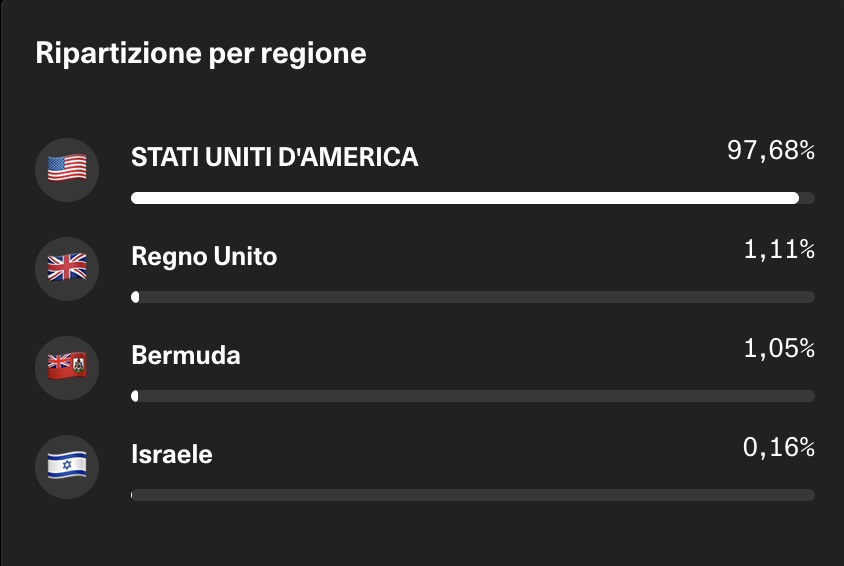

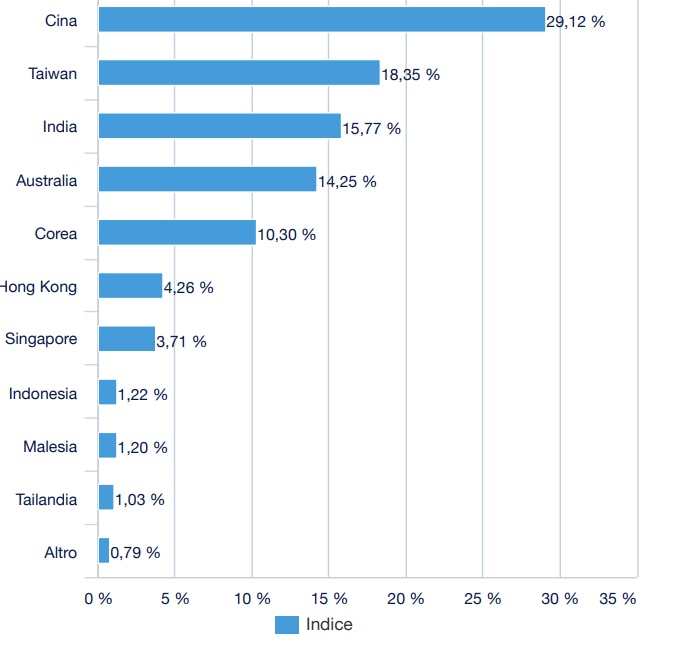

$AEJ (+1,4%) is listed light image below: It's wrong?

On JustETF, I think, is listed correctly (second image)

Messaggi

5$AEJ (+1,4%) is listed light image below: It's wrong?

On JustETF, I think, is listed correctly (second image)

What I had planned to do:

Besides the $VWCE (+0,68%) which is my largest position in the portfolio so far, the ETF's $SMEA (+0,41%) & $AEJ (+1,4%) with a higher savings rate.

This approach is going according to plan. Due to a significantly higher salary as a result of completing my training, I am only changing the size of the savings plan here.

I just want to achieve the same buy-in here. However, to be honest, this is only for an optical reason.

Some shares have clearly exceeded the 10% limit.

I have been saving large amounts of money in the stock itself since November 24. At least until I started thinking about portfolio management and investment strategies.

As a result, Apple was the top position in my portfolio during the slump.

It is now in second place with 20% of the portfolio. But that doesn't look so good due to the red figures.

I have set up a savings plan for this, which I pay into weekly with a small amount.

The aim is to reduce my buy-in and this has worked well so far, from over 12% down to 8% down.

The share has been in my portfolio for some time, but has been in the red for a long time.

I had decided to $MSFT (+1,17%) & $SIE (+0,03%) to sell. Both shares have generated good returns and I have been happy with them so far. So I thought "why not?".

I reinvested this money and wanted to reduce my buy-in of the Telekom share. Let's see how that goes.

I don't have much to say about the rest of the individual stocks. You can take a look at the portfolio yourself and ask any questions you may have.

Just a few months ago, I decided to split my salary at the end of the month on a percentage basis. This means that part of it goes into the custody account, part into the vacation account and part into the reserve account.

As I said, I was never taught how to handle money. This approach didn't work out at all.

Money came in -> money was divided up -> I ran out of money -> money was transferred back.

That sucks.

The only thing I never touch is the deposit. The custody account reminds me to grow financially and what my actual goals are. In addition, there are fees when selling, or the red numbers of the course: "if I sell now I have the amount "XY" REALLY made a loss.

Hence the attempt:

To put the portion of my vacation money into the Gerd Kommer ETF every month. $GERD (+0,1%) every month.

If the money is invested. I can't blow it. Even if the attempt fails and I go down 10%. In the end, it's still more than nothing.

In an emergency, I can also sell a single share and buy or sell it afterwards at a good price. If the timing is bad for a partial sale.

Overall, I can't get rid of the feeling that I should at least give it a try. I've been thinking about it for a while now.

I'm just still unsure whether the accumulating ETF was the wiser decision.

Thanks for reading and for your attention :)

Hi, since I find it really interesting to look at other portfolios, I thought I'd share mine as well.

My story: I'm 20 years old, started a savings plan on an ETF for the first time in November 2024 and then decided to invest in cryptos for a short time. I was never really taught how to handle money. For the first 2 years of my training, I had my account in the red for all sorts of shit. Thanks to a second job, I was able to afford a savings plan with ETFs and individual shares worth €600 for a few months as an apprentice. Now that this is no longer the case, I've made the decision to invest in ETFs and (in my opinion) expensive shares such as $SIE (+0,03%) or $MSFT (+1,17%) to save.

I buy everything else when the price drops and have a good feeling about it for the time being.

I always have this "Mr. Market" example from Warren Buffet in the back of my mind.

In addition, I had considered setting a limit of 10% per individual share in the portfolio to reduce the risk of extremely falling prices.

This $VWCE (+0,68%) was my first savings plan and I'm actually really happy with it so far, except that with a 60% share from the USA, it has given me a bit of a stomach ache over the last few months.

However, because my entire portfolio consisted of American shares. I was able to learn relatively quickly that you should diversify your portfolio across more continents.

In the end, I opted for $SMEA (+0,41%) and $AEJ (+1,4%) in the end.

Over the next few months, I will be saving in both with a higher savings rate than the $VWCE (+0,68%) to balance out all 3 in percentage terms.

At the end of the love story, I would say that I got off lightly with a 3% loss.

What do you think? I'm really looking forward to hearing the different opinions.

My savings plans for March were added🐸

50€ $IWRD (+0,6%)

50€ $O (-0,65%)

25€ $AAPL (+1,98%)

25€ $MCD (-0,04%)

25€ $ISPA (-0,23%)

25€ $NVDA (+0,6%)

25€ $AEJ (+1,4%)

25€ $FLXI (+1,04%)

Looking forward to the €3000 mark soon 💪🏼

Hello community!

My question relates to my ETFs

The $VWCE (+0,68%) is and should be my number 1, I also have $AEJ (+1,4%) and $MEUD (+0,51%)

Are the other two superfluous and do I put all my money in the $VWCE (+0,68%) ?

Thanks for your opinions and have a nice weekend!

I migliori creatori della settimana