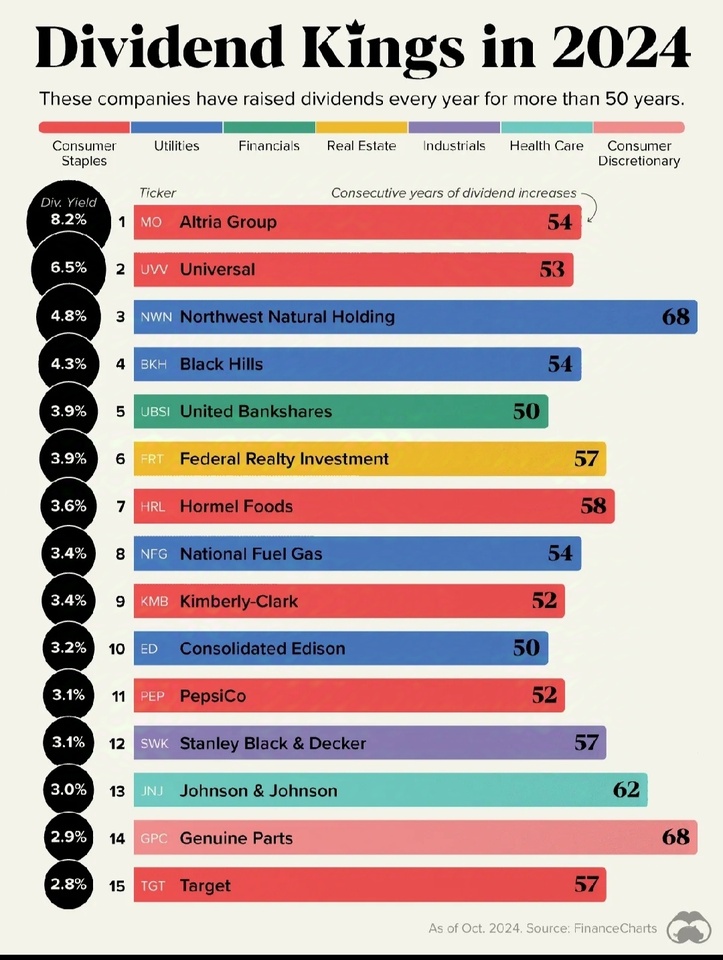

Why is it called "Dividend Kings" and not "Dividend Queens 👑"? 🤔

$NWN (+0,72%)

$UVV (-0,89%)

$BKH (-0,39%)

$UBSI (-0,74%)

$SWK (-2,49%)

$FRT

$GPC (+0,57%)

Messaggi

19Why is it called "Dividend Kings" and not "Dividend Queens 👑"? 🤔

$NWN (+0,72%)

$UVV (-0,89%)

$BKH (-0,39%)

$UBSI (-0,74%)

$SWK (-2,49%)

$FRT

$GPC (+0,57%)

$SWK (-2,49%) | Stanley Black & Decker Q3'24 Earnings Highlights:

🔹 Adjusted EPS: $1.22 (Est. $1.05) 🟢

🔹 Revenue: $3.75B (Est. $3.8B) 🔴; DOWN -5% YoY

🔸 Adj Gross Margin: 30.5% (Up 290bps YoY)

Narrows FY24 Guidance:

🔹 Adjusted EPS: $3.90-$4.30 (Est. $4.20) 🟡

🔹 GAAP EPS: $1.15-$1.75 (Prev. $0.90-$2.00)

🔹 Free Cash Flow: $650M-$850M (Reiterated)

Q3 SEGMENTS:

Tools & Outdoor:

🔹 Sales: $3.26B; DOWN -3% YoY

🔸 Organic Revenue: DOWN -2% (North America: -4%, Europe: +1%, Rest of World: +6%)

🔸 Adjusted Segment Margin: 11.1% (Up 180bps YoY)

🔸 Growth in DEWALT offset by weak consumer and DIY demand.

Industrial:

🔹 Sales: $488M; DOWN -18% YoY

🔸 Organic Revenue: DOWN -1%

🔸 Adjusted Segment Margin: 13.9% (Up 170bps YoY)

🔸 Aerospace growth offset by weakness in automotive markets.

Financial Metrics:

🔹 Operating Cash Flow: $286M

🔹 Free Cash Flow: $200M

🔹 SG&A Expenses: 21.2% of sales (vs. 20.1% prior year)

🔸 Adjusted SG&A Expenses: 20.8% (vs. 19.3% prior year)

Strategic Initiatives:

🔸 Executing a Global Cost Reduction Program, targeting $2 billion in pre-tax cost savings by 2025, with $1.5 billion from supply chain improvements.

🔸 Achieved $105M of cost savings in Q3, contributing to cumulative $1.4B savings since program inception.

🔸 Supply Chain Transformation improving margins and supporting growth investments.

I sold the dividend king Stanley B&D. It was not bad in the meantime with a price gain of almost 20% and 4-5%, but I sold the stock with a 7% gain.

I don't think the share will do well in the future, as retailers will also buy less here.

I'd rather invest this money in other shares 😉

+++ New price targets for you 🎯 +++

As already announced this morning, I would like to present my new course targets in time for the sunny weekend ☀️ new course targets.

I have also lowered some existing targets further. downwards which you are welcome to include in your considerations.

As some people do not agree with the course targets, I would still ask you to consider the reality recognize the reality. ~Thank you!

-New price targets:

$COIN (-3,83%) 35.00 $

$MARA (-4,38%) 2.50 $

$SBUX (-1,15%) 42.00 $

$ETH (-0,92%) 800.00 $

$RI (-2,05%) 15.00 $

$META (+0,4%) 90.00 $

$1211 (-1,07%) 3.50 $

$AVGO (-1,21%) 300.00 $

$AMD (-2,45%) 30.00 $

$CRM (-0,17%) 51.00 $

$BA (-2,23%) 60.00 $

$SQ (+5%) 10.00 $

$BLK 108.00 $

$SWK (-2,49%) 15.00 $

$DASH (+0,95%) 55.00 $

$PEP (+0,08%) 70.00 $

-Downgrade of my previous price targets:

$SOFI (-1,98%) 0.85 $

$NKE (+0,26%) 45.00 $

$PYPL (-0,29%) 16.50 $

$BTC (-0,4%) 4500.00 $

$NVDA (+2,32%) 85.50 $

As there were also some requests from the community, I would like to name these as well:

$ACLS (-1,98%) 25.00 $

$ULTA (+0,18%) 88.00 $

$LULU (+0,99%) 30.00 $

$TUI1 (-2,62%) 1.25 €

$UBER (+0,18%) 18.00 $

$V (-0,03%) 155.00 $

$CO 0.01 $

$BRK.A (-0,45%) 187.000 $

🚀 Price potential 🚀

$TSLA (-6,59%) 400.00 $

$AWE (-3,86%) 23.00 $

$MSFT (+1,59%) 490.00 $

$AAPL (+0,17%) 300.00 $

$GOOGL (+1,13%) 220.00 $

$RHM (+1,29%) 1500.00 $

$O (-0,83%) 91.00 $

$AMZN (+1,9%) 270.00 $

$KO (+0,08%) 105.00 $

$MUX (-3,44%) 69.00 $

So have a great weekend and never forget, the belief in rising rates is as old as a dinosaur, but sometimes it feels like we're all stuck on a stick waiting for the next rocket launch! 🚀

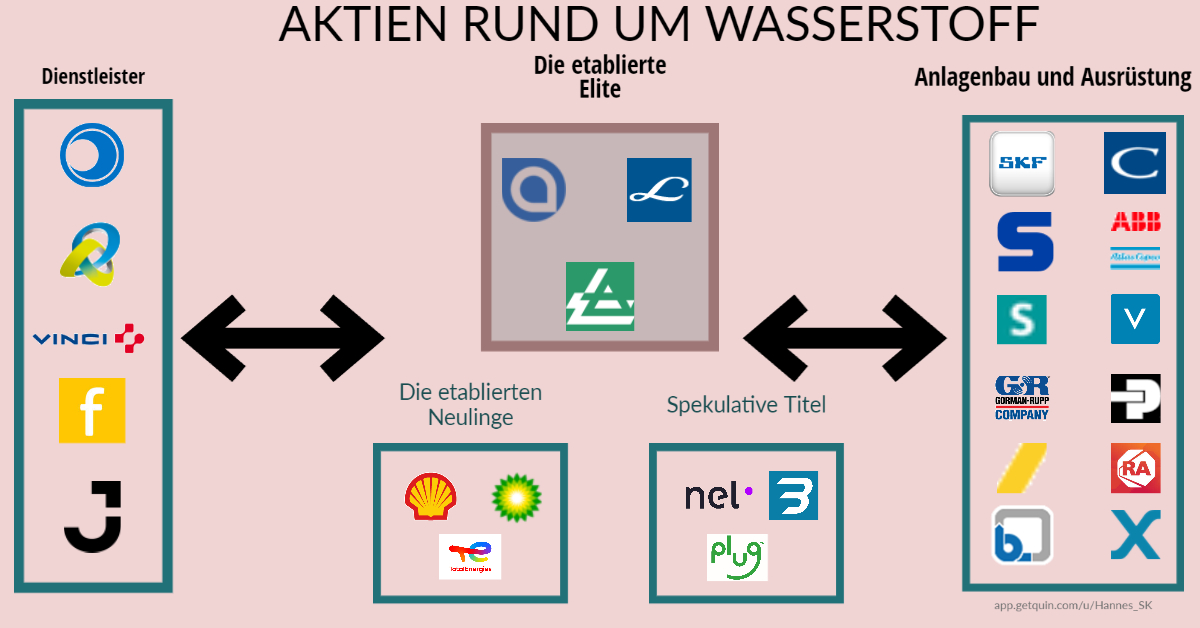

The 1x1 of the hydrogen industry on the stock exchange.

Hello dear community,

Considering the fact that there are a lot of newcomers on the platform, I have created a, for social media typical, dumb graphic to give you an overview of stocks, which may not be on everyone's radar. After all, it goes without saying that you can't know your way around every industry. But we have come together here in the community for a solid exchange.

But since we're here on Getquin and not on Instagram, here's some input for the inquisitive.

What do the companies do anyway?

Service provider:

On the service provider side, you'll find rather atypical companies for the sector.

Here I have Friedrich Vorwerk $VH2 (-4,96%) , Vinci $DG (-0,96%) , Ferrovial $FER , Bilfinger $GBF (-3,07%) and Jacobs Solutions $J (+0%) listed.

Their main focus is background work on the objects themselves. They support the companies in planning, realization, construction and maintenance. They work decentralized in regional working groups to cover the breadth of the industry. They provide almost any service for an industrial company.

The established elite

If you want to invest in the hydrogen sector, all roads lead to the giants Linde $LIN (-0,37%) , Air Products $APD (-0,59%) and Air Liquide $AI (-1,54%) . Their market power in the field of industrial gases and in today's market environment of commercial hydrogen production seems indisputable. Their know-how in the gaseous materials production segment has been proven over decades and their processes are almost perfectly optimized. Each company also has its own engineering divisions that position them perfectly for the future in electrolyzer development.

The established newcomers

With plenty of money in their satchels, the oil companies Shell $SHEL (-0,63%) , Total $TTE (-2,35%) and BP $BP. (-1,88%) are entering the segment. Oil is finite, but the business should not be. These companies are also experienced in dealing with hydrogen. In the refinery process, hydrogen is an indispensable component. In order to become less dependent on the big 3, they are also entering new market fields. Will they be able to prove themselves there?

Speculative titles

Nothing but expenses. Years of hype and yet a harsh reality hit the small fish in the shark tank around the segment. Nel $NEL (-1,72%) , Plug Power $PLUG (-3,79%) and Ballard $BLDP (-4,76%) are long-suffering. They have never managed to deliver even remotely profitable figures. On the contrary, quarter after quarter, things seem to be getting worse. Only sales are increasing. Can this ever work?

Plant engineering and equipment

Of course, in a globalized world, one no longer takes care of the entire value chain from A-Z. Each company is specialized in its own segment. Permanent beneficiaries of the industry are therefore the equipment suppliers, because they have to technically develop the cornerstones for every innovation in order to survive in the vastness of globalization.

The equipment suppliers

They manufacture the physical parts for the process plants.

Examples of this are Voestalpine $VOE (-2,26%) , Atlas Copco $ATCO B or Sulzer $SUNE .

The equipment suppliers

In addition, the transport of substances is also part of the process. Mass transfer in industry, but also at home, for example in water pipes, is ensured by pumps (for liquids) or by compressors (for gases). Established brands here are KSB $KSB (+3,5%) , Xylem $XYL (+0,62%) , Gorrman-Rupp $GRC (-2,24%) but also as total supplier Chart Industries $GTLS (-0,25%) or SKF $SKF B (-3,05%) or for specialized tools Stanley B&D $SWK (-2,49%) .

Furthermore, process control is indispensable. Here, brands such as Siemens $SIE (-3,08%) , ABB $ABBN (-2,66%) or also Rockwell $ROK (-0,33%) and Parker $PH (-0,96%) have established themselves. They not only supply the electronic equipment for the process plants. They also offer their software services as safety services, so that safety in process control can always be guaranteed.

I hope to have given you a little insight into the industry and would be very happy to receive constructive feedback.

Servus my dears ✌️☺️

Social Media , curse and blessing at the same time 😁 on the one hand you can exchange experiences and on the other hand there are people who know everything better and are clairvoyants and can tell you 100% with which strategy you will achieve the best return 😂

Since there has been in recent times at getquin again and again propaganda against the dividend strategy😁 and today #dividendsthursday I wanted to summarize my aristocrats and possible candidates for the future where I myself am invested. ☺️👍

If you discover the dividend strategy for yourself then it is important to buy shares that annually increase the dividend or at least not lower, and there are 80% actually only stocks from the USA in question 😁👍

My Aristocrats ☺️👍

Consumption

Coca-Cola $KO (+0,08%)

Procter & Gamble $PG (+0,18%)

Colgate-Palmolive $CL (+0,42%)

Kimberly-Clark $KMB (-0,52%)

Diageo $DGE (-1,66%)

Altria $MO (+1,18%)

British American Tobacco $BATS (-0,23%)

McDonald's $MCD (-0,74%)

Finance

Franklin Resources $BEN (-0,15%)

T. Rowe Price $TROW (+0,8%)

Old Republic $ORI (+1,24%)

Aflac $AFL (+0,53%)

Pharma/Healthcare

Johnson & Johnson $JNJ (-1,06%)

Energy/Oil

Chevron $CVX (-0,37%)

Consolidated Edison $ED (-1,5%)

UGI Corporation $UGI (-0,91%)

Real Estate

Realty Income $O (-0,83%)

National Retail Properties $NNN (-0,52%)

W.P. Carey $WPC (-0,72%)

Essex Property Trust $ESS (-0,79%)

IT

IBM $IBM (-0,98%)

Industry

Air Products and Chemicals $APD (-0,59%)

Caterpillar $CAT (-0,67%)

Ecolab $ECL (-0,62%)

Stanley Black $SWK (-2,49%)

Emerson Electric $EMR (-0,23%)

Archer-Daniels-Midland $ADM (-1,96%)

Nucor $NUE (-3,55%)

Leggett & Platt $LEG (-1,4%)

Utilities

Essential Utilities $WTRG (+0,05%)

Logistics

C. H. Robinson $CHRW (+0%)

Future potential aristocrats

Apple $AAPL (+0,17%)

Microsoft $MSFT (+1,59%)

Broadcom $AVGO (-1,21%)

Qualcomm $QCOM (-2,78%)

Texas Instruments $TXN (-1,11%)

Kellogg $K (+0,35%)

Verizon $VZ (+0,13%)

MetLife $MET (+0,82%)

Starbucks $SBUX (-1,15%)

KDDI $9433 (+1,27%)

Pfizer $PFE (+0,08%)

Bristol-Myers Squibb $BMY (-0,7%)

JPMorgan $JPM (+0,51%)

Visa $V (-0,03%)

Nike $NKE (+0,26%)

Lockheed Martin $LMT (-0,89%)

Home Depot $HD (-1,24%)

Oracle $ORCL (+0,49%)

Waste Management $WM (+0,5%)

Union Pacific $UNP (-0,97%)

BlackRock $BLK

What aristocrats do you have in your portfolio that I haven't mentioned here yet and which stocks do you see a chance to become an aristocrat in the future?

Thanks a lot ✌️☺️

Source:

Quarterly figures from 27.10.2022...

Amazon, Apple 📉🔥💥, T-Mobile US , Intel 📈❤️⤵️

In the post earlier today, yes some numbers were announced:

https://app.getquin.com/activity/PkJeFBqydK?lang=de&utm_source=sharing

Let gladly again a Like there, would be very pleased, as the morning posts also a lot of effort. I currently plan these also further expand with links, etc. But I still need some time for that. But now to the numbers from today:

$INTC (-2,95%)

Intel:

Beats analyst estimates of $0.34 in the third quarter with EPS of $0.59. Revenue of $15.3 billion below expectations of $15.43 billion. Intel with downside guidance for the fourth quarter. Sees EPS of $0.20 (consensus $0.68) and revenue of $14-15 billion (consensus $16.43 billion).

$AMZN (+1,9%)

Amazon:

Beats analyst estimates of $0.22 in the third quarter with EPS of $0.28. Revenue of $127.1 billion below expectations of $127.76 billion. Amazon with downside guidance for the fourth quarter. Sees revenue of $140-148 billion (consensus $155.37 billion).

$AAPL (+0,17%)

Apple:

Apple fourth quarter earnings per share of $1.29 beat analyst estimates of $1.26. Revenue of $90.1 billion beat expectations of $88.76 billion. Apple iPhone sales in fourth quarter at $42.6 billion (consensus estimate $43.4 billion, prior year $38.9 billion). Apple Mac revenue in the fourth quarter at $11.5 billion (consensus estimate $9.4 billion, prior year $9.2 billion). Apple wearables revenue in the fourth quarter at $9.7 billion (consensus estimate 9.0 billion, previous year 8.8 billion). Apple iPad revenue in the fourth quarter at $7.2 billion (consensus estimate $7.8 billion, prior year $8.3 billion). Apple service revenue in the fourth quarter at $19.2 billion (consensus estimate $20.4 billion, prior year $18.3 billion).

$TMUS (+0,19%)

T-Mobile US:

Beat analyst estimates of $0.39 in third quarter with earnings per share of $0.40. Revenue of $19.48 billion below expectations of $20.02 billion.

$S92 (-5,39%)

SMA Solar:

Raises earnings forecast for current year and now expects Ebitda of 60-75 million euros ahead of 10-60 million previously.

Reasons for the forecast increase are the continued high order intake and a gradually improving supply of electronic components. In addition, a special effect in the lower double-digit million euro range from a real estate sale had a positive impact on earnings in the third quarter. (Had just sold at 62€)

$WDC (-4,91%)

Western Digital:

Missed analyst estimates of $0.41 in the first quarter with earnings per share of $0.20. Revenue of $3.74 billion exceeded expectations of $3.64 billion.

$MA (+0,06%)

MasterCard:

Third-quarter earnings per share of $2.68 beat analyst estimates of $2.57. Revenue of $5.8 billion exceeded expectations of $5.65 billion.

$TTE (-2,18%)

TotalEnergies SE:

Missed analyst estimates of $3.99 in the third quarter with earnings per share of $3.83. Revenue of $64.92 billion below expectations of $79.43 billion.

$TROW (+0,8%)

T. Rowe Price Group Inc:

Third-quarter earnings per share of $1.86 beat analyst estimates of $1.85. Revenue of $1.59 billion exceeded expectations of $1.55 billion.

$MO (+1,18%)

Altria Group Inc:

Missed analyst estimates of $1.30 in the third quarter with earnings per share of $1.28. Revenue of $6.55 billion exceeded expectations of $5.6 billion.

$CMCSA (-0,41%)

Comcast Corp. Class A:

Third-quarter earnings per share of $0.96 beat analyst estimates of $0.90. Revenue of $29.85 billion exceeded expectations of $29.75 billion.

$MCD (-0,74%)

McDonald's Corp:

Surpassed analyst estimates of $2.59 in third-quarter earnings per share of $2.68. Revenue of $5.87 billion exceeded expectations of $5.72 billion.

$SWK (-2,49%)

Stanley Black & Decker Inc:

Third-quarter earnings per share of $0.76 beat analyst estimates of $0.72. Revenue of $4.1 billion exceeded expectations of $4 billion.

$CAT (-0,67%)

Caterpillar Inc:

Beats analyst estimates of $3.17 in the third quarter with earnings per share of $3.95. Revenue of $15 billion beats expectations of $14.15 billion.

$MRK (-1,64%)

Merck & Co. Inc:

Beats analyst estimates of $1.75 in the third quarter with earnings per share of $1.85. Revenue of $15 billion beats expectations of $14.07 billion. Merck & Co raises outlook to 2022 and sees revenue at $58.5 billion to $59.0 billion (previously: $57.5 billion to $58.5 billion) and adjusted earnings per share at $7.32 to $7.37 (previously: $7.25 to $7.35).

$LIN

Linde:

Reports Q3 sales of $8.8 billion (PY: $7.68 billion, analyst forecast: $8.34 billion), operating profit of $1.6 billion (PY: $1.3 billion) and adjusted net profit of $1.55 billion (PY: $1.42 billion, forecast: $1.47 billion). In the 2022 outlook, Linde expects adjusted earnings per share of $11.93 to $12.03 (previous: $11.73 to $11.93).

$BEI (-0,48%)

Beiersdorf:

Posts Q1-3 sales of €6.7 billion (organic +11.1%), Consumer business segment sales growth to €5.4 billion (organic +11.7%), organic growth across all brands: NIVEA +10.8%, Derma +25.3%, La Prairie +5.5%, Healthcare +12.8%; the tesa business segment achieved sales of €1.3 billion, organic +8.3%. Beiersdorf expects organic sales growth for tesa of between 7% and 9% for the full year 2022. The operating EBIT margin of the current business excluding special items is expected to be only slightly below the previous year, despite high raw material and transport costs.

$KU2

KUKA:

Achieves Q1-3 order intake of €3.68 billion (PY: €2.69 billion), sales of €2.76 billion (PY: €2.35 billion), Ebit of €80.9 million (PY: €45.5 million), Ebitda of €174.3 million (PY: €137.2 million) and profit after tax of €66.7 million (PY: €29.8 million). KUKA is adjusting its guidance for the financial year 2022. Orders received will exceed €3.9 billion (more than 10% above the previous year's figure). Sales will be above €3.6 billion (more than 10% above the previous year's figure). The EBIT margin guidance is substantiated and will be around 3.0%.

$ULVR (-0,75%)

Unilever:

Raises its sales guidance again. Organic growth of more than 8% is now expected for the full year (previously: 4.5 to 6.5%).

$MTX (-1,71%)

MTU:

Reports Q3 revenues of €1.349 billion (PY: €1.004 billion, analyst forecast: €1.315 billion), Ebit (adjusted) of €158 million (PY: €117 million, forecast: €153 million), Ebit margin of 11.7% (PY: 11.7%, forecast: 11.6%) and net profit (adjusted) of €113 million (PY: €85 million, forecast: €111 million). In its outlook for 2022, the company now expects revenue of €5.4 to €5.5 billion (forecast: €5.282 billion) and an increase in EBIT (adjusted) in the low 30 percent range.

$HFG (+0,3%)

HelloFresh:

Achieves Q3 revenues of €1.86 billion (PY: €1.42 billion, analyst forecast: €1.8 billion), Ebitda (adjusted) of €71.8 million (PY: €79.8 million, analyst forecast: €75.6 million) and Ebitda margin (adjusted) of 3.9% (PY: 5.6%). The number of active customers was reported at 7.51 million (previous year: 6.94 million, forecast: 7.5 million), the number of orders at 29.03 million (previous year: 27.59 million).

$NEM (-0,68%)

Nemetschek:

Achieves Q3 revenues of €202.8 million (PY: €169.3 million, analyst forecast: €199 million), Ebitda of €62.9 million (PY: €54.4 million, forecast: €62 million), Ebitda margin of 31.0% (PY: 32.1%, forecast: 31.1%) and net profit of €38.8 million (PY: €34.2 million, forecast: €36.4 million). Outlook for 2022 confirmed.

$KGX (-3,94%)

KION:

Achieves revenue of €8.24 million in 1Q to 3Q. Quarter: revenue of €8.24 billion (PY: €7.5 billion, analyst forecast: €8.1 billion), order backlog of €7.7 billion (end of 2021: €6.66 billion), EBIT margin of 2.6% (PY: 9.2%, forecast: 2.3%), Ebit (adjusted) of €210.6 million (PY: €691.1 million, forecast: €189 million) and net profit of €66.9 million (PY: €430.8 million, forecast: €35 million). Kion intends to withdraw completely from Russian business. Outlook confirmed.

$LHA (-1,3%)

Lufthansa:

Reports Q3 revenue of €10.06 billion (PY: €5.20 billion, preliminary: €10.1 billion), Ebit (adjusted) of €1.132 billion (PY: €251 million), adjusted free cash flow of €410 billion (PY: €43 million, preliminary: €400 million) and net profit of €809 million (PY: -72 million). In the outlook, the company sees itself on track to achieve medium-term targets for 2024.

$SOW

Software AG:

Posts Q3 revenue of €221.4 million (PY: €198 million, analyst forecast: €225 million), Ebita margin of 16.6% (PY: 16.8%, forecast: 13.9%), Ebita (adjusted, organic) of €35.3 million (PY: €33.3 million, forecast: €31.3 million) and net loss of €10.8 million (PY: €16.3 million). Outlook for 2022 confirmed.

$WCH (-4,33%)

Wacker Chemie:

Achieves Q3 sales of €2.13 billion (€1.66 billion, analyst forecast: €2.13 billion), Ebitda of €457 million (PY: €449.6 million, forecast: €499.3 million) and net profit of €258.9 million (PY: €264.5 million, forecast: €291.1 million). In its outlook for 2022, the company now expects Ebitda in the range of €2.1 to €2.3 billion (previous: €1.8 to €2.3 billion) and revenues unchanged in the range of €8.0 to €8.5 billion.

$AIXA (-1,56%)

Aixtron:

Achieves Q3 revenues of €88.9 million (PY: €130.8 million, analyst forecast: €127.7 million), order intake of €142.8 million (PY: €114.2 million), EBIT of €16.2 million (PY: €36.2 million, forecast: €30.8 million) and net income of €19.1 million (PY: €31.4 million). In the outlook for 2022, Aixtron raises its order intake guidance from €540 to €600 million (previously: €520 to €580 million).

#amazon

#intel

#tmobile

#unilever

#lufthansa

#hellofresh

#linde

#quartalszahlen

#news

#newsroom

#aktien

#aktientipps

#community

#communityfeedback

#lernen

I migliori creatori della settimana