👉 BYD (Build Your Dreams) is today the largest manufacturer of New Energy Vehicles (NEV)worldwide - even ahead of Tesla.

The company was founded in 1995, has vertically integrated production (batteries, chips, software, vehicles) and is one of the fastest growing car manufacturers in the world.

What does BYD do? ⚙️

BYD is much more than just a car manufacturer - the company covers the entire value chain:

➡️ Automotive: BEV & PHEV models such as Seal, Dolphin, Han, Tang, Atto 3

➡️ Batteries:

Blade Battery - proprietary LFP technology, safe, long-lasting, internal & external use

➡️ Semiconductors & chips: In-house development for power electronics & SiC chips

➡️ E-buses & commercial vehicles: World market leader in electric buses & trucks

➡️ Railway / Monorail:

SkyRail & SkyShuttle for urban mobility

➡️ Solar & Energy Storage: Complete solutions for PV, storage & charging infrastructure

📍 BYD is aiming for over 4.5 million deliveries in 2025 - with an increasing export focus.

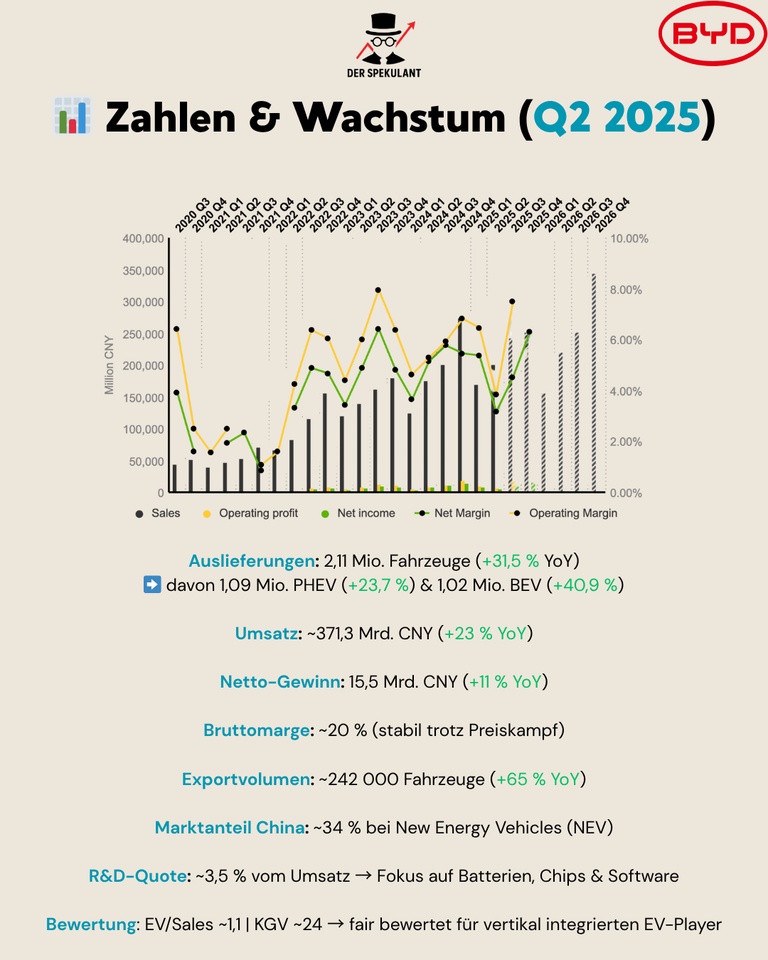

Figures & growth (Q2 2025) 💰

📊 Deliveries: 2.11 million vehicles (+31.5% YoY), 1.09 million PHEV (+23.7%), 1.02 million BEV (+40.9%)

📊 Turnover: ~371 billion CNY (+23% YoY)

📊 Net profit: CNY 15.5 billion (+11% YoY)

📊 Gross margin: ~20% (stable despite price war)

📊 Export volume: ~242,000 vehicles (+65% YoY)

📊 Market share China: ~34% for NEVs

R&D ratio: ~3.5% → Focus on batteries, chips & software

📊 Valuation: EV/Sales ~ 1.1 | P/E ~ 24 → fairly valued for a vertically integrated EV player

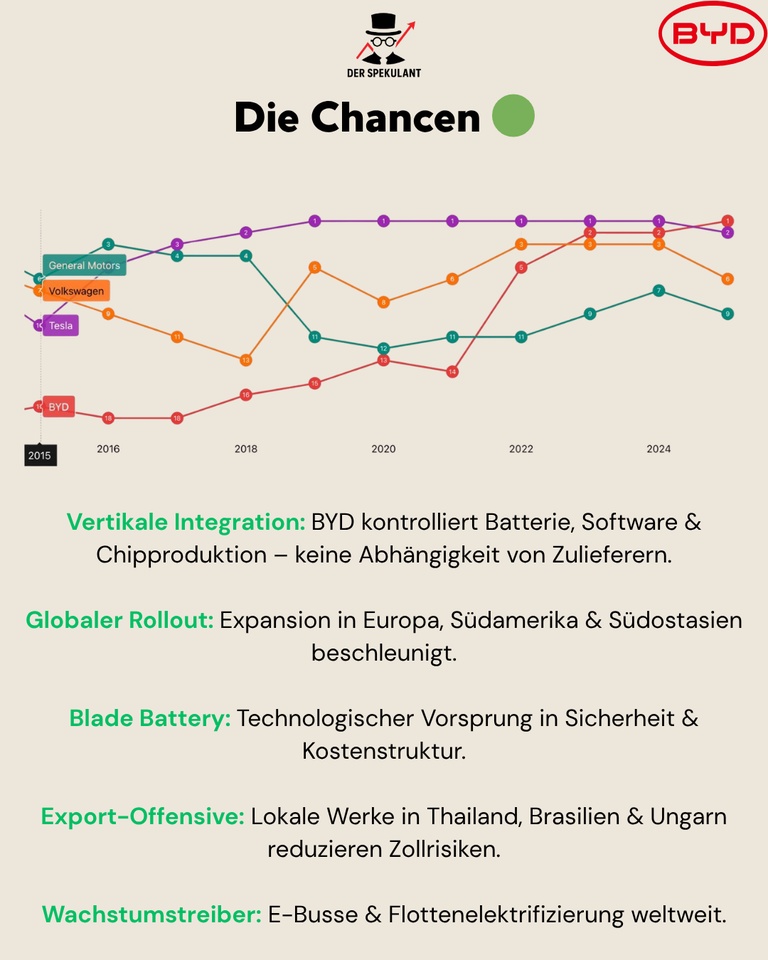

Opportunities 🟢

🟢 Vertical integration: Full control over battery, software & chip production

🟢 Global rollout: Expansion in Europe, South America & South East Asia

🟢 Technology leadership: Blade battery as a cost & safety advantage

🟢 Export offensive: Plants in Thailand, Brazil & Hungary → Reducing customs risks

🟢 Growth drivers: E-buses & fleet electrification

Risks 🔴

🔴 Price war: Tesla & Chinese competitors (Nio, XPeng, Li Auto) squeeze margins

🔴 US trade conflicts: Punitive tariffs & geopolitical tensions as an obstacle

🔴 Dependence on China: Majority of sales from the domestic market

🔴 Currency & regulatory risks: EU investigation into subsidies

🔴 Valuation: Not a bargain, but robust compared to Tesla or Nio

🧠 Conclusion

BYD remains a benchmark for vertically integrated e-mobility - strong growth, solid profitability and technological leadership in batteries.

With the export offensive & local production BYD is increasingly positioning itself as a global challenger to Tesla.

Margins could be under price pressure in the short term - in the long term BYD remains a potential compounder in the global EV boom.

❓ Community question:

BYD - solid growth stock or too much China risk already priced in?