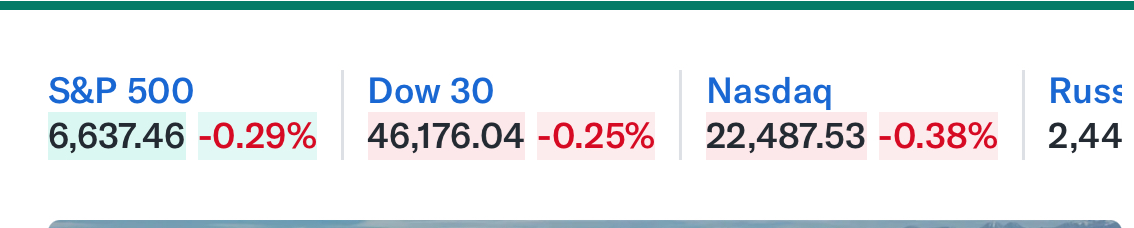

The stock market is turning red but my portfolio is green.

Follow my Road To 100K.

https://youtube.com/@meneervermogen1?si=-axDwKfrn_OFl1CP

$VHYL (+0,53 %)

$VWRL (+0,3 %)

$ASML (-0,5 %)

$NN (+1,07 %)

$MO (+0,39 %)

Postes

263The stock market is turning red but my portfolio is green.

Follow my Road To 100K.

https://youtube.com/@meneervermogen1?si=-axDwKfrn_OFl1CP

$VHYL (+0,53 %)

$VWRL (+0,3 %)

$ASML (-0,5 %)

$NN (+1,07 %)

$MO (+0,39 %)

Good morning,

I am quite new to the subject of investing etc. My knowledge ? I'm sure 99% of you have more.

And that's where I really need help. I am 39 and would like to build up a cash flow with dividends. Yes, I know that investing would be better in the long term. But I realized first hand how a little cold can lead you to the intensive care unit with 9 months of sick leave (including rehab etc).

That's when I realized that you also live in the here and now. Of course I also want to think about tomorrow, but I want to be able to do both. I would like to start with 250€ /month. I have in mind etf like $HMWO (+0,29 %) , $VHYL (+0,53 %) , $ISPA (+0,84 %) ,$TDIV (+0,76 %)

$ZPRG (+0,57 %) , $EUHD (+0,36 %)

$VWRL (+0,3 %) in mind.

And yet I am unsure . How much in whom, which one do I take ? should I possibly consider others ? Does the selection make sense at all? Do I want a distribution every month (would be great)?

At the moment I don't need the distribution and would reinvest it.

So many question marks buzzing around in my head .... Do you have any advice?

Thank you very much

Today is my 20th birthday and I thought I'd share my portfolio with the GetQuin community.

Last week I passed my final apprenticeship exam as an electrical and building services engineer with a special module in building control technology with an excellent result.

I first got involved with shares and ETFs when I was about 14 years old through various YouTube videos and had already developed a great interest in them. I made my first small investment at the age of 16, which at the time was around €600 in Bitcoin via the Swiss provider Relai (my average purchase price is €23,500)

On my 18th birthday, I opened a securities account with Trade Republic and invested in shares for the first time and immediately set up a savings plan. I continued to save and invest diligently. My savings rate was around €500 per month. I invested in 4 ETFs ($VWCE (+0,15 %)

$VHYL (+0,53 %)

$IUIT (+0,28 %)

$XAIX (-0,22 %) ) and various individual shares.

From time to time I added a bit more crypto to the portfolio, but I didn't buy any more this year as the crypto weighting in the portfolio became too high for me and my focus is more on shares and ETFs.

The gold in my portfolio comes from gifts for my birth and first communion.

As I will be joining the Austrian Red Cross as a civilian servant next week and will then only earn just under €950 per month, the savings rate will be reduced to €200 for the time being and will only be invested in $VWCE (+0,15 %) and $XAIX (-0,22 %) saved. When I see how I manage with the money, I will increase or decrease the savings rate accordingly.

I would be very interested to hear what you think of my portfolio and would also be very happy to receive suggestions for improvement.

Growth stocks continue to rise so I added dividends to my portfolio again.

If growth stocks go down I will buy them again.

I would like to start a completely new portfolio that will primarily revolve around dividends.

As a core I was thinking of $TDIV (+0,76 %)

Would you say this is a good core?

If not I would add $VHYL (+0,53 %) add.

Additionally I would like to have a CC ETF as a kind of support, probably $JEGP (+0,62 %) and or $SXYD (-0,03 %)

I would like to represent the NASDAQ with $EQQQ (+0,03 %) but I will represent it with $ASML (-0,5 %) and $2330 will be added.

Allianz $ALV (+2,34 %) and Munich Re $MUV2 (+3,96 %) I definitely want to include, but they are too expensive for me financially, so I was thinking of the $EXH5 (+1,82 %)

Oil shares are represented by $VAR (-0,98 %) and one more.

Do you have any recommendations?

I am thinking about $CVX (-0,68 %)

$EQNR (+0,05 %) and $PETR4 (-0,24 %)

I would also like renewable energies, but I'm not familiar with them.

Do you have any suggestions?

Becoming a defensive company $ULVR (-0,72 %)

$D05 (-0,81 %)

$O (+0,59 %) and of course $NOVO B (-1,76 %) Being.

$BATS (+1 %) I already have in a portfolio, would it be too much of a lump to add $MO (+0,39 %) to add to it?

I still have $KHC (+0,59 %) on the watchlist but the split is not going so well, would it be wise to start with a savings plan?

Apart from that $RIO (-0,63 %)

$NKE (-0,32 %)

$1211 (-1,52 %)

$SOFI (-0,75 %) and $HAUTO (-0,36 %) will be represented with smaller positions.

What is your opinion?

Would you improve anything?

What else would you add, especially in EE and defensive stocks?

Feedback is very important to me here, so far I have just been wandering aimlessly around the stock market without a fixed plan and strategy.

This is my first attempt to build something serious.

Greetings to all Getquins out there!

A sector that has lost so much ground in recent years, I think it's time to put something in the portfolio, I was undecided between $MRK (+0,9 %) e $PFE (+0,25 %) but seeing the data the former has had a steady growth in earnings, revenues and R&D investment, as well as a lower payout ratio than Pfizer and a higher dividend increase over time, more than sustainable by the way, another interesting factor is the exchange rate, a purchase gone through at the exchange rate of 1.1737, much better than the previous purchase of $MAIN (-0,47 %) which took place for 1.1699 eur/usd.

I would have loved to have added$O (+0,59 %) to ride the wave of the rate cut but the broker Directa only reserves it for "professional" clients, a scam....

As things stand right now I would say that for the next month I am going to add an ETF between $ISPA (+0,84 %) e $VHYL (+0,53 %) , I intend to have both in the future but following a contrarian strategy, that is, buying the one that has lost the most in the past month (or gained the least).

Alternatives to the $VWRL (+0,3 %) because degiro is going to revamp its core selection.

$VHYL (+0,53 %) Why is this actually called a high dividend?

I don't think 3% is particularly high.

Dear community,

Due to circumstances in my job, I am now able to invest EUR 1200 per month in my income portfolio.

Unfortunately, I am at an impasse with my ideas and somehow need fresh input.

About me: Through individual shares (e.g. $O (+0,59 %) , $MAIN (-0,47 %) , $KO (-0,85 %) , $HAUTO (-0,36 %) , $PEY (+0,11 %) etc.) I currently receive an average monthly net dividend of EUR 206.

My investment objective is to build up passive cash flow. I am currently investing this independently in other assets or buying individual shares. If everything goes well, I would reduce my job in the future (5-10 years) thanks to the dividends.

My interest is a hybrid strategy (approx. 60% in dividend ETFs with (hopefully) growth and 40% in covered calls).

After much deliberation, I have now arrived at the following weighting:

$VHYL (+0,53 %) - 25% - 300,-

$FGEQ (+0,3 %) - 5% - 60,-

$DEM (+0,01 %) - 10% - 120,-

$TDIV (+0,76 %) - 20% - 240,-

$JEGP (+0,62 %) - 20% - 240,-

$JEPI - 10% - 120,-

$QYLE (+0,2 %) - 10% - 120,-

I don't like the $FGEQ (+0,3 %) (dividend growth is not really good) and the $QYLE (+0,2 %) (poor performance). What do you think of the weighting? I would be more than grateful for any ideas, suggestions etc. Muchas gracias.

Portfolio keeps rising and I bought a stock. We are over half way through my Road To 100K. Subscribe and follow my Road.

$CVX (-0,68 %)

$VWRL (+0,3 %)

$ASML (-0,5 %)

$NN (+1,07 %)

$ASRNL (+0,02 %)

$VHYL (+0,53 %)

Meilleurs créateurs cette semaine