Hello dear community,

I've been investing for a little over a year now and have learned a lot during this time. I've tried things out and looked for my strategy. It was important to me to just get started before thinking about it and wasting time working on the theory.

- My goal: to accumulate as much money as possible in the long term in order to have enough money at the age of ~40 (currently 23). "Fuck-You-Money" and not be dependent on anyone and be able to live off investment income at some point.

- Medium-term goal: in 2030: 100K securities account

- Short-term goal: to complete a bachelor's degree in finance in 2026

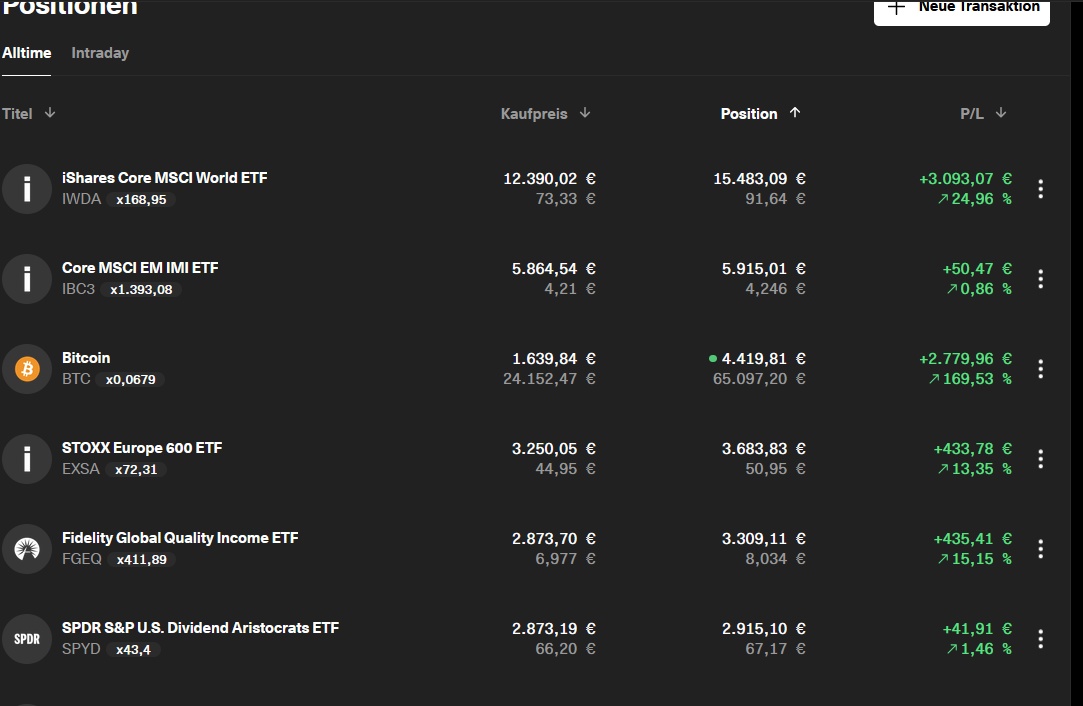

Net worth:

- 17K cash

- 7.5K gold (physical)

- 1.5K silver (physical)

- 12K securities account

- 1.2K crypto

Bottom line: just under 40K total capital

Now that I have searched for my strategy, I have found it and would like to pursue the following: a portfolio consisting of 65% ETFs and 35% individual stocks

30% $FGEQ (+0,27%) Fidelity Global Income (distributing)

15% $VUSA (+0,59%) S&P 500 (distributing)

10% $IBC3 (+3,26%) MSCI Emerging Markets IMI (distributing)

10% $IMEU MSCI Europe (distributing)

35% Individual shares

In terms of individual stocks, I want to focus on stocks that appeal to me (whether growth or value). Do my own analysis, form an opinion and enjoy seeing people on the street who consume the products I am invested in and who therefore pay my dividend.

I am fully aware that some people say that I should go for accumulating products as I age. Yes, I could do that. But in Austria it doesn't make sense from a tax point of view and psychologically it's always fun when dividends are paid out into your account. In addition, many people think that you should only switch to distributing products once you reach a certain age and then change over. I will save myself the trouble of switching because I have been invested in distributors from the outset.

Now I would like some constructive input from you.

- In your opinion, does it make sense $IWDA (MSCI World) and $VHYL (All World Dividend) and put everything into the $FGEQ (+0,27%) which I will save in from now on? Or would you keep these positions?

- How would you manage the overweight in precious metals? (Largely gifts)

- How would you bring the high cash holdings into the market? (Keep 5-6K nest egg)

Crypto will definitely be liquidated this year and reallocated to the portfolio.

Further education and increasing human capital will be pursued on the side anyway.

Many thanks for your ideas and feedback in advance!