Deckers Outdoor Corporation $DECK (-5.85%) is an iconic player in the global footwear and apparel market, best known for its highly recognizable brands UGG and HOKA. Since its founding in 1973, Deckers has built a reputation for innovative design and premium quality, positioning its products across lifestyle and performance-driven segments.

After a record rally that saw shares peak near $224 in December 2024, DECK has undergone a harsh correction in 2025, losing over 54% of its value and returning to price levels last seen at the end of 2023. This startling drop results from a combination of cautious revenue guidance, increased macroeconomic uncertainty, weakening momentum in the consumer sector, and lower direct-to-consumer sales for core brands. Despite this, Deckers stands out from its peers for its financial strength and the resilience of its portfolio.

Fundamentally, the company remains robust:

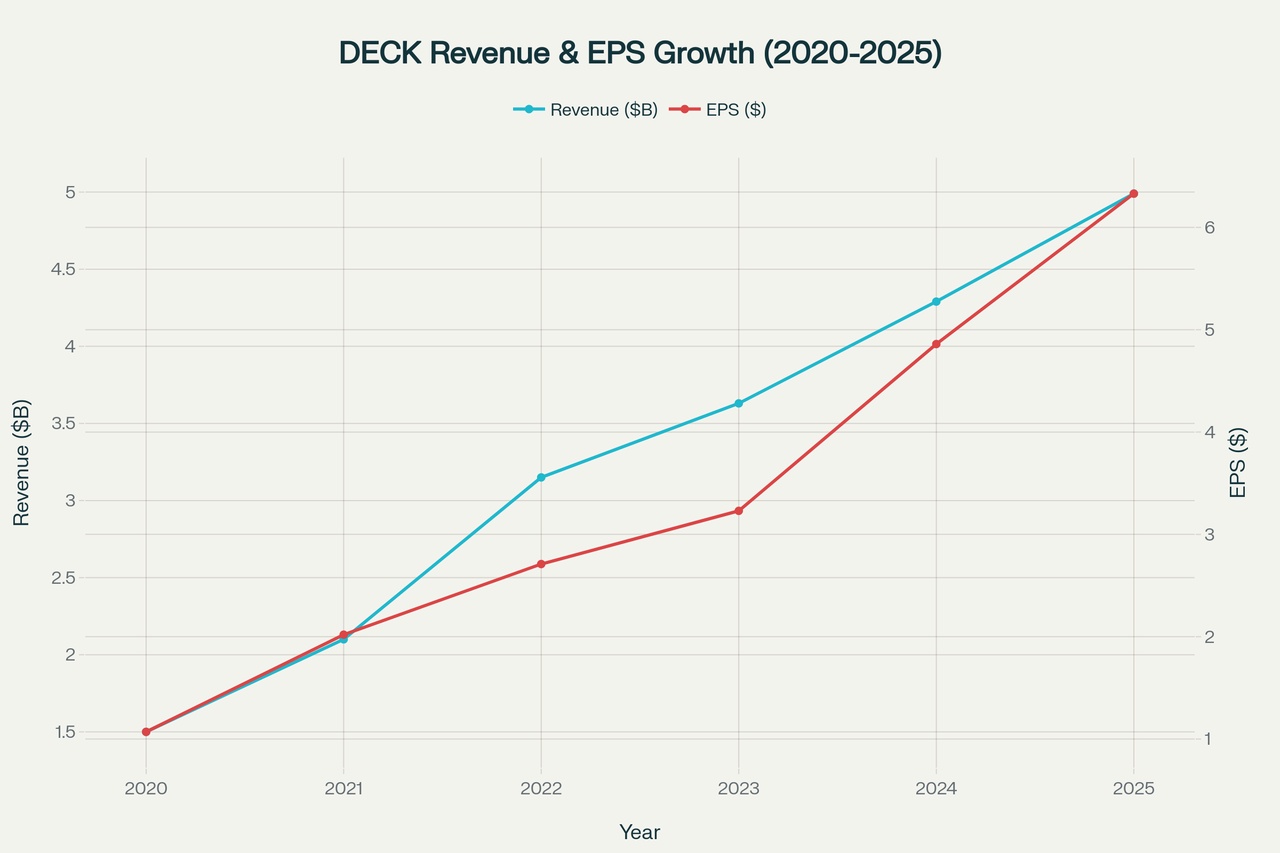

- Revenue growth averaged 27.2% annually over the past five years, climbing from $1.5 billion in 2020 to $4.99 billion in 2025.

- EPS grew even faster, at 42.7% CAGR, as operational leverage and buybacks amplified profitability.

- Gross margin improved by nearly 5 percentage points, showcasing pricing power and efficiency.

- Free cash flow CAGR at 26.3% enabled aggressive shareholder returns.

- Deckers has zero net debt and $2.2 billion in buyback authorization on a clean balance sheet, helping stabilize EPS and support the stock.

Recent quarterly results showed double-digit growth for flagship brands HOKA (+11%) and UGG (+10%), but macro headwinds—like tariff concerns and softer consumer spending—led management to adopt a conservative outlook for fiscal 2026. This triggered analyst downgrades and downward pressure on the stock, fueling volatility and a rapid reversal of prior gains.

However, with technical downtrends, many investors now consider DECK a classic “fallen angel” with deep value characteristics. Analyst consensus price targets range $125-130, indicating a potential 25-30% upside from current levels. The company’s ongoing buybacks and strong capital position may catalyze a rebound, as bargain hunters begin to step in and sentiment eventually recovers.

Below is a chart illustrating Deckers’ impressive growth trajectory in revenue and EPS, even as the stock faces near-term challenges:

Deckers Outdoor (DECK) Revenue and EPS Growth (2020-2025)

Outlook:

While short-term risk and volatility remain, Deckers Outdoor presents a strong case for value-oriented investors. Its solid fundamentals, powerful brands, and proven management provide resilience. If macro factors stabilize and consumer trends improve, DECK could recover quickly, rewarding those who buy at these depressed levels. As with any volatile stock, patience and careful entry timing are key—but the potential is real for a rewarding rebound in the years ahead.