up/down and closing price predictions for Monday - machine opinion not advice

$NVDA (-0,29%) added to DOW - so prediction likely affected...

$AAPL (+1,28%)

52.4 % chance down Monday

probable closing price $ 219.34

__________________________

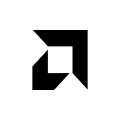

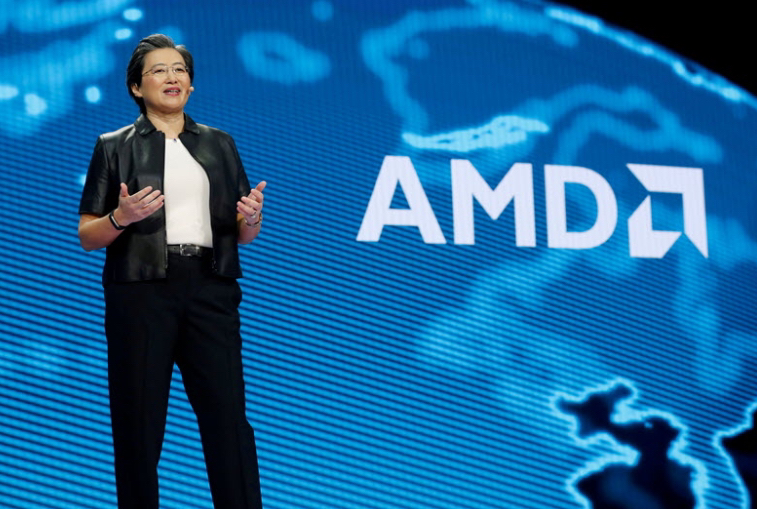

$AMD (+1,49%)

53.8 % chance down Monday

probable closing price $ 139.59

__________________________

$AMZN (+0,59%)

54.7 % chance up Monday

probable closing price $ 200.9

__________________________

$CAT (+1,08%)

50.5 % chance down Monday

probable closing price $ 373.51

__________________________

$COIN (+1,23%)

52.0 % chance up Monday

probable closing price $ 185.44

__________________________

$DIS (+0,72%)

54.6 % chance down Monday

probable closing price $ 94.28

__________________________

$GOOGL (+0,63%)

53.1 % chance up Monday

probable closing price $ 173.86

__________________________

$HOOD (-1,6%)

51.0 % chance down Monday

probable closing price $ 23.59

__________________________

$IWM (+1,79%)

51.6 % chance down Monday

probable closing price $ 215.51

__________________________

$META (+0,12%)

54.1 % chance down Monday

probable closing price $ 558.09

__________________________

$MSFT (+1,05%)

53.7 % chance down Monday

probable closing price $ 403.8

__________________________

$NFLX (+1,39%)

54.0 % chance up Monday

probable closing price $ 767.44

__________________________

$NVDA (-0,29%)

52.7 % chance down Monday

probable closing price $ 133.2

__________________________

$PLTR (+2,33%)

53.3 % chance down Monday

probable closing price $ 41.27

__________________________

$QQQ

55.3 % chance down Monday

probable closing price $ 479.63

__________________________

$SPY (+1,07%)

51.2 % chance down Monday

probable closing price $ 561.88

__________________________

$TSLA (+1,36%)

55.6 % chance up Monday

probable closing price $ 252.71