Disclaimer: No investment advice or recommendation, this article is for information purposes only. Before you decide on an ETF, take a closer look at it in terms of positions

take a closer look at positions, sampling, regions, etc. I can't describe all of this

I can't describe everything, as it would go beyond the scope of this article

Part 1 (definition, categories & Z-score and quality factor): https://getqu.in/RCSY4a/

Part 2 (Value ETF): https://getqu.in/Nfnhqb/

Part 3 (Low Volatility ETF): https://getqu.in/Ub7KpG/

Part 4 (Momentum ETF): https://getqu.in/CNMgGw/

Part 5 (Small and Growth ETF): https://getqu.in/0NoqmW/

What are dividend ETFs?

Abbreviated what dividends are, since everyone here probably knows this: distributions by a company to its shareholders, the amount is usually voted on at the annual general meeting and is usually paid out of profits, but does not have to be (if it is paid out of the substance, this is often counted as a bad indicator).

Dividend ETFs are therefore primarily ETFs that distribute the dividends paid by companies to the ETF holders; they are also referred to as distributing ETFs (Dist.). In contrast, an accumulating (Acc.) ETF uses the dividends to buy more shares, i.e. it reinvests.

Because the dividend ETF distributes money, I get cash flows back from my investments, usually on a quarterly basis. These ETFs are celebrated - especially on social media - as a form of passive income and have their advantages but also disadvantages, which we will examine in more detail below.

Dividends as a value premium (CAPM /French Fama model)

Short recap (in more detail in part 5): French Fama's 3 factor model raises beta (volatility), size- and value-premium as factors to determine the expected return of an investment. Dividends are not explicitly mentioned as a factor, but they are indirectly included in the value and beta factors, as a company must first be able to afford to pay dividends.

must first afford to pay dividends. Growth and small-cap companies

often do not yet pay dividends, as the revenue generated is used for more growth

growth or the balance sheets are not yet as sustainable. Dividend payers often have a stronger balance sheet, which makes them less volatile to changes in interest rates, for example (although this reduces the expected return according to the CAPM). Exceptions are high dividend payers, which are often riskier and reward investors with a high dividend for holding the share.

The fact that dividends also count as a quality factor can be clearly seen in the dividend aristocrats. These are companies that have been paying dividends continuously for 25 years and increase them annually. This makes them particularly attractive, which is why they can also be invested in via individual products such as the $SPYD (-0,84%) are investable.

Dividends are also included as a valuation factor in the Quality ETF as a positive valuation criterion (see also Index Methodology Part 1)

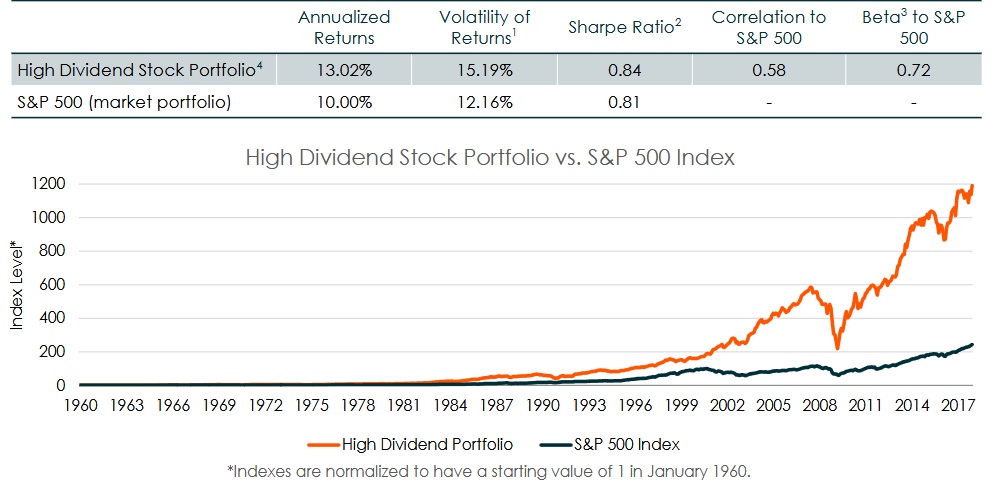

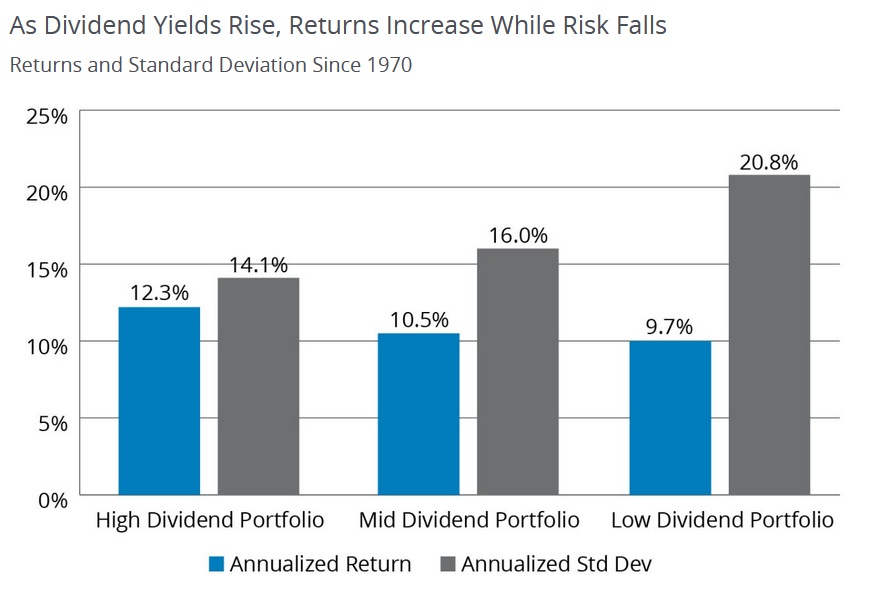

Historically, several studies for the US market show an outperformance of dividend stocks, especially even high dividend payers:

https://www.hartfordfunds.com/insights/market-perspectives/strategic-beta-etfs/what-drives-dividend-stock-performance.html

https://www.globalxetfs.com/content/files/High-Dividend-Stocks-In-Rising-Interest-Rate-Environments.pdf

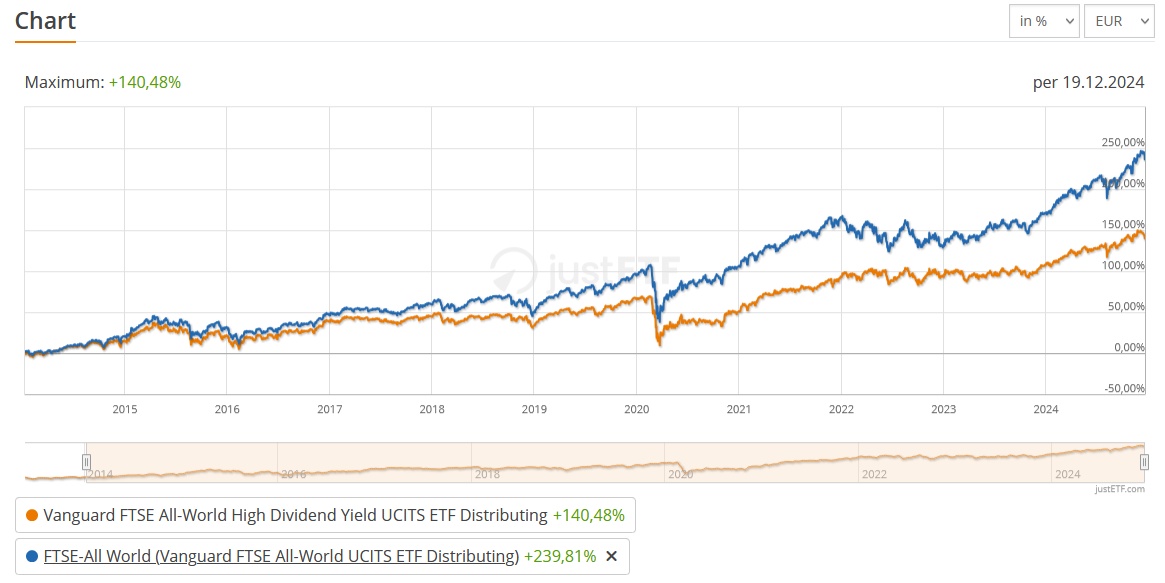

In the recent past, however

However, high-dividend stocks have underperformed in the recent past, with the ACWI High

Dividend has significantly underperformed the MSCI ACWI over the last 10 years (- 100 %).

Classes of dividend ETF?

In my view, dividend ETFs can be roughly divided into 3 categories:

- Dividend as a windfall: The focus of the ETF is not on dividends, but some companies are included in the index that pay dividends and these are then distributed to the holder. A classic example is the dividend-paying $VWRL.

- Quality dividend: The focus is on achieving dividends, but these are accompanied by quality factors such as dividend aristocrats or quality dividend ETFs

- High Dividend: The highest dividend yields are targeted here, whereby quality factors may play less of a role.

Why high dividend yields can be a problem

Unfortunately, I have often overheard conversations that sound like: "VW is so cheap, you get a 10% dividend yield, you can't go wrong". But that brings us to the problem of high dividend yields, because these are often a signal of structural weakness in the company and/or a sharp fall in the share price. If the dividend yield remains at this level, this could seriously jeopardize the company's long-term financial strength. If the dividend yield remains

and is even reduced, the original investment case is invalidated.

So even if the unsystemic individual risk in ETFs often "diversifies away", it is important to take another look at the largest positions and check whether this is not a structurally weakening company.

Advantages of dividends

In addition to the potential value premium mentioned above, dividends fulfill a different purpose at an individual level, depending on the stage of life: for most people reading this, this purpose is likely to be psychological, as they are not dependent on the cash flow from dividends.

cash flow from dividends. The dividends are then a nice motivational effect and

offer the "peace of mind" of a steady income even in the event of market setbacks

and therefore less worry about declining book profits.

Once you have reached an advanced age, the dividend offers a high comfort factor. This means that there is often no need for rebalancing or a withdrawal plan, as would be the case with accumulating ETFs. The dividends are then used as additional income for retirement; of course, withdrawals can also be made, but not to the same extent as would be necessary with accumulating ETFs.

would be necessary.

Disadvantages of dividends

Taxes! Because payments are distributed to the holder, capital gains tax, solidarity surcharge (26.375% in total) and, if applicable, church tax are also due. This tax is first deducted before I can reinvest the dividends, and reinvesting the dividends costs extra (even with neobrokers via the spread between the ask and bid price). Dividends therefore have a detrimental effect on the compound interest effect of the ETF's profits.

Although accumulating ETFs have been brought somewhat into line with dividend ETFs in terms of taxation with the advance lump sum taxation, they still offer the advantage that the tax burden is always lower than for dividend payers (if the dividend ETF has distributed less than the advance lump sum, an advance lump sum is also charged).

Another negative aspect that goes hand in hand with the above is market timing. Often not every small dividend is reinvested directly, but accumulated until, for example, EUR 1,000 is reached in the clearing account. If the market has then run away, you wait for a setback and may miss the entry or at least lose the lost performance where the money was sitting in the settlement account without earning interest.

account without interest. There is also more work involved in the savings phase due to the necessary reinvestments.

Tax comparison high-dividend vs accumulating (example 2024)

Assumption that the tax-free amount has already been exhausted

Investment amount: 100,000

ETF1: Vanguard FTSE ACWI High Dividend ($VHYL (-0,49%))

ETF2: iShares MSCI ACWI ETF ($ISAC (+0,14%) )

Tax Burden High Dividend:

Price at the beginning of the year: EUR 57

Shares: 100,000 / 57 = 1,754.39

Dividend per share: EUR 1.94

Absolute dividends: EUR 3,403.51

Partial exemption ratio: 30%

Tax (26.375 %) = EUR 628.38

Tax burden accumulating ACWI

Fund value at the beginning of the year: EUR 100,000

Prime rate 2023 (for 2024): 2.55%

Base yield (70%): EUR 1,785

Partial exemption rate: 30%

Up-front lump sum: EUR 1,249.50

Tax (26.375%) = EUR 329.56

There is a tax disadvantage of around EUR 300, which is thus withdrawn from compound interest.

For whom are dividend ETFs worthwhile?

In summary, the disadvantages of strongly dividend-oriented investing outweigh the advantages for me. Of course, there are many shades of gray between focusing on high dividends and reinvesting. Dividends as an addition - especially as they often come with a premium - make perfect sense, but the explicit focus on high dividends can be dangerous and has tax disadvantages.

Dividend ETFs are therefore primarily for investors who want to generate income regardless of the current market phase and appreciate the stability of the cash flow. If the dividends also ensure that you can sleep better at night when the market fluctuates and are not tempted to panic sell, then the small tax disadvantage is no reason not to invest.

the small tax disadvantage is no reason not to invest in dividends. Also

It also has its charm to have a less intensive withdrawal phase in old age.

withdrawal phase. So if you are emotionally affected by market fluctuations, appreciate regular income and are convinced of the dividend premium (as part of the value premium), then dividend ETFs are just right for you.

👉Dividends-ETFs:

Performance comparisons incl. dividends

$VHYL (-0,49%) (World | TER 0, % | Tracking Difference -0.04 % | DivRendite 3 %| EUR 5 bn invested volume | 3Y underperformance vs. MSCI World - 5 %pt | 5Y underperformance vs. ACWI - 30 %pt | 10Y underperformance vs. ACWI -100%pt)

- Index methodology: Based on the FTSE All-World Index, which includes large and mid-cap companies from developed and emerging markets worldwide. REITs are excluded. Companies are sorted according to the expected 12-month dividend yield and the stocks with the highest dividend yield are selected. The aim is to achieve around 50% of the market capitalization of the original index and then to weight these companies according to their size in the index.

$TDIV (-0,61%) (World | TER 0.38 % | TD 0.47 % | Div yield 4.3 % | EUR 1.2 bn invested | 3Y outperformance vs. ACWI + 18 %pt | 5Y underperformance vs. ACWI - 7 %pt | 8Y underperformance vs. ACWI - 38%pt)

- Index methodology: Screening for consistent dividend payers with ESG relevance. Weighting by dividend max. 5% per share and max. 40% per sector. Selection of 100 stocks with the highest dividend yield. Semi-annual rebalancing

$SPYD (-0,84%) (US | TER 0.35 % | TD -0.07 % | Dividend yield 1.5 % | 3.5 bn invested | 3Y underperformance vs. S&P 500 -23 %pt | 5Y underperformance vs. S&P 500 - 63 %pt. | 10Y underperformance vs. S&P 500 - 283%pt.)

- Index methodology: Includes components of the S&P Composite 1500, then selects for companies with the highest dividend yield whose dividends have been increased for the last 20 consecutive years. Furthermore, minimum requirements for market capitalization and liquidity of the share must be met. Maximum weighting per share 4%.

$SPYW (+0,05%) (Europe | TER 0.30 % | TD -0.35 % | DivRendite 3.7 % | 3Y underperformance vs.

Eurostoxx 600 - 1 %pt. | 5Y underperformance vs. Eurostoxx 600 - 24 %pt | 10Y underperformance vs. Eurostoxx 600 - 28 %pt.)

- Index methodology: Based on the S&P Europe Broad Market Index, companies must have increased or maintained stable dividends for 10 consecutive years, selection of the 40 companies with the highest dividend yield and weighting accordingly. Max. 5 % per share, 30 % per country/sector.

Conclusion - what remains: A balanced strategy with dividends as an admixture can make sense, whereby the focus should be on quality dividends rather than high payouts.

#smartbeta

#etf

#dividende