After a bad start into the week, the $CL2 (-1,07%) has a BANGER start today and is up 2,32% so far.

Hope you guys enjoy the green as much as I do!

#stocks

#investing

#finance

#freedom

#dividends

#investingjourney

Messaggi

56After a bad start into the week, the $CL2 (-1,07%) has a BANGER start today and is up 2,32% so far.

Hope you guys enjoy the green as much as I do!

#stocks

#investing

#finance

#freedom

#dividends

#investingjourney

My new main positions in ETFs ($TDIV (+0,29%) and $WINC (-0,38%) ) will be gradually built up over the next few months through deposits / transfers from other asset classes. However, I now have the opportunity to switch my existing savings plan to 'something else'. And here I am fulfilling a long-awaited wish:

The Holy Amumbo 😅 - $CL2 (-1,07%)

Is it smart to start the paper as a savings plan when the stock market is on fire? No, probably not. I've just always wanted it and have had it on my watchlist for ages.

On the other hand, you have to BELIEVE in saints! If it goes wrong and you go to hell, it's probably because you didn't believe in it hard enough.

It will take forever until a significant sum is accumulated in the savings plan anyway.

[Image material AI generated with Loveart.ai, modified with Photoshop]

Hi guys,

I'm 20 years old and about to finish my apprenticeship. My monthly savings rate is currently around 1,000 euros, which I earn additionally through a mini-job. As I still live at home, I have hardly any running costs and can therefore save consistently.

My aim is to have a long-term investment horizon so that I can withstand major price fluctuations. That's why I invest around 25% of my savings rate in the $CL2 (-1,07%) to benefit specifically from growth opportunities.

The overweighting of the USA is of course a risk / bet on this market.

I would be pleased if you could give me an assessment of the portfolio.

Today I got rid of some of my winners and shifted further into my ETFs.

I have sold:

$CL2 (-1,07%) +5% this fine ETF, also known as holy amumbo, will be rebuilt right next week via savings plan.

$TXRH (+0,57%) +13% whether this will not become a tenbagger in the long term and was therefore a stupid sale?

$JPM (+0,55%) +20%

$V (+1,04%) +25%

$CAT (+1,49%) +26% I suspect that we are at the end of the cycle here. But who knows for sure?

$LULU (-1,5%) -10% good numbers, very bad chat history, but at least it saved me some taxes.

$RKLB (+7,92%) +28% This stock always made me think of Peter Lynch's quote, "don't buy the stocks of rocket companies, buy the boring ones..."

Bought:

$VWRL (+0%) at €129.48 🥱

and

$EQQQ (-0,61%) at 481.75 € 😎

Hi dear GQ community,

After some back and forth. And learning and getting advice, I have finally finished my portfolio.

I have now divided it up as follows:

At this point, first of all a huge thanks to @Epi and to @SemiGrowth for your patience and advice regarding the 2xSpytips strategy and the improved version of the 2xSpytips Cool strategy.

As follows, I have now restructured my portfolio today:

B&H strategy:

$IWDA (-0,04%) -> 25% -> Broad diversification

$O (+0,39%) -> 20% -> Dividends

$EIMI (+0,23%) -> 10% -> emerging markets

$BTC (+1,88%) -> 10%

2xSpytips-Cool-Strategy:

$CL2 (-1,07%) -> 35%

I think I will do better in the long run with this portfolio than with the previous one. I can also sleep well with this one.

I follow both strategies so that if the 2xSpytips-Cool strategy is no longer profitable or doesn't perform well for whatever reason, I don't lose 100% of my investment.

And now it's your turn, I'm curious what you have to say and please stay objective 😊😅.

I had described here https://getqu.in/wtMaho/ described an investment reserve that can generate an excess return with similar or lower volatility than the overall market.

Very abbreviated:

We hold 20% in cash bonds and gold and start buying in reset, pyranized with increasing leverage.

What has changed since the last post?

1. all US bonds and US dollar cash have been removed from the portfolio, the uncertainties surrounding the Mar-a-Lago Accord are simply too great in relation to the opportunity to take a few percentage points in currency gains.

2. as it was (rightly) pointed out that the strategy is somewhat fragmented, I decided to make a few small adjustments.

The inflation-linked government bonds have left the portfolio. On reflection, money market funds and long-dated bonds are completely sufficient to compensate for inflation. (thanks for the comment @SchlaubiSchlumpf )

The investment reserve therefore looks like this:

-------------------------------------------

EURO

30.0% Money Market $CSH2 (-0,01%)

30.0% German Gov. Bonds 7+Y $X03G (-0,08%)

-------------------------------------60%

Swiss Franc

20.0% Swiss Gov.Bonds 7-10Y $CH0440081393 (+0,17%)

-------------------------------------20%

Swiss Gold

20.0% Gold $EWG2 (+0,78%)

-------------------------------------20%

==========100%==========

3. on the way south, the portfolio has already been rebalanced twice.

In concrete terms, this means that bonds have been sold and the $VWCE (-0,05%) bought so that the 80/20 ratio is maintained.

The $ACWI in USD broke through the threshold of 10% to its all-time high today, whereby the first still leveraged position was built up.

Purchased were:

2.5% MSCI World Ex USA $EXUS (+0,35%)

1.0% MSCI USA 2x $CL2 (-1,07%)

This means that the first 17.5% of our investment reserve is now invested.

The next purchase will be made when the $ACWI 20% away from the ATH, which would then be around $100.00

I'm slowly being tempted to open the first tranches here and add monthly if it continues to fall. Anyone else? $CL2 (-1,07%)

(see @Epi )

The TIPS indicator is extremely positive, but the S&P 500 is clearly below its SMA.

This makes the first month with this strategy the worst since 2000, nice.

Previously the maximum drawdown was -18.9%, now it is just over -20%.

I have already warned that the strategy may not be as robust as expected, but I will continue to stick with it. I have also experimented a bit to limit the drawdown (e.g. selling at -15% within a month directly in the month and not at the end). However, this led to a significantly worse performance, as it was surprisingly often the case that the index was higher at the end of the month.

I probably have a few more months now (on average SPYTIPS is 3.88 months out of the market), maybe I can think of something else.

Here are the general stats again:

CAGR: between 16-18%pa (with money market funds)

max drawdown: -20%

Beta vs SP500: 0.91

Alpha vs SP500: approx. 8%pa

Avg time in market: 5.96 months

Avg time out market: 3.88 months

Profit probability of an in market period: 79%

Avg profit in an in market period: 15%

the money now goes into $XEON (-0,01%)

Foreword:

An investment reserve can be a great thing, it smoothes out volatility and in extreme phases you have the opportunity to implement something meaningful in your portfolio, which has a very calming effect psychologically.

Unfortunately, the expected additional return from buy the dip often fails to materialize, as the opportunity costs eat everything up again.

Very nicely described here by Gerd Kommer:

https://gerd-kommer.de/buy-the-dip/

But what if we turn a few screws, don't hold our investment reserves in cash and buy leveraged?

I have thought too much about this topic and built a model for a war chest, which I am also implementing myself.

Building up the reserve:

Investment Reserve

-------------------------------------------

EURO

30.0% Money Market / 0-1y Bonds EUR $CSH2 (-0,01%)

30.0% German Gov. Bonds 7+Y $X03G (-0,08%)

-------------------------------------30%

Swiss Franc

20.0% Swiss Gov.Bonds 7-10Y $CH0440081393 (+0,17%)

-------------------------------------20%

Swiss Gold

20.0% Gold $EWG2 (+0,78%)

-------------------------------------20%

==========100%==========

The reserve must be structured in such a way that it is not torn apart in a crisis. In the best-case scenario, parts of the reserve should even rise during crises.

This is why part of it consists of government bonds; in economic crises, interest rates are generally lowered, which is why long-term bonds should rise.

As inflationary phases may well occur, I have decided to include gold, especially as gold has a low correlation with equities.

The total of 30% in money market funds exists in order to have a volatility-free position.

This reserve is not a standalone, it should be seen as part of a global portfolio and can make up between 10% and 30% of the total portfolio.

It is not intended to generate returns, but merely to compensate for inflation and to remain stable in value during crises.

The strategy:

As an anchor point we use the all-time high of the $ACWI (USD) from -10% we invest step by step. We try to buy the ACWI with increasing leverage. As there is no 2x ACWI, FTSE All-World, MSCI World or similar, we have to build our own as best we can. I only try to use ETFs and ETCs as long as this is practical, as they have no counterparty risk.

Mode 1 ACWI -10% - Lev. 1.28x - Correction

5.0% MSCI USA 2X Lev. $CL2 (-1,07%)

12.5% World ex USA $EXUS (+0,35%)

-------------------------------------17,5%

Mode 2 ACWI -20% - 1.55x Lev - Crisis

5.0% MSCI USA 2X Lev. $CL2 (-1,07%)

4.5% Euro Stoxx 50 2X Lev. $LVE (-0,11%)

1.5% FTSE 100 2X Lev. $LUK2

3.0% Japan $PRAJ (+1,77%)

6.0% Emerging markets $EIMI (+0,23%)

-------------------------------------20,0%

Mode 3 ACWI -30% - 1.68x Lev - Escalation I

12.5% MSCI USA 2X Lev. $CL2 (-1,07%)

6.0% Euro Stoxx 50 2X Lev. $LVE (-0,11%)

2.0% FTSE 100 2X Lev. $LUK2

4.0% Japan $PRAJ (+1,77%)

5.5% Emerging markets $EIMI (+0,23%)

-------------------------------------30,0%

Mode 4 ACWI- 40% - 3x Lev. - Escalation II

32.5% MSCI ACWI 2x Lev. $null (+1,56%)

-------------------------------------32,5%

==========100%==========

Rebalancing

After the crash is before the crash, the investment reserve must be replenished.

After the price has recovered a distance of approx. 60% from the low to the top (ACWI), I would recommend selling all MSCI ACWI 2X Lev. positions and thus filling the reserve.

You can then fill the rest of the reserve with your savings rates and partial sales of the 2x positions.

Since we do not put the return from this "trade" completely back into the bond, but keep a part of the "Do-It-Yourself-Leveraged-Getto-ACWI", we build up a small leverage over time, at favorable conditions.

Problems and risks:

Especially if it goes down further than 50%, things can get ugly.

In the 2019 financial crisis, for example, we would have made -58%. As a result, the recovery would have taken 1 year longer than if we had bought a normal ACWI. However, in all other corrections (including Corona), we would have come out of the crisis better with this strategy and would have generated an annual outperformance of 1-2% p.a. after tax (varies depending on the period).

In long bull markets, without significant corrections, this strategy underperforms. In sideways markets, we should outperform a 100% equity portfolio due to the interest income.

It is not entirely clear which part of the investment reserve will be sold first and which last. Depending on the nature of the crisis, some shares may rise and others may fall.

If it is a debt crisis, for example, it may not be wise to sell your gold right at the beginning. If it is an economic crisis, long-dated bonds are king, although inflation-linked bonds will probably suffer somewhat.

If you don't want to be caught on the wrong foot here, you can always sell 50% of the best-performing asset and 50% of the worst-performing asset at the same time.

Which wouldn't be a good thing if we had two cycles in quick succession before we had the opportunity to rebalance.

Colorful pictures:

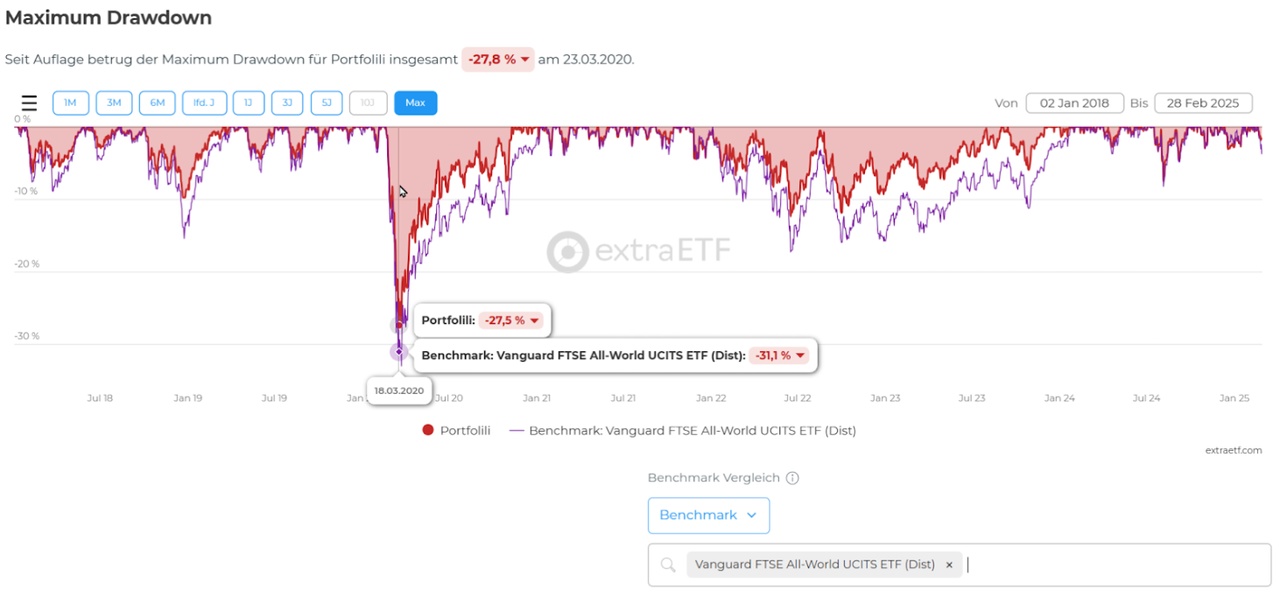

I have recreated the period from 01.01.2018 to 01.01.2025 in ExtraETF.

Unfortunately, you can't currently share the portfolio there, which is why I've used a few screenshots here.

I chose this period because I am familiar with it and it had both negative and positive interest rates. In addition, there were a total of 3 drops of more than 10% and a bond crash.

Note during the negative interest rate phase, the portfolio held no bonds (except the inflation-indexed ones) and instead held negative interest cash.

Here you can see a

100% FTSE-All World $VWCE (-0,05%) vs

80% FTSE-All World + 20% investment reserve.

Maximum Drawdown VS FTSE-All World

Although we buy leveraged products, the maximum drawdown is lower, at least as long as it does not go lower than approx. 35%.

The meme for Sunday (even if it's not Sunday):

I have created an 80% FTSE All-World + 20% Reserve portfolio starting 01.01.2025 and will continue to maintain this, so everyone can see the real performance of this module. And of course I will update you when we are down 10%.

What do you think of the pyramized investment reserve and the Do-It-Yourself-Leveraged-Getto-ACWI?

Hello everyone,

Who knows the $CL2 (-1,07%) and what do you think of it?

I've had it for 5 years now and so far it has performed mega well.

I would be grateful for any feedback.

Greetings

I migliori creatori della settimana