After I recently sold my $AMZN (-1,75 %) shares (which resulted in mostly negative feedback😉), my stop-limit order was also executed today at $KLAC (-2,62 %) was executed today. You shouldn't get greedy and realize profits from time to time, especially if you are currently "over" invested in tech like me and we are constantly scratching the ATH.

Discussion sur KLAC

Postes

45Nova Ltd (ISIN IL0010845571): Analysis moat, margins and 10x potential

This report analyzes $NVMI, (-1,74 %) an Israel-based provider of metrology and process control systems for the semiconductor industry. The company's current market capitalization is around USD 9.5 billion. To achieve a tenfold (10x) increase, Nova would have to grow to a valuation of USD 90 to 100 billion in the coming years.

I. First the summary

The path to 10x potential

Nova Ltd. is a critical technology enabler whose metrology solutions are imperative for the manufacture of advanced semiconductors (advanced nodes, 3D stacking). The central investment thesis for a tenfold increase is based on the exponential increase in metrology demand (dollar content per wafer) in advanced architectures such as High-Bandwidth Memory (HBM) and Gate-All-Around (GAA).

To reach the targeted market capitalization of USD 95 billion (maintaining the current high EV/Revenue multiple of 11.5x), Nova would need to achieve annual revenues of approximately USD 8.26 billion. This implies a compound annual growth rate (CAGR) of approximately 65% over five years (2025-2030), which is well above current consensus estimates (7.3% to 9.1%). The 10x potential is therefore theoretically feasible, but only through over-cyclical, structural growth in the HBM and ATM metrology niches.

The greatest risk is the high customer concentration and the inherent volatility of the semiconductor CapEx cycle.

II Business model and management

Nova Ltd (NVMI) develops and distributes metrology equipment for advanced process control in semiconductor manufacturing. Metrology is the essential quality control step that directly determines yield and profitability in miniaturization to 3nm or 2nm nodes.

The product portfolio includes metrology solutions for critical process steps such as lithography, etching, planarization (CMP), and advanced packaging. The most important areas are

Dimensional metrology: measurement of critical dimensions and alignment.

Film thickness and material metrology: Precise measurement of thin films.

Chemical metrology: Monitoring of chemical processes, critical for complex 3D architectures such as HBM.

Nova serves all major global manufacturing regions, including Israel, Taiwan, the United States, China and Korea.

The company was founded in 1993 by Giora Dishon (PhD in Materials Science) and Moshe Finarov (PhD in Semiconductor Physics), reflecting its technological depth. The current top management includes:

Gabriel Waisman President and CEO

Eitan Oppenhaim Executive Chairman of the Board

Dr. Shay Wolfling Chief Technology Officer (CTO)

The strategic leadership, supported by Dr. Wolfling, is driving the expansion of the Total Addressable Market (TAM) through targeted acquisitions, such as the acquisition of German ancosys GmbH in 2022, which strengthened the expertise in chemical metrology that is critical to HBM architectures. Remuneration (including restricted stock units) is geared towards the long-term commitment of management to the company's growth.

III The moat

Nova's moat is based on two main pillars: High switching costs and technological specialization.

Metrology systems are deeply integrated into the highly complex, automated production lines (Fabs). Replacing a qualified measurement tool is extremely costly, time consuming and jeopardizes critical yields in nanometer manufacturing. This deep integration creates high switching costs for customers and strengthens Nova's market position.

In the metrology market, which is dominated by market leader KLA Corporation (KLAC), Nova is positioning itself as a key challenger with an estimated 18 percent market share in the process control segment.

Nova's competitive advantage lies in its specialization in integrated metrology: measurements are taken directly during the process (real-time control).

Material metrology: expertise in dimensional and chemical monitoring.

The strength of this niche moat is reflected in its financial profitability:

Nova Ltd. $NVMI (-1,74 %) / KLA Corporation $KLAC (-2,62 %) / Lam Research $LRCX (+0,44 %)

Market Share (Process Control) ~18% / ~55% / N/A

Operating Margin (TTM) 32.16% / 38.20% / 32.31%

Market capitalization (USD) $9.19B / $9.63B / $140.15B

The operating margin of 32.16% is on par with much larger industry players, demonstrating Nova's ability to command a price premium in its specialized niches.

IV. Margins and sales development

Nova's financial structure is characterized by high profitability and volatility inherent in the semiconductor cycle.

The company experienced strong sales growth during the post-pandemic chip boom (54.46% growth in 2021; 37.16% growth in 2022). The industry-wide CapEx decline led to a 9.25% drop in sales to USD 517.92 million in 2023.

However, the recovery is strong: last twelve months (LTM) revenue through Q2 2025 increased 43.69 percent to USD 807.09 million, demonstrating the critical nature of NVMI technology.

Profitability is stable and high, a strong indicator of the moat:

Gross Margin was exceptionally stable between 2017 and 2022, consistently above 54 percent, mostly above 55 percent.

The EBIT margin expanded significantly, from 16.18% (2019) to 27.01% (2021) and remained at 26.27% in 2022.

These high and rising margins demonstrate strong operating leverage. Any increase in sales in the next cycle (HBM/GAA) should lead to a disproportionately high increase in net profit.

V. Growth catalysts and investment conclusion

The 10x potential depends on the successful penetration of two structural technology trends: HBM revolution (high-bandwidth memory)

The AI boom is driving demand for HBM, whose market could grow to over USD 100 billion by 2030. HBM manufacturing requires extremely complex 3D stacking and advanced packaging. Nova reported record results in the HBM segment due to its leadership in chemical metrology. A leading memory manufacturer has also adopted the Nova Syntronics platform for key applications in HBM, as it offers unique solutions to problems such as wafer warpage in 3D structures.

The transition to the GAA architecture (from 2nm nodes) requires a multiplication of the metrology content per wafer, as the new transistor structures are much more complex. Nova expects the revenue acceleration from ATM starting in 2026, and the ability to deliver these new, precise measurements is the structural lever that expands Nova's TAM and accelerates growth beyond the pure CapEx cycle.

Nova Ltd. is structurally well positioned as a highly specialized niche player with high operating leverage and a technology-based moat to benefit from the increasing metrology demand in the semiconductor industry.

However, the share is already trading at a premium P/E of 43.81. The market is already pricing in strong growth. The tenfold potential (10x) is only achievable if Nova further expands its technological leadership in HBM and GAA and gains massive market share there, increasing sales growth forecasts from 9 percent to over 30-40 percent CAGR.

Successfully manages the risk of high customer concentration (over 10% sales from two main customers) and diversifies its customer base.

It is a high-risk bet on exponential technological growth, which requires continuous, flawless management execution to achieve the extremely high growth forecasts.

management to achieve the extremely high growth targets.

I will only buy here after a corresponding setback of at least 20%. What is your opinion?

New 52-week highs for these stocks

These shares reached a new 52-week high today:

Meta $META (+0,33 %)

Broadcom $AVGO (-0,59 %)

AMD $AMD (-4,24 %)

Blackrock $BLK (-0,55 %)

Astera Labs $ALAB (+2,29 %)

Arista Networks $ANET (-0,03 %)

Reddit $RDDT (-0,02 %)

Lam Research $LRCX (+0,44 %)

KLA Corp $KLAC (-2,62 %)

S&P Global $SPGI (-0,92 %)

Celsius $CELH

United Rentals $URI (-4,36 %)

Do you hold one of the shares? If yes, congratulations!

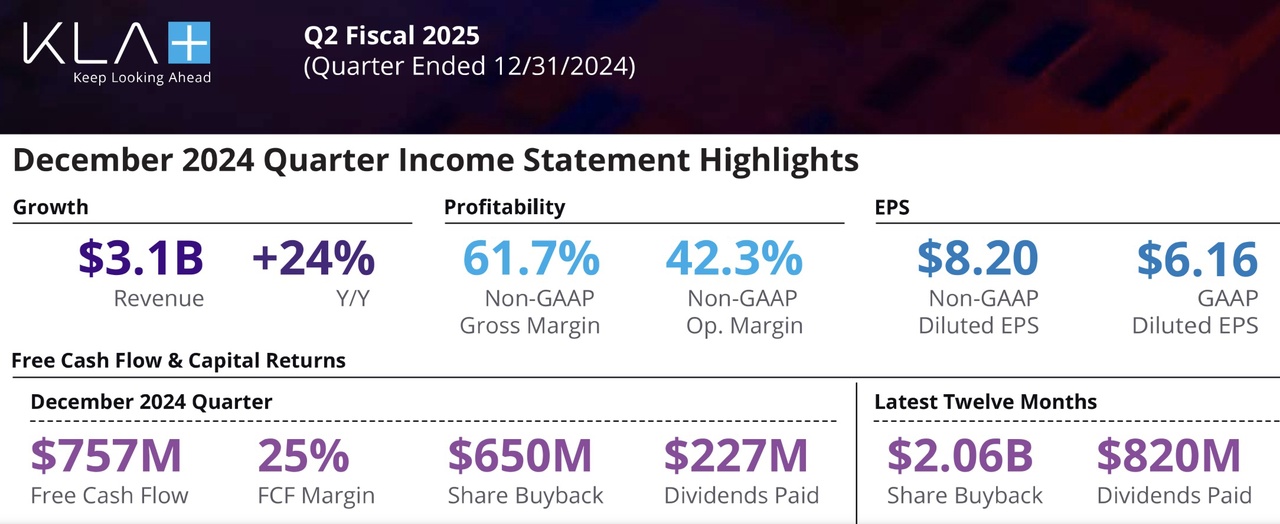

KLAC Q2'25 Earnings Highlights:

🔹 Revenue: $3.08B (Est. $2.94B) 🟢; UP +24% YoY

🔹 EPS: $8.20 (Est. $7.75) 🟢

Q3'25 Guidance:

🔹 Revenue: $2.85B-$3.15B (Est. $2.89B) 🟡

🔹 GAAP EPS: $7.45-$8.65 (Est. $7.50) 🟢

🔹 Non-GAAP EPS: $8.05 ± $0.60

Cash Flow & Shareholder Returns:

🔹 Gross Margin: 60.6% (Non-GAAP: 62.0%)

🔹 Net Income: $1.10B (Non-GAAP); $825M (GAAP)

🔹 Operating Cash Flow: $849.5M (Est. $906.26M) 🔴

🔹 Free Cash Flow: $757.2M (Est. $710.14M) 🟢

🔹 Capital Returns: $876.9M in Q2, $2.88B over last 12 months

Strategic & Business Highlights:

🔸 AI and high-performance computing demand driving semiconductor industry growth

🔸 Leading-edge investments gaining momentum, enabling growth for KLA

🔸 Strong cash generation & disciplined capital allocation continue to drive shareholder returns

CEO Rick Wallace's Commentary:

🔸 "Despite new U.S. government export controls, KLA delivered strong Q2 results, outperforming revenue expectations. AI and high-performance computing investments continue to expand, reinforcing our strategic positioning in an evolving semiconductor landscape."

Market Insights & Outlook:

🔸 Strong demand for semiconductor process control tools, aligning with next-gen chip manufacturing trends

🔸 Growth in AI and high-performance computing presents long-term opportunities for revenue expansion

🔸 Export restrictions remain a risk, but KLA continues to execute well within constraints

Diversification / sector breakdown

Hello everyone,

Yesterday showed me once again how important it is to invest across all sectors. Anyone who invests in individual stocks should "divide" their money into as many different sectors as possible.

Tech stocks did not do so well yesterday, in contrast to some classic blue chips such as $PEP (+0,03 %) or $JNJ (+0,17 %) . Even if these stocks are no longer a huge growth story, they give my portfolio stability in stormy times.

So I was still able to end the day on a positive note yesterday, even though I $AVGO (-0,59 %) and $KLAC (-2,62 %) etc. in my portfolio.

This was probably also due to the low weighting here and there, but I'm still happy about it and feel somehow confirmed that I'm on the right track with my "strategy".

These are my current thoughts on this....how did you see yesterday?

Greetings from DivGrowth1989 ;)

But in my opinion it's total nonsense. The two stocks have been going completely sideways for 3-4 years, while stocks like NVIDIA and Broadcom have risen massively. Sure, the keyword is AI hype, but I'd rather bet on something like that and take the risk of a -10% drop than a sideways movement for years and talk myself into the high dividend. I also have no idea that Jnj or Pepsi will outperform NVIDIA over the next few years.

But everyone as they feel comfortable👍

Semiconductor and power stocks fall today due to Deepseek panic

Semiconductor stocks and electricity shares are falling today because of the Deepseek panic. This panic is probably exaggerated. We'll talk about it in tonight's podcast. So be sure to subscribe to the podcast: https://open.spotify.com/show/3SHlvxmpYWkpiWnykajNPa

Semiconductors:

-12% Broadcom $AVGO (-0,59 %)

-12% TSMC $2330

$TSM (-1,97 %)

-11% Nvidia $NVDA (-1,17 %)

-11% BE Semiconductor $SMH (-1,28 %)

-11% ARM Holdings $ARM (-1,72 %)

-11% ASML $ASML (-1,3 %)

-9% Dell $DELL

$DELL (+1,57 %)

-9% Micron $MU (-2,2 %)

-6% AMD $AMD (-4,24 %)

-5% KLA $KLAC (-2,62 %)

Power stocks:

-20% Siemens Energy $ENR (-2,95 %)

-15% Bloom Energy $BE (-9,82 %)

-14% GE Vernova $GEV (-2,46 %)

-13% Vistra $VST (-0,71 %)

-11% Schneider Electric $SCHNEIDER

#deepseek

#openai

#ai

#ki

#china

#podcast

#spotify

$SPOT (-0,89 %)

#semiconductor

#halbleiter

TSMC Q4'24 Earnings Highlights

- Revenue: $26.24B (Est. $25.83B) ; +39% YoY

- Net Income: $11.31B (Est. $11.17B) ; +57% YoY

- Gross Margin: 59.0% (Est. 58.5%) ; +53% YoY

- Oper. Margin: 49.0% (Est. 48.1%)

- FY25 CapEx: $38B - $42B (Est. $35.15B)

- FY24 CapEx: $29.76B (Est. ~$29.5B)

Q1'25 Guidance:

- Revenue: $25B - $25.8B (Est. $24.43B)

- Gross Margin: 57% - 59%

- Operating Margin: 46.5% - 48.5% (Est. 46.4%)

- Management expects a ~5.5% sequential revenue drop (smartphone seasonality) but sustained robust AI demand.

Long-Term Revenue CAGR: ~20% (2024-2028)

- AI-related revenue was mid-teens percent of total in 2024 and is expected to double in 2025, with a ~40% CAGR for AI accelerators through 2029.

- AI & HPC cited as main growth engines

- Smartphone & PC segments also gain from higher silicon content

Q4 Process & Segment Details:

- Wafer Shipments: 3.418M; UP +15.6% YoY

- ASP per wafer: ~$6,850 (FY basis); UP +19% YoY

- Advanced Technologies (7nm & below): 74% of total wafer revenue (vs. 69% in Q3)

- 3nm: 26% (vs. 20% in Q3)

- 5nm: 34% (vs. 32% in Q3)

- 7nm: 14% (vs. 17% in Q3)

Q4 revenue by product platform

- HPC (incl. AI): 53% (vs. 51% in Q3) - HPC up +69% YoY

- Smartphone: 35% (vs. 34% in Q3)

- IoT: 5%

- Automotive: 4%

- Consumer Electronics: 1%

- Others: 2%

Q4 Revenue by Geography

- North America: 75% (vs. 71% in Q3)

- China: 9%

- Asia Pacific (ex-China): 9%

- Japan: 4%

- EMEA: 3%

Capital Expenditure:

- FY24 CapEx: $29.76B (Est. ~$29.5B)

- ~70% allocated to advanced nodes (N3, N2)

- ~10-20% for specialty tech & non-wafer (e.g., advanced packaging, mask)

- Sees FY25 CapEx: $38B - $42B (Est. $35.15B)

- "Higher than 2024" to fund advanced nodes (N3, N2) & packaging expansions

- Overseas fabs contribute to increased spending

Advanced Packaging (CoWoS, SoIC):

- ~8% of revenue in 2024; expected to exceed 10% in 2025

- "Any rumors about CoWoS order cuts are simply not true. We continue to increase capacity."

Comment from the management:

Sales drivers and overall performance in the 4th quarter

- "We attribute our sales performance in the fourth quarter to strong demand for 3 nm and 5 nm process technologies."

- "Advanced technologies (7nm and below) accounted for 74% of total wafer sales compared to 69% in the third quarter."

Full year 2024 and future outlook

- "TSMC expects 2025 to be another strong growth year, with revenue growth of over 20% in US dollar terms."

- "Over the next five years (from 2024), we expect a compound annual growth rate (CAGR) of around 20%, driven primarily by AI-related demand and the continued growth of silicon content in smartphones and PCs."

- "In 2024, AI-related revenue was a mid-double-digit percentage of TSMC's total revenue. It is expected to double by 2025 as the strong increase in AI demand continues."

- "We expect a compound annual growth rate (CAGR) of 40% for AI accelerator revenue over the next five years (2025-2029). This is an important driver for future growth."

AI demand, HPC and HBM

- "Memory will grow overall, but HBM (High-Bandwidth Memory) will grow very fast."

- "Demand for AI has more than tripled at TSMC in the last year and we expect it to more than double again in 2025."

- "We continue to see a robust demand profile in AI and can only hope that we can get enough teams and capacity together to support this growth."

Comment on rumors and expansion abroad

- "Rumors about capacity cuts at CoWoS are just rumors - we are continuing to expand our capacity. There are no plans to cut orders."

- "Factories abroad, including in the US and Japan, have an annual gross margin dilution effect of 2-3%, mainly due to smaller scale and higher supply chain costs. We expect this 2-3% margin effect to continue over the next five years."

- "Taiwan will always be the first to ramp up new nodes due to its proximity to our R&D labs (Hsinchu). Other factories abroad will follow depending on customer demand and government support."

- "Our factory in Arizona has started mass production of N4. The second factory is on schedule to produce N3 or N2 technology. Japan's second factory is planned for 2025 and Europe's first factory is also on schedule."

Non-AI markets and silicon content

- "Smartphones are still experiencing low single-digit growth, but the trend towards higher silicon content (AI features, advanced functions) will drive further growth and shorten replacement cycles."

- "PC is similar: overall unit growth is modest, but AI features in PCs are increasing, leading to advanced nodes and higher ASP."

Export controls and demand from China

- "We believe the new US export rules are manageable. We will apply for special licenses for customers as needed, especially in the automotive, industrial or other non-AI use cases."

- "China remains an important market, but currently only accounts for around 9-10% of sales. We continue to work within the regulatory framework."

Silicon photonics and packaging

- "We've had some technical success with silicon photonics, but we probably won't reach significant volumes for another year to a year and a half."

- "Advanced packaging accounted for over 8% of sales in 2024 and is expected to be over 10% in 2025. Our margins for advanced packaging are still slightly below the company average, but are improving."

- "The demand for CoWoS is extremely high for HPC and AI. Other applications (such as smartphones or PCs) may adopt CoWoS in the future, but for now the focus is on AI."

HBM, partnerships and supply chain

- "We are working with all memory manufacturers to provide advanced logic for HBM controllers. It could be another 1.5 years before significant product production from HBM-related logic makes a big revenue contribution."

- "We do not see TSMC as a bottleneck for AI demand. We are expanding capacity for advanced packaging (CoWoS) as quickly as possible and working with memory partners to align capacity."

Margins & pricing strategy

- "We operate in a capital-intensive business and therefore need a healthy gross margin to continue investing in advanced technologies. Pricing must reflect this."

- "We are seeing several cost headwinds including N3 ramps, N2 R&D, conversions from N5 to N3, inflationary pressures and higher costs overseas. We remain confident that we will achieve a gross margin of ~53% or more in the long term."

- "For wafers produced in the US, we are discussing with customers how they will bear the higher costs. Customers understand that the cost structure is different."

Further questions and answers for CEO/CFO

- "We don't comment on competitors' IDMs, we just say that they are important customers. This business is important to us."

- "AI includes CPUs, GPUs, ASICs and HBM logic for HPC/data centers. Edge AI could create 5-10% more chip area in smartphones/PCs, further driving the adoption of advanced nodes."

- "Currently, SoIC is mainly used in AI applications, but we expect more applications in the future."

- "We expect continued strong growth in the AI sector in 2026, although we have not yet made a specific forecast. Our focus is on ensuring sufficient capacity."

- "We are focused on narrowing the cost gap between factories in the US and Japan, but realistically the scale will remain smaller than Taiwan for years to come."

Final note from the CEO

- "2025 will be another strong year. We expect a 20% increase in sales in US dollars, driven by AI and our advanced technologies. We are ramping 3nm and preparing for N2 and beyond to maintain TSMC's technology leadership."

$ASML (-1,3 %) , $ASML (-1,36 %) , $NVDA (-1,17 %) , $AMD (-4,24 %) , $KLAC (-2,62 %) , $QCOM (+1,5 %) , $INTC (-3,2 %) , $MU (-2,2 %) ,

Depot review 2024

The stock market year is now history and I am quite satisfied with the performance, or rather it was my personally best year on the stock market so far in my almost 8 year "career" as a "fund manager", almost 50,000 € gross asset growth in one year, for me as a simple man and normal earner still surreal. I mean, that's more than my gross annual income from my job. In addition, there was a gross dividend of around €9,000, which I have to rely on getquin for, because I got a bit lazy this year and didn't track the net dividend in Portfolio Performance on my PC. It's a bit strange to share my "successes" anonymously here on social media, talking about them in real life with friends/colleagues and sometimes with family is still unimaginable for me.

As far as the portfolios are concerned, there has been a lot of movement, at least in my Scalable portfolio.

Reit has been reduced somewhat, the BP and Shell positions are out and have been partially reallocated to Chevron and Exxon. Altria and BAT are also no longer in the portfolio. With a heavy heart, I have also sold $UKW (-0,79 %) with a heavy heart 😥

As these are positions with high dividends, the cash flow for 2025 will also fall to around €7,000 gross.

I used some of the money to invest in shares with a little more potential in the future and so I only added positions in November, such as $ASML (-1,3 %)

$LRCX (+0,44 %)

$KLAC (-2,62 %)

$DB1 (-0,47 %)

$CSL (-1,11 %)

$NXPI (-1,05 %)

$TTEK (-2,73 %)

$CTAS (-1,58 %)

In addition, I started my "savings plan project" at Trade Republic in February 2024 with the "Ultimate Homer Hardcore ETF", which has now reached a "fund volume" of over €70,000 💪😁

2025 is the turn of the 100k 😁👍

The 50k is divided into approx. 45k price gains for shares and 5k for gold/silver

A happy new year and a happy new year 2025 to you all 🥳💰🍀❤️

Titres populaires

Meilleurs créateurs cette semaine