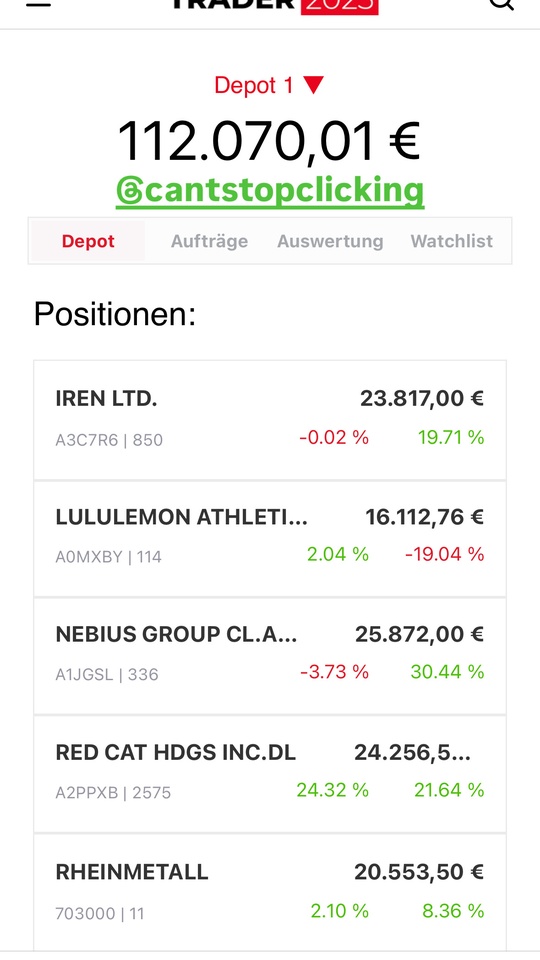

$LULU (+0,34 %)

🔹 Revenue: $2.53B (Est. $2.54B) 🔴; UP +7% YoY

🔹 EPS: $3.10 (Est. $2.87) 🟢; flat YoY

🔹 Comparable Sales: UP +1% YoY

FY Guidance (lowered):

🔹 Revenue: $10.85B–$11B (Est. $11.20B) 🔴; UP +2–4% YoY

🔹 EPS: $12.77–$12.97 (Est. $14.61) 🔴

Q3 Guidance:

🔹 Revenue: $2.47B–$2.50B (Est. $2.56B) 🔴; UP +3–4% YoY

🔹 EPS: $2.18–$2.23 (Est. $2.90) 🔴"

Other Q2 Metrics:

🔹 Gross Profit: $1.5B; UP +5% YoY

🔹 Gross Margin: 58.5%; DOWN -110 bps YoY

🔹 Operating Income: $523.8M; DOWN -3% YoY

🔹 Operating Margin: 20.7%; DOWN -210 bps YoY

Segment / Regional Results:

🔹 Americas Revenue: UP +1% YoY

🔹 International Revenue: UP +22% YoY (20% constant currency)

🔹 Americas Comparable Sales: DOWN -4% YoY (-3% constant currency)

🔹 International Comparable Sales: UP +15% YoY (13% constant currency)

Other Metrics:

🔹 Tax Rate: 30.5% (vs. 29.6% prior year)

🔹 Cash & Equivalents: $1.2B

🔹 Inventories: $1.7B; UP +21% YoY (units +13% YoY)

🔹 Share Repurchases: 1.1M shares for $278.5M

🔹 Store Count: 784 (added 14 net new in Q2)

CEO Commentary:

🔸 “We continued to see positive momentum internationally, but are disappointed with U.S. results and product execution.”

🔸 “We are taking actions to strengthen our merchandise mix and accelerate our business.”

🔸 “We remain confident in our long-term growth opportunity.”

CFO Commentary:

🔸 “EPS exceeded expectations, but revenue fell short, driven by U.S. weakness and higher tariffs.”

🔸 “We revised our FY outlook to reflect these dynamics, while maintaining financial discipline and growth investments.”