Originally I had intended to use Badger Meter ($BMI (+0,08 %) ). A company that, in my view, is investing cleanly in a long-term, structural megatrend: Digital water infrastructure, efficiency and supply. This topic remains important and exciting.

Nevertheless, in the short term reoriented and invested in RENK ($R3NK (+3,01 %) ) invested.

The reason:

The current market and capital allocation clearly signals that defense and security-related industries are currently seeing more capital inflows, higher priority in political budgets and more active demand than traditional industries, which, as important as they are, are priced in with less "urgency".

With RENK, I am betting on a company that is positioned in a defensive, but politically highly prioritized sector sector: Propulsion systems and gear units for high-performance military and civilian systems.

Brief company overview - RENK Group AG 📍

Headquarters: Augsburg, Germany

Industry: Special gearboxes & drive solutions for defense, marine, industry and energy

Employees: around 4,000 globally

IPO: February 2024, SDAX member

History: Founded in 1873, long-standing tradition as a technology partner in gear and drive technology.

Today, RENK is a specialized manufacturer of mission-critical propulsion and drive solutionsthat have to function in very demanding environments. From tanks and ships to large industrial plants. The product portfolio covers gearboxes, hybrid drives, power packs, couplings, plain bearings and test systems.

Business Model & Products ⚙️

RENK supplies technical components that are "invisible" but crucial for mobility, performance and reliability and reliability:

- Transmissions for wheeled and tracked military vehiclesincluding main battle tanks

- Drive systems for naval platforms

- Hybrid and electric drive solutions

- Industrial gearboxes and test systems for energy & production plants

RENK covers both defense and civil-technical fields of application, with the defense part traditionally dominating.

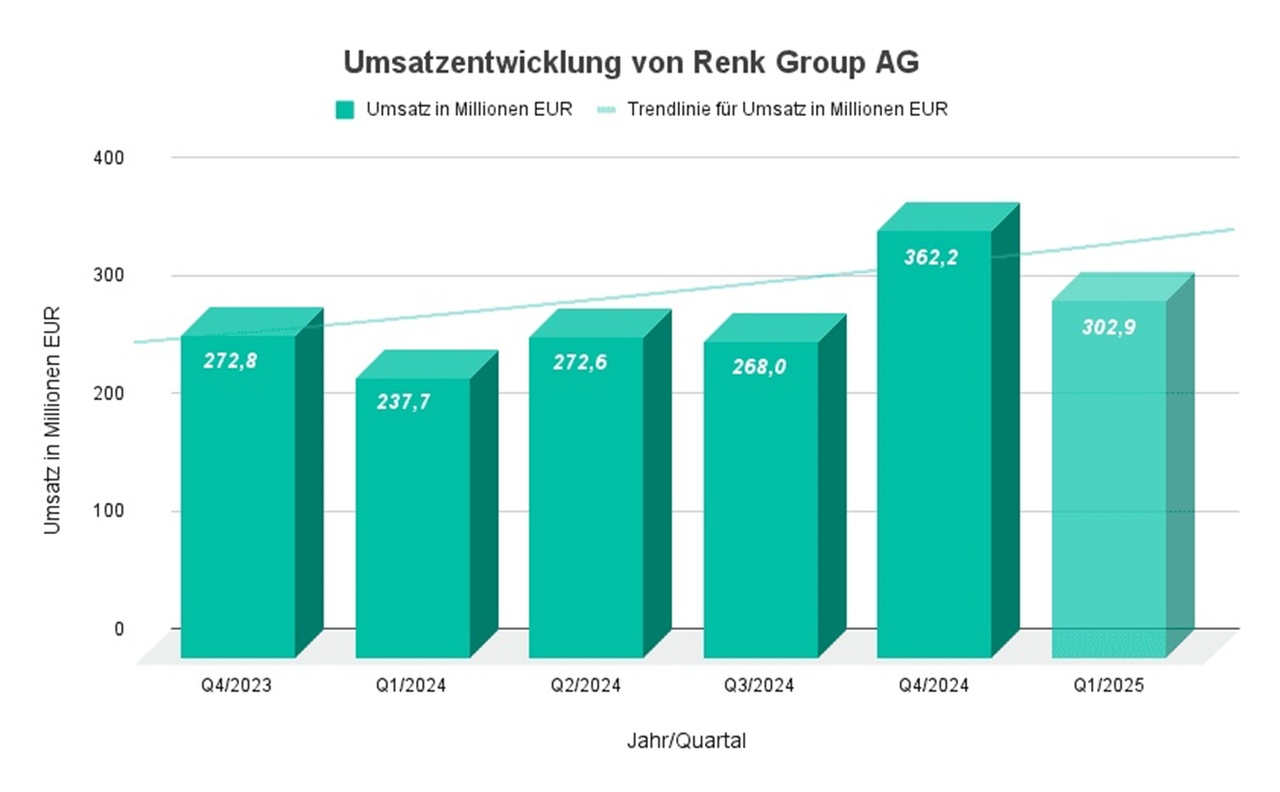

Financial data - sales, orders, growth 📊

- Turnover 2024: approx. 1.1 billion euros, incoming orders ~€1.4 billion

First quarter of 2025 ⚙️

- Turnover: 273 million euros

- Growth compared to previous year: +14,7 %

- Adjusted EBIT: 38 million euros

Solid start to the year, with a clear increase in profitability despite ongoing production adjustments

First half of 2025 📈

- Turnover: 620 million euros

- Growth compared to the previous year: +21,5 %

- Adjusted EBIT: 89 million euros

This clearly shows that demand is not only picking up, it is also materializing in significantly higher sales and earnings.

First nine months of 2025 📦📊

- Turnover: 928 million euros

- Growth compared to the previous year: +19,2 %

- Adjusted EBIT: 141 million euros

- Order backlog: around 6.4 billion euros (record level)

The high order backlog is one of the most important points: It ensures multi-year sales visibility and significantly reduces short-term planning risks.

This is remarkable in such a narrow field of technology, because Order backlog and visibility are available over several years. A rare luxury in the military supply business.

Strategic orientation & market position 🎯

RENK has a very clear focus:

➡️ Focus on defense applications Armored and marine gear units form the core of the business.

➡️ Technological moat through high specialization and certification.

➡️ Expansion of the production capacityto meet the increasing demand.

➡️ Development of modular, high-performance systems for various classes of main battle tank.

➡️ Medium-term sales target of 2.8 - 3.2 billion euros by 2030 with a high EBIT margin if the defense cycle continues.

RENK has a strong international presence: 11 plants in Europe, North America, India and other regions, over 20 support and maintenance locations worldwide.

Growth drivers in detail 🚀

1) Geopolitical situation & defense budgets

Rising military budgets in Europe, NATO spending and modernization programmes are creating demand that goes far beyond short-term stimuli. These findings support medium to long-term visibility for incoming orders.

2) Technological lead

RENK supplies components that have to withstand extreme loads. This creates high switch costs for customers and stable margins. Technological complexity acts as a barrier to entry.

3) Production scaling

Conversion from classic manufacturing to modular series production should significantly increase annual production capacity - a quantitative lever for growth.

4) Aftermarket & Services

A large proportion of turnover comes from maintenance, spare parts and long-term service contracts - an often underestimated stabilizing factor.

Evaluation & personal classification

RENK is not a broadly diversified industrial stock. Its strength lies in a strategic niche with a technological focus and high transparency of the order situation.

I got in for the following reasons:

✔️ Strong demand and high order pipeline

✔️ Technological market leadership in specialty segments

✔️ Production expansion and rising margins

✔️ Long-term political prioritization in the defense sector

At the same time:

⚠️ political dependence

⚠️ sectoral concentration

⚠️ Valuation pressure in anticipation of future prospects

In my opinion, RENK is not a short-term "hype", but a strategic sector playwhich, despite all the risks, can have a place in a long-term portfolio, especially if the perspective of security and political prioritization is taken into account.

Conclusion

RENK is a specialized gear and drive manufacturer with a strong strong presence in the defense sector and a clear growth strategy for the coming years. The excellent order situation, production expansion, technological edge and robust forecasts provide a solid foundation. At the same time, the business model is heavily dependent on political decisions and defense budgets - which represents both an opportunity and a risk.

No investment advice - just my well-founded, personal assessment.

Lg Don

For your information

The article here was partly created with AI