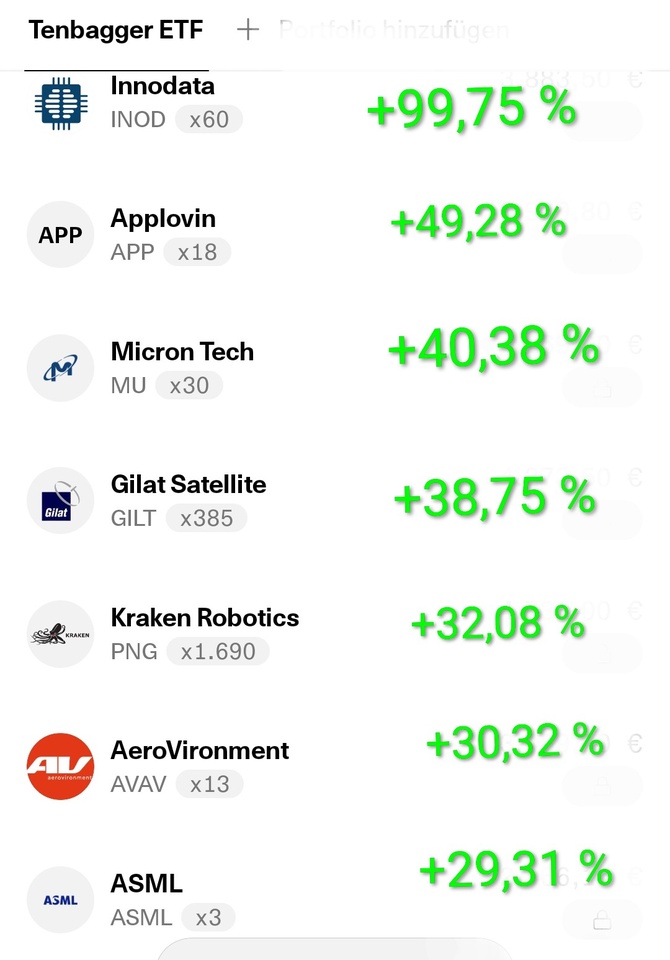

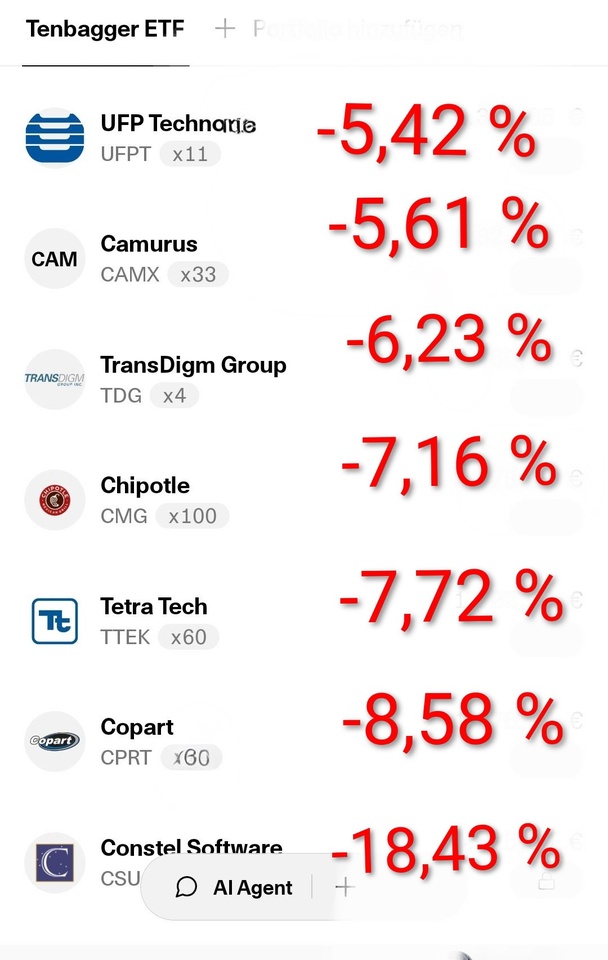

$UFPT (-3,15 %) as soon as the share price picks up again I will buy more here.

(no investment advice)

- Dear shareholders, the company is growing both organically and inorganically through targeted acquisitions. The healthcare market will offer further potential thanks to progress and an ageing society. There are no alternatives to sterile packaging. Due to rising demand and few competitors, UFP can constantly increase its margins. I therefore see a moat here and remain invested.

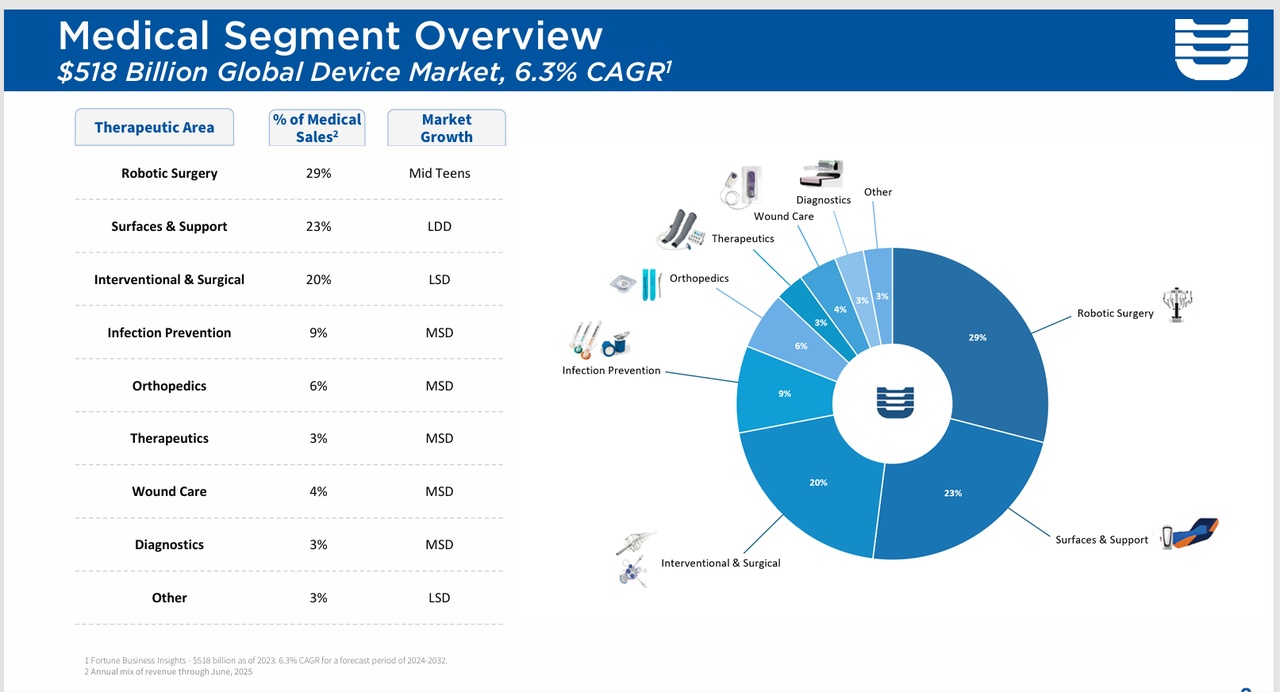

Resources are now being concentrated on the fast-growing medical segments such as robotic surgery, infection prevention, surgical devices and sterile packaging.

However, UFP Technologies also offers advanced components and packaging solutions for other industries such as aerospace and defense, including military equipment and protective helmets. Typical applications include military uniforms and equipment, automotive interior trim, sports seat covers, environmentally friendly protective packaging, air filtration and protective covers. Various materials such as foams, fabrics and nonwovens, plastics, natural fibers, films and adhesives are used.

UFP has made great progress in integrating its recent acquisitions in Ireland, Costa Rica, Rhode Island and the Dominican Republic. Synergies have been leveraged by sharing best practices, standardizing information technology, quality and safety systems and relocating operations to the most convenient locations for customers. For example, products manufactured in Ireland and Rhode Island have been moved to the Mexico facility, saving labor costs and significantly reducing customers' freight costs.

Perhaps most importantly, new factory space, clean rooms and equipment have been added in the Dominican Republic, increasing the capacity to serve customers in the field of robot-assisted surgery by approximately 70%. Robotic-assisted surgery is a highly skilled, high-value and fast-growing medical market segment that is ideally suited to UFP's expertise. In addition, cleanroom capacity was increased in Ireland and Costa Rica to position for further growth in other target areas such as infection prevention and sterile packaging.

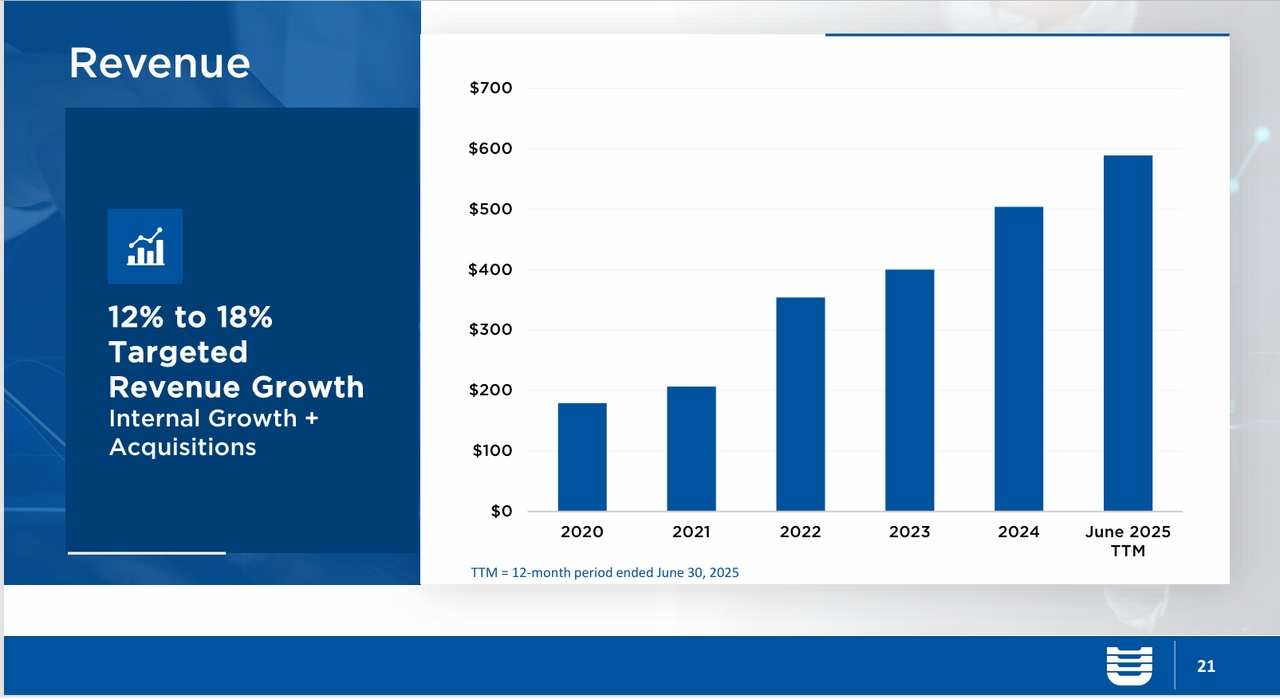

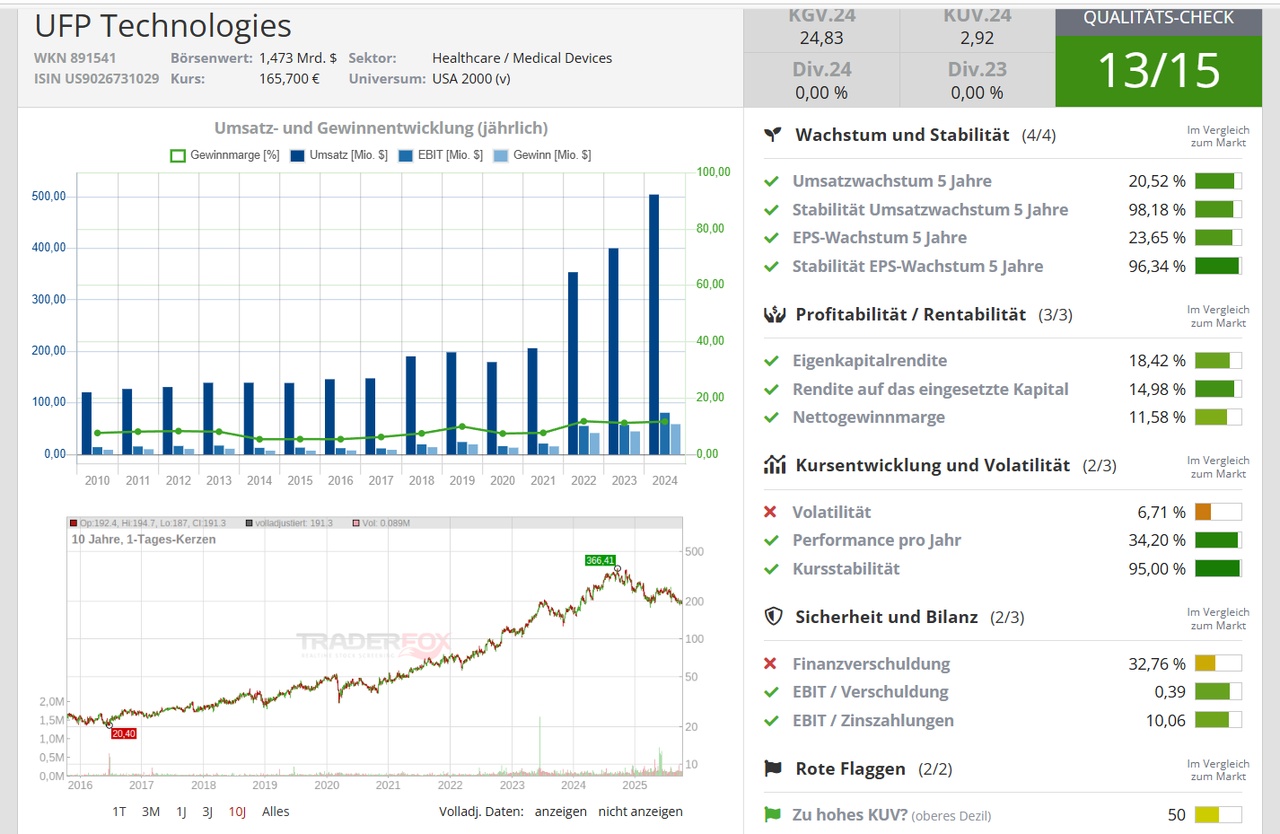

A medical technology manufacturer that hardly anyone is familiar with - and yet UFP Technologies impresses with breathtaking growth figures. While the share price has been moving sideways for months, the fundamentals paint a completely different picture: 41% sales growth and a return on equity of almost 20%. Why is this performance not reflected in the share price?

Analysts see great potential

The expert opinions could not be clearer: Two analysts recommend buying the shares, while two others recommend holding them. The average price target of 311 dollars indicates an upside potential of over 30% - with top targets of up to 370 dollars. But why is the market so cautious?

Fundamental data speaks volumes

The company's figures read like something out of a growth stock textbook:

- Sales growth: +41.1%

- Return on equity (ROE): 19.36%

- Free cash flow: 29.6 million dollars

Particularly noteworthy: UFP Technologies is reinvesting all of its profits in further growth - a clear strategic decision that should please long-term shareholders.

Medical technology as a driver

The company is benefiting greatly from the growing demand in key sectors such as medical technology, aerospace and defense. Its innovative product development seems to be falling on fertile ground here. However, the share price has so far lagged behind this success story - a discrepancy that investors should monitor closely.

As a leading contract manufacturer in the healthcare sector, UFP Technologies (UFPT) already serves 25 of the 30 largest manufacturers of medical technology devices. It supports design processes through to series production, including in the aerospace, industrial, automotive and consumer goods sectors. However, 87% of its revenue comes from the medtech segment, which serves a USD 518 billion market that is expected to grow by 6.3% p.a. until 2032, according to Fortune Business Insights. AI is now likely to provide the breakthrough in surgical robotics, which already accounts for 35% of MedTech revenues. Just last year, a strategic supply agreement was renewed with Intuitive Surgical, which offers sales potential of USD 500 million over a term of four years. UFP Technologies could benefit from higher capacity utilization of the da Vinci Surgical System with medical components and packaging.

Fundamental key figures

Profit 2027 2026 2025

Earnings per share in EUR 9.79 8.63 7.48

KGV 16.90 19.16 22.12

Profit growth (%) +12.30 +17.69 +12.99

SALES (USD million) 689.00 665.00 613.00

EBIT margin (%) 19.12 17.51 16.18

(Ebit margin, sales and profit are increasing nicely, resulting in a lower P/E ratio)