Salesforce

$CRM (+4,64 %) plans, according to Bloomberg, to hire more than 1.000 employees to boost sales of its new product "Generative AI Agent" product.

Photo: Talkdesk

Postes

148Salesforce

$CRM (+4,64 %) plans, according to Bloomberg, to hire more than 1.000 employees to boost sales of its new product "Generative AI Agent" product.

Photo: Talkdesk

Depot review September 2024 - The first green September in my depot since 2019 📈

September is generally regarded as the worst month on the stock market, with a negative monthly performance more than 50% of the time. This is also consistent with my experience since 2013. In 11 years, it has been negative 6 times and positive 5 times. From 2020 to 2023, the last 4 years were all negative. However, September 2024 is now the first positive September since 2019, which means it is exactly 50/50 for me - 6 positive and 6 negative Septembers since 2013.

The Fed's interest rate turnaround and the stimulus in China have certainly contributed to the positive trend

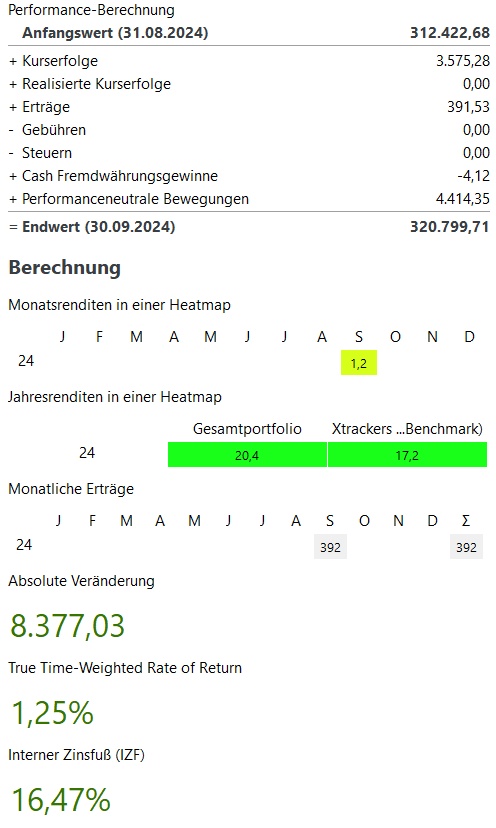

Monthly view:

In total, September was +1,2%. This corresponds to price gains of ~3.600€.

The MSCI World (benchmark) was +1.0% and the S&P500 +1.3%

Winners & losers:

A look at the winners and losers is particularly exciting this month.

On the winning side at the very top are my China ETF with € +1,300 and is thus back in the green for the first time in a long time. The following winners are also a colorful mix with Meta, Bitcoin, Home Depot and Sea. Really a very broad mix with no clear tendency towards regions, sectors or the like

On the loser side in my portfolio in September were mainly pharmaceutical stocks. Novo Nordisk, Amgen and Johnson & Johnson. Even worse, with price losses of ~€700 each, were only Palo Alto Networks and ASML.

The performance-neutral movements in September were just under €4,500. The premium refund from my private health insurance also played a large part in this. In September, I received over €2,000 back for the year 2023, which was of course invested directly to compensate for any higher pension contributions.

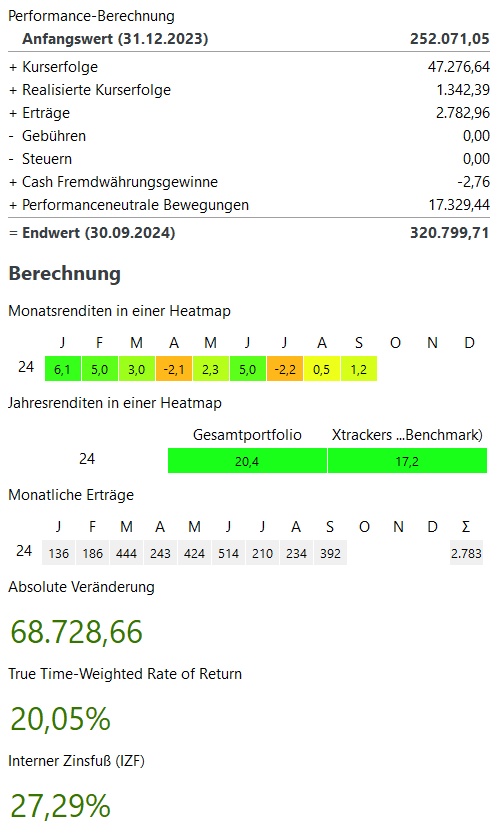

Current year:

My performance in the current year is +20,4% and thus above my benchmark, the MSCI World with 17.2%.

In total, my portfolio currently stands at ~321.000€. This corresponds to an absolute growth of ~€69,000 in the current year 2023. ~49.000€ of this comes from price increases, ~2.800€ from dividends / interest and ~17.000€ from additional investments.

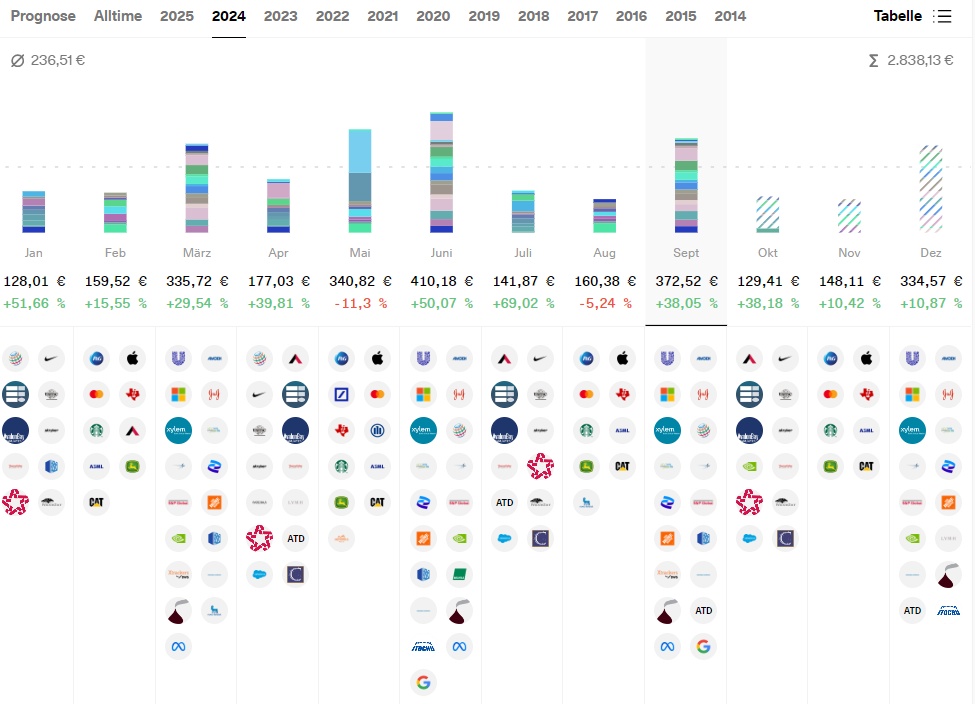

Dividend:

Buys & sells:

Target 2024:

My goal for this year is to reach €300,000 in my portfolio. Due to the extremely positive market development in the current year, my portfolio currently stands at ~€321,000.

At the beginning of September, my portfolio was still quite a bit lower at €304,000 due to the weak start to the month. At this point, it was therefore quite a way off the previous high of €320,000 in June.

I have now reached a new high of €321,000 and am optimistic that I can still beat my year-end target of €300,000.

Salesforce

$CRM (+4,64 %) and Nvidia

$NVDA (-0,03 %) have signed a strategic partnership to provide "advanced AI solutions for enterprises that enable autonomous agents and interactive avatar experiences".

Hi everybody

After the $NVDA (-0,03 %) figures I took two days to decide what I wanted to do with some money I put aside.

If Nvidia dropped a lot I would have added a tranche to my portfolio. It didn’t so I spread my money across the whole world. $IWDA (+0,72 %)

Reasons for doing so:

1) If Nvidia disappointed I anticipated that stocks would drop everywhere and we would end up in a period of stagnating markets.

2) Continuing in the topic of AI: I also looked into the quarterly figures of $CRM (+4,64 %) and we can see that AI is being monetised, which results in improving figures.

3) When we look broader than just AI and technology, macroeconomic figures indicate that inflation has decreased to 2,2% in the Eurozone. It is now almost certain that the ECB will cut intrest rates in september.

It would be nice if you gave me your insights about all this! Thanks 🤘

Finally $CRM (+4,64 %) into the depot👌 Next up $BLK

$MCD (+2,19 %)

$OR (-2,66 %)

$O (+2,65 %)

$MC (-2,6 %)

$HAG (+2,31 %)

$DTE (+0,79 %) Still a long way to go😅

29.08.2024

Nvidia disappoints stock market despite strong AI growth + Salesforce exceeds expectations + Crowdstrike lowers annual targets + Super Micro Computer does not submit annual figures on time

With significant share price losses Nvidia $NVDA (-0,03 %) reacted to the figures and, above all, the chip company's outlook with significant share price losses in after-hours trading. Although the highly anticipated business figures of AI chip manufacturer Nvidia exceeded consensus estimates, the gross margin and data center sales rose more slowly than in the previous quarter. In addition, the outlook was not convincing in all respects. For example, the new chip generation ("Blackwell") will go into series production one quarter later than planned. Nvidia fell by around 7 percent in the after-hours trading.

MI 22:22:33 *NVIDIA Q2 GROSS MARGIN AT 75.7% (PROG 75.5)

MI 22:22:59 *NVIDIA ANNOUNCES FURTHER SHARE BUYBACK OF USD 50BN

MI 22:23:31 *NVIDIA MAINTAINS QUARTERLY DIVIDEND OF 1 US CENT

What do you say? Is Nvidia too big in the hype and therefore the expectations of the stock market simply far too high? The figures are basically good, but the expectations of the stock market were very high...

In contrast, the figures from Salesforce $CRM (+4,64 %) The SAP competitor's revenue, profit and operating margin exceeded expectations. The company also raised its outlook. The share gained 4 percent. Salesforce Inc's second-quarter earnings per share of $2.56 beat analysts' estimates of $2.35. Sales of $9.33 billion exceeded expectations of $9.22 billion.

Crowdstrike $CRWD (+0,55 %) lost 2.7 percent. Although the company earned more than expected in its second quarter, it lowered its annual targets and gave a pessimistic outlook for the current quarter. The reason for this was the faulty software update that caused widespread disruption worldwide in July. Among other things, numerous flights were canceled, operations were canceled and stores had to be closed. Crowdstrike Holdings Inc's second quarter earnings per share of $1.04 beat analysts' estimates of $0.97. Revenue of $963.9m beat expectations of $958.32

The US group Super Micro Computer

$SMCI needs more time to review its accounts and misses the deadline for filing its annual report. Its share price plunged 25.1 percent to a seven-month low in early U.S. trading, putting it on track for its biggest one-day selloff since a record 41.1 percent plunge on Oct. 4, 2018. The stock has fallen 41.5 percent so far in August, putting it at risk of its worst monthly performance in history.

Thursday: Stock market dates, economic data, quarterly figures

ex-dividend of individual stocks

Diageo 0.63 GBP

Glencore 0.07 USD

Plus500 1.00 GBP

Quarterly figures / company dates USA / Asia

Untimed: Best Buy quarterly figures

Quarterly figures / Company dates Europe

07:00 Schott Pharma | Adler Group Quarterly figures

07:30 Delivery Hero | Fielmann Group | Mister Spex half-year figures

08:00 Syngenta half-year figures

09:00 Pernod-Ricard Annual results

10:00 Sto SE half-year figures | Deutsche Euroshop AGM

14:00 Delivery Hero Analyst Conference

17:00 Thyssenkrupp PK after supervisory board meeting

22:00 Morphosys half-year figures

Untimed: Birkenstock quarterly figures

Economic data

Salesforce

$CRM (+4,64 %) has just published its quarterly results:

A earnings per share (EPS) of 2,56 USD exceeds expectations of 2,35 USD.

The turnover of 9,3 billion USD exceeds expectations of 9,2 billion USD.

Earnings times today (+6h for CEST) ⏰

Real-time results & analysis: https://t.me/Aktien_Stammtisch

Meilleurs créateurs cette semaine