I had been planning to expand my EM and especially Latin America exposure for several weeks and see the best opportunities in fintechs. $NU (+2,61 %) As you'd expect, the EM was at the top of my list, but there was more than one point here that has put me off investing so far.

But thanks to the community, Shiya introduced DLocal yesterday. I very quickly realized that this was the perfect addition to my Mercadolibre position and that I wanted to have it.

Thank you for your stock presentation @Shiya 😇

Here is the original presentation:

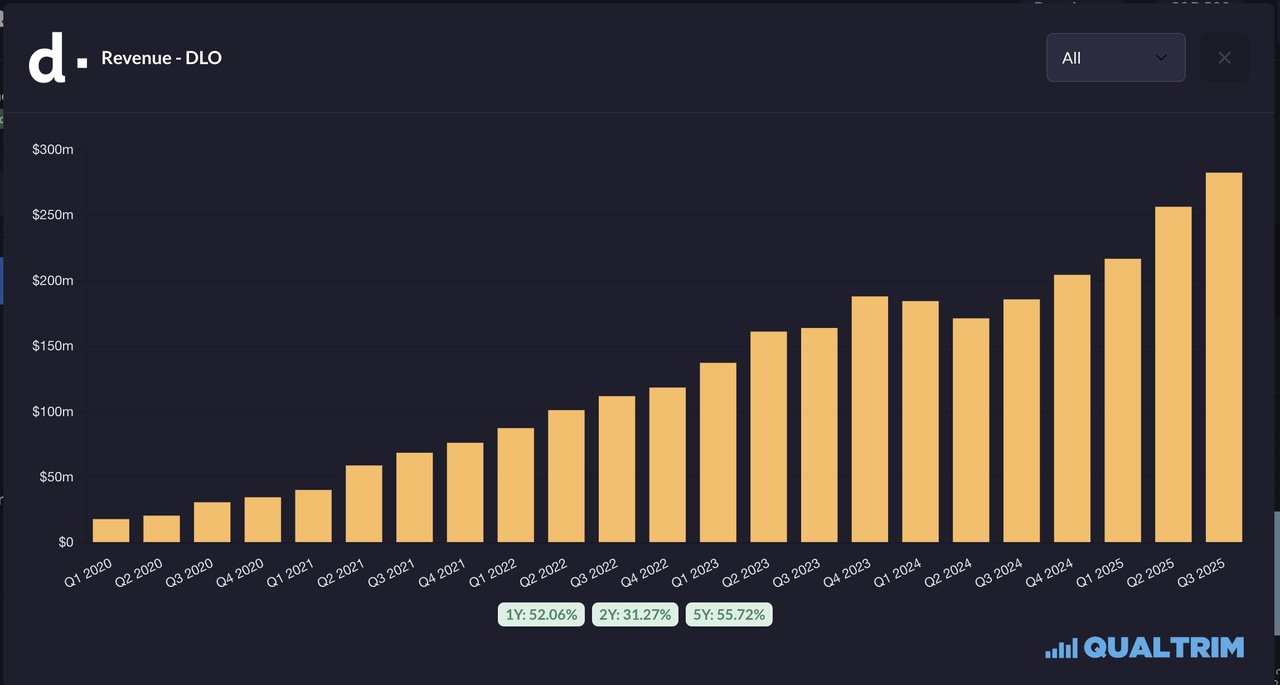

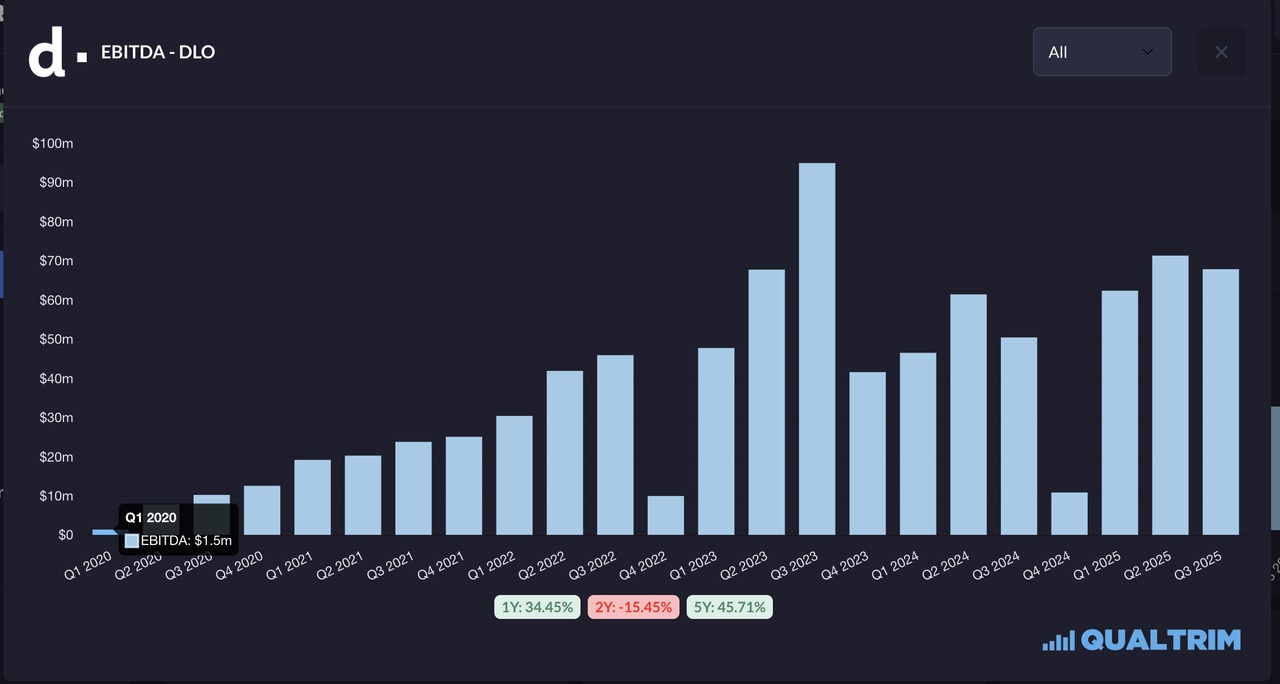

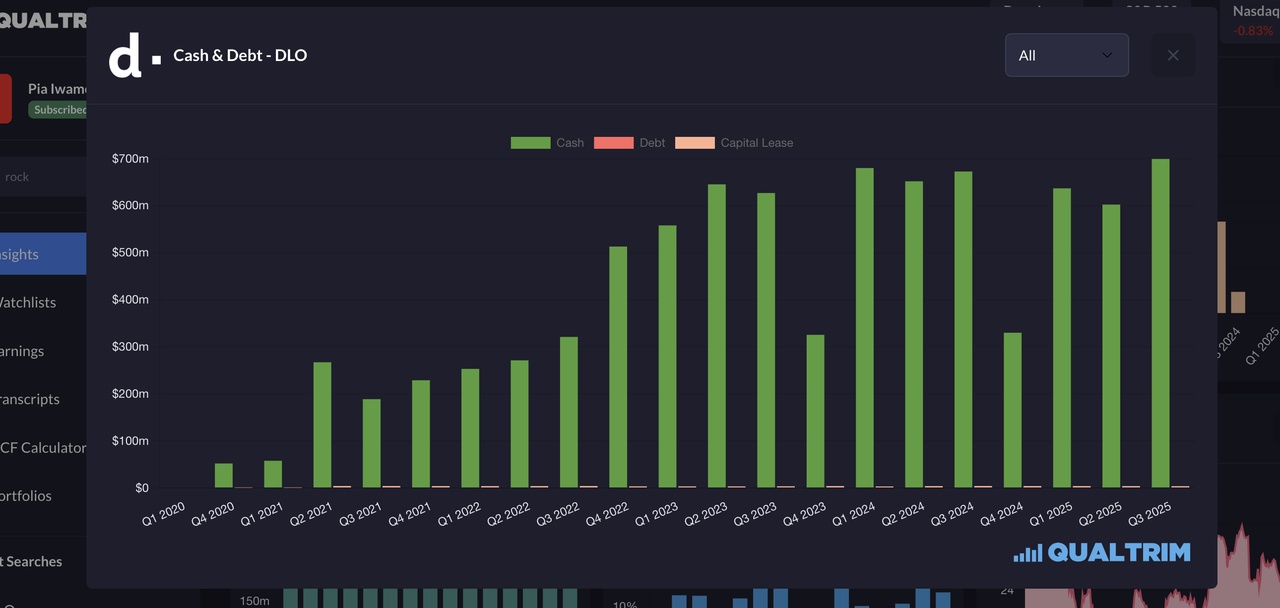

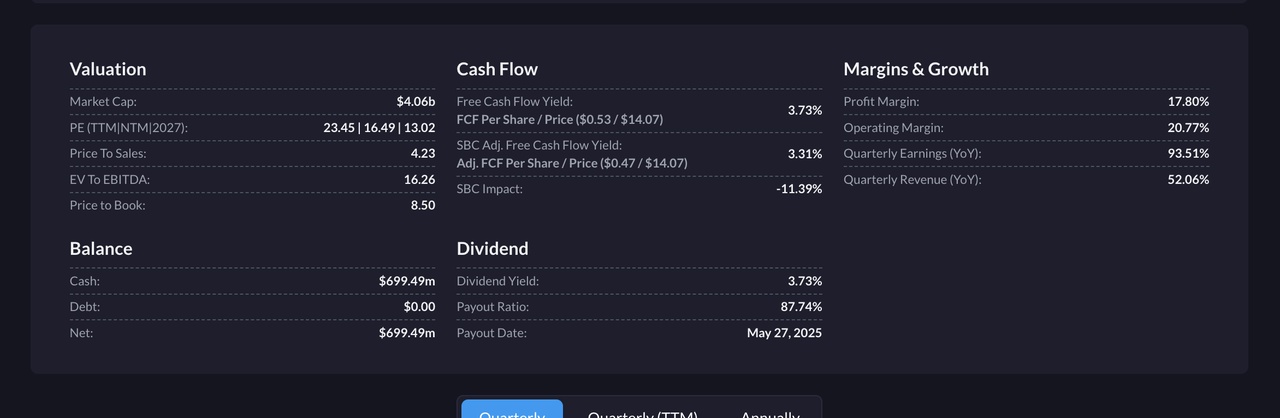

And here are a few more fundamental graphs and short-term charts:

We see massive growth at DLO ☝️ and already have a very profitable company 👇

As if that wasn't enough, the company is sitting on a mountain of cash and is debt-free. 👇

The number of shares is fairly constant and is only increasing very slowly. ☝️ I assume this relates to employee or management remuneration. Also worth noting that shares were bought back in 2023 and 24 for around $200m in total.

Risks and side effects 🤪

As "always", the geographical and currency risk.

Specifically, I have only noticed that margins are declining somewhat. 👇

The chart ⚖️

(Sorry for the presentation in euros. I normally use the home currency, but the drawings disappear when I convert and I'm lazy. Nevertheless, this is the home exchange and is sufficient for a short-term view)

The chart shows an intact upward trend within a rising trend channel, with a very bullish trend. 👩🏻🚀

A strong upward movement was followed by a healthy consolidation back to the EMA 200, where the price found support.

The coming days are likely to be exciting: The price has failed several times at resistance at around € 12.20. The EMA 100 currently runs in the € 11.60-11.70 range.

I hope that the price will bounce off this and rise parabolically.

But a particularly important level is around € 11 (1️⃣). Several factors come together here: EMA 200, 38 Fibonacci, several trend lines, etc. . This area could be approached and should hold in my opinion.

In a worst-case scenario, a setback to the 2️⃣ zone would also be conceivable, but I consider the probability of this to be lower.

I plan to buy the first tranche immediately and would add to 1️⃣ and 2️⃣ accordingly.