I would like to know your opinion on the 3 stocks in the title, as they are all at the top of my watchlist. I have briefly summarized my most important reasons for buying below, but this is not intended to be an analysis of 0, so you should definitely have heard of the companies before in order to get added value from the article.

$PYPL (-3,22 %) Will not manage the complete turnaround towards 300 $ for the time being. Nevertheless, a P/E ratio of less than 14 is quite reasonable for a company whose earnings per share are growing by a double-digit percentage every year.

Although there is competition that never sleeps (Apple Pay, Google Pay, Adyen, Stripe, Zelle, Block), the pie in online shopping is huge and continues to grow.

In my opinion, the most dangerous competition comes from the possible introduction of the digital euro or stablecoins (even if PayPal itself is already active here). I would like your opinion on this.

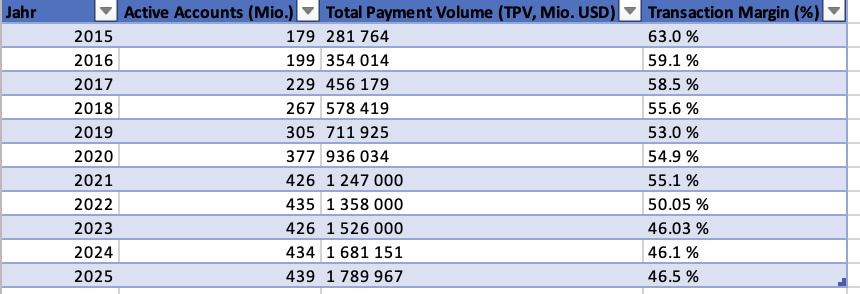

If you look at some figures, it actually looks very good:

Although PayPal's transaction margin has fallen since 2023, it has remained stable.

The number of active accounts fell in 2023, but has also remained stable since then.

Nevertheless, PayPal has managed to increase its Total Payment Volume (TPV) every single year.

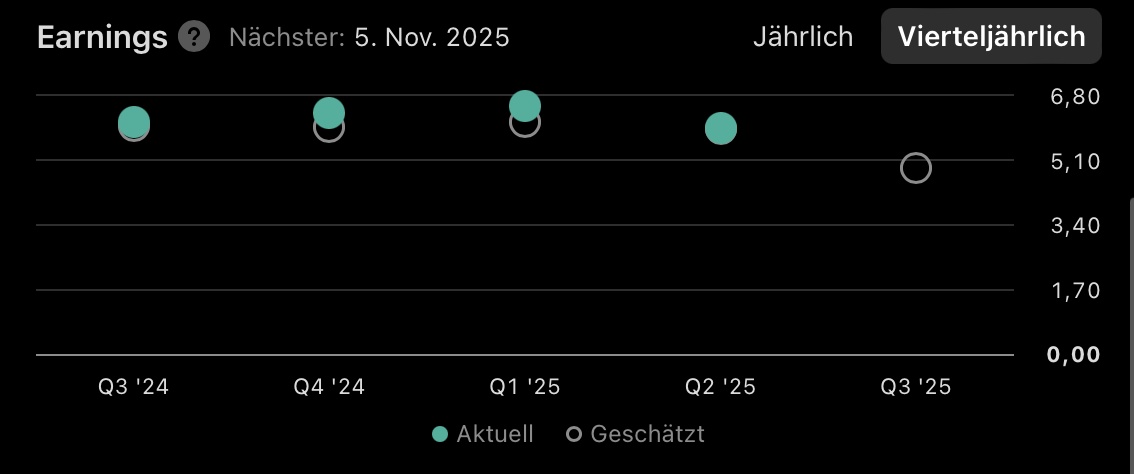

As mentioned, earnings per share are growing at double-digit rates.

The cooperation with OpenAI provides scope for further growth in TPV. PayPal could also gain new users who could also use PayPal services outside of ChatGPT in the future.

$NOVO B (-1,37 %) Without going into specific figures too much, this company has become extremely cheap.

In Europe and especially in the US, the percentage of obese and overweight people is very high (even in the upper middle and upper class in the US, more than a third of men and about a third of women are obese - which is important to me as this is where most of the money can be made).

I had initially thought that these weight loss injections were drugs that patients could take for a year, for example, and then stop. This is not the case. Studies show that most patients are back to their previous weight one year after stopping the injections.

So this is a market where customers remain loyal for decades - and a disease that often affects even the wealthiest.

The figures will be out tomorrow morning. The last quarterly figures have surprised positively in earnings every single time, but have never led to a real, sustainable and long-term turnaround. It remains to be seen whether that will change this time.

$META (-1,69 %) I have actually always been largely spared the social media addiction and only know it from many of the young people around me.

But unfortunately, I also occasionally spend several hours scrolling through Instagram reels and can hardly stop. Meta's algorithm is really extremely good at finding out exactly what you're interested in.

In my case, for example, it was mostly just memes that were displayed at first.

Then at some point I got hungry and suddenly, out of nowhere, only food creation videos appeared (it may well be that the causality here was the other way around, but you get what I mean).

I also saw how much this algorithm binds you in Meta's extremely strong growth figures.

The valuation is accordingly very high, but I still think there is a lot of potential here.

Meta continues to invest billions in AI in order to place even more targeted advertising, increase the click-through rate of advertisers and thus be able to charge even more money per ad.

These investments are - at least according to ChatGPT - also one of the reasons for the drop in Meta's share price that we have seen recently, as many investors have concerns about whether these investments are justified.

I'm not yet as deeply invested in Meta as I am in Novo and PayPal, so I'd like to know your opinion.

I'm also interested in whether you have any moral concerns about investing in Meta - after all, millions of young people are wasting half their lives in front of a screen due to the ever-improving algorithm.

(It's a shame that I can't add a vote, is it just me or does it just stop working after a certain number of words?)

Kind regards