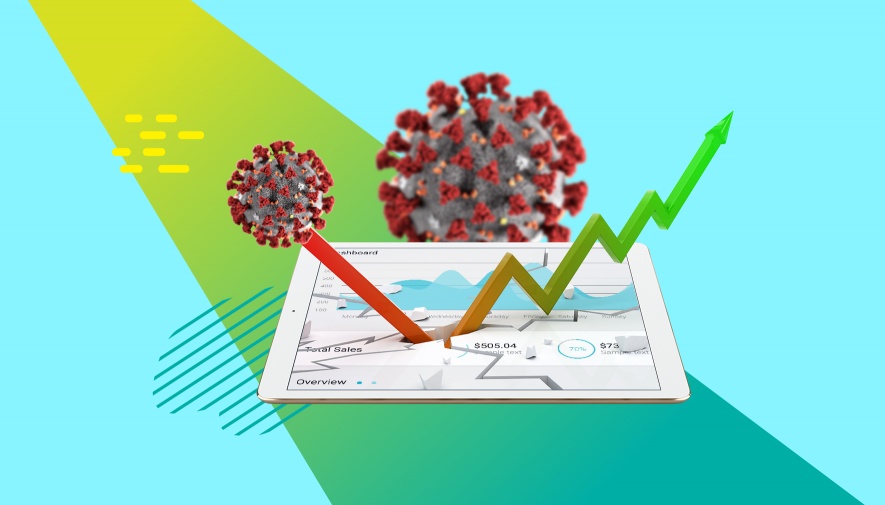

It is April 2020, and I am a young and hopeful student who has been studying the theory of financial education for several years and decide to take advantage of the supposedly unique opportunity of the "crash" to finally enter the stock market despite limited capital.

Theoretically, the idea was that it should be easy to get in during a difficult market phase, as all assets should be cheap due to the uncertainty. At least cheaper than they were before. When markets fall, multiples fall too. So even if you don't get everything right or even get a lot wrong, from a purely mathematical point of view you should still be better off than someone who got in in 2018 or 2019. So far, this logic is actually conclusive.

But the pandemic crash was not a normal crash. And I actually find it far too interesting not to talk about it.

In my experience, there is still a lot of talk today about the new markets in 2001 and the real estate bubble in 2008. However, the exciting market phase of the pandemic has hardly been looked back on at all. This may also be due to the fact that we don't feel we can look back at it yet, as we can still feel the effects and have barely really overcome them. However, it is now slowly becoming apparent that a new era has dawned on the market, which is primarily about tariffs, trade deficits and currencies.

But what makes the pandemic a bad time to start?

If you look back at the charts of some securities (and for the sake of clarity, I would like to refer mainly to equities here), you can see several things.

In the case of shares with a gravitas such as $BRK.B (-1,45 %) only a tiny corona dent can be seen on the long-term chart. From this you can see that it didn't really matter when you invested. However, the earlier the better. It was important to invest at all, but it was not necessary to wait for a specific point in time. However, this even applies to clear pandemic losers such as $BKNG (+2,11 %) and $EVD (-1,5 %) .

For some stocks like $AMZN (+1,61 %) and $MSFT (+1,42 %) the entry point during the actual crash was not ideal. There was an optimal entry point for both stocks recently, but this would not have been apparent until 2-3 years after the crash. Both stocks survived the pandemic almost unscathed, but were then affected by severe secondary factors that put the business under pressure.

Stocks like $TMO (-1,09 %) or $AFX (-1,22 %) were considered pandemic winners. You could have picked them up at the beginning of the crash ... or you could have left them alone and got them back 5 years later at exactly the same price as before the pandemic started.

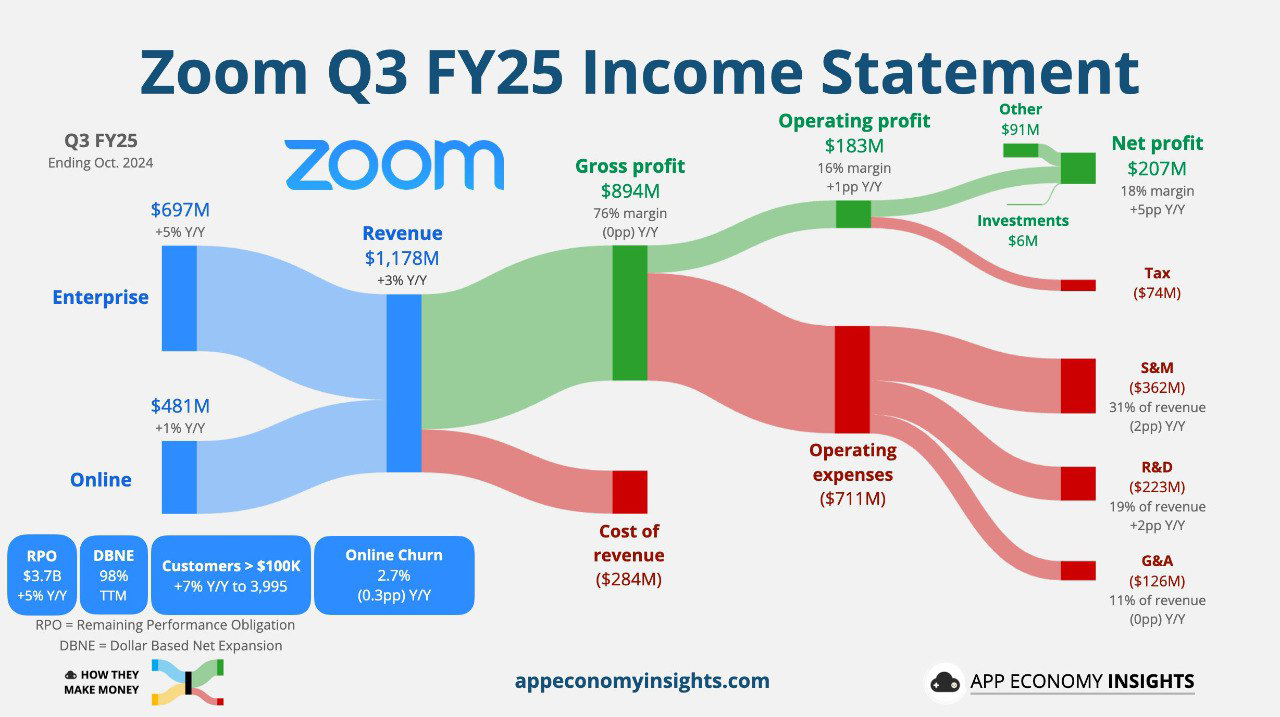

And now the worst category: hype stocks. The absolute catastrophe happened to all those who were looking for opportunities where there were actually none. Whether investments in emerging markets or hopes for the future in $ZM (+1,46 %) and $FVRR (+1,93 %) - Money that was taken out of the broad market ended up largely concentrated in assets that will not reach their ATH for another 20 years. Anyone wanting to be in it for the long term found their Waterloo in the pandemic. Some companies such as $EUZ (-1,4 %) or $SRT (-0,87 %) may well be doing great things. But here the "crash" was simply the absolute worst entry opportunity of the entire decade.

Correction Edit: I only found a group of stocks that I really needed to buy in the crash and that was Big Oil. There were certainly other stocks that were a bit cheaper at the time. But for the most part, it was not essential to enter at the low point in order to make good returns. That is what made this market phase so difficult. The good stocks were NOT extremely cheap, but there were many bad stocks that were extremely expensive. For newcomers, such a situation is incredibly difficult to navigate.

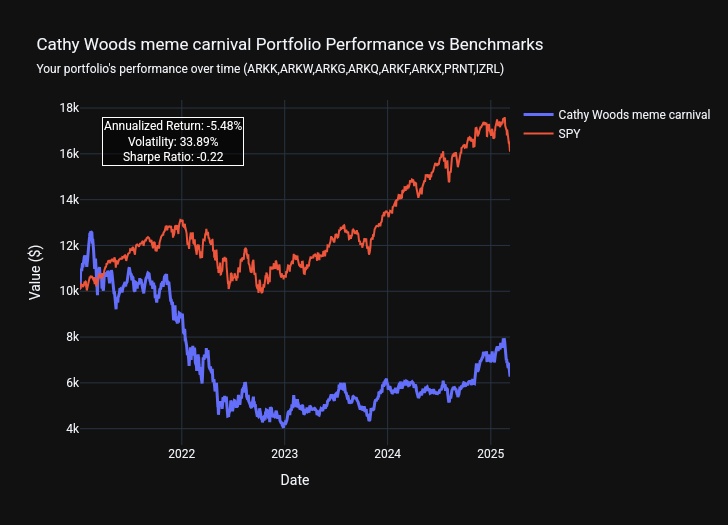

I closed 2020 with +12% and 2021 with +8% only to get a -22% in 2022. So I didn't make any returns at all in the first 3 years and just paid a lesson.

I thought I would have been smart at least not to have entered in 2018/2019 when all shares were valued much higher on average. But I might have gained experience in these two years so that I would have had more guidance in 2020. Or I could have started in 2022/2023, when there were no more hype stocks and you could pour money into the market with a watering can and it almost always turned into a flower.

I recently saw the portfolio of a friend who restarted his portfolio in 2022. Almost the same portfolio size as mine. However, while I have made 7% p.a. since the start of my portfolio, he has an IZF of 15%. With a portfolio size of 100k, this means that I am sitting on €12,000 book profits and he on €33,000

Backtests are currently showing that my strategy has really put me to sleep and put me to sleep by ALL known and common indices over 5 years. The only consolation here is really the 3-year performance, where it is clear that I can keep up with the major indices and also leave a few big names behind me.

So on a positive note: I'm getting better.