TL;DR like to roast my deposit, appreciate all opinions!

I always find the many posts here and reading various biographies very interesting, so I've wanted to say a few words for a while now.

Tried early, but started late

I am now 32 and unfortunately started investing seriously far too late, studied far too long, and with the larger salaries finally built up as much as possible and tried to catch up as quickly as possible. "Unfortunately" means for the most part the past calendar year, which is why I put a large part of my money into shares at already high prices and then had very little cash left in the crash to add to it. Fully invested, in other words. During the crash, I mainly reallocated and continued to fully invest what was left over from my monthly salaries.

Yet back in 2011, at the age of 18, I had a share called Facebook and a Starbucks share in my portfolio without much of a clue. I just wanted to know what my mother was actually doing with her shares and how it worked, and with FB and Starbucks I simply chose two companies that "everyone" uses/needs anyway. The idea wasn't that stupid, it worked, and after a short time I was happy about the small profit in absolute terms, sold the shares at DiBa despite the high fees at the time and simply forgot about shares for years - wealth accumulation, a word that wasn't in my vocabulary, the money I had was simply turned upside down as a young adult. Well, young me, just leave the shares lying around or, even better, take a closer look at them and carry on, it "might" have been worth it...

Of priorities and wrong horses

The years went by without any shares, but with lots of fast food and partying, but at least things have changed. At some point, I started to think about the future and wealth accumulation, first taking an interest in interest rates, and then the logical next step was dividends and shares. Unfortunately, it started rather haphazardly. As a student, I started investing small amounts, and of course betting on the wrong horses. Speculative lithium shares were particularly bad in this phase, unfortunately these were large sums even by my standards, from my grandfather's estate. That was bad. However, crypto was a very good horse, more precisely $BTC (+1,71 %) and $ETH (+4,05 %) which (as a computer scientist) I became interested in early on and exited several times with high profits, also thanks to domestic mining. It's just stupid that back then, in the last decade, I would never have imagined how cryptos would develop. If I had, I would have simply left it all, or at least part of it. You learn and you're always smarter afterwards anyway.

Fully invested - excessive, unhealthy, or simply good housekeeping?

So now I'm 32 - and proud of a portfolio that I think I've built up to a good size in a relatively short time. Which has given me other ideas for some time now. I'm still a long way from reaching my goal, but I have to get back on the "invest 100%" path, which has been completely contrary to my past for a long time now, and strangely enough, I'm finding it difficult to do so - something to reflect on. There are too many (supposed?) opportunities every day. So I simply could not $UNH (+0,49 %) after a long period of observation yesterday and of course the savings plans had to run today too. I think I've always been good at budgeting, or let's put it this way, at least good at getting by with the money available to me in a perfectly timed way, but "indulging", not just in company shares, may become a little more prominent again. I don't go without noticeably in everyday life, I need very little, which I don't think is a bad quality to begin with. But I have changed a lot in the area of "consumption" compared to the past. I think it would be good to find a healthy balance. In my opinion, just as you don't just live to work, but work to live, the same applies to saving/investing. I actually read a post here on gq today that described exactly that and I could relate to it very well. So, reflection and taking your foot off the gas is allowed - no, it's a must! I am familiar with frugalists, but I never wanted to be one. I'd be interested to know if anyone else here feels the same way, or did?

Wrong decisions, mistakes... and (hopefully) the right conclusions

Back to the topic! (Not only) on the way to today's portfolio I have made many wrong decisions, as already mentioned, so I thought that a well-kept portfolio roast could do me some good. Other, new opinions and assessments can't be bad!

In particular, in the past I have often missed the opportunity to simply let profits run their course and instead dragged losses around with me for too long (which brings us back to lithium). A thought that I recently had again when I was thinking about when it would make sense to $HIMS (+2,87 %) possibly realize, as an example. $PLTR (+0,51 %) and $NVDA (+0,22 %) are two examples that, like so many others, I naturally had on my radar, but they always seemed too expensive, the setback never came and I really missed the big rallies as a result. At the same time, I also get caught out by FOMO from time to time. So in both good and bad phases, I try not to just see red or green, fear or hope, but simply to evaluate what actually makes sense "from now on". Sometimes you realize a loss in order to try your luck elsewhere, sometimes you should let profits run, sometimes take them, sometimes endure the dip, sometimes be courageous and sometimes defensive. Easier said than done. I find it very nice and helpful to exchange ideas on this platform and how open and "yet" respectful it generally is. Of course, I will most likely never reach some portfolio sizes, but you can always learn something about how some people manage their portfolios, regardless of the absolute figures. You will always make mistakes, but at least you should deal with them correctly and draw the best possible conclusions.

Portfolio restructuring, planned investments / savings plans

And today? After some evaluation, research, regrouping and restructuring, I now have fewer, but still quite a few positions in different sectors, most of which are already of a decent and roughly balanced size. My medium-term plan is now to build up all positions to a certain target size. This is why I am currently running savings plans:

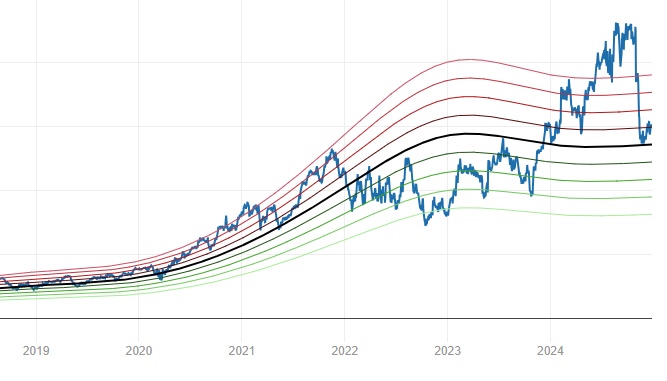

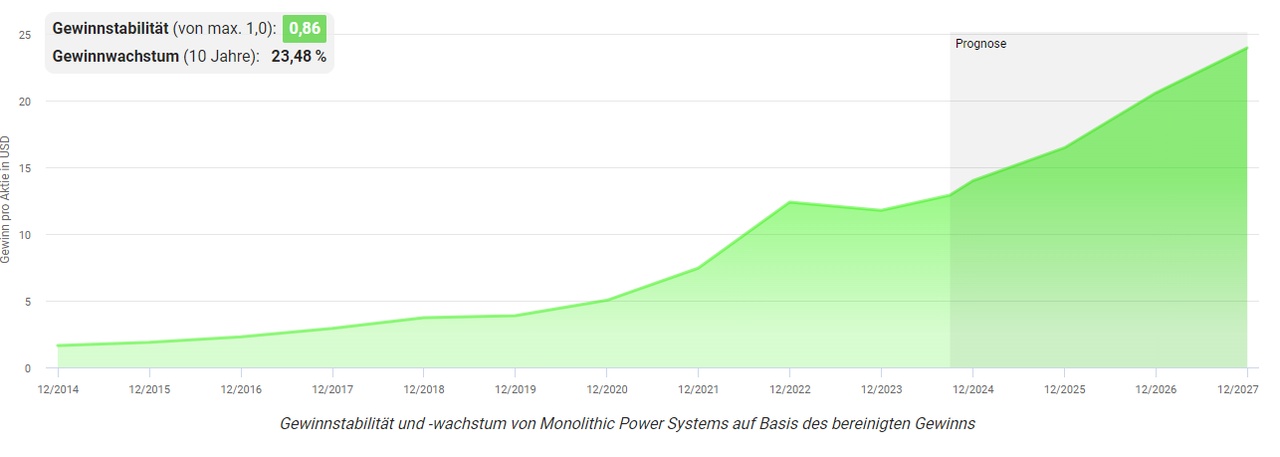

$MPWR (+0,55 %)

$AVGO (+0,71 %)

$ISRG (+0,37 %)

$DXCM (+0,73 %)

$DHR (+0,43 %)

$ALV (-0,04 %)

$9988 (+0,3 %)

$BRK.B (+0,2 %)

$APH (+0,32 %)

$MELI (-0,18 %)

$BLK (-0,24 %)

$RSG (+0,34 %)

$DGE (+0,24 %)

$VKTX (+1,28 %)

ETF/ETC:

$UBU7 (+0,34 %)

$EWG2 (+0,08 %)

Partly with small weekly amounts, until enough cash is available to fill the target position evenly. With $AVGO (+0,71 %) for example, there is not much left. Also $BRK.B (+0,2 %) / $APH (+0,32 %) and others are already approaching the target. In some cases with somewhat larger sums for still small but prioritized positions, until opportunities and/or resources for individual purchases arise, such as the $ALV (-0,04 %) and $RSG (+0,34 %) should be mentioned here, as well as $DGE (+0,24 %) as a turnaround candidate.

Once the aforementioned positions are full, I would like to turn my attention to the more defensive candidates that are already in the portfolio but which I am currently prioritizing - $MCD (+0,15 %) / $KO (+0,07 %) / $CCEP (+0,32 %) / $ULVR (-0,07 %) and others - and finally increase the ETF and gold share in the long term.

$VKTX (+1,28 %) is a bit of a gamble, as I have actually said goodbye to pharma - $ABBV (+0,31 %) / $NOVO B (+0,44 %) / $LLY (+0,28 %) and $MRK (+0,27 %) were still part of the inventory until recently. Instead, I decided to go with $DXCM (+0,73 %) / $ISRG (+0,37 %) / $DHR (+0,43 %) on medical technology.

$BTC (+1,71 %) remains a fixed value in the portfolio, while I $ETH (+4,05 %) (incorrectly entered due to staking - around 0.4 shares or €1000) and $XRP (+2,33 %) would/will sell at corresponding prices.

I still lack around €15,000 in individual stocks at current prices to bring all positions to the current desired/dream target. This will take some time, but is foreseeable. And then I would be really quite proud and happy "as things stand now"! In any case, I now feel very comfortable on the path I have chosen and, as I said, I have to stop myself from forgetting that not all money has to be invested all the time.

Savings rate

To put this into figures, I have averaged a savings rate of around €1500 over the last 24 months, with an average of €100 a month in dividends. 1400€ investment, that's about 82% of my monthly budget after deducting all "unavoidable" fixed costs including fuel and household, but not including consumption such as clothes, going out or vacations. Exaggerated, I can't say otherwise myself. But at least I have a good reason to step on the gas and get the compound interest going.

So what is all this for?

In the long term, my girlfriend and I dream of owning a property somewhere on the Croatian Adriatic, her homeland, and where I was able to spend many wonderful weeks with my parents every year as a child. A beautiful region that I consider an important part of my life, with many great moments and memories that may become even more. I hope to get closer to this goal "quickly" with the depot. The language is already halfway there! :)

In the long term, this would probably involve a little reallocation into value dividend payers, which should help with repayment. However, I would also like to lay the foundations for later distributions today, without neglecting growth. There is probably no perfect mix for this, but you are welcome to rate mine.

So, unfortunately I was once again unable to be brief. Thank you for reading, whoever has made it this far, and for your comments! I'm very excited and wish you all a great weekend.