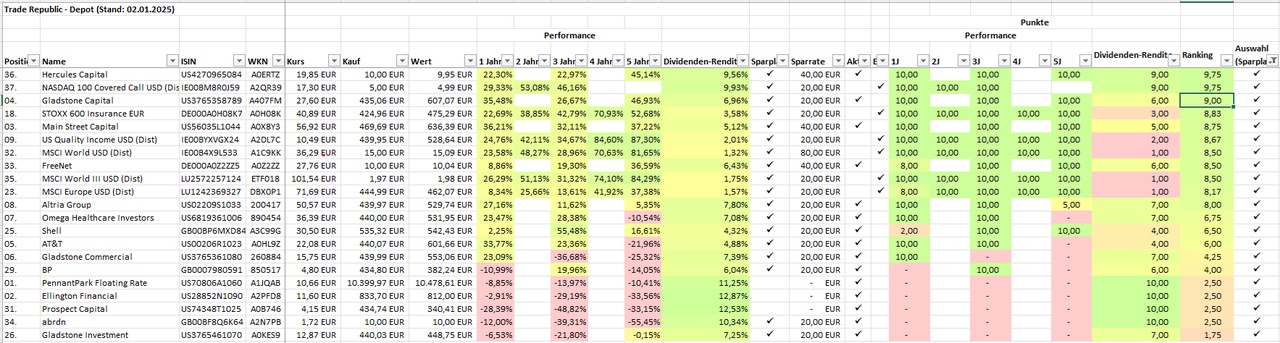

Due to some partial profit-taking in the (US) tech/AI sector ($NBIS (+0,58 %) / $AVGO (+0,33 %) / $MPWR (-0,36 %) / $AMD (+0,36 %)) and OS selling ($RKLB (+0,42 %) / $AMD (+0,36 %)), the portfolio will be rebalanced and restructured. $RKLB (+0,42 %) , $LMND (+0,83 %) , $GOOG (+0,05 %) and $9988 (-0,59 %) but I'm not touching them (yet) 😀

Unfortunately, the entry prices for GQ have been completely messed up due to the recent transfer from TR to SC.

- After almost a year of watching, I dare to re-enter at $GRAB (+0,99 %) - further increase to 500 shares would be considered

- at $HIMS (+0,65 %) a limit buy at €25 is lying in wait, increase from 40 to 60 shares planned

- $NOW (+0,93 %) increased to 13 shares

- $WKL (-2,23 %) increased to 18 shares

- $AJG (+0,92 %) Position filled, 7 shares

- $DXCM (-0,07 %) Position filled, 26 shares

- Doubling of the small speculative position at $ONWD (+1,11 %) planned to 120 shares, limit buy @ € 4.30

- 10 shares $TEM (+1,72 %) collected, savings plan continues

- $RSG (-0,09 %) , $CCEP (+0,22 %) and $DDOG (+0,16 %) also continue to run in the savings plan alongside the ETFs $UBU7 (+0,13 %) , $WINC (+0,85 %) , $SCWX (+0,87 %) and $EXH5 (+0,2 %)

I am still undecided about the potential increase in $UBER (+0,42 %) , $NU (+1,06 %) , $ZTS (-0,46 %) and $TTD (+0,17 %) - and would be happy to hear a few opinions! I feel Nu and Uber are the most likely at the moment - although Waymo is accelerating well.