Smart Beta ETF

Part 3 - Low-Volatility ETF

Disclaimer: No investment advice or recommendation, this article is for information purposes only. Before you decide on an ETF, take a closer look at it in terms of positions, sampling, regions, etc. I can't describe everything here as it would go beyond the scope of this article

Part 1 (Definition, Categories & Z-Score and Quality Factor): https://getqu.in/RCSY4a/

Part 2 (Value ETF): https://getqu.in/Nfnhqb/

What is volatility?

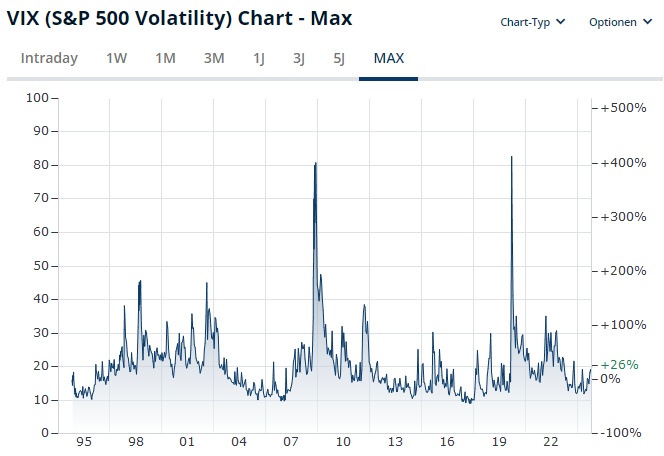

Volatility is a measure of risk for a share; it is determined by the range of fluctuation around the mean value of the share price. Put simply, the more volatile a share is, the higher or faster its price changes. The CBOE Volatility Index, often abbreviated as the VIX Index, is very well known:

This measures the volatility of the S&P 500. A low VIX indicates stable markets and a high level of confidence among market participants. If, on the other hand, volatility rises, investors expect greater market fluctuations in the future and are generally more uncertain. The spikes in 2008 (Lehman Brothers bankruptcy) and 2020 (coronavirus) illustrate this very clearly.

However, the risk can increase in phases of low volatility, as investors are inclined to take more risks in calm phases. In my view, this can currently be seen in the hype surrounding leveraged ETFs.

Since volatility is used as a risk index, this simply means that the higher the volatility, the higher the inherent risks and since risks are rewarded with returns on the stock market, volatility is reflected in valuation models for shares, e.g. in the form of the beta factor in the discounted cash flow model, which gives a "safety discount" in the valuation.

Low Volatility ETF

What are low volatility ETFs?

These ETFs focus on shares that have a relatively low historical volatility. The primary aim is to minimize risk and therefore not to optimize returns. They are therefore suitable for risk-conscious investors who, for example, want a more stable performance over the years or do not want to be so badly affected by crashes. High volatility can also cause stress for some investors, which is why low-volatility ETFs are the "calmer" option.

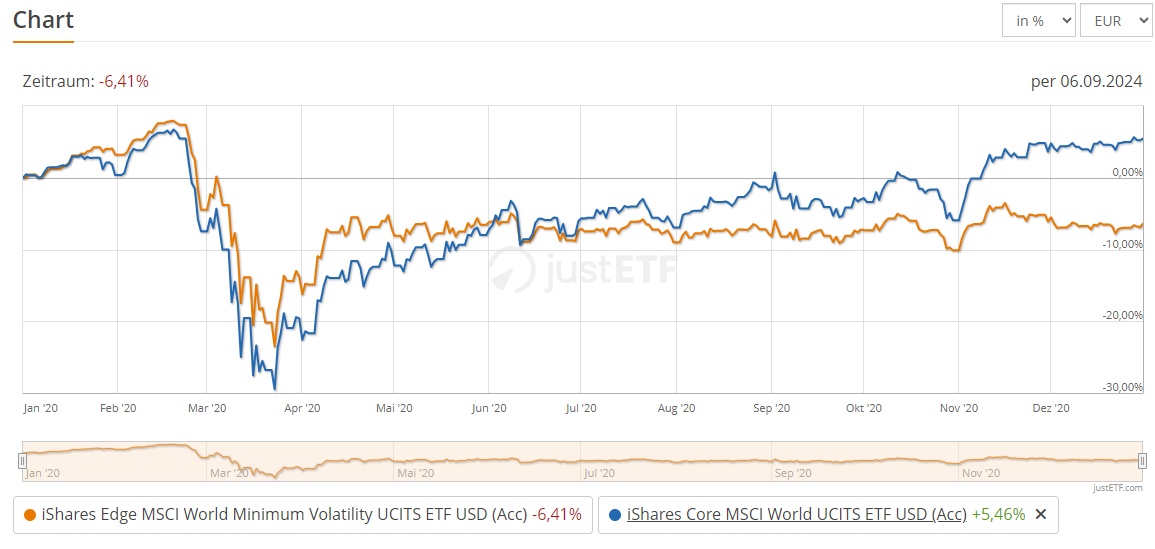

The example of 2020 (corona-related high volatility) shows very clearly that risk minimization is the top priority here. The drawdown of the World Minimum Volatility was "only" - 23 % at the beginning of the year, while the World ETF recorded - 30 %. However, during the subsequent recovery, minimum volatility lagged well behind its parent index.

In times of prolonged negative stock market years, e.g. 2015-2017 ("China crash"), minimum volatility ETFs can certainly achieve a small excess return (see chart 2). In the long term, however, this also levels out.

Low volatility ETF

The following is a selection of well-known low volatility ETFs and their calculation logic.

MSCI Low Volatility ETF

Optimization based on "Barra" score with focus on low beta and volatility

- $MVOL (-0,32 %) (World | TER 0.30 % | TD 0.01 % | 2.6 bn | 3Y underperf. vs. world -5,5 %. |3Y Vola 11.6% | max Drawdown 29%)

- $XDEB (+0,13 %) (World | TER 0.25 % | TD n.a. | 0.5 bn | 3Y underperf. vs. world -4,8 %. 3Y vola 11.6% | max drawdown 29%)

- $MVUS (+0,23 %) (US | TER 0.20 % | TD -0.20 % | 1.7 bn | 3Y underperf. vs. S&P 500 -4,1 %. 3Y Vola 15.6% | max Drawdown 33%)

- $MVEU (+0,33 %) (Europe | TER 0.25 % | TD - 0.07 % | 0.8 bn | 3Y underperf. vs. Eurostoxx 600 -3,8 % 3Y Vola 11.0% | max Drawdown 30 %)

Index methodology:

- First the starting (parent) index is calculated, here e.g. MSCI World. Then optimizations, e.g:

- a share may never be represented by more than 1.5% or 20 times the parent index (i.e. if 0.005% in the parent index, max. 1%) Minimum share: 0.05%

- Country weighting no more than +/- 5% of the parent index (if > 2.5%)

- Barra Optimizer is then used to put together the portfolio with the lowest risk (mathematical model that incorporates macroeconomic and microeconomic parameters)

- The aim is to achieve a lower beta and lower volatility as well as a lower weighting of large caps compared to the parent index.

Invesco: High dividend with low volatility

$HDLG (-0,98 %) (US | TER 0.30 % | TD - 0.48 % | 0.4 bn | 3Y Underpfer. vs. S&P 500 -1,1 % | Dividend yield 3.6 %. |(3Y vola 16 % | max drawdown 40 %)

Index methodology:

- 50 high-dividend stocks are selected from the S&P 500, the individual weight of the stocks in the ETF may only be between 0.05 % and 3 %, and a CIGS sector (Global Industry Classification Standard - 11 in total) may contain a maximum weight of 25 %

- Dividend ranking: shares are sorted in descending order according to their 12-month dividend

- 75 stocks with the highest dividend yield are selected, with a maximum of 10 stocks per CIGS sector

- Volatility: the volatility of the last year is now calculated for the 75 shares and the 50 shares with the lowest volatility mark the selection for the ETF.

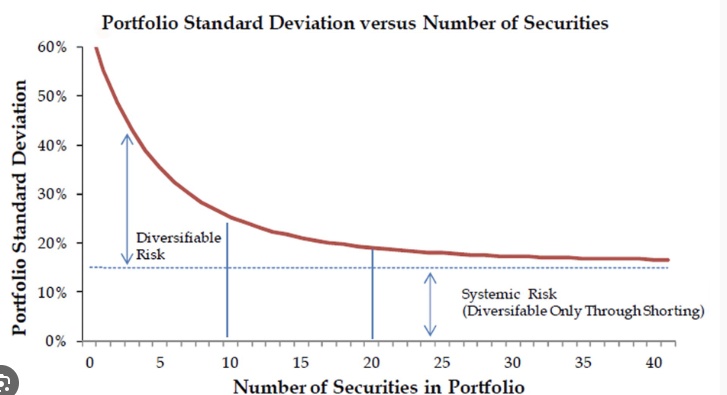

- Insufficient diversification? One might think that the small selection of only 50 stocks leads to insufficient diversification. However, studies have shown that even with 50 stocks, the non-systemic (company-related) risk is almost leveled out:

Conclusion:

In my view, personal resilience and risk tolerance play the biggest role in the choice of a low volatility ETF. If market fluctuations make you sleep uneasily, it can be a good idea to include such ETFs in your portfolio. Even if you are sitting in cash, for example, and the market seems overvalued, such a vehicle can be a sensible way to enter with a slightly limited risk.

Of the ETFs listed, the Invesco Dividend ETF appeals to me the most, as it contains a risk adjustment with sector and volatility weighting compared to classic dividend ETFs.

Do you have low-volatility ETFs in your portfolio? What are your opinions on this?