$HIMS (-0,18 %) - Introduction and personal opinion

Hims & Hers is my 2nd largest position

Current advertising: https://youtu.be/7e9knxa6npk?si=7vPQdIdI_yhaAW2-

As I cannot use Hims & Hers in Austria myself and have not been able to test it myself, the following descriptions, results and opinions are compiled from my research and information from the Internet.

I briefly discuss the business model, the key figures, the competition, the moat and the finances.

Summary/business presentation:

Hims is a 100% online platform that connects patients with licensed medical professionals across the country and provides treatments for various health needs such as sexual health, skin care, mental health and hair care.

Process:

- You begin by filling out an online form detailing your symptoms and medical history.

- Then a licensed provider evaluates the information and recommends a personalized treatment plan, including prescription medications (if needed), delivered discreetly to your doorstep

- Hims providers include physicians, nurse practitioners, psychiatrists, dermatologists, and pharmacists who are licensed in all 50 states and should provide safe, quality care/treatment.

Key metrics Q3'23 and Q4'23 :

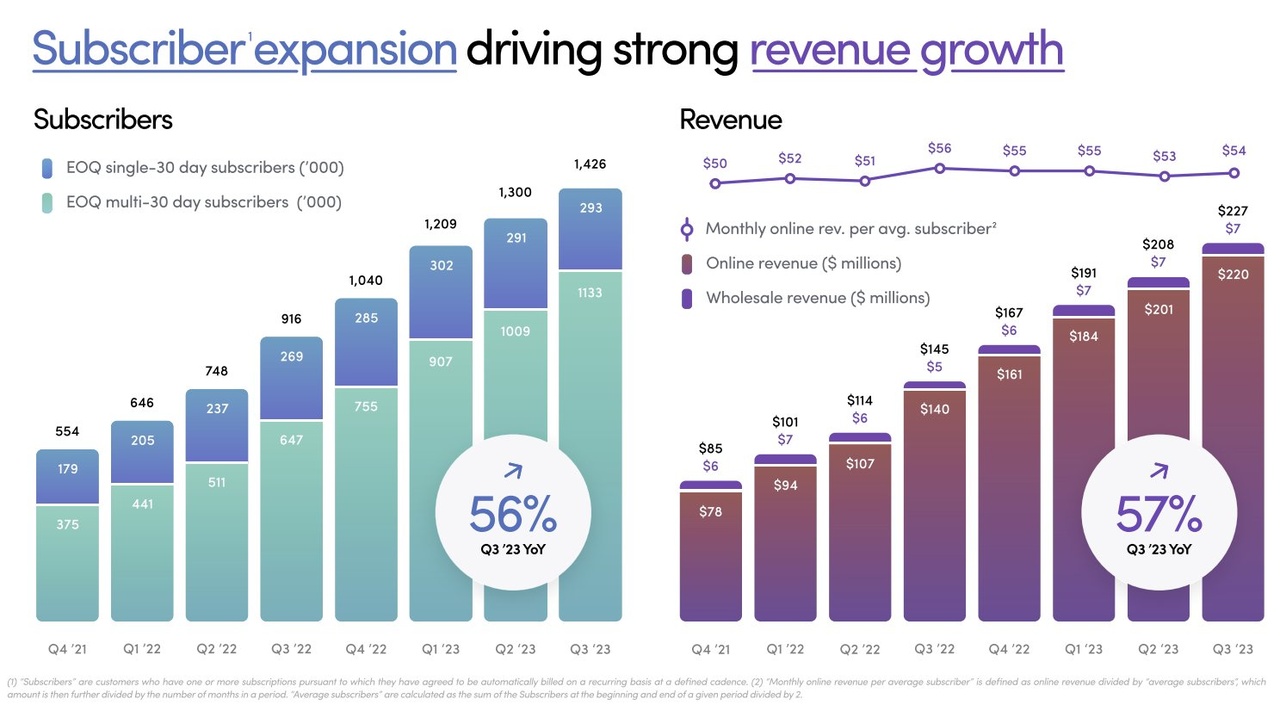

- Q3'23: Hims has a total of 1.426 million subscribers, an increase of 56% year-on-year from 916 million.

- This number has increased for 8 consecutive quarters, showing a steady trend of growing market share. This is, in my opinion, their most important metric.

Monthly online revenue per average subscriber* is $54, down 4% from $56 last year - but up 2% quarter-over-quarter.

(*Average subscriber: sum of total subscriptions at the beginning and end of the month, then divided by 2)

This figure fluctuated by a few percent over the course of 2022-23. But that's a volatility I can live with.

Net orders amounted to 2.22 million, an increase of 33% on the previous year's figure of 1.67 million.

The average order value (AOV) is USD 99, an increase of 19% compared to USD 83 in the previous year.

Hims is a fairly small company when you think of companies such as the Magnificent 7. However, this small company is not only able to get their 1.4 million subscribers to trust their health to this only 6-year-old telemedicine company, but also to get them to place an average order value of 99 US dollars.

Most people in America already have a health care provider/doctor they trust. The health care/health care system in America is also very different than in Austria/Germany, it is also much more costly in terms of out of pocket expenses for health care and many of us can't imagine this either.

then came Q4'23:

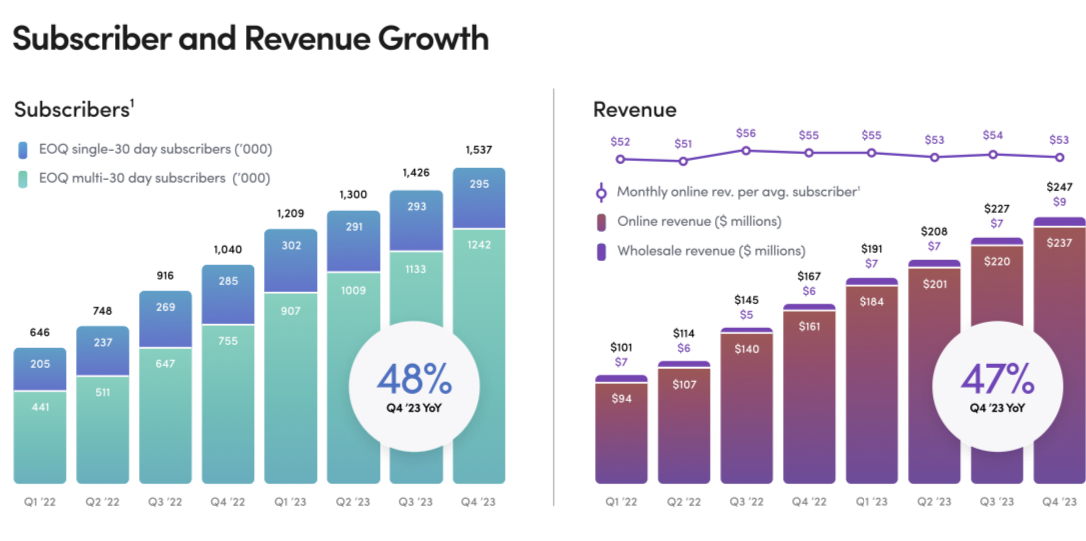

Hims has attracted more and more subscribers as they expand their core specialties - sexual health, dermatology for men and women, mental health and weight loss.

Since Q1'22, they've grown from 646,000 subscribers to 1.5 million today. That's +132% in less than 2 years!

Revenue:

Q1'22: $101 million

Q4'23: 246.6 million $

That is an increase of 143 %!

I assume that this growth will continue in the coming years.

The average order value has risen by 18 % compared to the previous year:

AOV (The average order value):

2022: 87 $

2023: 103 $

-> these values are higher than in Q3'23 as there is no Q4'23 was included

I find the AOV (Average Order Value) really impressive.

(The average order value (AOV) is the average amount of money each customer spends per transaction in your store)

Not only is the number of subscribers growing, but they are also adding more products/services to their treatments.

Hims currently has 1.537 million subscribers - an increase of 48% year-on-year

The CEO stated in the 4Q23 conference call that Hims' core competencies provide solutions to problems that affect 100 million people. The company expects its subscriber base to grow from 1.5 million to tens of millions.

Although there is no timetable, I believe Hims can continue to grow for many years to come.

Revenue

2019: 82 million $

2020: 148 million $

2021: 271 million $

2022: 526 million $

2023: 872 million $

Not only is the number of subscribers increasing, but Hims is also expanding its offering e.g. Hims weight loss was just announced in December.

This launch increased the relevance of Hims by entering a HUGE market. These category expansions will allow Hims to sell additional services to already loyal subscribers - providing potential easy revenue growth.

If someone cares enough to pay for a subscription for hair loss, they'd probably be willing to spend money on weight loss too.

The more offer Hims has, the more they can cross-sell, resulting in a higher AOV.

Hims just announced its first quarter of profitability. This milestone has finally given this stock some momentum and will continue to do so as long as it maintains its profitability.

Reaching profitability could now attract a new group of investors as many (especially fund managers) are staying away from unprofitable companies and Hims has now proven that they can be profitable.

If Hims can maintain this profitability, not only will the stock attract interest from safer/less risky investors who tend to be more risk averse, but the company will also have more money to spend on improving its products and services.

I personally see steady growth here and further growth opportunities in many different areas and countries, which has certainly been accelerated by the pandemic.

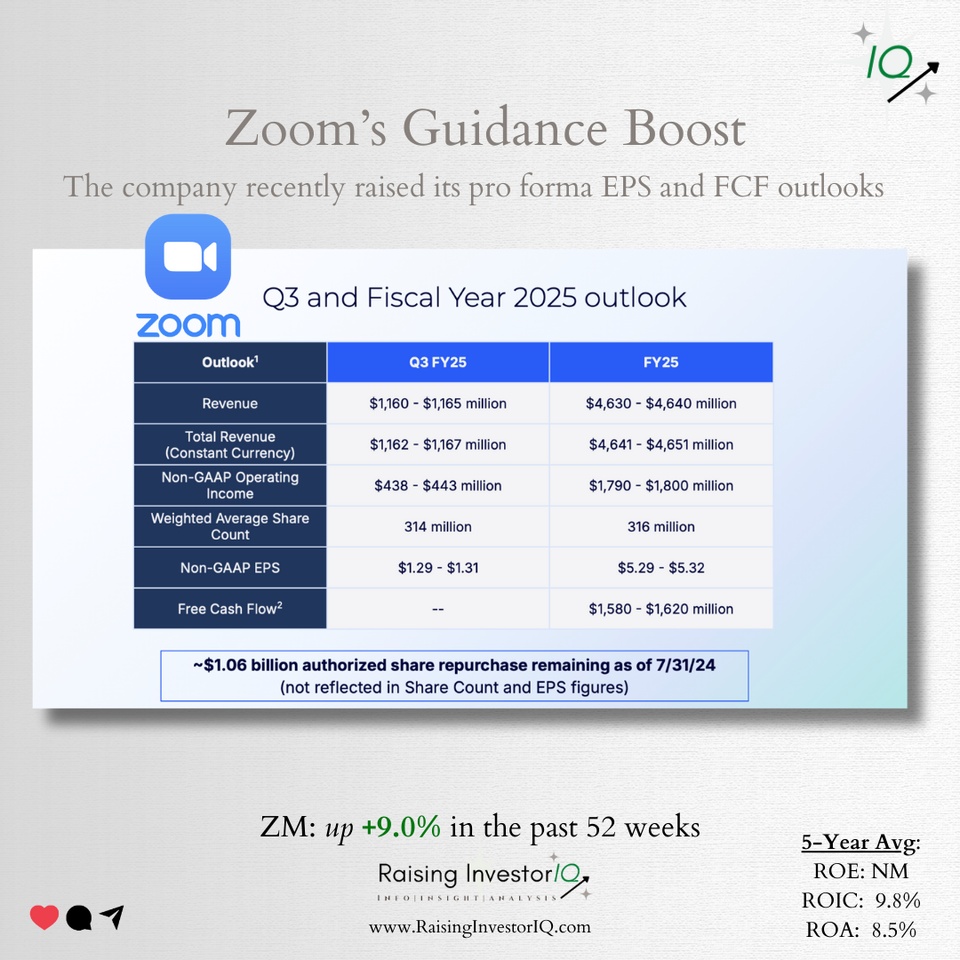

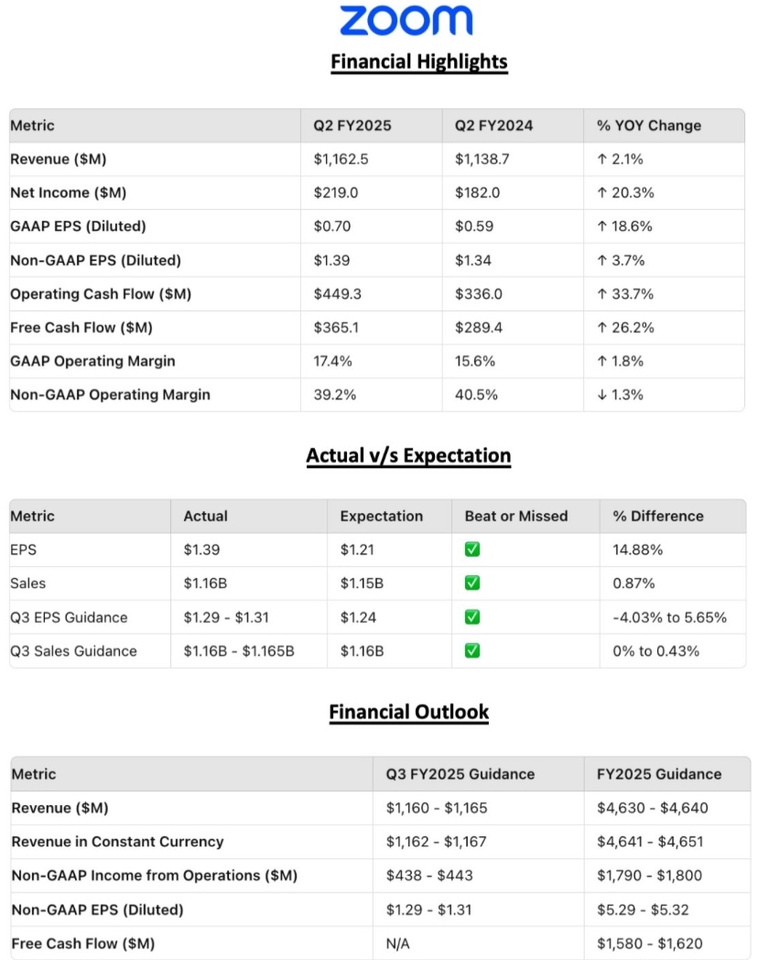

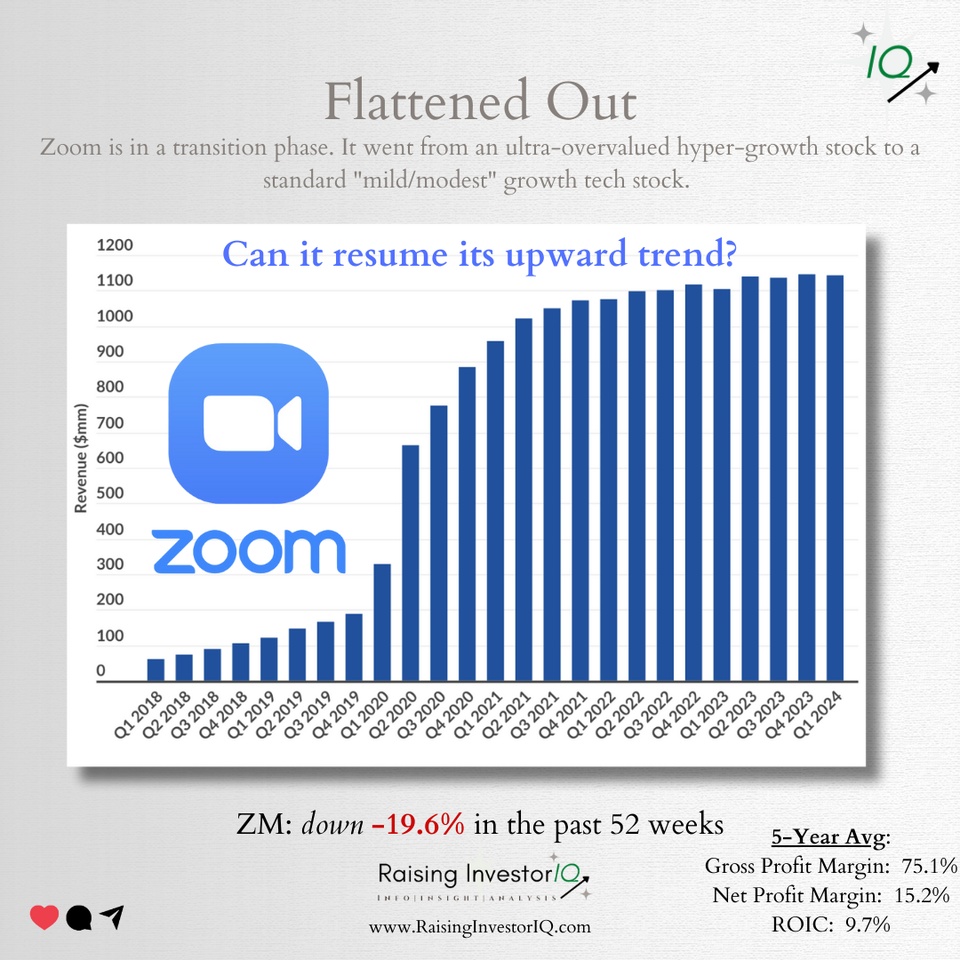

However, I don't believe that Hims only had a boom factor due to Corona and that user numbers are slowing down, as is the case with $ZM (+2,61 %) the growth is steady, as the figures show.

There is really no reason to give Hims a try, but they still attract subscribers. Not only do they attract subscribers, but they can also get those subscribers to pay close to $100 when they place an order.

This could be for the following reasons:

1.) You sell some pretty high end products/services that justify a high spend.

2) They offer options that subscribers can't resist and want to try or add to their regular regimen

3) It turns out that getting prescriptions/products sent/delivered personally and directly to the doorstep is very popular and in demand.

4) or all of the above in combination with MedMatch (Ham's biggest innovation) leads to this strong demand

MedMatch is a service from Hims (owned by Hims) that leverages the collective knowledge of hundreds of providers and millions of data points to help Hims providers offer treatments/prescriptions with the greatest chance of success for patients.

MedMatch uses AI and machine learning to accelerate the personalization of individual patient treatments. The model is trained based on anonymized clinical visits, demographics, treatment types and patient outcomes.

Find out what's so special about Hims MedMatch.

MedMatch helps Hims providers by eliminating trial and error from the doctor/patient experience. If a patient has a problem, a doctor would typically prescribe the lowest strength solution to fix that problem. If the problem then persists, the doctor would prescribe something stronger until the problem is resolved. With MedMatch AI, you immediately choose a perfect, personalized treatment.

(I'm not a doctor, but I'm sure or can imagine that this saves a lot of time for the doctor by not having to deal with follow-up appointments in an attempt to adjust a patient's treatment)

MedMatch allows providers to deliver personalized and accurate care on day 1 by leveraging proven proprietary data* with AI.

*Proprietary data: Data that is owned by the organization and not publicly available. Think about how hospital staff protect patients' personal data with their lives, because this is not public information and belongs to the hospital.

Competition/Castle Moat :

2 names come to mind when I think of Ham's competitors: Teladoc $TDOC & Amazon Clinic $AMZN

All 3 of these business models are very similar:

- They virtually connect customers with doctors

- They provide this healthcare without involving insurance

- They all offer the convenience of NOT physically attending healthcare appointments

So it's not like Hims is in a lane of its own. Costco is also $COST also wants to get into the telehealth market.

What really sets Hims apart is its widening moat - MedMatch. Before I get into how MedMatch can provide a competitive advantage, let's define what exactly a moat is. What is the value here?

When I look for a moat in a company, I look for the X-factor advantage within the company that makes the business model more efficient and that competitors cannot easily copy.

When I think of Hims, I believe that MedMatch can be seen as the company's moat. Although they are not the only ones using data with AI, they are the only ones using proprietary data to develop an algorithm that provides treatments with the highest chance of success.

Amazon's AWS has developed HealthScribe:

A service that eliminates healthcare paperwork by digitally documenting appointments and creating a digital database by recognizing speech during doctor-patient conversations. HealthScribe can automatically generate transcripts, extract important details (medical terms and medications) and create summaries of doctor-patient conversations that can then be entered into an electronic health record (EHR) system. Teledoc has similar AI integrations contributed by Microsoft's Azure that reduce the administrative burden on providers by minimizing the need for physicians to turn away from patients to take notes during conversations.

Sure, that sounds like it would save the doctor time by taking notes and then submitting documentation of patient visits to an electronic medical record, but it's nothing compared to what MedMatch does. This is a service that healthcare organizations can apply to their own systems. Similar to the integration of Shopify $SHOP POS into your digital storefront.

As I mentioned earlier, MedMatch uses proprietary data to develop personalized treatments by using AI to filter millions of data points, trends, patterns, physician notes, and proven outcomes from previous appointments to find the best path for a Hims patient.

This technology will make the barrier to entry insanely difficult for up-and-coming telemedicine companies to copy Hims' business model as long as Hims continues to improve MedMatch's effectiveness. In a few years, I imagine MedMatch's success rate will be a key metric for investors. That's their moat in my opinion.

Closing thoughts:

If/when interest rates are cut this year, it will be a massive year for smaller companies. Small businesses - especially those with profitability issues - need credit more than the giants. These additional funds help them to increase their turnover. Profitable giants have billions in cash that they can spend on growing the business without having to increase their debt. Smaller companies tend not to have this luxury.

Hims has an insane amount of room to grow! They are barely scratching the surface of their expanding TAM. Literally only 1% of their target market is currently subscribed.

(Which in my opinion, due to the healthcare system, the US and neighboring countries are predestined)

It remains to be seen how telemedicine will establish itself in Europe or Austria/Germany, but I could imagine (provided that data protection is not too strict and the regulatory system can manage this) that Hims could be used for simple/digital prescriptions or niches such as hair loss, potency problems, etc. in the distant future. (Although other providers will probably prevail in Central Europe, but perhaps even use MedMatch as a license, who knows what the future holds)

The total addressable market (TAM) for Hims is basically limitless when you consider that everyone needs healthcare and this is constantly increasing. (Demographic change)

They currently have 1.4 million subscribers, but there are 8 billion people in the world who need healthcare. As this company grows, the traditional healthcare system will become obsolete, much like internal combustion engine vehicles as electric vehicles become the standard or banking/FinTech. Everything in this world has an unhealthy level of convenience, such as extending digital apps into your physical reality because you don't even want to take your phone out of your pocket. Why not transfer some of that convenience to healthcare?

Let's imagine a world where we receive prescriptions (after a digital conversation) without having to go to the first doctor's appointment in person to receive referrals, which we simply pick up, receive in the mail, or even have delivered digitally.

What if the referral and treatment were online?

What if the prescription was sent by post to our front door, by email or by app?

What if treatment was efficient, saved us a lot of time, made the hurdle of going to the doctor easier for some people and treatments actually became easier and quicker (especially for unpleasant diagnoses/areas such as hair loss, potency or weight problems etc.) ? ) ?

I like to look to the future and many things will certainly become reality.

Technology accelerates technology and I think we will see a lot more progress in this area.

Your BamBam 😊

As always, this is not investment advice or a recommendation to buy, just my personal opinion and assessment

Here are a few more insights, form your own opinion

https://www.hims.com/

Snoop Dog advertising Hims:

https://youtu.be/ucwyJvzk7tohttps://youtu.be/ucwyJvzk7to

https://www.instagram.com/p/BiHvqqwA3XP/?igsh=MXhsNW44N2ludm5mbw==