The "Welt" financial editorial team has drawn up a proposal for a solid equity portfolio that pays dividends every week. This works with a combination of individual shares that pay dividends with a time lag.

US stocks are particularly suitable for this, as they usually pay out four times a year. Investors should not be blinded by the sheer amount of the dividend. Hajek (Rheinische Portfolio) warns against concentrating on supposedly high-dividend sectors: "Those who focus exclusively on utilities, pharmaceuticals and banks, for example, are missing out on growth momentum from tech and innovation."

With foreign shares, investors must be prepared for pitfalls such as withholding tax or currency risks. On the other hand, you can cover 48 weeks of the year with just twelve American blue chips, with twelve times four staggered distributions.

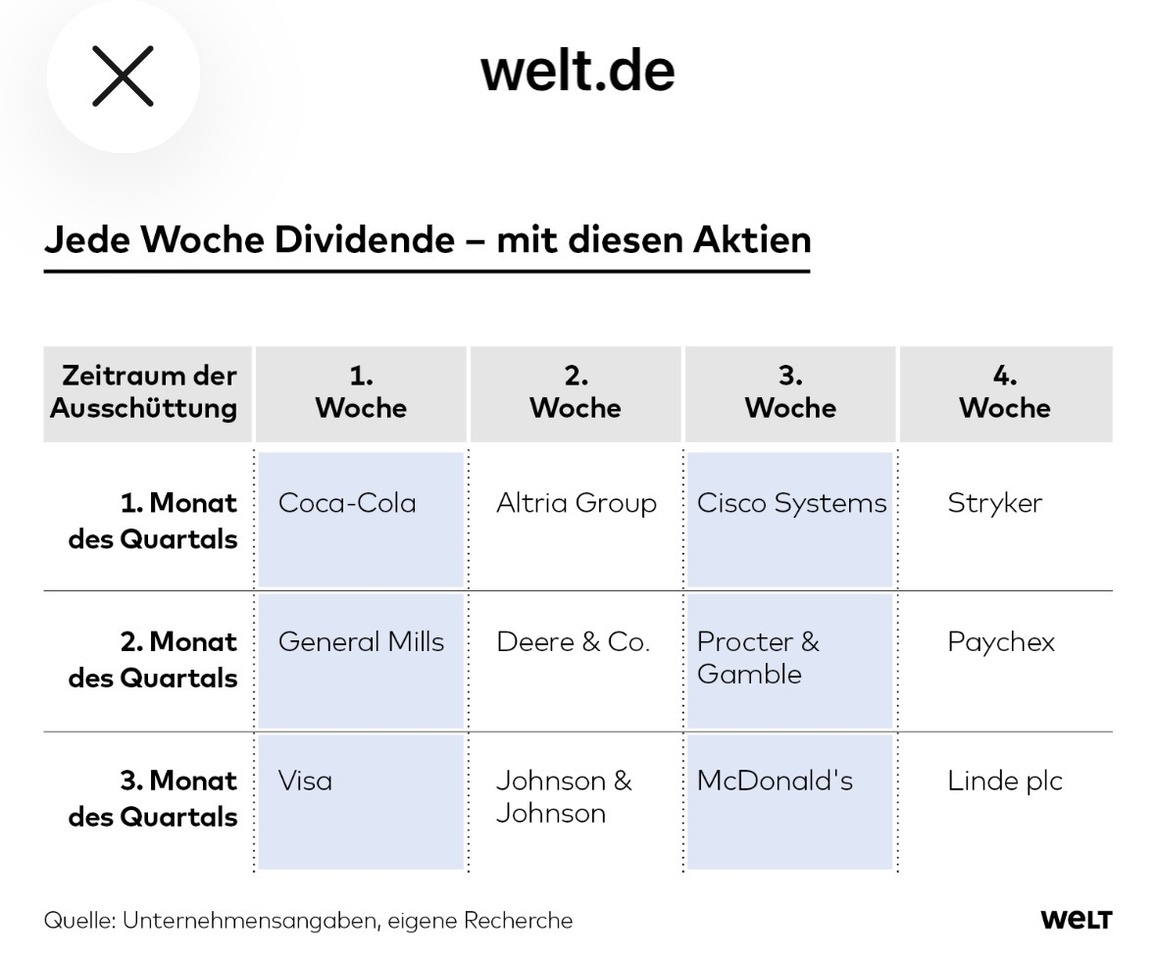

This is possible with this portfolio, for example:

- Month 1 of the quarter

Coca-Cola $KO (-1,87 %), Altria Group $MO (-1,23 %), Cisco Systems $CSCO (+2,4 %), Stryker $SYK (-0,64 %)

- Month 2 of the quarter

General Mills $GIS (-2,32 %), Deere & Co. $DE (-0,58 %), Procter & Gamble $PG (-0,98 %), Paychex $PAYX (+0,07 %)

- Month 3 of the quarter

Visa $V (-0,18 %), Johnson & Johnson $JNJ (-1,21 %), McDonald $MCD (-0,58 %) and Linde plc. $LIN (-0,72 %)

Source text (excerpt) & graphic: Welt, 26.12.25