As I wrote in my analysis, it could be a buying opportunity. I am starting a position with room for more additions. $DECK (-4,4 %)

Discussion sur DECK

Postes

16Deckers Outdoor Corporation: Opportunity in Uncertainty

Deckers Outdoor Corporation $DECK (-4,4 %) is an iconic player in the global footwear and apparel market, best known for its highly recognizable brands UGG and HOKA. Since its founding in 1973, Deckers has built a reputation for innovative design and premium quality, positioning its products across lifestyle and performance-driven segments.

After a record rally that saw shares peak near $224 in December 2024, DECK has undergone a harsh correction in 2025, losing over 54% of its value and returning to price levels last seen at the end of 2023. This startling drop results from a combination of cautious revenue guidance, increased macroeconomic uncertainty, weakening momentum in the consumer sector, and lower direct-to-consumer sales for core brands. Despite this, Deckers stands out from its peers for its financial strength and the resilience of its portfolio.

Fundamentally, the company remains robust:

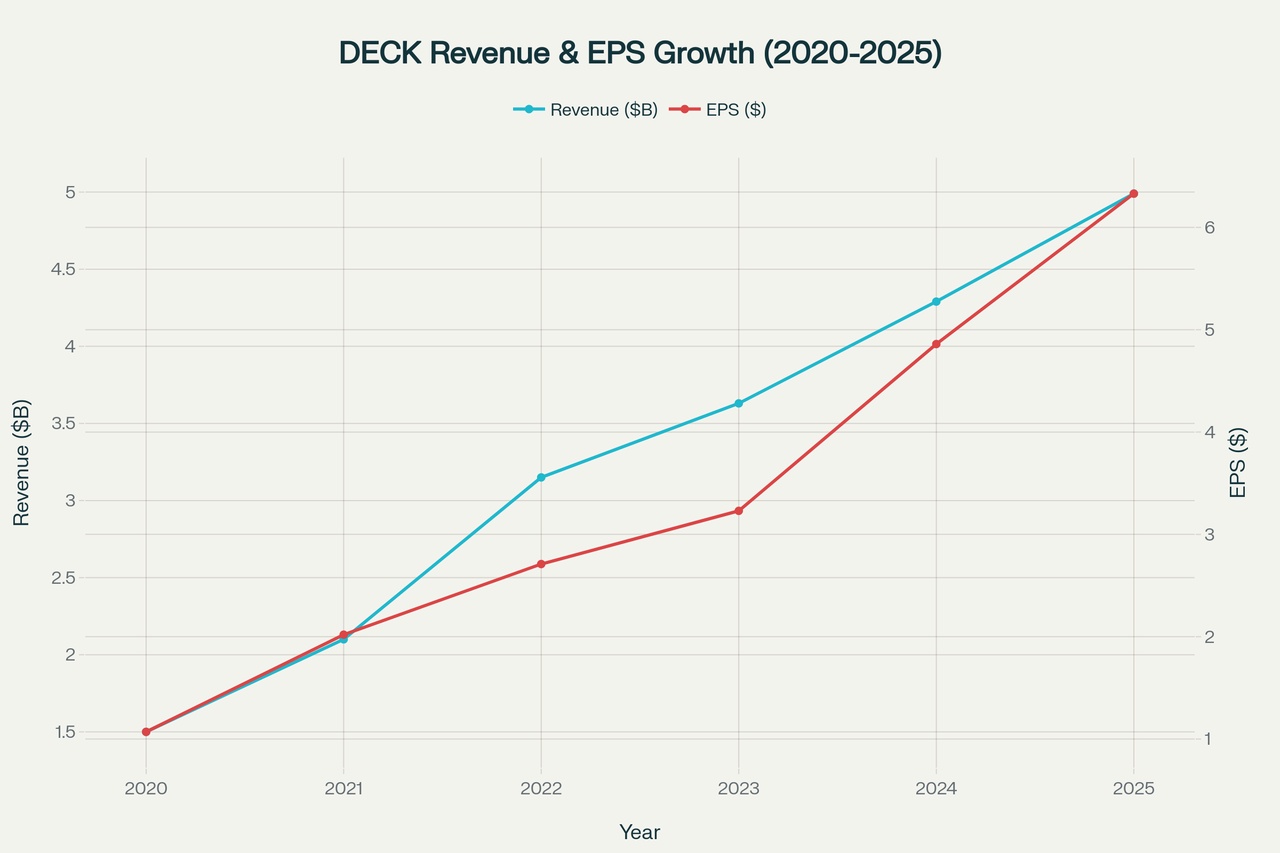

- Revenue growth averaged 27.2% annually over the past five years, climbing from $1.5 billion in 2020 to $4.99 billion in 2025.

- EPS grew even faster, at 42.7% CAGR, as operational leverage and buybacks amplified profitability.

- Gross margin improved by nearly 5 percentage points, showcasing pricing power and efficiency.

- Free cash flow CAGR at 26.3% enabled aggressive shareholder returns.

- Deckers has zero net debt and $2.2 billion in buyback authorization on a clean balance sheet, helping stabilize EPS and support the stock.

Recent quarterly results showed double-digit growth for flagship brands HOKA (+11%) and UGG (+10%), but macro headwinds—like tariff concerns and softer consumer spending—led management to adopt a conservative outlook for fiscal 2026. This triggered analyst downgrades and downward pressure on the stock, fueling volatility and a rapid reversal of prior gains.

However, with technical downtrends, many investors now consider DECK a classic “fallen angel” with deep value characteristics. Analyst consensus price targets range $125-130, indicating a potential 25-30% upside from current levels. The company’s ongoing buybacks and strong capital position may catalyze a rebound, as bargain hunters begin to step in and sentiment eventually recovers.

Below is a chart illustrating Deckers’ impressive growth trajectory in revenue and EPS, even as the stock faces near-term challenges:

Deckers Outdoor (DECK) Revenue and EPS Growth (2020-2025)

Outlook:

While short-term risk and volatility remain, Deckers Outdoor presents a strong case for value-oriented investors. Its solid fundamentals, powerful brands, and proven management provide resilience. If macro factors stabilize and consumer trends improve, DECK could recover quickly, rewarding those who buy at these depressed levels. As with any volatile stock, patience and careful entry timing are key—but the potential is real for a rewarding rebound in the years ahead.

Deckers Brands Q2’26 Earnings Highlights

🔹 EPS: $1.82 (Est. $1.58) 🟢; UP +14% YoY

🔹 Revenue: $1.43B (Est. $1.42B) 🟢; UP +9% YoY

🔹 Gross Margin: 56.2% (vs. 55.9% LY)

🔹 Operating Income: $326.5M

FY26 Guidance

🔹 Net Sales: ~$5.35B (Est. $5.45B) 🔴

🔹 EPS: $6.30–$6.39 (Est. $6.33) 🟡

🔹 Gross Margin: ~56%

🔹 Operating Margin: ~21.5%

Q2 Brand Performance

🔹 HOKA: $634.1M; UP +11% YoY

🔹 UGG: $759.6M; UP +10% YoY

🔹 Other Brands: $37.2M; DOWN -26% YoY (phase-out of Koolaburra)

Channel / Geographic Mix

🔹 Wholesale: $1.04B; UP +13% YoY

🔹 DTC: $395M; DOWN -1% YoY

🔹 Domestic: $839.5M; DOWN -2% YoY

🔹 International: $591.3M; UP +29% YoY

CEO Commentary (Stefano Caroti)

🔸 “HOKA and UGG delivered double-digit growth, reflecting strong international momentum.”

🔸 “Our innovative products and disciplined execution give us confidence in achieving FY26 goals.”

Deckers

Second tranche added $DECK (-4,4 %) .

Top value. Let's see what effect the tariffs will have in the medium term.

Deckers Brands Q1’26 Earnings Highlights

🔹 Net Sales: $964.5 M (Est. $900.31 M) 🟢; UP +16.9% YoY

🔹 EPS: $0.93 (Est. $0.68) 🟢; UP +24% YoY

🔹 Net Income: $139.2 M; —

🔹 Gross Profit: $537.9 M; Gross Margin: 55.8% (vs. 56.9% YoY)

Q2’26 Guidance

🔹 Net Sales: $1.38 B – $1.42 B (Est. $1.51 B) 😐

🔹 EPS: $1.50 – $1.55 (Est. $1.40) 🟢

Q1 Segment / Brand Results

🔹 HOKA® Net Sales: $653.1 M; UP +19.8% YoY

🔹 UGG® Net Sales: $265.1 M; UP +18.9% YoY

🔹 Other Brands Net Sales: $46.3 M; DOWN –19.0% YoY

Channel Performance

🔹 Wholesale Net Sales: $652.4 M; UP +26.7% YoY

🔹 DTC Net Sales: $312.2 M; UP +0.5% YoY (Comp. Sales DOWN –2.2% YoY)

Geographic Performance

🔹 Domestic Net Sales: $501.3 M; DOWN –2.8% YoY

🔹 International Net Sales: $463.3 M; UP +49.7% YoY

Other Metrics

🔹 Operating Income: $165.3 M; UP +24.5% YoY

🔹 Pre‑Tax Profit: $183.1 M

🔹 SG&A Expenses: $372.6 M; UP +10.5% YoY

CEO Commentary

🔸 “HOKA and UGG outperformed our first quarter expectations, with robust growth delivering solid results to begin fiscal year 2026.”

🔸 “Though uncertainty remains elevated in the global trade environment, our confidence in our brands has not changed, and the long‑term opportunities ahead are significant. We will lean on the fundamental strengths of our powerful operating model as we continue executing our strategy.”

Position full

The position in $DECK (-4,4 %) is now full

👇👇👇👇

DECK Raymond James analyst Rick Patel lowered the price target on Deckers Outdoor from $140 to $123 and maintains a Strong Buy rating on the stock. Deckers' Q1 results are expected to be similar to its "lackluster" Q4 results, but the underlying strengths of HOKA and UGG remain intact, the analyst said in a research note. The firm expects HOKA to pick up momentum from Q2, which should drive estimates higher and improve visibility.

Lynx analysis

Deckers Brands share: Chart from 23.05.2025, price: USD 126.09 - symbol: DECK | source: TWS

If the share price falls below USD 108 in regular trading, a renewed setback towards USD 100 or USD 94 must be expected.

Below this level there would be a Verkaufssignalwith possible price targets at USD 82 and USD 75.

If, on the other hand, the share price returns above USD 108, the situation will ease immediately.

Deckers goes on the offensive

However, earnings of only USD 0.62 - 0.67 per share are forecast for the first quarter, disappointing expectations of USD 0.79 per share.

Deckers therefore assumes that the waters will become rougher for the time being.

But instead of going on the defensive, the company is going on the offensive and buying back its own shares on a large scale. Aktien back.

In the last 12 months, 3.80 million treasury shares have been retired, 1.8 million of them in the final quarter - i.e. in the period from January to the end of March. In the first weeks of the current quarter, a further 765,000 treasury shares were purchased.

In total, this corresponds to around 3% of the outstanding shares, but this is not the end of the story.

Yesterday, Deckers decided on further buybacks with a volume of USD 2.25 billion. This would currently be enough to cancel almost one in seven shares.

Furthermore, the balance sheet is squeaky clean. The company has no debt and USD 1.89 billion in cash. Deckers should therefore be well equipped for a possible crisis.

The only question that remains is how long and how deep the crisis will be. Perhaps the time is not yet right to make a large-scale investment in Deckers.

However, it seems to be mainly a question of timing.

Deckers Outdoor Q4 Earnings Highlights

🔹 Revenue: $1.02B (Est. $1.006B) 🟢; +6.5% YoY

🔹 Adj EPS: $1.00 (Est. $0.59) 🟢

🔹 OI: $173.9M (Est. $107.1M) 🟢

🔹 Net Income: $151.4M (Est. $89.5M) 🟢

FY Outlook Withdrawn:

🔸 Deckers withdrew full-year FY26 guidance due to macroeconomic uncertainty and evolving global trade policies.

Q1 Guidance:

🔹 Revenue: $890M–$910M (Est. $925.3M) 🔴

🔹 EPS: $0.62–$0.67 (Est. $0.79) 🔴

Segment Revenue (Q4 YoY):

🔹 HOKA®: $586.1M; +10.0% YoY

🔹 UGG®: $374.3M; +3.6% YoY

🔹 Other Brands: $61.3M; -6.3% YoY

Channel Performance (Q4 YoY):

🔹 Wholesale: $611.6M; +12.3% YoY

🔹 DTC: $410.2M; -1.2% YoY

↳ DTC Comparable Sales: -1.6% YoY

Geographic Performance (Q4 YoY):

🔹 Domestic Sales: $647.7M; Flat YoY

🔹 International Sales: $374.1M; +19.9% YoY

💰 Capital Allocation:

🔹 Q4 Buyback: 1.78M shares for $266M

🔹 FY25 Buyback: 3.8M shares for $567M

🔹 FY26 Q1 Buyback (as of May 9): 765K shares for $84M

🔹 Total Buyback Authorization Increased to $2.5B

CEO Stefano Caroti:

🔸 “Despite global trade uncertainty, HOKA and UGG remain strong category leaders with long-term growth potential.”

CFO Steve Fasching:

🔸 “FY25 marks our 5th consecutive year of double-digit growth in revenue and EPS. With $1.9B in cash, strong cash flow, and a $2.5B buyback authorization, we’re well-positioned for strategic investment and shareholder return.”

Earnings Week - Highlights of the reporting week from May 19, 2025 💰

Numerous exciting quarterly figures are due this week. Particularly in focus: Palo Alto Networks ($PANW (+1,51 %)), Snowflake ($SNOW (+2,17 %)), Target ($TGT (-0,33 %)), Intuit ($INTU (+1,84 %)), Workday ($WDAY (+0,4 %)), Deckers Outdoor ($DECK (-4,4 %)) and BJ's Wholesale ($BJ (-2,49 %)).

⸻

📅 Monday (19.05.)

- Trip.com ($TCOM)

- ZIM Integrated Shipping ($ZIM)

- 8x8 ($EGHT)

- Gilat Satellite ($GILT)

- Agilysys ($AGYS)

- Compugen ($CGEN)

- Transcat ($TRNS)

📅 Tuesday (20.05.)

- Palo Alto Networks ($PANW)

- Bilibili ($BILI)

- Tuya ($TUYA)

- Modine ($MOD)

- Toll Brothers ($TOL)

- Viking Holdings ($VIK)

- Amer Sports ($AS)

- Arbe Robotics ($ARBE)

- XPeng ($XPEV)

- Full Truck Alliance ($YMM)

- XP Inc ($XP)

📅 Wednesday (21.05.)

- Target ($TGT)

- TJX Companies ($TJX)

- Baidu ($BIDU)

- Medtronic ($MDT)

- Wix.com ($WIX)

- Urban Outfitters ($URBN)

- Domo ($DOMO)

- American Superconductor ($AMSC)

- Qifu Technology ($QFIN)

📅 Thursday (22.05.)

- Analog Devices ($ADI)

- BJ's Wholesale ($BJ)

- Deckers Outdoor ($DECK)

- Autodesk ($ADSK)

- Intuit ($INTU)

- Workday ($WDAY)

- Ross Stores ($ROST)

- Advance Auto Parts ($AAP)

- Lightspeed Commerce ($LSPD)

- TD Bank ($TD)

- Keysight Technologies ($KEYS)

📅 Friday (23.05.)

- Booz Allen Hamilton ($BAH)

🔗 Full overview: earningswhispers.com/calendar

S&P 500 - catch-up potential?

In the S&P 500, 224 out of 500 shares are in the red this year. "Welt" has analyzed which stocks have the potential to catch up.

The criteria:

The stocks must have lost at least 20 percent in price since the beginning of the year, have at least double-digit price potential according to analysts' estimates and also be recommended as a buy by at least 50 percent of augurs.

The candidates (selection):

$UNH (+0,79 %) - United Health

$DECK (-4,4 %) - Deckers Outdoor

$UPS (+0,39 %) - UPS

$HAL (-1,69 %) - Halliburton

$MRK (-0,26 %) - Merck

$NCLH (+0,33 %) - Norwegian Cruise Line

$IQV (+0,53 %) - IQVIA Holdings

Source: Welt, 14.05.25 (excerpt) | Image: ChatGPT

Titres populaires

Meilleurs créateurs cette semaine