Hello dear getquin community and dear dividend investors,

inspired by some users (@Simpson I'm looking at you!) here and have been thinking about it myself for some time, I would also like to put together a sustainable and high-quality dividend stock ETF. I used the tool from Aktienfinder.net and paid attention to growth in earnings, growth in dividends and growth in overall price performance. I also wanted to diversify a little more broadly across several countries and sectors so that it covers a lot all round.

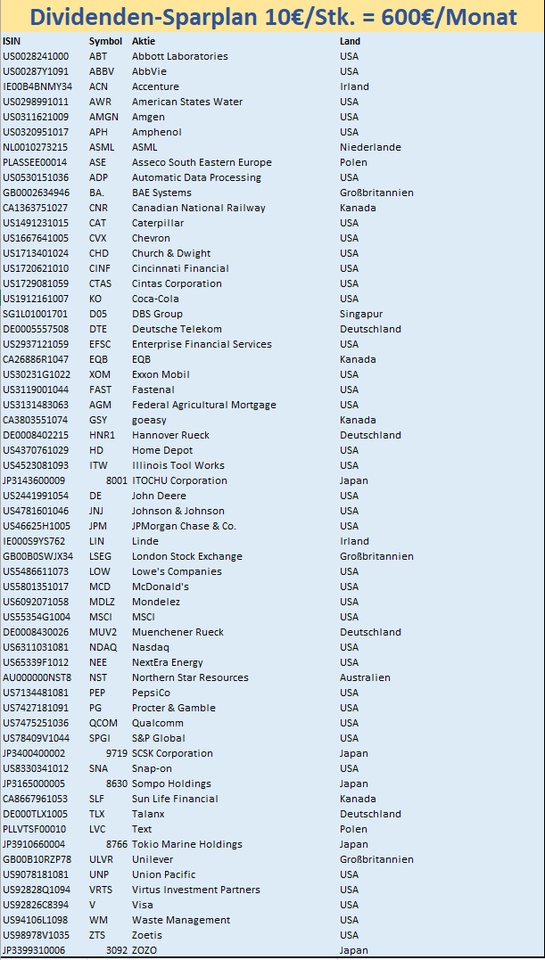

I have put together a total of 60 shares (satellite), which I would like to invest €10 in each. I don't really want to do any reallocations, I've also focused mainly on established companies (moats etc.). It's a mix of dividend growth and share price growth together, so the dividends here range from 0.62% to 5.38%.

I realize that there are a lot of US companies here, but I think it's hard to avoid them.

My 6 ETFs serve as a core, which I would put on hold for the time being, but of course continue to generate cash flow:

My goal here is clearly to outperform a few of the ETFs mentioned above with the shares, be it in dividend yield after x years with better price growth overall.

What do you think of the selection?