Here's to a good week everyone! AI companies are up in the pre-market

$IREN (+1,44 %)

$CIFR (-3,09 %)

$CLSK (+3,04 %)

Postes

29Here's to a good week everyone! AI companies are up in the pre-market

$IREN (+1,44 %)

$CIFR (-3,09 %)

$CLSK (+3,04 %)

$IREN (+1,44 %) is not on the list for the second week due to the convertible note. It has also $HIMS (+0,71 %) slipped out of the top 15. The company is exciting $CLSK (+3,04 %) 👀

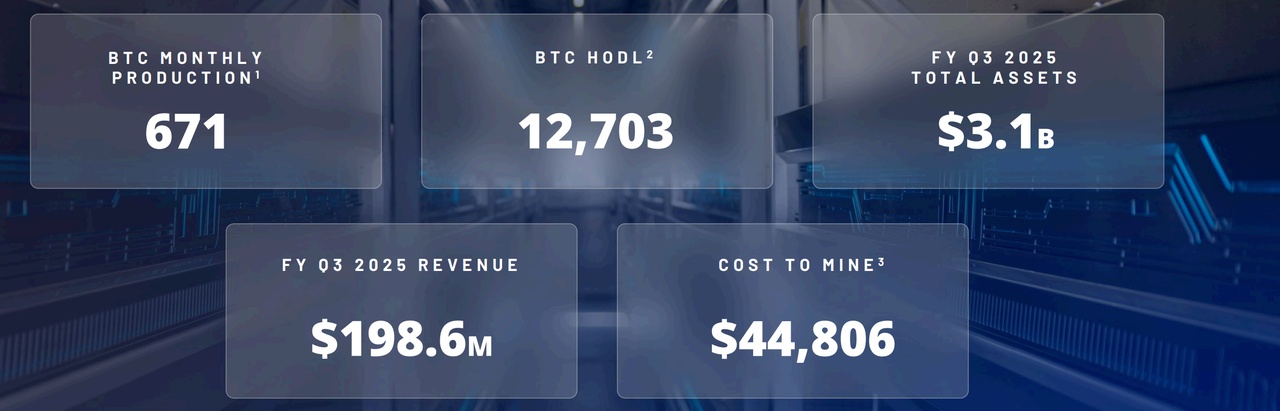

$CLSK (+3,04 %) could also be an exciting company in the data center sector that also comes from the Bitcoin division.

The advantage of CleanSpark is that they have not yet started so strongly, have a favorable valuation and have also secured contracts of 1GW and 1.7GW in the long term (almost 1/3 of Irish). However, CleanSpark is at the beginning of the transition and needs to show real initiatives in the data center area and needs more time to gain a proper foothold here, and is still deeper in the mining business:

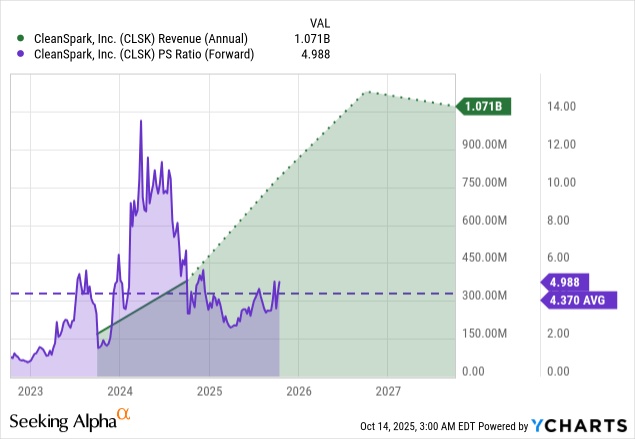

Valuation:

If we look at the valuation we have a current PS ratio of 8x (IREN 26x) and generally has a low valuation, but also has a different company/growth structure. They also have a 4.9x FWD P/S ratio. Cleanspark is therefore valued up to 3x lower purely from a fundamental perspective!

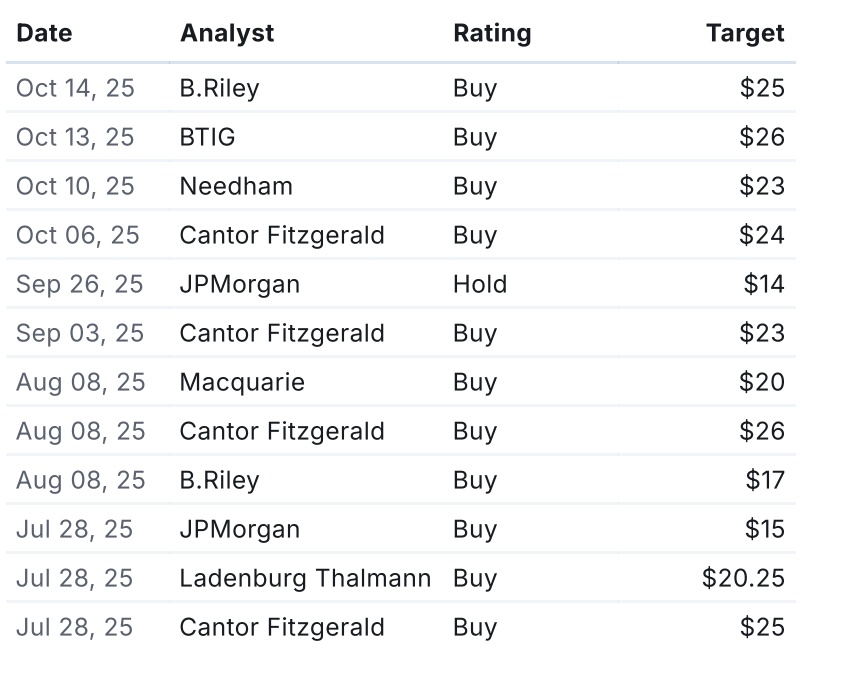

Banks: Upside potential to $25 per share

Technical rebound possible:

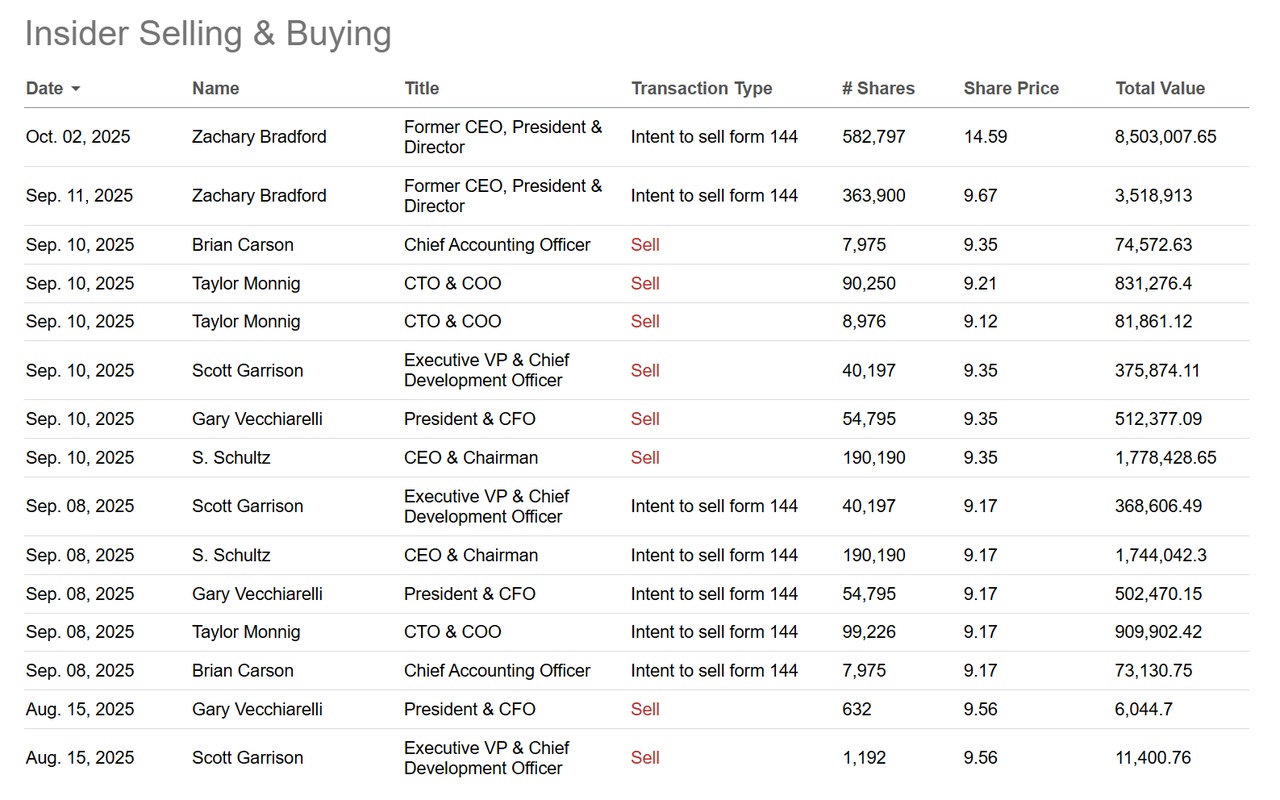

On the negative side, however, the massive insider selling should be noted:

Generally very exciting and will be analyzed further over the next few days!

+ 2

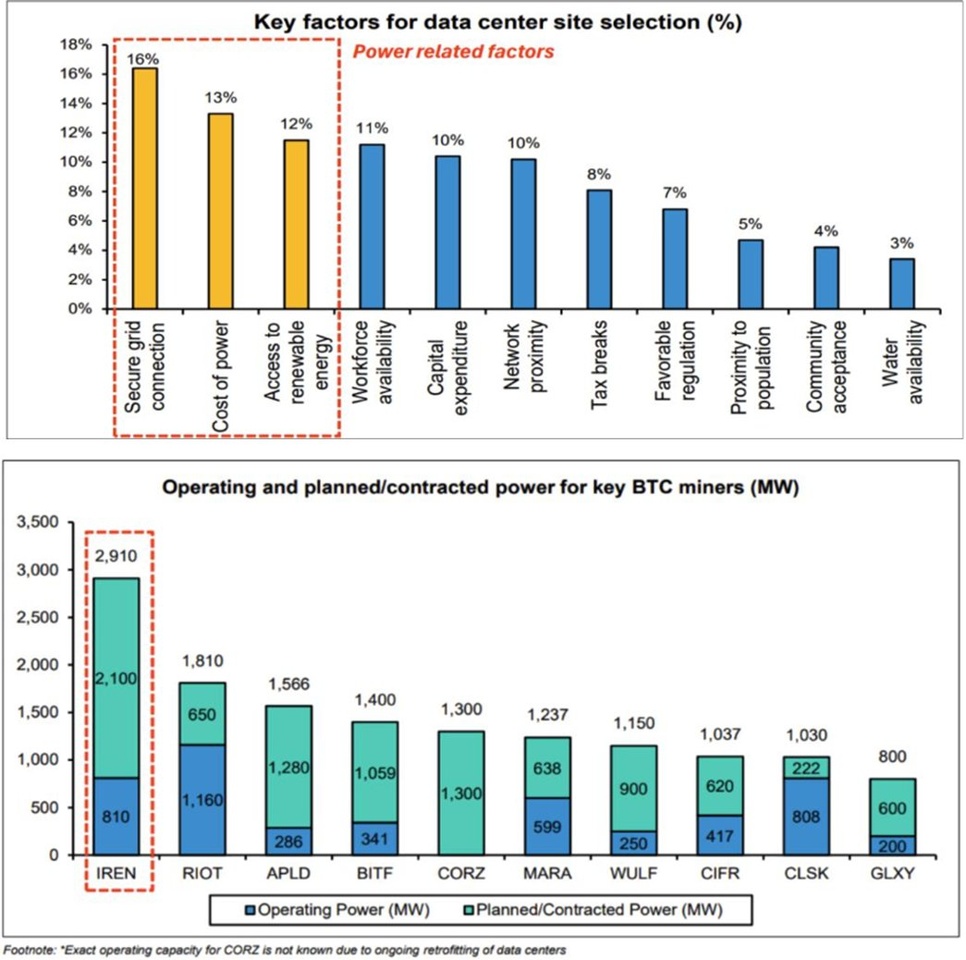

Analysts at research and brokerage firm Bernstein said Bitcoin miners are becoming the unexpected winners of the artificial intelligence infrastructure boom thanks to their access to pre-secured, high-density power capacity.

In a new report on Friday, analysts led by Gautam Chhugani argued that this power advantage makes miners key partners for AI cloud providers facing long connection delays and increasing network congestion. Bernstein named the leading listed Bitcoin miner by market capitalization IREN as its top recommendation, rated the stock as "outperform" and reiterated its recently raised price target of USD 75.

The report points out that Bitcoin miners have collectively secured access to more than 14 gigawatts of grid-connected power - much of it in regions with surplus renewable energy. This infrastructure could reduce the time it takes to deploy AI data centers by up to 75%, according to the analysts. This gives miners an edge over greenfield developers who face multi-year queues to connect to the grid. "Access to the power grid has become a very scarce resource in the US," the analysts write, emphasizing that miners are now attractive strategic partners for hyperscalers and AI infrastructure providers due to their early expansion.

$IREN (+1,44 %) The company controls around 3 gigawatts of operational and in-development power capacity in North America alone and has been the fastest to capitalize on the opportunity, according to analysts. The company has also acquired more than 23,300 GPUs - including the latest Blackwell models from $NVDA (+2,3 %) - and expects its AI cloud business to exceed $500 million in annual revenue by the first quarter of 2026. The upcoming 50-megawatt liquid-cooled data center from $IREN (+1,44 %) and a 2-gigawatt Sweetwater hub in Texas are key components of this expansion.

$CIFR (-3,09 %)

$BTC (+0,92 %)

$BTBT (+0,89 %)

$BITF (-3,57 %)

$CLSK (+3,04 %)

Trimmed a part of $RKLB (+0,9 %) (15%) and $SOFI (+3,27 %) (20%) waiting for a pullback in the next weeks.

200 wma shows short term overvalue.

In watchlist:

Add to $AMD (+0,64 %) position,

Whatching $NOVO B (-0,62 %) , $DUOL , $CLSK (+3,04 %) , $JD (+3,24 %) (but i don't wanna spend my liquidity)

$BIDU (+5,59 %)

$BABA (+2,93 %)

$HIMS (+0,71 %) i'm preparing to my first safe trim after a strong impulse

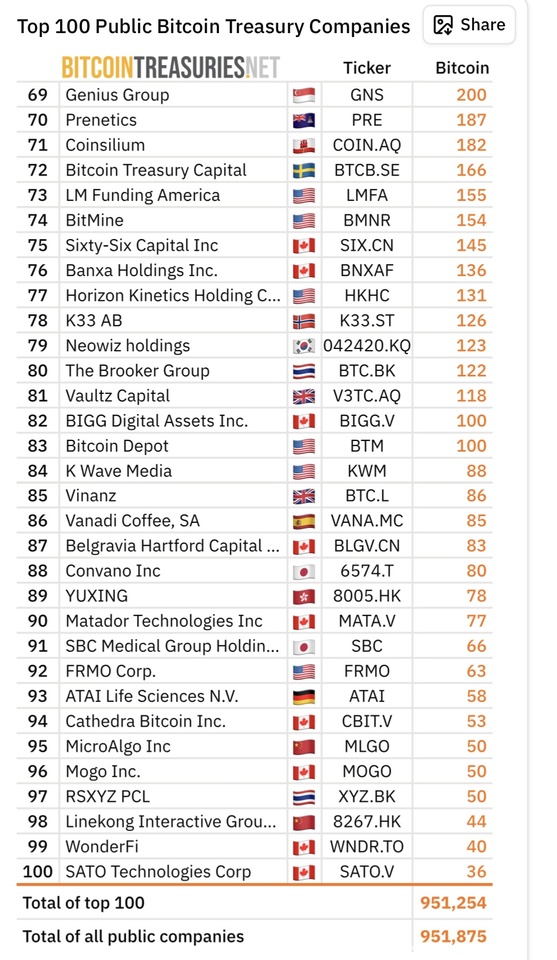

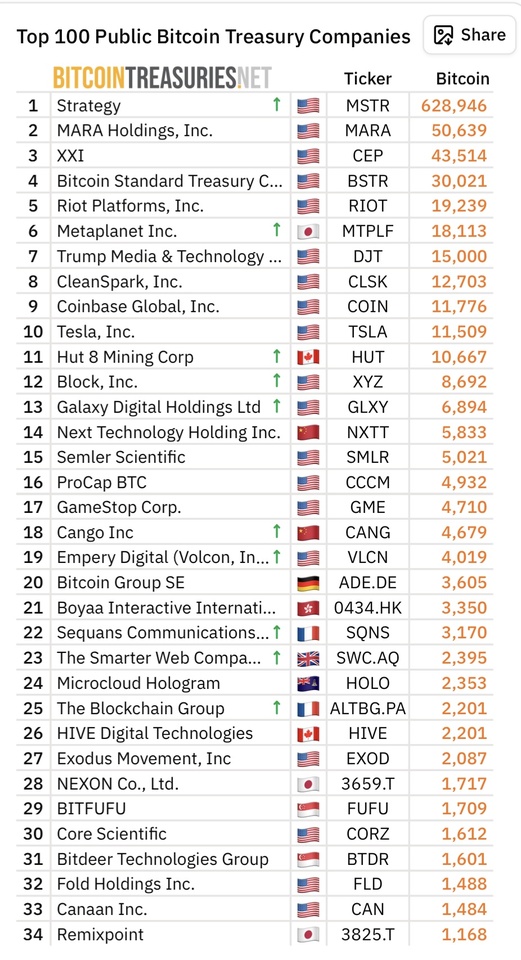

For those who are interested:

https://bitcointreasuries.net/

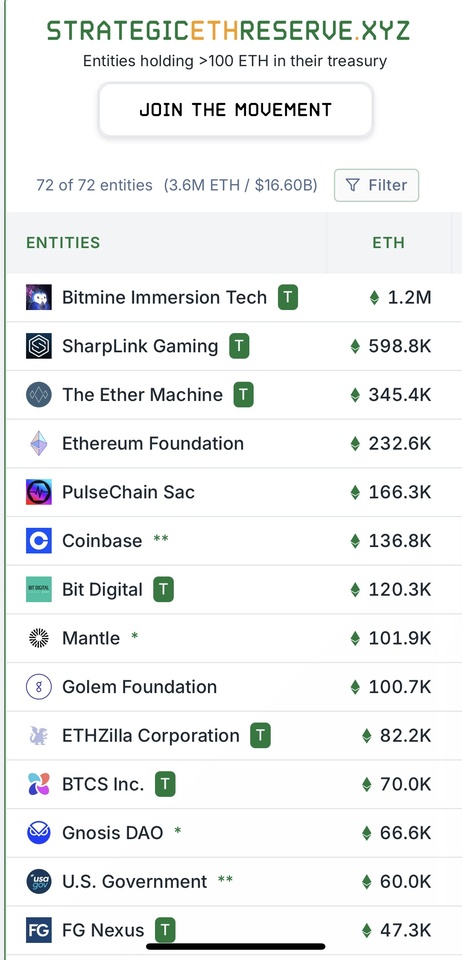

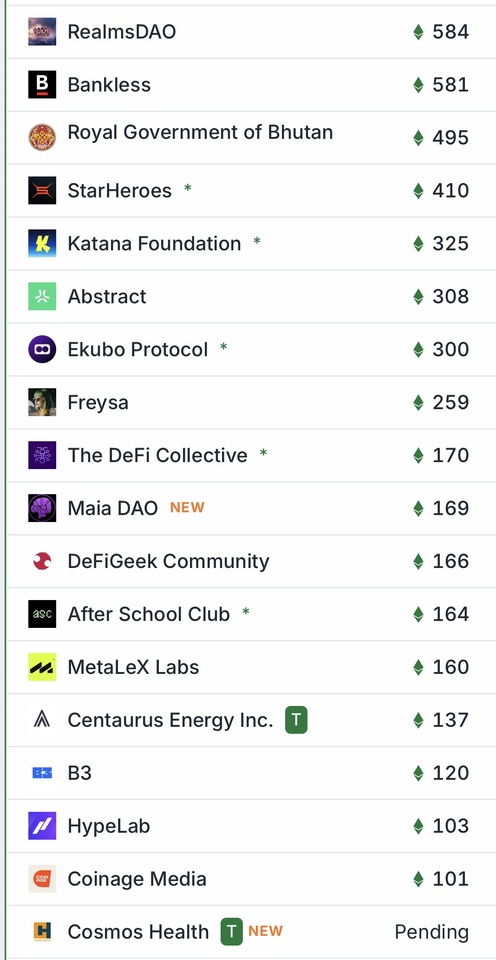

Entities holding >100 ETH in their treasury:

https://strategicethreserve.xyz/

$BMNR (+5,73 %)

$SBET (+5,83 %)

$MSTR (+2,57 %)

$SWC

$3350 (+5,17 %)

$CLSK (+3,04 %)

COIN (+3,88 %)

$MARA (+2,65 %)

$RIOT (+5,31 %)

$BTBT (+0,89 %)

$ETHM (+0,53 %)

$CORZ (+1,38 %)

$BTDR (+3,86 %)

$GLXY (+2,33 %)

$CIFR (-3,09 %)

$IREN (+1,44 %)

$DJT (+0,8 %)

+ 3

Completely closed 2 stock positions today.

$CLSK (+3,04 %) and ?

A large part of the investment thesis of $IREN (+1,44 %) is linked to the company's ambitious expansion into the fast-growing AI/HPC sector.

While $IREN (+1,44 %) Bitcoin mining yields remain exceptional, performance in this segment is heavily influenced by factors outside of the company's control - namely price, network difficulty and ASIC prices. $BTC (+0,92 %) -price, network difficulty and ASIC prices.

Today's demand for AI computing power is only a fraction of what will be needed.

The reasons are:

- AI switches from text to real-time video, 3D and full scene understanding

- AI co-pilots integrated into every productivity and development tool

- Autonomous robots, vehicles and smart factories

- AI-generated content on a large scale: ads, movies, virtual worlds

- Constant retraining of boundary models, 100 times more computationally intensive

Access to AI computing power and related infrastructure will be critical for major tech companies to defend and grow their multi-billion dollar valuations. These players are outbidding each other, not only to secure capacity, but also to prevent others from obtaining it. Whoever controls the most computing power capacity and supporting infrastructure will gain a massive advantage over the other.

We have already seen this in the race for $NVDA (+2,3 %) chips, the biggest bottleneck in the AI value chain today. But this bottleneck is shifting as computing capacity becomes increasingly constrained by access to AI-optimized energy infrastructure.

And here, in my opinion $IREN (+1,44 %) that has more than 3 GW of AI-optimized infrastructure will benefit. It takes time to build, contracts for infrastructure and power connection contracts are becoming more difficult, and the land and locations required are becoming more expensive, $IREN (+1,44 %) has recognized this early on.

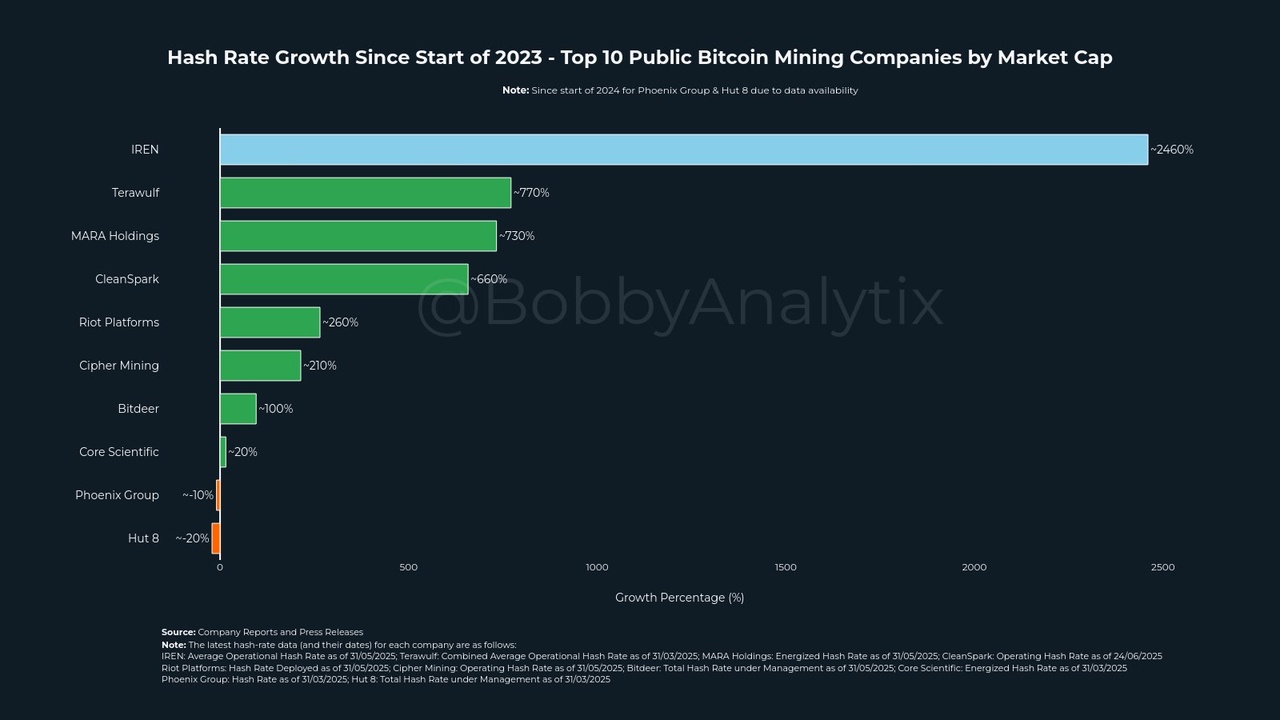

Increase in hash rate since 2023:

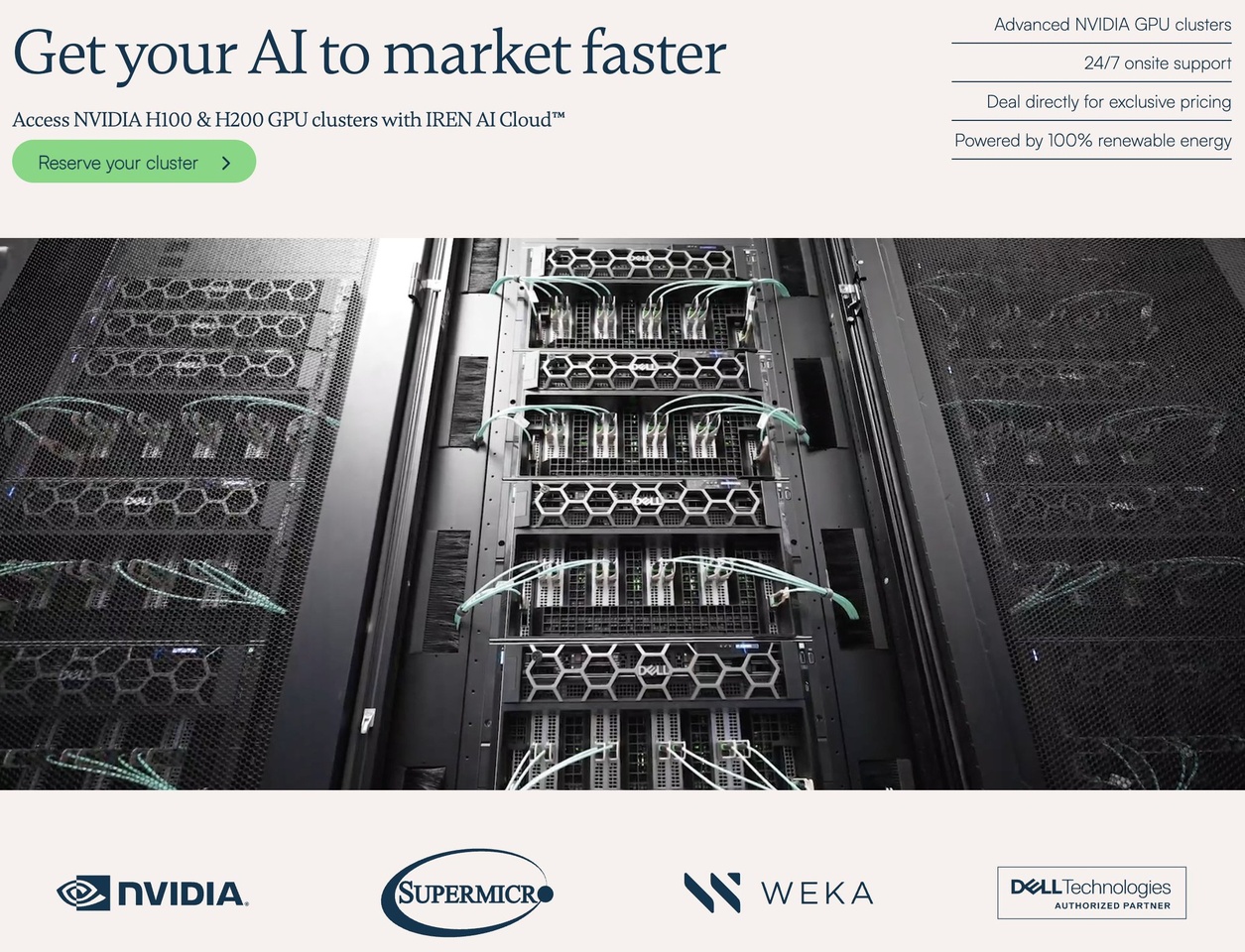

$IREN (+1,44 %) available today with $IREN (+1,44 %) AI Cloud has $NVDA (+2,3 %) H100 and H200 GPU clusters.

These clusters are powered 100% by renewable energy.

$MARA (+2,65 %)

$CLSK (+3,04 %)

$BTC (+0,92 %)

$MSTR (+2,57 %)

$RIOT (+5,31 %)

$CRWV (+1,54 %)

$META (+1,39 %)

$AMZN (+1,55 %)

$GOOGL (+2,68 %)

$NVDA (+2,3 %)

$MSFT (+1,24 %)

$WULF (+0 %)

$CIFR (-3,09 %)

$CORZ (+1,38 %)

$BTDR (+3,86 %)

$3350 (+5,17 %)

$MSTR (+2,57 %)

$BTC (+0,92 %)

$TSLA (+5,43 %)

$MARA (+2,65 %)

$BLOCK (+3,66 %)

$HUT (+4,08 %)

$CLSK (+3,04 %)

$RIOT (+5,31 %)

$COIN (+3,88 %)

$DAPP (+3,94 %)

Following the purchase of 1,234 additional BTC, the Japanese company now holds $3350 (+5,17 %) now holds 12,345 Bitcoins, overtaking Tesla's 11,509 BTC. This makes the company the seventh largest corporate holder. The company plans to reach 210,000 BTC by 2027. $BTC (+0,92 %) by 2027. $MSTR (+2,57 %) continues to lead with 592,345 BTC.

Meilleurs créateurs cette semaine