📈 I’m on a mission to grow this position to $10,000 by year-end, which will generate four strong quarterly dividend payments and help me steadily increase my passive income.

VanEck VanEck Developed Markets Div Lead ETF

Price

Discussion sur TDIV

Postes

262💸 Just boosted my position in $TDIV by another 1000 EUR! 🚀

I like having solid exposure to dividend-paying tech companies, and TDIV keeps delivering both growth + income potential.

📈 Long-term mindset: stacking quality ETFs, reinvesting dividends, and letting compounding do the heavy lifting.

How are you positioning your portfolio right now? Focusing more on growth, dividends, or a mix of both? 🤔

New purchase made! 🚀

Glad I was able to invest another nice amount of money in . $TDIV (+1,26 %) .

Also bought €100 in $BTC (+0,9 %) bought.

Everything can be seen in the new video!

Portfolio €39,250 - Duo provides new purchases! 🚀

September savings plan part 2

A total of €3,200 was invested this month, of which €1,000 was invested in the $TDIV (+1,26 %) were invested. Deposit now stands at €130,000, target for this year is €140,000.

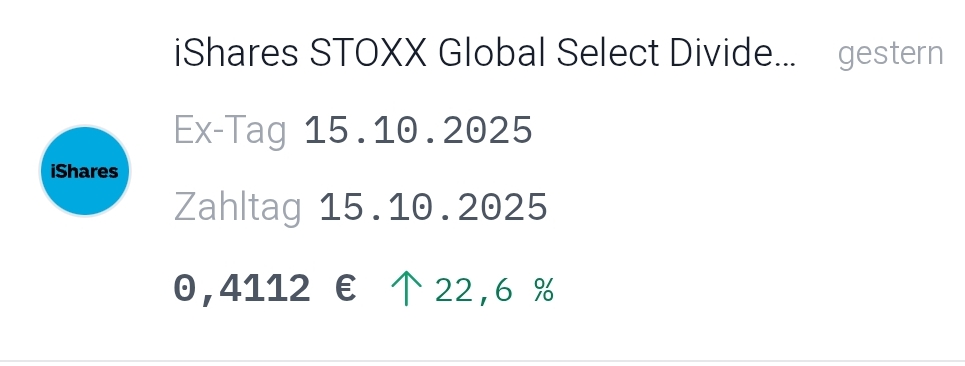

Dividend increases significantly

Compared to last October, the dividend from the $ISPA (+0,58 %) considerably. 😃

Also performing better than my favorite ETF lately $TDIV (+1,26 %) .

Dividend Reinvested, and 2 goals realized !

Dividend Reinvested $JEGP (+0,12 %) & $TDIV (+1,26 %) further expanded

Roast my concept...

...you have all become my most valuable advisors here. Every day you prove to me that you enjoy investing and know your stuff.

I am satisfied with my portfolio, but it is too complicated and could be simplified. That's why I'm toying with a new concept until December 2026.

My current portfolio should be streamlined by then and follow a clear long-term line. The tax burden would be devastatingly low in the event of a partial sale if gains and losses are offset against each other.

You are welcome to evaluate, root for, criticize or whatever you like about the future concept here and now 😄

The plan looks like this:

41% of the portfolio size should henceforth $IWDA (+0,79 %) be

10% $XMME (+2,29 %)

10% $WSML (+0,6 %)

8,5% $GGRP (+0,92 %)

8,5% $TDIV (+1,26 %)

I would sell the FTSE, the other dividend ETFs and the individual stocks. This should reduce the TER slightly and with 9 total positions it would probably not only be clearer but also yield-optimized at best.

I look forward to your opinions on this.

Thanks as always, good returns to you all and best regards

_EvD_ 😊

What's next....?

Good morning,

I am quite new to the subject of investing etc. My knowledge ? I'm sure 99% of you have more.

And that's where I really need help. I am 39 and would like to build up a cash flow with dividends. Yes, I know that investing would be better in the long term. But I realized first hand how a little cold can lead you to the intensive care unit with 9 months of sick leave (including rehab etc).

That's when I realized that you also live in the here and now. Of course I also want to think about tomorrow, but I want to be able to do both. I would like to start with 250€ /month. I have in mind etf like $HMWO (+0,76 %) , $VHYL (+0,71 %) , $ISPA (+0,58 %) ,$TDIV (+1,26 %)

$ZPRG (+0,66 %) , $EUHD (+1,04 %)

$VWRL (+0,53 %) in mind.

And yet I am unsure . How much in whom, which one do I take ? should I possibly consider others ? Does the selection make sense at all? Do I want a distribution every month (would be great)?

At the moment I don't need the distribution and would reinvest it.

So many question marks buzzing around in my head .... Do you have any advice?

Thank you very much

Investment strategy

Hey, I'm 20 and currently invest €600 a month: €300 in $ISAC (+0,51 %) as a basis and € 300 divided into € 75 $FGEQ (+0,38 %) and $TDIV (+1,26 %) , 50€ $WINC (-0,38 %) and €10 each in 10 dividend shares. My aim is for the savings plans to pay for themselves at some point through dividends (in around 15-20 years according to my calculations). I'm now considering whether it wouldn't make more sense to focus more or entirely on growth first in order to build up capital more quickly and then switch to dividends later.

I would be happy to hear a few opinions and ideas from you.

Thank you in advance

You have already recognized this correctly yourself. It would be advantageous to switch to growth over the next few years and then to dividends.

Titres populaires

Meilleurs créateurs cette semaine