again, or rise less sharply. However, the dam blowing up in Ukraine could cause the price of grain to rise again in the medium term.

The #ezb has raised the key interest rate again, to four percent now. So there are no real surprises. Lagarde also emphasizes that there are currently no plans for an interest rate pause like at the Fed. The ECB's inflation expectations have been raised. Which makes further interest rate steps more likely.

https://app.handelsblatt.com/finanzen/geldpolitik-ezb-hebt-die-zinsen-erneut-an/29207708.html

Friday:

At the Capital Markets Day presented $KTA (+7,27%) remarkable growth expectations. The Group aims to double sales to around EUR 2 billion by 2027. Annual growth is expected to be 16 - 18 %. At the same time, the EBITDA margin is to rise to over 10% through economies of scale, and the focus is on cash flow. Knaus Tabbert is not a classic growth stock, but also pays a handsome dividend. In the future, 50% of the surpluses according to IFRS (international accounting standards) are to flow into this.

https://goldesel.de/Artikel/16-18-wachstum-jedes-jahr

Building permits in Germany continue to slump. This should come as less of a surprise, as interest rates have risen further as a result of the central bank's increases. Permits for single-family houses slumped 33.5% year-on-year to 18,300, while those for two-family houses fell 52.1% to 5,300. There was also a 27.1% decline in apartments to 48,200. This will probably create a gap of 700,000 housing units for 1.4 million people looking for a home by 2025. Profiteers are likely to be real estate groups such as Vonovia, where we recently bought a position. In our view, Vonovia is profiting from this development, but not causing it. Do you see it the same way?

The most important dates for the coming week:

Monday: 12:00 Monthly Report Bundesbank (DE)

Tuesday: 3:15 Interest rate decision (China)

Wednesday: 8:00 Inflation data (UK)

Thursday: 9:30 Interest rate decision (Switzerland)

Friday: 9:30 Purchasing Managers' Index (DE)

Thanks for creating this challenge @Michael-official .

Over the long weekend it had me again in my vacation region to Lower Bavaria to visit good friends. In addition to very good hiking and biking trails, but there are also beautiful lakes in between, outside Passau. So with a fancy car from $SIX2 (+0,13%) drove again to my favorite place. However, the photo is from last year.

In addition, one of my favorite stocks is located here $KTA (+7,27%) . Unfortunately never made it in so far, but have had a lot of good beers with staff. 😂

If this continues with $KTA (+7,27%) then I can soon buy myself a motor home 😂 Memo to myself

Memo to myself: next time buy Airbus shares 🛩️ 🚁

Good evening dear community,

since the depot is so nice and green again today, I thought it was about time for my #gewinnerdestages is.

so, drum roll: -> Zack, Boom 💥 it is with about 5% Knaus Tabbert $KTA (+7,27%)

The southern German motorhome manufacturer, whose products are guaranteed everyone has ever (at least unconsciously) to face 😉.

Entered at the beginning of November at 28 euros near the bottom, I am today almost 80% up. The nice thing is that the party is probably not over yet. Recent price targets of 70€, full order books, a P/E ratio of currently 16 and otherwise also healthy company key figures probably let me stay with it for quite some time, if not years. We'll see... 😉

I am actually a bit proud of Knaus Tabbert in my portfolio, as it has finally paid off to watch the market here.

At the end of October/beginning of November 2022, there was massive insider buying by the board. So I took a closer look at the stock and found out that the company, which is still young on the stock market, had to suffer a lot from the Ukraine conflict. There were massive problems with the suppliers, so that they simply couldn't meet the really high demand due to a lack of chassis.

However, the company's management has done its homework and has been able to win a few more new suppliers, so that there is now a strong diversification of suppliers.

That's what makes the stock market fun! 🚁

Have a successful and healthy week 😊

Hello dear community,

I wanted to ask you for the valuation of the $KTA (+7,27%) share.

The company seems to be making its record earnings of more than 1 billion in sales, according to individual media reports. I personally am up 40% on the stock. And I wanted to ask how you guys evaluate the future of the stock. The analyst's assumption and predictions were never true for this stock.

LG

Quarterly figures on Valentine's Day (14.02.23)

From Coca-Cola to SFC Energy and AirBNB ⤵️

Today there were again some quarterly figures that are very interesting for us investors. The numbers are one thing but how are the outlooks. On the outlooks we can otherwise like to go into the comments times, from the companies that are interesting.

The consumer figures from the U.S., were not quite so convincing today.

USA: Consumer prices in January +6.4%. Expected +6.2% after +6.5% in the previous month (y/y).

USA: Consumer prices (core rate) in January +0.4%. Expectations were +0.4% after +0.3% in the previous month (m/m).

Perhaps the figures will make us a bit more positive again:

$ABNB (-6,51%)

Airbnb:

Beat analyst estimates of $0.25 in fourth-quarter earnings per share of $0.48. Revenue of $1.9 billion beat expectations of $1.86 billion.

$KO (+1,1%)

The Coca-Cola Co:

Hits analyst estimates with fourth-quarter earnings per share of $0.45. Revenue of $10.1 billion above expectations of $10.01 billion. In the outlook for 2023, Coca-Cola expects organic revenue growth of 7% to 8% (analyst forecast: 7.15%).

$SZU (-0,09%)

Südzucker:

Expects fiscal 2022/2023 group sales of 9.5 billion euros (ate forecast 9.7-10.1 billion), group Ebitda of 1-1.04 billion (old 0.89-0.99 billion), and group operating profit of 640-680 million (old 530-630 million).

$JEN (-0,92%)

Jenoptik:

Expects sales of 1.05-1.1 billion euros and an Ebitda margin of 19-19.5 percent for fiscal year 2023. The forecast is based on preliminary sales in fiscal 2022 of around 980 million euros (last forecast 945-960 million).

$MAR (+1,62%)

Marriott International Inc:

Surpassed analyst estimates of $1.83 in fourth-quarter earnings per share of $1.96. Revenue of $5.92 billion exceeded expectations of $5.39 billion.

$RBD

Restaurant Brands Intl Inc:

Missed analyst estimates of $0.74 in the fourth quarter with earnings per share of $0.72. Revenue of $1.69 billion exceeded expectations of $1.67 billion.

$MTUAY

MTU Aero Engines:

Achieves 2022 revenues of €5.33 billion (PY: €4.188 billion, analyst forecast: €5.405 billion), Ebit (adjusted) of €655 million (PY: €468 million, €633 million), Ebit margin of 12.3% (PY: 11.2%, forecast: 11.7%) and net profit (adjusted) of €476 million (PY: €342 million, forecast: €455 million). Proposed dividend 2022 at €3.20 (PY: €2.10, forecast: €2.90). In the outlook for 2023, MTU Aero Engines now expects a higher revenue growth of 10 % and for 2025 still an Ebit (adjusted) of approximately €1 billion (forecast: €1.00 billion).

CFO: Expect 2023 Ebit (adjusted) of €775 to €750 million. Dividend payout ratio for 2023 to increase to 40%. Will have to deal with share buyback issue from 2024.

$KTA (+7,27%)

Knaus Tabbert:

Achieves 2022 consolidated group sales of €1.050 billion (PY: €863 million) according to preliminary figures (driven by strong growth spurt in Q4).

$F3C (-1,36%)

SFC Energy:

2022 sales of €85.2 million (PY: €64.3 million), Ebitda (adjusted) of €8.2 million (PY: €6.2 million) and Ebit (adjusted) of €3.2 million (PY: €1.9 million). For 2023, the company expects revenues of €103 bid €111 million and Ebitda (adjusted) of €8.9 to €14.1 million.

$NEM (-0,52%)

Nemetschek:

Achieves fiscal 2022 revenue and profitability targets, 2022 revenue growth of +17.7% (+12.1% at constant currency) to €801.8 million, 2022 Ebitda growth of +15.8% to €257.0 million, 2022 Ebitda margin at 32.0% (PY: 32.6%), detailed 2022 figures and 2023 outlook on March 23.

$CEC (+0,81%)

CECONOMY:

Reports 1st quarter sales of €7.1 billion (PY: €6.85 billion, analyst forecast: €7.1 billion), Ebit (adjusted) of €224 million (PY: €274 million) and net income of €127 million (PY: €122 million). Forecast 2022/2023 confirmed. CECONOMY sells majority stake in Mediamarkt Sweden to Power International; in return CECONOMY receives 20% stake in Swedish subsidiary Power Sweden from Power International.

$TKA (-3,23%)

ThyssenKrupp:

Reports 1st quarter order intake of €9.2 billion (PY: €10.4 billion), sales of €9 billion (PY: €9 billion, analysts' forecast: €9.1 billion), EBIT (adjusted) of €254 million (PY: €378 million, forecast: €174.6 million) and net income of €75 million (PY: €106 million). Outlook for 2022/2023 confirmed.

#quartalszahlen

#boerse

#börse

#aktien

#news

#newsroom

#community

#communityfeedback

#nachrichten

#täglich

#investieren

#wirtschaft

#politik

#inflation

#fed

#rezession

#cocacola

#ceconomy

#thyssenkrupp

#mtu

#knaustabbert

I migliori creatori della settimana