🇺🇸 USA

$SPX500 — Futures are moving in a decisive drop, indicating a strong negative open due to renewed regional bank stress.

$DJ30 — Futures in a sharp decline, dragged down by financial and cyclical stocks.

$NSDQ100 — Futures are markedly lower, with weakness in tech stocks solidifying.

💻 Tech & Growth Snapshot

$NVDA (+1,84 %) — Up in pre-market, holding strong against the general weakness thanks to robust AI demand.

$GOOGL (+0,23 %) — Under strong pressure, aligned with the overall Nasdaq decline.

$AVGO (-0,02 %) — Aggressive profit-taking in the semiconductor sector.

$META (-0,03 %) — Stable in pre-market, showing relative strength against its peers.

$MSFT (+0,28 %) — Slight dip, following the market's bearish trend.

$QBTS (+0,07 %) — Down again, volatility remains extreme in this sector.

$RGTI (-6,89 %) — Down, the quantum computing sector is highly sensitive to the risk-off mood.

🛍️ Retail & Commerce

$AMZN (+0,41 %) — Down in pre-market, negative sentiment weighs on consumer confidence.

$BABA (+2,25 %) — Stable, counter-trending thanks to Asian positive sentiment.

$CVNA (-0,54 %) — Down, the stock struggles to find a stable support base.

$SHOP (+0,8 %) — Correcting some of its recent gains.

⚕️ Health & Pharmaceutical

$LLY (+1,13 %) — Stable/Up slightly, the defensive sector offers timid refuge.

$HIMS (-0,07 %) — Profit-taking in pre-market despite recent catalysts.

$INSM (+1,06 %) — Mixed, the biotech sector moves disconnectedly, but with caution.

🇪🇺 Europe

STOXX 600 — Opening solidly up, boosted by defensive sectors and positive earnings reports.

GER40 — Up slightly, showing resilience despite US banking worries.

$LDO.MI — Up, the defense sector continues to outperform.

$IBE.MC — Stable, utilities confirm their defensive asset status.

$OKLO — Stable, the nuclear tech stock awaits concrete catalysts.

🏦 Banking & Finance

$$UCG (+0,04 %) — Under strong pressure, the financial sector is generally affected by contagion fears.

$$ISP (+1,03 %) — Markedly lower, negative sentiment dominates.

$$BAMI (+0,32 %)

$CE (+1,18 %) , $BPE (+2,55 %) — Widespread selling on Italian banks.

$$BBVA (+0,68 %) — In strong increase, counter-trending the sector due to positive corporate news or insulation from US regional bank stress.

$AXP (+0 %) — Down in pre-market, facing consumer slowdown concerns.

$V (-1,26 %) — Essentially flat, confirms its more defensive status.

🌏 Asia

$JPN225 — Close down, weighed by Wall Street losses and trade uncertainty.

$KOSPI — Close flat/slightly down, the market remains in a holding pattern.

$HK50 — Sharp fall, due to regional bank pressures and China's plenum anticipation.

$CHINA50 — Weak, caution dominates.

💱 Forex

$EURUSD — Down, the Euro loses ground against the haven Dollar.

$GBPUSD — Down, the Pound is under pressure.

$USDJPY — Falling sharply, the Yen is rallying as the Dollar loses momentum on Fed rate-cut hopes.

$DXY — The Dollar Index is showing strength, acting as a safe haven.

💎 Commodities & Precious Metals

$GLD (+1,93 %) — Strong rally, gold hits new record highs on strong safe-haven demand.

$CDE (+6,17 %) — Up sharply, following the explosive trend of gold.

$BRENT — Down slightly, global demand fears persist.

$WTI — Losing ground, affected by negative macroeconomic sentiment.

📈 Benchmark ETFs

$VOO (+0,37 %) — Tracks the negative S&P 500 futures.

$VGT (+0,72 %) — Down, reflecting weakness in the technology sector.

$CSNDX (+0,48 %) — Tracks Nasdaq futures in negative territory.

$VWCE (+0,32 %) — Stable/Down, reflects the mixed global trend.

$BND (+0,09 %) — Up, as bond yields fall due to safe-haven demand.

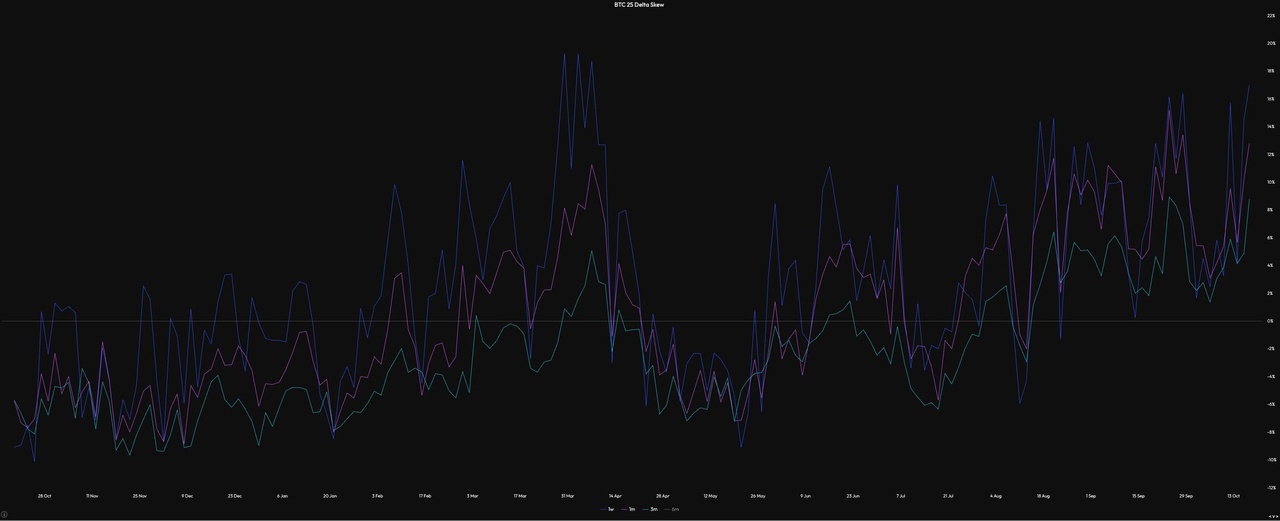

💰 Crypto

$BTC (+0,08 %) — Down slightly, aligned with the general risk-off mood.

$ETH (+0,51 %) — Following Bitcoin, showing broad weakness.

$CRO (-1,2 %) — Flat/Down slightly, in line with the rest of the market.

$TRX (-3,02 %) — Down slightly, the sector struggles to find significant support.

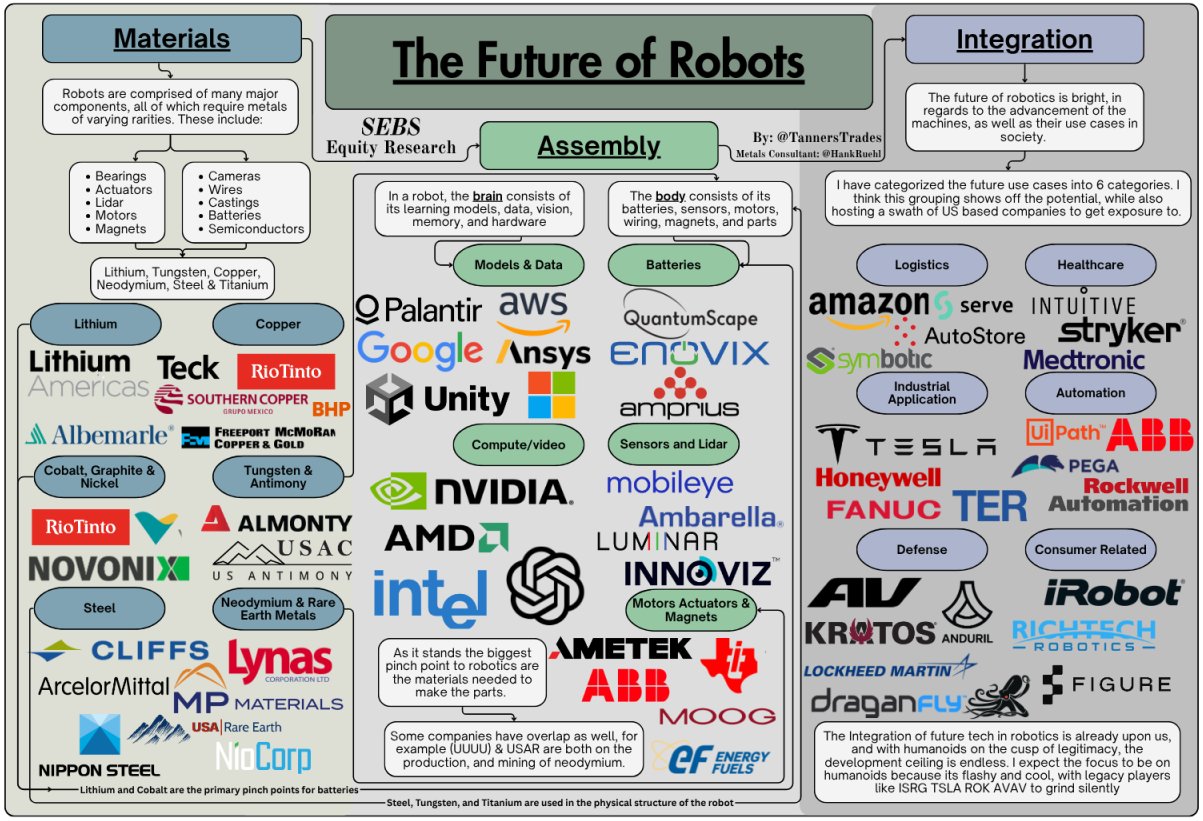

🚀 Space & New Tech

$RKLB (-0,45 %) — Weak in pre-market, aligning with other growth stocks.

🔎 Deep Dive: Gold & Banking Stress

The day is polarized: the strong safe-haven demand for Gold ($GLD) is the dominant theme, hitting new all-time highs due to persistent US regional bank stress. While European markets, specifically $BBVA.MC, show resilience and an isolated uptrend, the US futures and Italian financial stocks are struggling. The overall takeaway is a heightened sense of systemic risk, forcing investors into traditional havens while penalizing US high-beta stocks. The strength of $NVDA remains a key structural theme resisting the general decline.

⚠️ Disclaimer: Past performance is not indicative of future results. Investing involves risks, including the loss of capital.