So here's another little update on my 212 gadget. I'm still testing it and can't say anything negative so far.

I have created a second pie with a start date of 15.9. I'm mainly interested in dividend stocks here. The Schbeeball should slowly start rolling there

My target there is 100k and I'm currently paying in €50 every 2 weeks on Wednesdays.

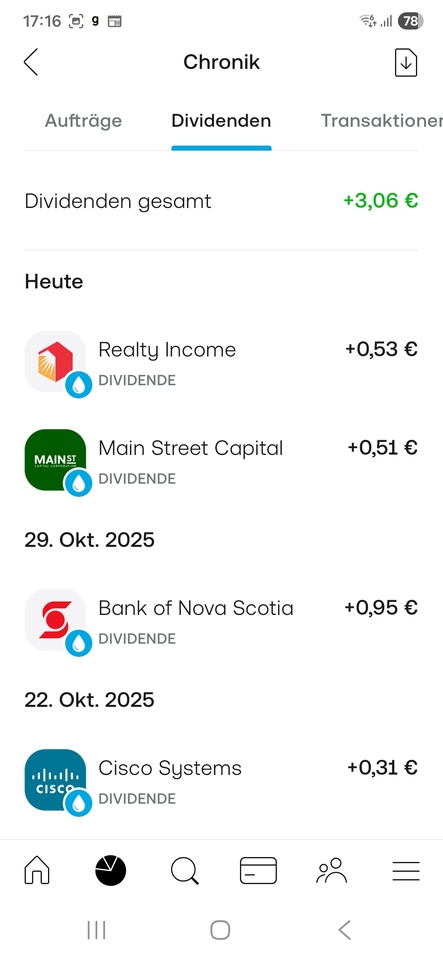

I have received €2.63 so far, of which €1.59 is already invested. The rest will be invested automatically when the next savings plan is executed.

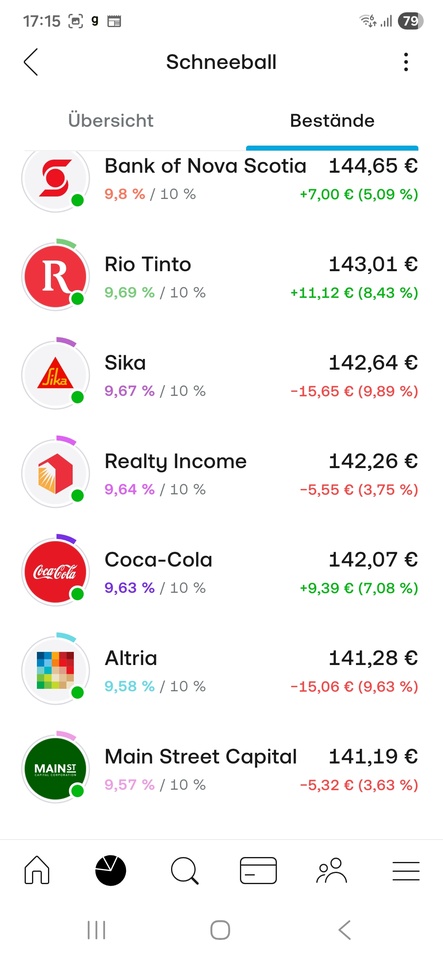

My holdings are as follows

$LUG (+3,01 %)

$LHA (-3,69 %)

$PETR4 (+1,19 %)

$BNS (-1,76 %)

$RIO (-0,19 %)

$SIKA (+1,38 %)

$O (+0,76 %)

$KO (+1,01 %)

$MO (-0,54 %) and $MAIN (-2,93 %) all have a target weighting of 10%

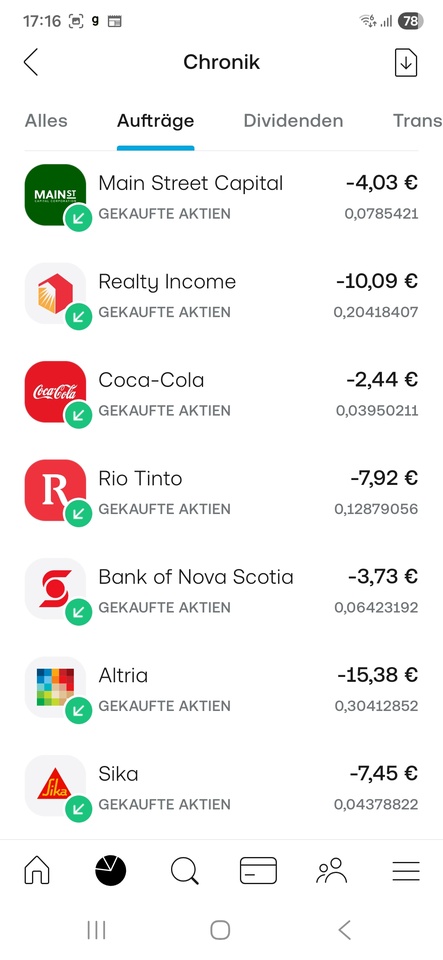

Here is the last savings plan execution, the Pie is self-balancing which I personally absolutely love. You don't have to change anything manually, dividends are also reinvested automatically and the whole thing costs no fees, plus the advantage that I can choose the stock exchanges, so I trade Coke etc. directly on the NYSE.

And the dividends arrive punctually in the account on payday.

https://www.trading212.com/invite/1Bl7fzXX7K

Here is my invitation link for everyone who is not yet a member but would like to have a really cool broker. There are random free shares worth between €10 and €100

And thanks again to the many people who used my link last time. I myself only get the free shares for 5 customers, but that doesn't matter for you. Even the fiftieth still gets the free shares, just not me 😉