$BTC (-0,03%)

How lost can you be? Savings bank: Yes

When reading an article hurts:

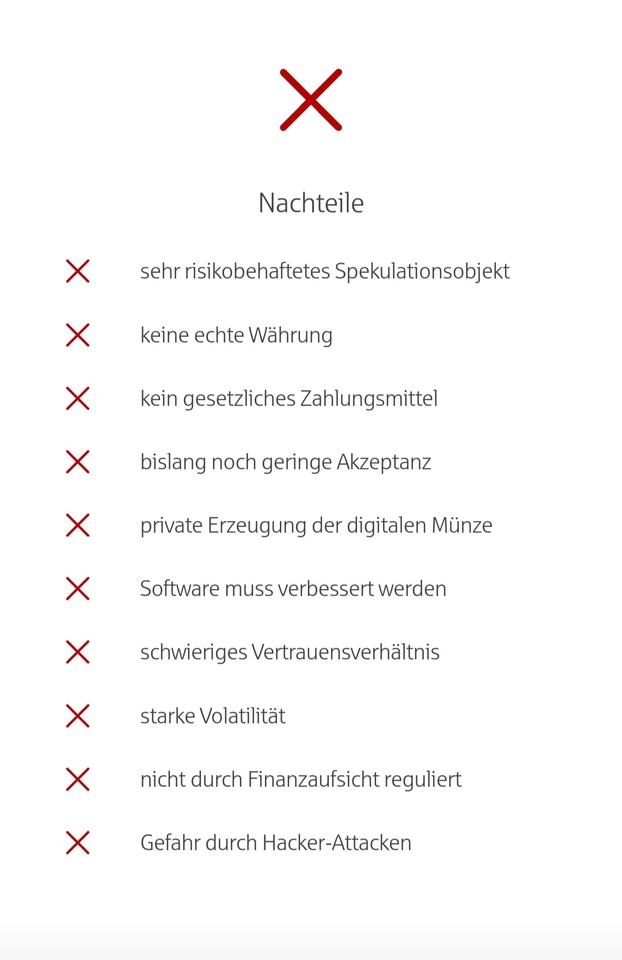

Not only is there a warning about Bitcoin because it pays no dividends and boils the oceans, not only is it claimed that the code needs to be changed because the blockchain is overloaded and a target for hackers, there is also praise for "alternative cryptocurrencies" such as "BitGreen" because they are more climate-friendly💀

And on top of that, CBDCs are highlighted in a positive light.

https://www.sparkasse.de/pk/ratgeber/finanzplanung/investieren/bitcoin.html