Hello everyone,

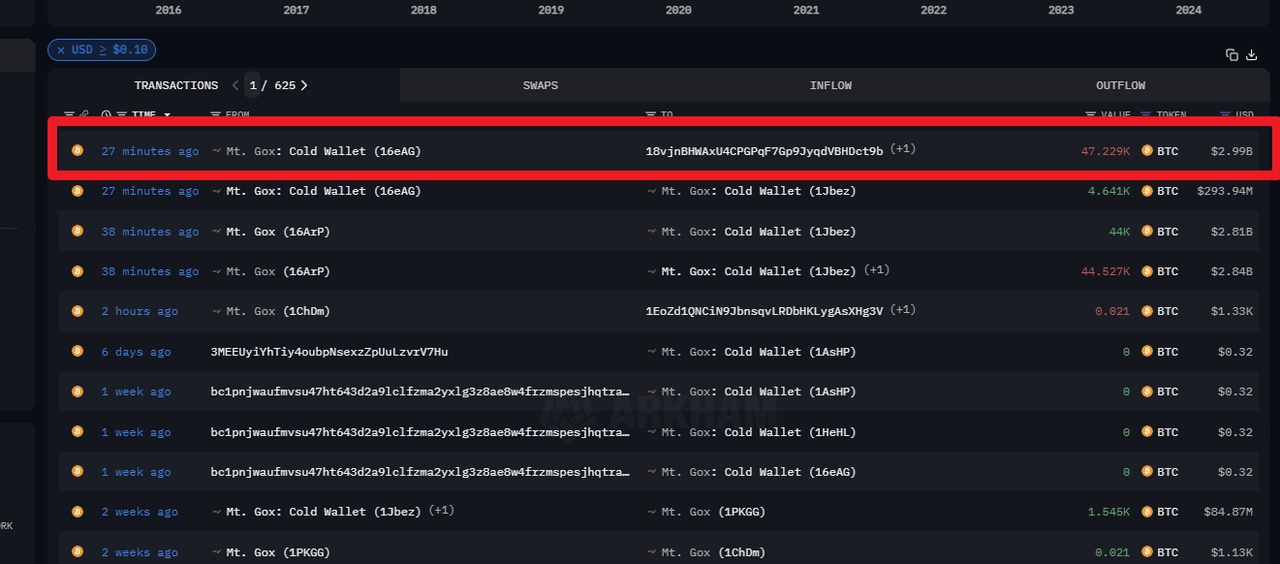

after my extra post on the topic #krypto there is a continuation today.

The text is long. But I only exist in long.

First a short summary.

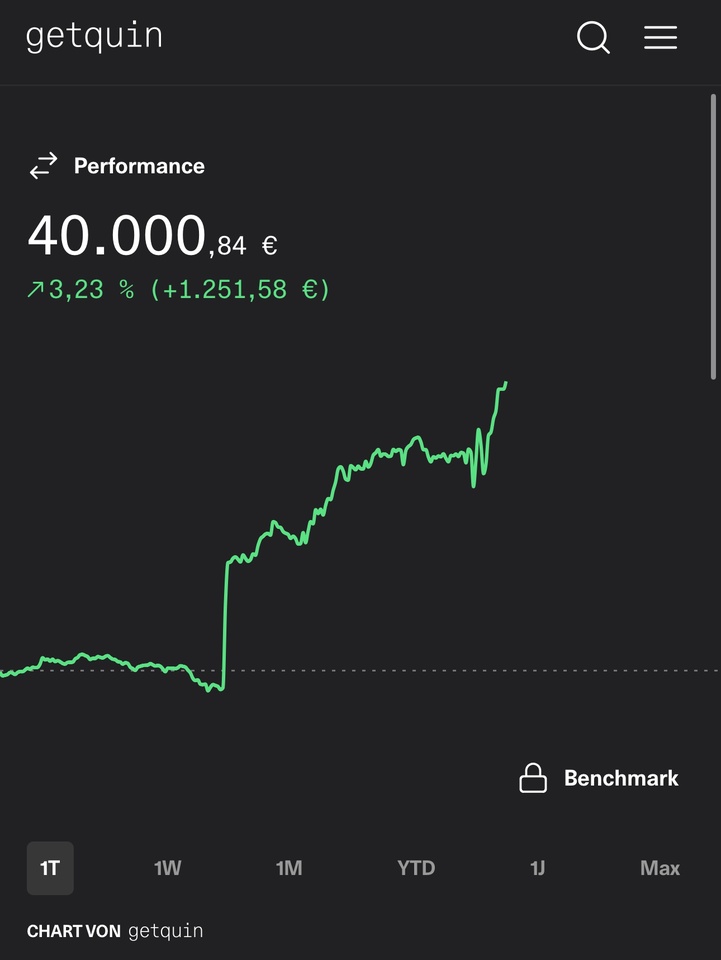

In the current bull market, I will gradually sell all my crypto holdings according to plan and invest the proceeds in dividend-paying stocks (or perhaps even ETFs) in a separate portfolio in order to gradually accumulate new holdings again in the coming bear market with the help of the distributions.

The reason why I am taking this approach is that, with the exception of $SOL (-0,37%) all my holdings are tax-free, as the holding periods have expired and I can let the entire profit work for me. Reparking in stable coins is out of the question for me. I play this strategy because I see a connection between the debt cycle and the crypto cycle, which in my opinion are related as in the article below. You are welcome to read my reasons and assumptions again.

Please note that this is not investment advice or recommendation. All I did this Sunday afternoon was get the crystal ball out of the cupboard and try my hand at fortune telling. I will almost certainly be wrong somewhere.

In today's second part, I will discuss the price exit targets for altcoins and other thoughts. I divide my cryptos into four groups.

Group 1: "The big ones"

Price exit line for ETH

$ETH (-0,03%) is for me one of the few coins that can still achieve a higher ATH than the big leader $BTC (+0,12%) . However, we can clearly see that ETH has underperformed against BTC so far, with a downward trend. That's why I don't trust it to reach the target of $10K. With BTC I have seen a multiplier of 7-8x from the last bear market to the current bull market, here with ETH I see less as it is underperforming. From the last ATL to the top in February we have roughly a 3.8x increase. Now we are still below the February high. That's why I think that 4x (to 5x at the very most) is the end. As a result, I have set exit levels of 3.8K, 4K, 4.2K and 4.4K. This puts us below the last ATH, but as I said, I simply don't trust the coin anymore, as it seems to be constantly losing against BTC. What speaks against my thesis is ETH's dominance in what it is intended for and a possible future through staking.

Price exit line for SOL

$SOL (-0,37%) has already proven brilliantly that it seems to be winning over the crypto investor. In this coin, I've put the remnants of my seemingly infinite loss from the $DFI (+34,32%) / DUSD debacle in the hope that Solana's performance will somehow enable me to recoup some of it. Certainly not everything, but a little. And that has worked out quite well so far. I'm up 40% and expect even more here. Solana is the only coin I have that has already exceeded the old ATH, which is why I believe it can reach a higher level in the bull market. However, my calculation method (as with the following coins) does not work for this one. I therefore have to choose levels based on gut feeling and have set them at $350/400/450 and 500. The coin can certainly rise even further, but I simply lack the ability to calculate a level somehow.

Group 2: "The remains of liquidity mining"

Price exit line for BCH

Yes, my portfolio also contains $BCH (+1,32%) again. This was one of the two coins with which I gained experience in liquidity mining at CakeDefi. With little money, which then became even less due to the exit from the LM pool (but there were even more worthless DFIs). I was very impressed in the spring when this coin fought its way to $700. Looking at the overall chart, we can see that the ATHs have become smaller and smaller. That will also be the case this time. First just under 3.9K, then 1.5K. In other words, less than half of the rise. And I expect something similar again. Half would then only be just above the March high. That's why I'm positioning myself here at 650, 700 and 750. Maybe I'll be happy to get rid of the crap and throw them all out of the portfolio at once. Back then I was more convinced of LM than I was of the DFI ecosystem. Today, for me it's just worthless junk that will definitely be thrown out. The good thing is that I bought the coin in several tranches during the bear market and added it to the LM; my performance is now already at +280% (since "retrieving Cake").

Price exit line for LTC

And what is the name of the other coin that is no longer any good and suffers from the same disease as BCH? Of course the $LTC (-0,47%) . Both used to be hard forks. But in contrast to BCH, this one has not performed at all for me. Only +4% (measured since the retrieval of Cake, it's too complicated for me to determine that with the previous one because of the daily rewards at the time). LTC has made another higher top, but that won't happen again now. I'm sure of that. I don't even see the 200 USD. I'll be out at 150 at the latest and I'll throw everything on the market right away. After all, the coin has already doubled this year since the August low and there's certainly not that much air left in the balloon.

Group 3: "Convincing use cases for me"

Price exit line for LINK

$LINK (-0,88%) was a project that convinced me of its use case at the time. In times when I still believed in use cases for crypto and before I learned and understood the crypto cycle and before I realized that crypto (despite its advantages) is a zero-sum game. I bought Link with the next coin I'm about to list at around USD 10. Later, things continued to go downhill and I added more. This one is in the green zone for me at +95%. So today I am pleased. If we look at the maximum chart, we have a cycle ATH so far. So my method is not working here either. But I'm sure that we won't get to the old one, or is anyone still talking about this coin? At USD 20, 22 and 24 it's out for me.

Price exit line for UNI

In $UNI (-1,92%) I went in at the same time as $LINK (-0,88%) in spring 2022 and also topped up at the same intervals. I also liked the use case here at the time. A decentralized exchange. I found it very interesting back then how the whole thing works with liquidity pools and I still find it somewhere today. Nevertheless, this coin will also be removed from my portfolio. My performance here is slightly worse than with Chainlink, only +40%. And looking at the overall chart only gives me the opportunity to estimate I'm taking my cue from the previous one and scaling down. I liquidate at USD 16, 18 and 20.

Group 4: "For whatever reason..."

Price exit line for DOT

I just can't remember why I bought $DOT (-2,16%) bought. Same goes for the one time top up. Again, I plan to exit at $20. I've invested even less here, so I'll get everything out at once. Performance to date +40%.

Price exit line for MATIC/POL

$MATIC (-3,73%) I bought and added together with Polkadot and don't remember my intention to enter here either, but I think I promised myself a ride on the wave here. Want to get out at $1 here. All at once. My performance here is still negative at -50%.

Further thoughts and additions

Anyone who has read this far will have realized that I have undergone a transformation in my crypto journey. At the beginning, I only bet on the two big ones, then the DeFi world came along for me, at the same time two use cases convinced me and finally I simply bought two in the hope that they would rise (fortunately only with small play money).

When I was involved in CakeDefi back then and tried my hand at staking and liquidity mining, I simply wanted cash flow. The thought still lives in me, but I'd rather have it in FIAT currency. It just makes it a lot easier with tax. Withholding tax and that's it, it couldn't be simpler. I also got to know leverage at Cake with the borrow. It was a great story when you could immediately exchange mined DUSD for DFI and then leverage it again or put it into LM with BCH and LTC. But I didn't see the warning sign when the possibility of immediate exchange disappeared and then came the stabilization fee. I should have been out of the game by this point, I'd more or less paid the penalty. I won't do that again. What remains, however, is that I want to reinvest cash flow for free and try my hand at a small securities loan in times of even lower interest rates.

You can also see that I used to believe in use cases, but today I no longer believe in them at all. Even better, I exploit these use cases to make a profit. That's why I made my last investment in Solana with the Cake-Restern (and also with deposit money from found returnable bottles). I believe that there are others who see a future in Solana and am therefore getting in to take the exit liquidity that the newcomers bring with them.

For me, the only thing that matters now is the belief in the crypto cycle, coupled with the debt cycle. Please read the first post again, where I set out my assumptions.

Ultimately, my journey with equities and ETFs is much more exciting and even more complex. That is my main focus. For me, BTC is an admixture, and the rest of crypto is just crap. Of course, this looks very different through the eyes of someone who lives in Africa and can't get a bank account.

And now I wish us all good prices so that you too can take profits.