2025 was a special year. Since the birth of our son in February, family came first, which led to a lower savings rate. Denkoch I am satisfied with the year.

The highlights:

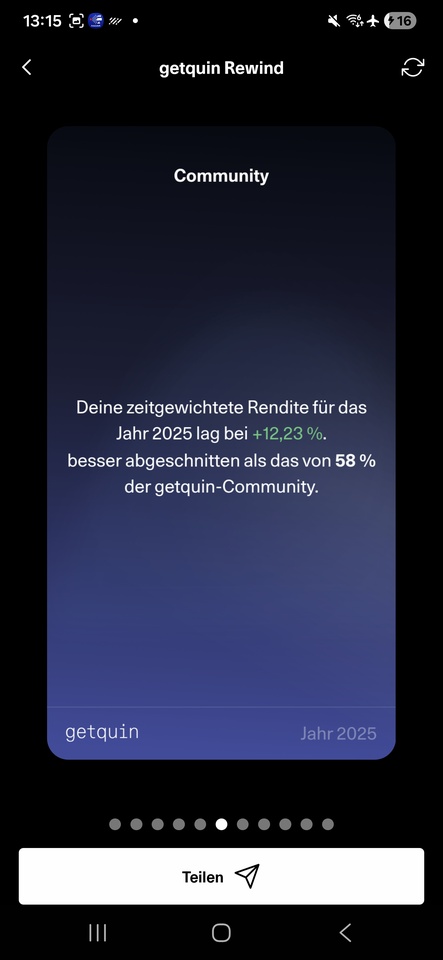

Performance: With an IRR of 13.15 %, my target of 8 % was clearly exceeded, although I currently hold 25 % in bonds.

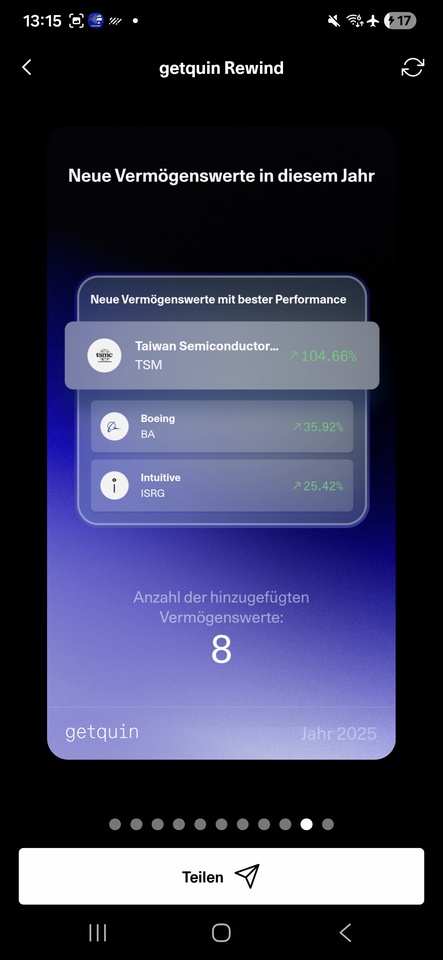

Top performer: After the "Rosegarten crash", opportunistic entries/repurchases paid off. Particularly strong performance:

$TSM (+5,94 %) : +104,6 %

$INTC (+7,35 %) : +59,4 %

$ASML (+7,43 %) : +40,4 %

$BA: (+3,99 %) +35,9 %

$NET (-0,9 %) once again contributed the largest absolute gain as the largest item.

Sector focus: The Healthcare segment was strengthened, including with $EXEL (-3,49 %) and the perennial favorite $ISRG (-1,95 %) (+25,4 %).

Outlook 2026:

The focus is on second-tier AI winners and the healthcare sector. In the event of setbacks in the semiconductor sector, I plan to further expand positions.