After -33% YTD it raised 14 percent this month.

Is Snapchat going to make a comback?

Postes

84Just like for you, for me $SNAP (-8,55 %) always been the app of the same name. In my opinion, however, there is much more hidden and overlooked potential here.

Snap has been developing AR glasses for over 10 years and has invested 3 billion dollars in them. In 2026, Snap will be the first company to bring a pair of glasses to the mass market that are standalone, significantly lighter and smaller than the current Spectacles model, which is only aimed at developers and was released in 2024.

Even here, the possibilities are already impressive, see from minute 07:39 https://youtu.be/HF_PgiM2btw?si=85ugnLHYOFjlRtk_

Snap is the first mover here and the glasses themselves are already doing well in various reviews; according to the management, the new ones will be even better.

Snap is nevertheless unprofitable with its current business, as a lot of money is naturally invested in development. Furthermore, Snap is currently only growing by around 10% a year.

Nevertheless, with a solid balance sheet, a P/E ratio of 2, an EBITDA ratio of 23 and a price-to-free cash flow ratio of 23 for 2026, Snap is not really expensive.

How do you see it? Is the market overlooking the potential of the glasses?

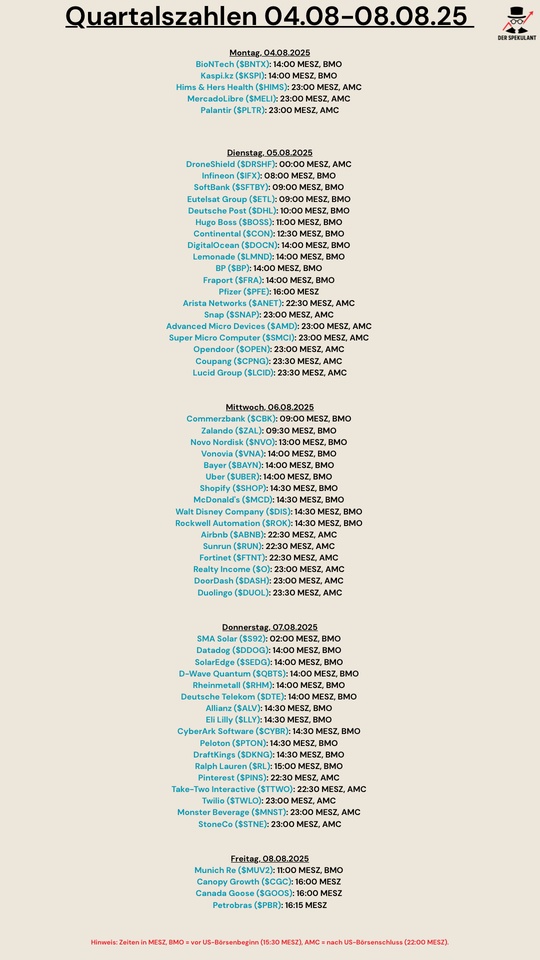

The AEX index starts the day with an indication of +0.3%, while international markets also turn green. Wall Street largely managed to recover from Friday's sell-off, and Asian stock markets follow with Korea and Taiwan as outliers. U.S. 10-year interest rates rise slightly to 4.21%, while German rates fall to 2.62%. The euro/dollar exchange rate is quoted at 1.1550. The Damrak is relatively quiet, with only B&S presenting figures. Internationally, however, there is plenty of activity: Palantir surprises with strong quarterly results, while Hims & Hers falls sharply. Figma debuts with a 27.4% drop. The US puts pressure on India and China because of Russian oil imports, further raising trade tensions. Investors look forward to figures from AMD, Snap, Rivian and Super Micro Computer. Also on the agenda are the purchasing managers' indices of the service sectors in Germany and the US. In short: plenty of excitement and thrills on the trading floor.

$PLTR (-7,09 %)

$HIMS (-8,47 %)

$SHEL (-3,05 %)

$BP. (-2,96 %)

$AMD (-10,01 %)

$SNAP (-8,55 %)

$RIVN (-3,35 %)

$SMCI (-9,91 %)

🔗 Source reference:

This summary is based on the article "AEX indicatie is +0,3%, volop spanning en nog meer sensatie" by Arend Jan Kamp, published on StockWatch on Aug. 5, 2025.

$BNTX (-2,88 %)

$KSPI (-2,43 %)

$HIMS (-8,47 %)

$MELI (-6,22 %)

$PLTR (-7,09 %)

$DRO (-4,78 %)

$IFX (-4,21 %)

$9434 (-3,05 %)

$FR0010108928

$DHL (-1,89 %)

$BOSS (-1,63 %)

$CONTININS

$DOCN (-5,38 %)

$LMND (-10,89 %)

$BP. (-2,96 %)

$FRA (-0,1 %)

$PFIZER

$SNAP (-8,55 %)

$AMD (-10,01 %)

$SMCI (-9,91 %)

$OPEN (-10,72 %)

$CPNG (-4,08 %)

$LCID (-3,53 %)

$CBK (-0,56 %)

$ZAL (-4,18 %)

$NOVO B (-3,44 %)

$VNA (+0,52 %)

$BAYN (-1,05 %)

$UBER (-3,78 %)

$SHOP (-9,54 %)

$MCD (+0,18 %)

$DIS (-2,19 %)

$ROK (-3,15 %)

$ABNB (-2,76 %)

$RUN (-8,53 %)

$FTNT (-4,55 %)

$O (-1,42 %)

$DASH (-5,35 %)

$DUOL

$S92 (-2,39 %)

$DDOG (-5,26 %)

$SEDG (-9,46 %)

$QBTS (-7,49 %)

$RHM (-2,26 %)

$DTE (+0,17 %)

$ALV (-0,68 %)

$LLY (-3,36 %)

$CYBR (-3,24 %)

$PTON (-6,11 %)

$DKNG (-7,73 %)

$RL (-4,68 %)

$PINS

$TTWO (-2,88 %)

$TWLO (-6,43 %)

$MNST (+0,39 %)

$STNE (-3,7 %)

$MUV2 (-0,74 %)

$WEED (-16,71 %)

$GOOS (-2,97 %)

$PETR3T

$ANET (-4,24 %)

Hi guys, I am currently looking for a great company that is still at the beginning of its success story. I am specifically looking for a company that is active in the social network sector and is active in various business areas.

Do you have any suggestions or favorite stocks in this sector?

What do you think of $SNAP (-8,55 %) ?

- Revenue: $1.36B, +14% YoY

- Net Loss: -$140M, improved 54% YoY

- Adjusted EBITDA: $108M, +137% YoY

CEO Evan Spiegel: "We surpassed 900 million monthly active users, with revenue growth driven by direct-response advertising, SMB momentum, and Snapchat+ subscription expansion."

🌱Revenue & Growth

- Total Revenue: $1.36B, +14% YoY

- North America Revenue: $832M, +12% YoY

- Europe Revenue: $224M, +14% YoY

- Rest of World Revenue: $308M, +20% YoY

- Daily Active Users (DAUs): 460M, +9% YoY

- Monthly Active Users (MAUs): over 900M milestone

- ARPU: $2.96, +5% YoY

💰Profits & Health

- Net Loss: -$140M vs -$305M in Q1 2024

- Operating Loss: -$194M, improved 42% YoY

- Free Cash Flow: $114M, +202% YoY

- Operating Cash Flow: $152M, +72% YoY

- Cash & Equivalents: $911M

📌Business Highlights

- Total active advertisers +60% YoY

- Other Revenue (mostly Snapchat+): +75% YoY

- Launched AI-powered Lenses and Easy Lens creation tool

- Expanded Agency Partner Program for advertisers

- Launched Sponsored Snaps auction testing

🔮Future Outlook

- Focus on accelerating direct-response ad solutions

- Continued growth in Snapchat+ subscriptions

- Expansion of AR platform and Spectacles ecosystem

- Strategic investments to drive monetization and user engagement

🔹 Revenue: $1.56B (Est. $1.547B) 🟢; UP +14% YoY

🔹 Net Income: $9M (Prev. -$248M) 🟢

🔹 Adjusted EBITDA: $276M (Prev. $159M) 🟢; UP +73% YoY

🔹 Operating Cash Flow: $231M (Prev. $165M) 🟢; UP +40% YoY

🔹 Free Cash Flow: $182M (Prev. $111M) 🟢; UP +65% YoY

Key Operating Metrics:

🔹 Daily Active Users (DAU): 453M; UP +9% YoY

🔹 Active Advertisers: More than doubled YoY

🔹 Other Revenue (Snapchat+ Subscriptions, etc.): UP +131% YoY; Exited 2024 at an annualized run rate well over $500M

Engagement & Advertising Growth:

🔹 Public Snaps: Over 1B shared monthly

🔹 Snap Star Creators: +40% YoY growth

🔹 Sponsored Snaps & Promoted Places: +30% increase in reach

🔹 New Snapchat+ Features: Early access tools like "Footsteps" for tracking Snap Map visits

Augmented Reality (AR) Innovations:

🔹 200M+ Spotlight videos created featuring Lenses

🔹 400M+ users engaged with new Gen AI Lenses (4B+ interactions in Q4)

🔹 First-ever Pre-Generated AI Lens launched, reducing GPU utilization

🔹 Lens Studio Downloads: Surpassed 1M

Snap Spectacles & AR Expansion:

🔹 New Snap OS Version launched with enhanced camera & SnapML capabilities

🔹 Expanded Spectacles availability to six new countries (Austria, France, Germany, Italy, Netherlands, Spain)

🔹 New AI-powered Lenses for education & gaming (calligraphy, soccer training, pool shot accuracy)

🔹 Launched educational pricing for Spectacles with a student discount

CEO Evan Spiegel's Commentary:

🔸 "In 2024, we made significant progress in revenue growth and deepening engagement. With advertising improvements and AR innovations, we are well-positioned to build toward our long-term vision for augmented reality."

How did the markets perform in 2024 and what things didn't exist 25 years ago?

The news team wishes you a Happy New Year. A good start on the stock market, good health and everything else you could wish for.

The new year has already begun and many people like to look back. We would like to provide you with a few facts:

How did the markets perform in 2024?

DAX40: +17,92%

NASDAQ100: +26,54%

S&P500: +24,14%

Nikkei225: +20,19%

CSI300: +14,85%

Gold: +26,62%

Silver: +21,73%

Bitcoin: +123,41%

Are you satisfied with your annual performance?

You will soon be able to view your Rewind 2024 on getquin and there will also be a little surprise for you. Stay tuned and take a look, you'll find out more as soon as the Rewind is available. You'll be informed here in the app and on Instagram.

What didn't exist 25 years ago that we enjoy using and investing in today?

Snapchat $SNAP (-8,55 %)

Pinterest $PINS

AirBNB $ABNB (-2,76 %)

Bitcoin $BTC (+0,42 %)

Tesla $TSLA (-6,86 %)

Netflix $NFLX (-2,08 %)

Amazon Prime $AMZN (-5,92 %)

Uber $UBER (-3,78 %)

Facebook and services thereof $META (-5,02 %) :

Services from Google $GOOGL (-3,4 %) :

GoogleMail

YouTube

Google Maps

Android

Services from Microsoft $MSFT (-3,3 %) :

XBox

What else can you think of that should not be missing from the list?

We will continue to provide you with news and facts in 2025.

Best regards

Your News Team

INITIAL MARKET REACTION TO TRUMP VICTORY:

Aftermarket after quarterly figures

+17% Reddit $RDDT

+5% Snap $SNAP (-8,55 %)

+4% Alphabet $GOOGL (-3,4 %)

$GOOGL (-3,4 %)

+4% Stryker $SYK (-2,46 %)

+2% Visa $V (-2,33 %)

+1% Unum $UNM (-1,67 %)

+0% Chubb $8240

+0% Mondelez $MDLZ (+0,21 %)

-2% Chipotle Mexican Grill $CMG (-3,56 %)

-3% Caesars Entertainment $CZR (-5,23 %)

-3% First Solar $FSLR (-4,1 %)

-7% AMD $AMD (-10,01 %)

-15% Qorvo $QRVO (-7,68 %)

Meilleurs créateurs cette semaine