A joint analysis by V-Bank and the Institut für Vermögensaufbau provides fascinating insights. More than 53,000 custody accounts managed by 170 independent asset managers were examined. V-Bank is a custodian bank that holds the securities and carries out transactions on behalf of the asset managers.

The first thing that stands out is that index funds (ETFs) now dominate when it comes to equity vehicles. While actively managed equity funds account for a good eight percent of portfolios, more than eleven percent are invested in equity ETFs. The situation is different for mixed funds or bond vehicles. Here, the professionals still rely on the skills of fund managers, i.e. actively managed products.

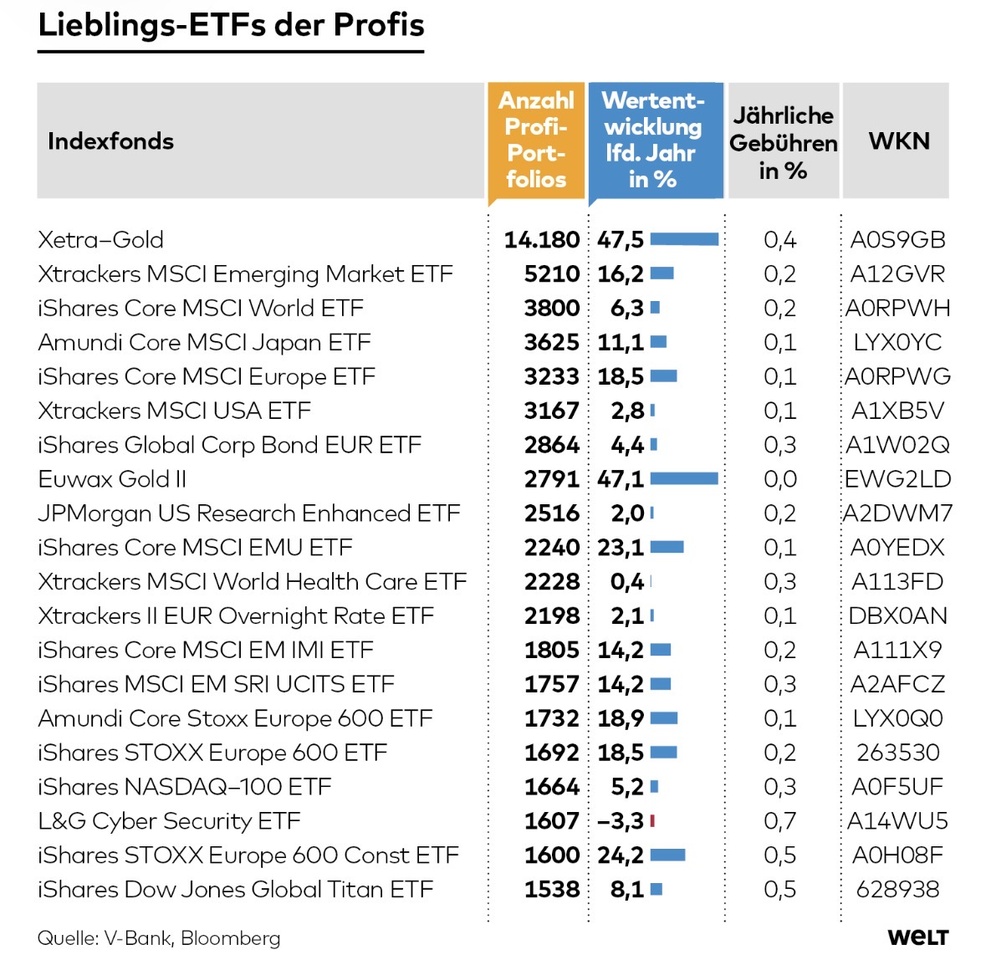

When selecting their products, the professionals rely on the large, liquid battleships of the ETF world with low costs from well-known providers. The logic behind this is simple and consistent: maximum diversification at minimum cost. The ongoing charges of the favorites are usually between 0.07 and 0.20 percent. Special sustainability criteria hardly play a role in the choice of ETF.

One thing is striking in the construction of the underlying investments. In their global index funds, the professionals do not rely on combined products that combine industrialized countries and emerging markets in one ETF, such as the MSCI All Country World or the FTSE All World, but prefer to invest separately in the MSCI World and the MSCI Emerging Markets and can thus mix the two components individually. The advantage: the emerging markets are weighted very low in the combined products, and this problem can be better addressed by the professionals' strategy.

Gold is a must for the professionals. It is not high-tech shares or exotic theme funds that dominate the professional portfolios, but the oldest safe haven in financial history. Xetra-Gold is by far the most frequently represented product: the ETC is held in 14,180 professional portfolios. Alternatives such as Euwax Gold II can also be found thousands of times over. And the courage to be safe has been rewarded. While traditional stock markets only made moderate gains in 2025 - the iShares Core MSCI World is up around 6.3% - gold shone with an impressive performance of 47.5%. The message is clear: in uncertain times, gold is not jewelry, but a foundation.

To stabilize the overall portfolio, asset managers are also turning to bonds. Around 28% of assets are invested in bonds, preferably in corporate bonds with good credit ratings. In the ETF segment, the iShares Global Corporate Bond EUR is in the top 20, combining a defensive approach with current yields. In the current year, the ETF has made 4.4 percent, while many bond products are in the red. In the money market, the Xtrackers II EUR Overnight Rate ETF is the most popular ETF product. The principle of balance applies to currency risk: although the euro dominates at 53%, the US dollar is a key component of the hedge at 34%.

In the end, the professionals' figures do not tell a story of hectic changes of direction, but one of structure, cost awareness and clear priorities. Gold serves as both a protective shield and a yield driver. Equities are broadly and favorably represented via global, US, emerging market and Japanese indices. Fees are consistently kept low. And ETFs and ETCs are playing an increasingly important role: almost 20 percent of customer funds are now invested in these instruments - and the trend has been rising since 2023.

This is a reassuring realization for the overburdened private investor. There's no need to reinvent the wheel. A look at the books of the professionals shows that it is often the simple, cost-effective and broadly diversified solutions - supplemented by a good portion of gold - that point the most reliable course in a storm.

$4GLD (-1,32%) | $EWG2 (-1,14%) | $CSEMU (-0,26%) | $EIMI (+1,74%) | $MEUD (+0,33%) | $EXSA (+0,26%) | $XMME (+1,71%)

Source text (excerpt) & graphic: World, 20.12.25