$NIBE B (-2,09 %) 10% per week until today! Speculatius, I hear you. But Nibe will get there in the end, it would be nice if this were a trend reversal *keep dreaming*....

Nibe Industrier

Price

Discussion sur NIBE B

Postes

50That's enough ...

Tidied up a bit.

In addition $INTC (-1,3 %) and $NIBE B (-2,09 %) were also kicked out straight away.

I had a small savings plan for all of them, which resulted in a total loss of around €600

Does anyone know what is $NIBE B (-2,09 %) is going on. Now ytd is down over 30%. Couldn't find anything.

And here is another addition to my portfolio. Nibe is for me a pure play on the revolution of the wHeat sector in terms of heat pumps and Co.

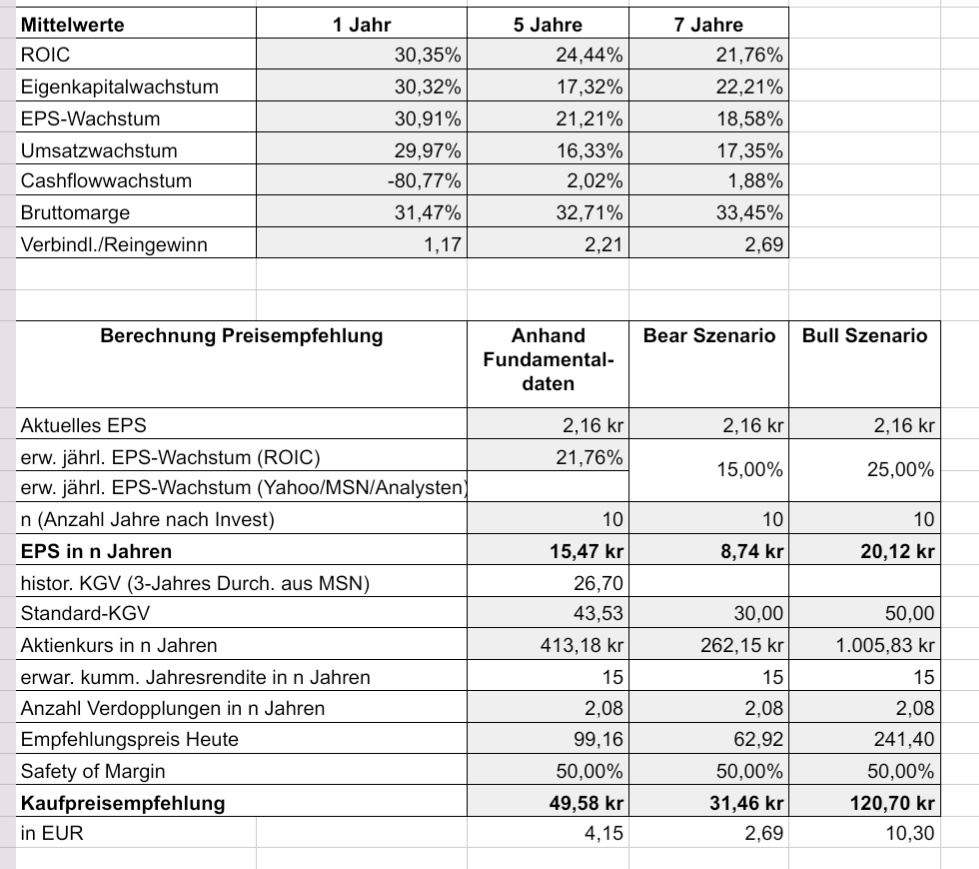

The hype of the last months was well sold off and based on my fundamental analysis, it is now worth buying.

I have also attached an excerpt from my analysis.

What do you think of Nibe? How do you see the future? Do you have the company in your portfolio?

+++ Signs of life +++

(from the series: Investment Diary & Thoughts)

Knee surgery survived last week. 🩼

Whether good, is the other question... 😣 In the meantime got postoperative fever, knee still swollen, probably needs to be punctured again... and otherwise so?

I lie around the whole day, meow at my wife from time to time (which I feel sorry for again seconds later, because she certainly can't help it...) and then I think to myself:

Look again in your depot. But no, I don't feel like it. Health and all that. That comes first.

Now I fell so when planking on the sofa suddenly my own trains of thought to the topic invest. And the decision is made after 2 days:

I will make my investing even simpler and less complex.

What follows:

Nearly all BigBlueChips are sorted out and shifted into the MSCI World & MSCI EM. After all, they are represented there anyway, so why bother with them?

What remains for the pension is the MSCI World ($IWDA (-0,69 %) ) , MSCI EM ($EIMI (-0,63 %))and EUWAX GOLD II ($EWG2 (+1,48 %) ).

In addition, I focus on 5 (max. 7) individual stocks. According to the current status these include $ST5 (-1,74 %) (Steico SE), $NIBE B (-2,09 %) (NIBE "is love"); $YSN (+0,46 %) (Secunet); $UKW (-5 %) (Greencoat for ever - or what better comes); $COLO B (-0,4 %) (Coloplast) and $MRK (-1,41 %) (Merck KGaA).

Over the years, I have become less and less interested in more.

Investing remains important. But please make it as boring as possible.

The last weeks alone (preparation for surgery and now the aftercare) have shown me that I am not ready for this and especially not able to keep track of 15-20 values. Thus, the focus on investing as simple as possible and still preserve individual value opportunities for me has become more attractive again.

Maybe this will actually create opportunities for the activated trading of 1-2 values from the basic framework... if not, also not so wild. And yet I will be able to focus even better on these values.

Concentrating on a few individual values and a really large core (I'm also talking about more than 150k€ in the core here) is the true core-satellite strategy for me. That I had neglected this over the years somewhat, or expanded - normal. So now "back to the roots", or "back to simplicity".

Time is not money, but valuable in terms of family, free time and your own health.

And otherwise so?

Soon the physiotherapy will start. I have no idea how to cope at the moment, but that will come.

I still have the post on hold for the "Green Investment" and the resolution (win pronounced in the poll) of the winner of the getquin-Cap. Both of which I have not forgotten. As soon as I can sit reasonably, without problems, I will get back to writing.

To getquin I will certainly become more active again, I have time now. At least 8 weeks (with good progress) is a long time.

So, keep your head up, dad is doing it too....

Your KneePapa. 🦵

+++ NIBE: Acquisition of Climate for Life +++

(from the series: My Investments)

Due to time constraints, only the short info about the acquisition of Climate for Life Group by NIBE Industriers. $NIBE B (-2,09 %)

Excerpt from the announcement:

CFL successfully develops, manufactures and markets energy-efficient solutions in HVAC (heating, cooling, hot water, ventilation and air conditioning). The Group has an excellent position in the Dutch residential and commercial market. It stands out for its ambitions regarding energy-neutral living. CFL is a well-known player with impressive know-how, having a well-established product range including water heaters, heat pumps and ventilation systems.

Source: NIBE Investor Newsletter

https://mailchi.mp/aa671a8a0125/pressemitteilungen-15369390?e=d38d247181

❤️ NIBE IS LOVE! ❤️

+++ Viessmann! NIBE, what now? +++

(The heat pump and investing - nothing but hot air?)

The news broke like a storm in the German news last week: Viessmann is switching to Carrier $CARR (-0,98 %) for a hefty 12 billion euros. 💰

But is this news really that big or is it not actually exactly the scenario that I have repeatedly alluded to and discussed in my previous articles on NIBE? ☝️

The heat pump market has been a topic with enormous potential, opportunities and risks, and not just since the decision by the German government and other countries.

Reason enough for me to look at the topic of heat pumps and once again at my investment, NIBE Industriers $NIBE B (-2,09 %) 🧐

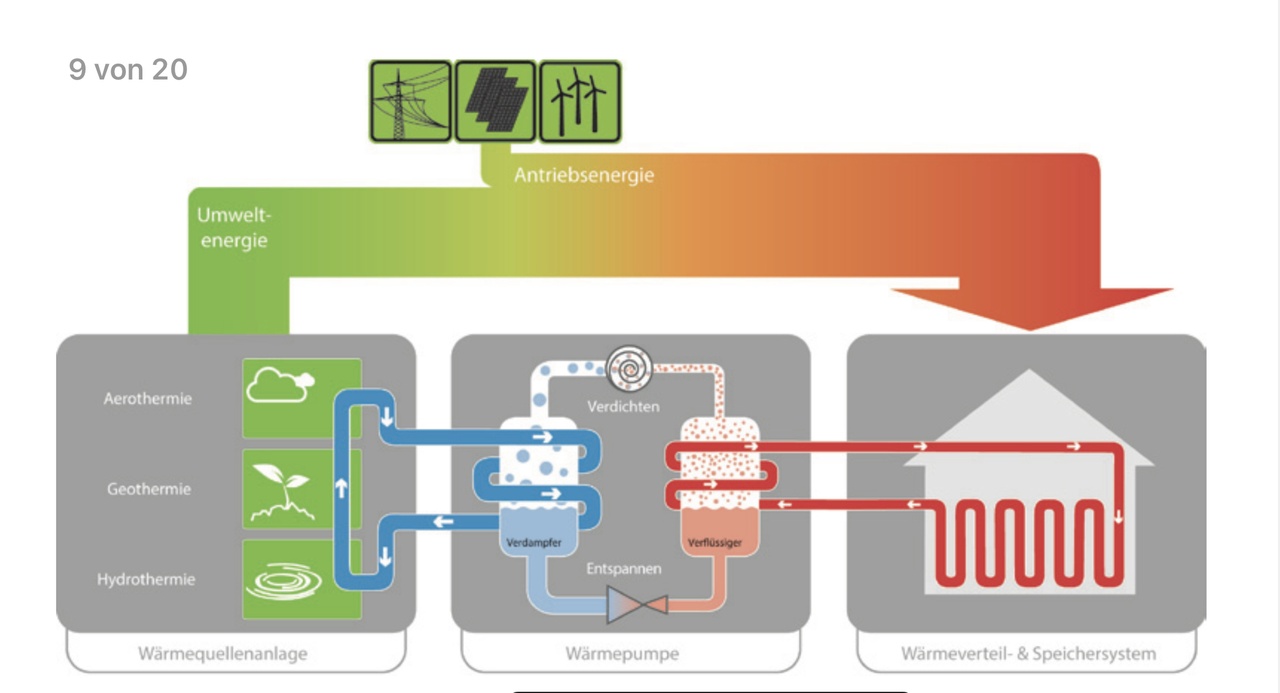

The heat pump - definition and function:

In short, a heat pump is a heat engine that uses technical-mechanical work to absorb thermal energy from a source with a lower temperature than the target temperature and transfers it to a heating system as useful heat. [see diagram 1; source 1]

Heat pumps are primarily used to heat buildings, but are also used in the process industry, in domestic tumble dryers and also in refrigerators (at least systematically with the process principle of the heat pump...).

Heat pumps are classified according to their process, heat source, heat utilization and mode of operation. It would go beyond the scope of this article to go into all the different methods. You can find more details in [Source 2]. What is important for most people, however, is the type of heat source.

There are three main sources and the associated operating modes of heat pumps:

- Air-to-water heat pump (energy from the ambient air is drawn in and when it comes into contact with the refrigerant, it evaporates and sets the heat pump circuit in motion)

- Brine-water heat pump (geothermal heat is transported via a geothermal probe and brine-filled pipe to generate energy, known as a geothermal heat pump)

- Water-to-water heat pump (groundwater is pumped via a probe and well into another "well", where it is heated by the geothermal energy and then fed into the heating process)

The heat pump - advantages and disadvantages:

Below I briefly list the advantages and disadvantages of the heat pump. However, the advantages and disadvantages mentioned here are WITHOUT evaluation. It is therefore purely a list to provide an overview. Also, certain points in the advantages and disadvantages are only relevant if certain conditions are met!

No claim to completeness, these are my loose considerations.

Advantages:

- Energy efficiencythrough the use of environmental heat

- Cost savings, lower energy requirement of the pump leads to lower operating costs

- Environmentally friendly, no fossil fuels therefore reduction in CO2 emissions

- Versatility, various applications are possible - heating, hot water preparation and cooling

- Comfort, with a constant room temperature throughout the year

- Durability, long service life and low maintenance requirements

Disadvantages:

- High purchase costs, conventional heating systems are cheaper to purchase, therefore higher investment costs are required

- Dependence on ambient temperature, reduces energy efficiency, especially in winter

- Space requirementDue to the size and installation space required, more space is needed in the house and on the property

- Noise developmentsome heat pumps generate a lot of noise, especially when starting up or under load

- Complexityheat pumps are not maintenance-free and require regular servicing to ensure the pump's longevity

The heat pump - a "short" history

In 1834, Jacob Perkins was the first developer to complete the construction of a machine based on the principle of the heat pump. At that time, he designed a cooling device in which ether was pumped into a cooling coil system and used on ships, for example. 💡

The machine he designed already contained the four main components of a modern heat pump: the compressor, a condenser, an evaporator and an expansion valve.

It was Lord Kelvin (yes, the very gentleman after whom the Kelvin temperature unit is named) who predicted that a "reverse heat engine" could and would also be used for heating purposes. It was also he who recognized that a heat pump would require less primary energy to be of effective use due to its principle of extracting heat from the environment.

Nevertheless, another 85 years passed before the first heat pump for space heating went into operation. It was thanks to pioneers such as the German Carl von Linde (inventor of the modern refrigerator) and other inventors with a thirst for action, that heat pump technology could be further developed and built upon thanks to refrigeration machines.

Finally, the Swiss Heinrich Zoelley was the first daring inventor to propose and devise an electrically driven heat pump using geothermal energy as a heat source. He was granted patent number 59350 in 1919, but again... the time was not yet ripe and it took another 20 years for the first technical realization. From 1930, the first air conditioning systems for room cooling with the option of additional room heating were built. However, the efficiency was sufficiently modest. 😔

In the wake of the Second World War and the resulting coal shortage, Swiss companies such as Sulzer, Escher Wyss and Boverei developed and commissioned around thirty-five heat pumps between 1937 and 1945. The main sources of heat were lake water, river water, groundwater and waste heat. The first pumps mentioned were therefore water-water heat pumps. Special mention should be made of the heat pump from Escher Wyss, as this heat pump built in 1937/38 was used to replace wood-burning stoves in Zurich City Hall. This heat pump heated the town hall for 63 years. Until the year 2001.😳

Falling oil prices in the 1950s and 60s, on the other hand, were a major blow to the development of the heat pump. Burning fossil fuels was more lucrative, sometimes more effective and, above all, cheaper.

In Germany, the first heat pump was installed in a detached house in 1968. Here, a geothermal heat pump was used in combination with low-temperature underfloor heating.

It was only with the oil embargo and the resulting rise in the price of oil that the heat pump suddenly became interesting again. But the story would be too simple if the many incompetent suppliers in the heat pump sector and the renewed fall in oil prices at the end of the 1980s had not heralded another abrupt end to heat pump technology.

In the end, it was the Swedes who, together with the Swiss company Sulzer-Escher-Wyss, developed and commissioned the largest heat pump system in the world (180 megawatt heat pump system) with 6 pump units of 30 MW each for the Stockholm district heating network. The system works with the heat source of seawater from the Baltic Sea.

The rapid spread of heat pump heating began in 1990. This was due to technical advances, greater reliability, more efficient compressors and, of course, significant price reductions. 📈

Renewed and even greater importance has been attached to heat pump technology since the outbreak of the Ukraine conflict and the associated war. This is because the heat pump promises to decouple the use of fossil fuels such as gas and oil.

The heat pump - manufacturers in Germany and internationally

In Germany, the market for heat pumps is served by manufacturers such as Bosch Thermotechnik, Stiebel, Eltron, Vaillant and, last but not least, Viessmann. Bosch Thermotechnology is the subsidiary of the supplier Bosch and stems from the takeovers of Buderus and Junkers. This makes Bosch one of the largest heating manufacturers in Europe. Vaillant was founded in 1874 and today stands primarily for the manufacture of heating, ventilation and air conditioning technology. Vaillant achieved a turnover of 3.3 billion euros in 2021. Sales of heat pumps at Vaillant increased by 50% compared to the previous year. Striebel Eltron was founded in 1924 and has been developing heat pump technology since the early 1970s. The company generated a turnover of more than 830 million euros in 2021. There are plans to more than triple production capacity at the Holzminden site.

Among international manufacturers, Daikin Industriers and Panasonic (both Japan) as well as LG or Samsung (both South Korea) and NIBE Industriers (Sweden) are among the largest manufacturers of heat pumps. With the acquisition of Viessmann and the recent takeover of Toshiba Klimatechnik, Carrier Global has also made further inroads into the heat pump market.

It can be assumed that other, currently smaller players want to and will jump on the heat pump bandwagon. This also includes companies that we still classically assign to fossil fuels or only remotely associate with air conditioning and heating technology.

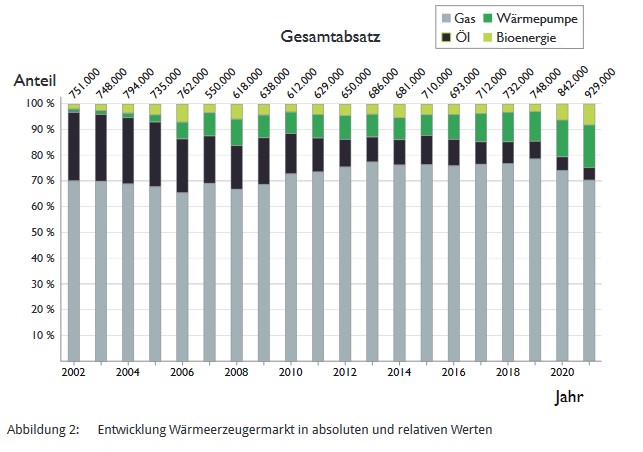

The heat pump - the market (in Germany), its key figures and future

The market for heat pumps has experienced a massive upswing in recent years. The sales volume in 2017 was 48 billion US dollars. It is now expected to double to up to 100 billion US dollars worldwide this year. 🤑

While Asia and the USA were still the drivers of global demand for heat pumps in recent years, Europe has seen a real boom in demand since the outbreak of the war in Ukraine. In Germany alone, sales rose from 154,000 heating heat pumps in 2021 to 236,000 appliances in 2022 (+53.25%).

The federal government in Germany also decided to consistently expand and standardize this heating technology by 2030. Half a million heat pumps are to be installed in 2024, and by 2030 the installed base will be 6 million appliances. 📊

No wonder the industry association "Bundesverband Wärmepumpe e.V." summarizes: "This will make the heat pump the new standard heating system." According to its study from January 30, 2023, these targets can be considered realistic. [Source 3]

The market share of heat pumps in the so-called heat generator market increased from 16.5% to approx. 25% in 2022. This means that one in four heating system replacements involves the installation of a heat pump. Around 56,000 heat pumps were installed in new buildings, which corresponds to 54% of newly built properties. 🏠

In 2022, 1.45 million heating heat pumps were in operation in Germany. The majority of these systems were installed in the last 15 years. With the long service life of these appliances described above, most of them are still in their "youth", which is why the replacement rate for old appliances is currently still below 2% of annual sales. An increase of 5% is expected by 2030.

The International Energy Agency (IEA) expects the installed heating capacity of heat pumps to increase from the current 1,000 GW (gigawatts) to up to 2,600 GW (gigawatts) by 2030. In some countries, such as the USA and Scandinavia, heat pumps are already a standard heating system.

By the end of the decade, the heat pump industry association expects the annual number of heat pumps installed in Germany to be slightly less than one million.

My investment - NIBE at risk?

Of course you start to wonder when you read news like the Viessmann takeover. Is my investment and the decision to invest in it the right one? Can the Group survive in this tough market? Is the company equipped for the future?

NIBE - The company

In 1949, Nils Bernerup and Christian Backer founded Backer Elektro-Värme AB in Sösdala, Sweden, which manufactured the so-called Backer element (based on a patent held by Christian Backer for tubular heating elements). In 1952, Bernerup also founded NIBE-Verken AB in Markaryd by taking over Ebe-Verken. Since then, Bernerup's initials have formed the company name NIBE.

With Sven Christiensson and then Rune Dahlberg, NIBE developed into a leading manufacturer of tubular heating elements with a focus on quality and efficient production by 1987.

However, the company was already present in 1952 with water heaters in the agricultural sector (here for milking systems), manufactured fireplaces for the Handöl brand as a subcontractor, later took over this brand and introduced the first heat pump (Fighter Twin) from NIBE in 1981. Production of heat pumps begins immediately afterwards in Markaryd.

In 1989 the Bernerup family decides to sell the two companies Backer-Värme AB and NIBE-Verken AB. Employees from these two companies, together with two other investors, set up what is now known as NIBE Industrier AB and took over the business.

Gerteric Lindquist is appointed CEO, who is still the CEO of NIBE today.

NIBE Industrier AB has been listed and traded on the Stockholm Stock Exchange since 1997. The IPO is also the starting signal for the company's strong expansion and acquisition strategy, which continues to this day.

More than 70 acquisitions and purchases have been made since the IPO. The complete list is available at https://www.nibe.com/nibe-group#Text3 and https://www.nibe.com/de/nibe-group/akquisitionen-der-nibe-group to view the complete list.

A special feature of acquisitions by NIBE is the independence of the acquired companies after the takeover. Newly acquired companies are encouraged to continue to write their own corporate history with commitment. This means that acquired companies should retain their identity and brands. The previous business owners are also left untouched as far as possible. The companies are to be continued with their existing management at the original locations and thus stand for continuity and responsible local action.

NIBE in figures = love?

The latest annual report can be found at [Source 5] from 14.04.2023.

NIBE's core market is North America with 27%, the Scandinavian countries with 22% and Europe with 46%. In the year 2022, the sales amounted to SEK 40.071 billion (EURO 3.5 billion) compared to SEK 30.83 billion (EUR 2.7 billion) in the previous year. This corresponds to growth of 30%. Sales growth has been stable for at least 5 years.

The earnings per share amounted to SEK 2.17 (0.19 EURO). This is the fifth consecutive year of profit growth.

The operating margin increased slightly in 2022 from 14.4% (2021) to 14,7%. After tax, NIBE will generate consolidated profit of SEK 4.428 billion (EUR 387 million)which corresponds to an increase of 33.16% compared to the previous year (SEK 3.348 billion). With an equity ratio of more than 50% the company is financially sound and ready for further acquisitions.

NIBE pays a dividend. However, this is quite meagre. However, it makes sense in view of the capital expenditure required for development and acquisitions. The dividend yield in relation to the share price is approx. 0.57% at SEK 0.65 (€0.057). In the long term, the payout ratio is expected to be 25-30% of consolidated profit. Investors should also be aware that Swedish shares are subject to a higher withholding tax.

NIBE = future?

NIBE has already defined targets for its business activities in the past. These include corresponding targets for key operational figures, but also targets in the areas of SRI and ESG.

The corporate targets focus on growth (at least 20% per year), return on equity (at least 20%), operating margin (of at least 10% of sales) and equity ratio (should not fall below 30%).

In terms of the sustainable corporate goals, 60% of the product portfolio was originally intended to represent sustainable and higher climate protection by the end of 2023; this target has now already been achieved at 63.2% and has therefore been reformulated to 70% by 2026.

Energy consumption is to fall continuously and the accident rate in the workplace is to remain constantly low. The LTIF value is used for this purpose.

The CO2 balance is to be improved and NIBE wants to be completely climate-neutral by 2050. To achieve this, emissions are to be reduced to 65% of the 2019 baseline by 2030. This corresponds to 11,500 tons of CO2.

NIBE sees its opportunities in the areas of energy efficiency in the end consumer's own home, safety in everyday life in the supply of hot water, energy efficiency in buildings, infrastructure and industry.

Opportunities for NIBE:

- Great market potential for heat pumps and climate control solutions

- Potential in the renewable energy sector

- International market presence

- Broad product range

- Intensive and proactive product development

- Synergy effects from new acquisitions and cooperations

- Expansion through acquisitions

- Energy prices may force consumers to take action

Risks for NIBE:

- Legislative changes and decisions by authorities affecting existing product ranges

- Weak economy

- Increasing competition and competitors from Asia and the USA

- Energy prices could fall for consumers or rise for production

- raw material prices

- Currency fluctuations (SEK to dollar and EURO)

- Dependence on suppliers (see supply chain problems)

- Geopolitical situation such as wars and sanctions

The bottom line:

The topic of heat pumps is a highly complex one. Not only are politicians currently looking for solutions and ways to quickly move away from fossil fuels or reduce dependence on certain countries or resources, but complex interrelationships such as the energy-efficient use of air conditioning technology products or heat and cooling pumps used in production and process chains will also play an important role in the future.

The sale of Viessmann's air conditioning division to a major player in air conditioning technology shows that the cleansing and consolidation of the market is only just beginning. Large groups from Asia in particular will penetrate the individual regional markets.

In market terms, there is still a lot of cake to be divided up, but the battle for distribution is no children's birthday party and will take one or two competitors and protagonists out of the race.

Viessmann was just the beginning for us Germans and now, of all times, the big outcry. In a normal news situation without the explosive nature of the current situation, this takeover would probably have remained a side note. Now, in the meantime, the news is being spread with brute words such as the "sell-out of German industry"... but this sale is by no means a sell-off, but it shows the direction in which the market is moving. Eat or be eaten.

NIBE has been expanding for many years now. The areas of activity are broadly based and not just limited to heat pumps. Whether heating solutions with fireplaces, heat pumps or as a partner to industry, NIBE has established itself as a professional, solution-oriented and, above all, committed company (in terms of the environment and social responsibility). The solutions on offer are constantly being developed, collaborations with other companies are being sought and the company's expansion strategy is being driven forward.

I am not currently concerned that the market for heat pumps or other climate-friendly solutions will slow down or be sold off to Asian competitors (similar to PV and solar solutions in the past). NIBE would do well to maintain its growth trajectory.

I am also positive about the company's future goals and competencies and hope for further sustainable developments in the future.

I am sticking with it, even if I expressly warn against exuberant feelings for shares:

NIBE is LOVE. ♥️

At least for my portfolio.

Source 1: Chart 1 - https://um.baden-wuerttemberg.de/fileadmin/redaktion/m-um/intern/Dateien/Dokumente/2_Presse_und_Service/Publikationen/Energie/Energieeffiziente_WP_Heizungsanlagen.pdf or as a video at https://youtu.be/KDL1Xf-kuIA

Source 2: Wikipedia on the heat pump https://de.m.wikipedia.org/wiki/Wärmepumpe

Source 3: Heat pump industry study 2023 https://www.waermepumpe.de/fileadmin/user_upload/waermepumpe/05_Presse/01_Pressemitteilungen/BWP_Branchenstudie_2023_DRUCK.pdf

Source 4: Graphic from the study by source 3, heat pump sales (Heat pump sector study 2023)

Source 5: Annual report 2022 from 14.04.2023 https://www.nibe.com/download/18.4ccfd67f186f21bb5967bdd/1681288254456/DE-G-bericht-22-W.pdf

Long live the #tldr club ! 📝

Hello all,

Opinion: About Viessmann -->$CARR (-0,98 %) Carrier Global? Is it worth a bet to invest in Viessmann via this route among others?

Ort what are the alternative investments if you want to invest something in the air conditioning sector? (besides $NIBE B (-2,09 %)

$6367 (-0,92 %)

$8058 (+0,01 %)

$005930 etc etc)

Thanks!

+++ Cherry Blossom 🌸 +++

(from the series: Investment Diary & Thoughts)

It's that time again:

Every year, the cherry blossom also announces the AGM and dividend season in my portfolio.

Naturally, my German stocks in particular are in the portfolio with $EOAN (-0,23 %)

$ALV (+0 %) and $MRK (-1,41 %) the main drivers for the big dividend payment in May, but also other stocks like $COLO B (-0,4 %)

$NIBE B (-2,09 %) and $UKW (-5 %) are then in the middle instead of just being there.

So while in the rest of the year in my stock garden rather the motto: "Stupid run, smart wait, wise go to the garden."

prevails, May is a true sign of life in the portfolio. 🌱

Something is happening here, something is growing here (namely, at times, the dividend and its yield).... and if I notice that, how will it only be with our dividend hunters on getquin be? 🤑

This small and sympathetic exception in my portfolio (the strong dividend payment for the remainder of the year) make me then nevertheless also again and again happy. Because, as with the cherry blossom, this is a time that I always look forward to anew.🥳

As is typical for German and European shares, the Annual General Meeting also falls at this time. (because without bees no cherries... er, without AGM no dividend) and here remains only a quote from the garden of long-term growth: "Green is not everything, but without green everything is nothing." 📈

Happy cherry blossom season to you....

(attached a current picture from my garden)

Titres populaires

Meilleurs créateurs cette semaine