A brief question to understand how the $WINC (-0,71 %)

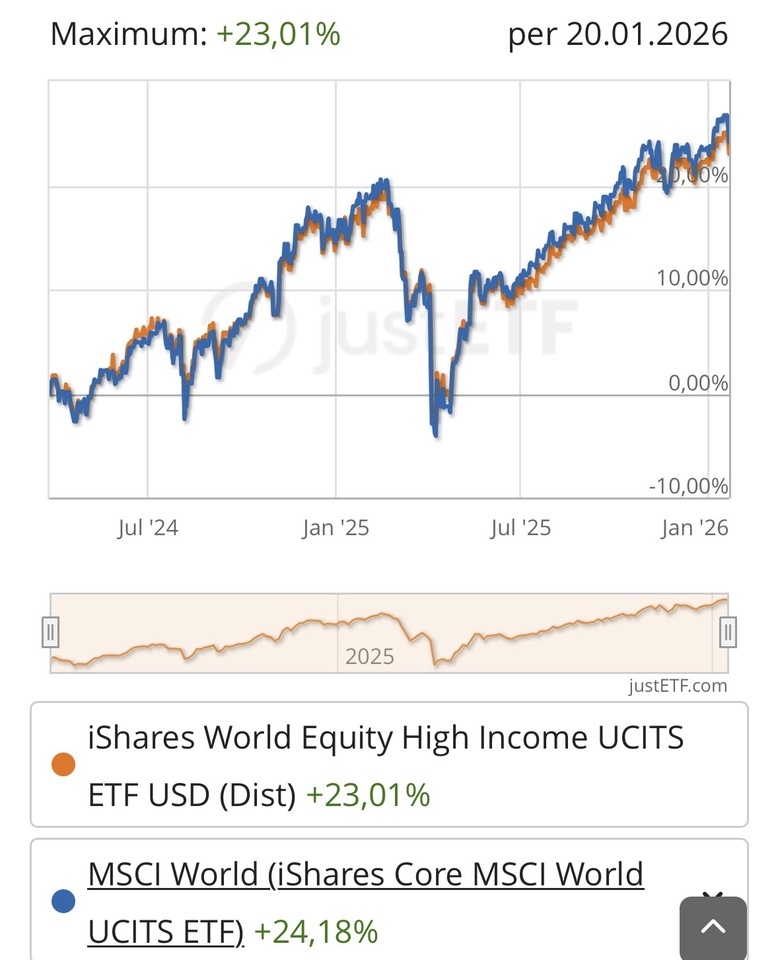

Unlike the $JEGP (-0,32 %) the ETF works with futures in order to capture the upside in strongly rising markets. In itself a very nice idea, which works well compared to other covered call ETFs, if you look at it in comparison to the benchmark MSCI World.

Now to the actual question:

if you assume a long-term average return of approx. 7% for the MSCI World and the $WINC (-0,71 %) 9.5%, then there should be a negative price trend in the long term with the dividend or payout discount (-2.5%). Am I right or have I missed something?