A few days before the Bundestag elections, Wall Street has discovered its special love for Europe and German second-line stocks. The small cap index MDaxwhich is usually overshadowed by the Dax, is suddenly enjoying a level of attention not seen for years. Several major Wall Street addresses have published analyses of the index of medium-sized companies almost simultaneously.

The MDax is considered to be one of the most undervalued indices in the Old World and this is precisely what makes it particularly attractive from Wall Street's perspective. The Bundestag elections are fueling this bet: if Germany manages to turn the economy around afterwards, the MDax could benefit disproportionately.

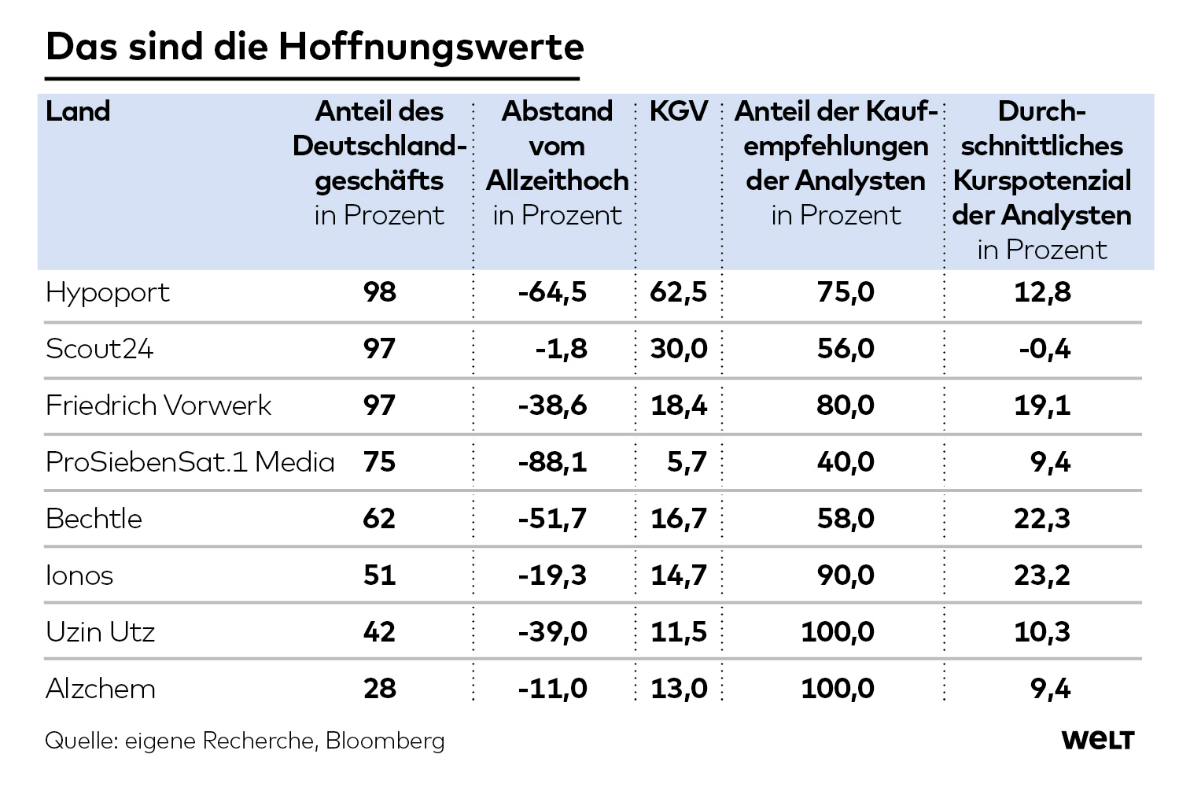

Around a third of the MDax companies' business is attributable to the domestic market. Accordingly, the local misery has weighed much more heavily on the index. By contrast, the index has not yet priced in the economic policy stimuli that could arise after the election.

Possible beneficiaries are (examples):

Through lower energy costs:

$WCH (-0,56 %) | $LXS (-3,34 %) | $GBF (+1,71 %)

Improved consumer sentiment:

$CTS (+0 %) | $BOSS (+0,22 %) | $SIX2 (-0,34 %)

Suitable funds could be

$EXID (+0,32 %) | $MD4X (+0,28 %)

Source (excerpts) & graphic:

WELT editorial team "Alles auf Aktien"