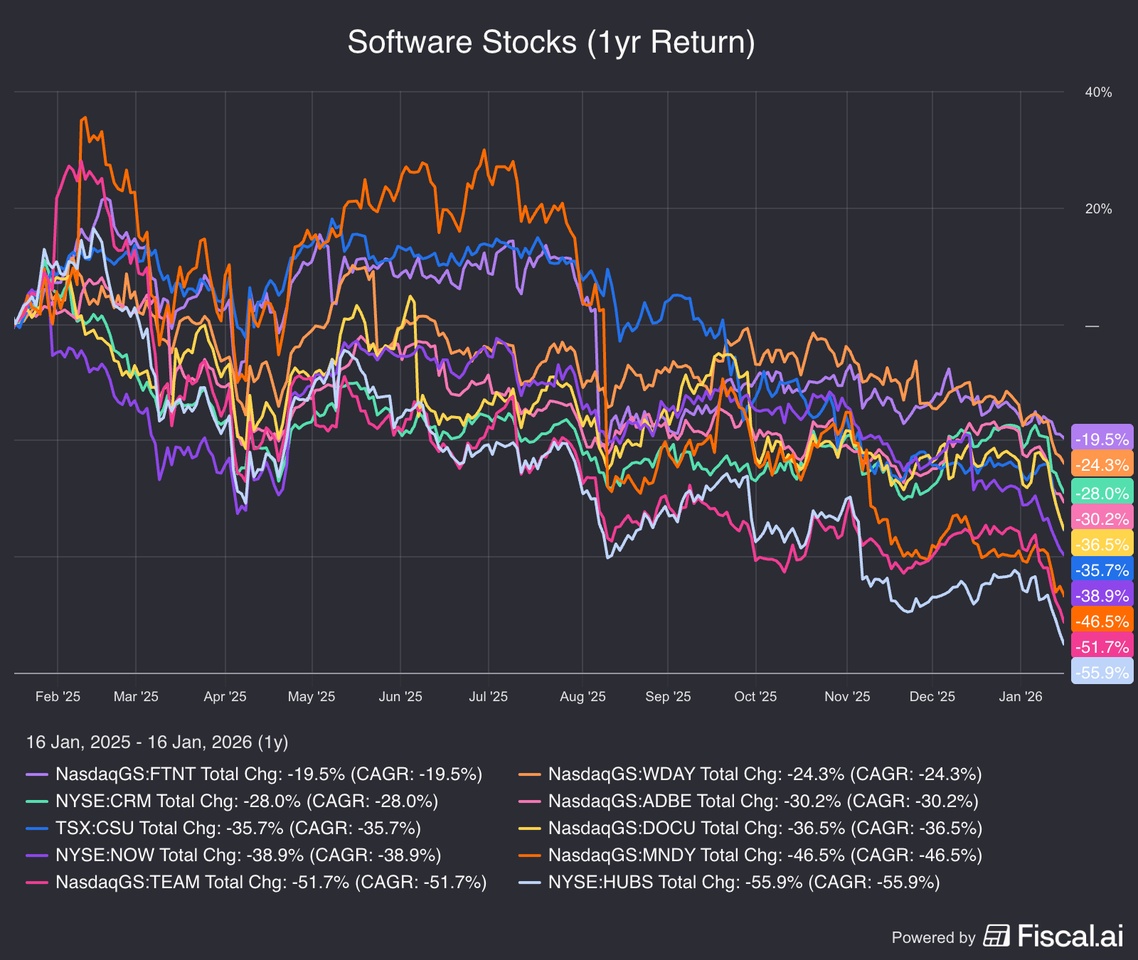

$ADBE (-2,41 %)

$CSU (-5,54 %)

$TEAM (-6,89 %)

$CRM (-4,35 %)

$NOW (-6,01 %)

The End of Software?

If you’re a software investor, this week probably didn’t feel too good.

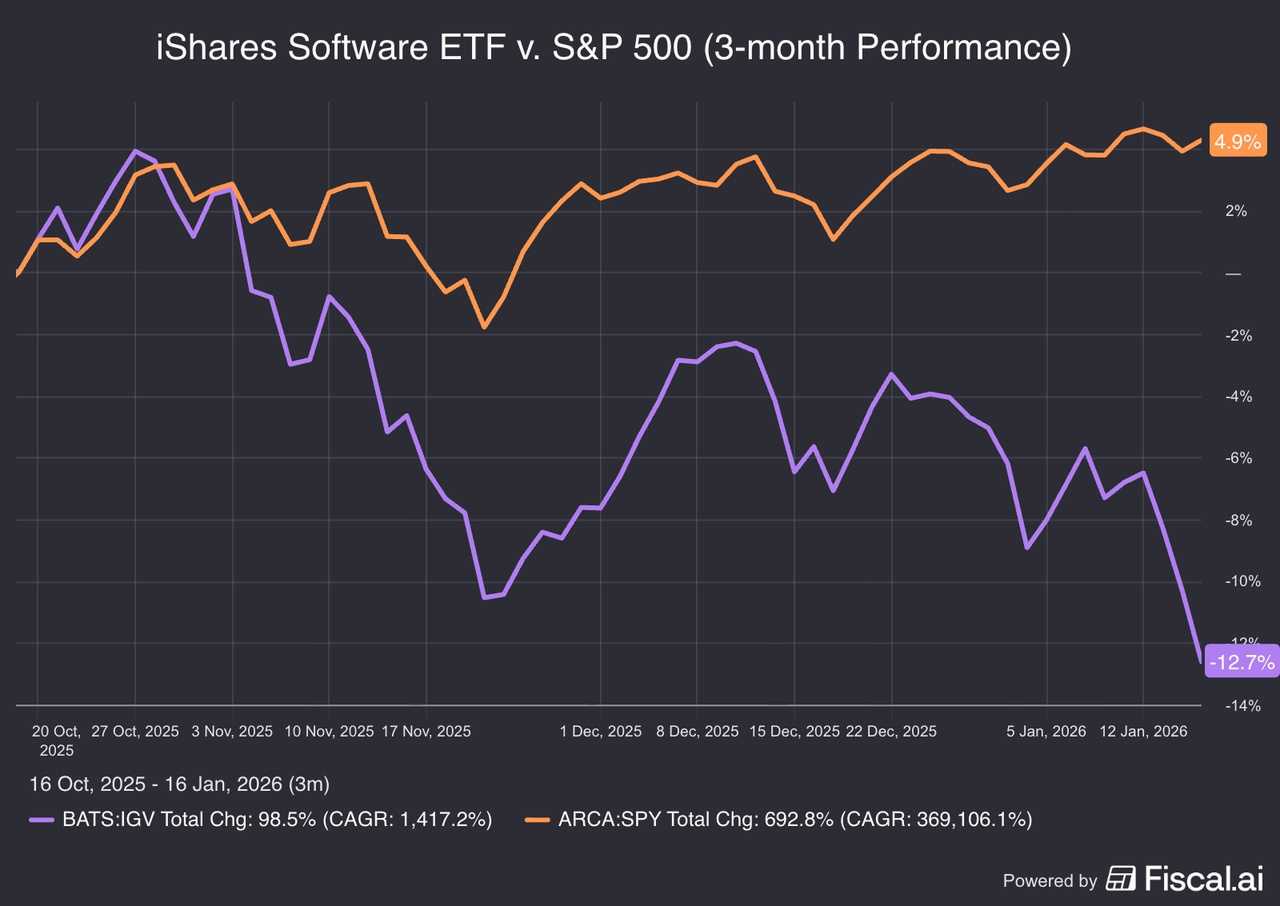

Software stocks saw large drawdowns across the board, which caps off one of the worst years for the sector in recent history.

Here are a few notable companies in large drawdowns:

What’s causing the collapse?

While it’s hard to point a finger at a single cause of a multi-year drawdown, AI has been the recurring culprit.

For the last several years, companies all over the AI space have reduced the barriers to entry of web development through robust coding agents. Anthropic’s Claude Code is considered one of the most advanced, and this week they made their complex problem-solving capabilities available to non-developers with their launch of Claude Cowork.

This release spooked investors.

There now seems to be a pervasive belief among Wall Street that with lower barriers to entry in web development, companies will be less reliant on 3rd party software vendors.

Is the AI threat real?

While Claude’s advancements will no doubt inspire many companies to try to build more systems in-house, the likelihood that a “vibe-coded” prototype is good enough to rip and replace critical software systems at the enterprise level seems quite low.

Imagine for a second, going to the Chief Accounting Officer of a Fortune 500 company and telling them that they need to pivot from SAP to a new in-house tool built by a couple developers and Claude Code. They’ll have to migrate all their data, train their employees on the new system, oh, and not mess up any reporting because they have a 10-Q to deliver in a month. Yeah… tough sell.

That’s an extreme example, but you get the point. Critical systems are sticky, and switching is risky.

Beyond that, as any developer knows, building large-scale software systems for multiple use cases isn’t exactly a “set-it and forget it” process. Things break, improvements are needed, and ultimately, these systems need a team to maintain them. Is that cheaper than buying from an outside vendor? Is it an improvement for the departments using these systems?

While the above might sound dismissive of the AI threat entirely, it’s not. AI certainly brings about real long-term risks to legacy software companies.

Here’s what Jeff Bezos had to say on the topic:

“AI is a horizontal enabling layer. It can be used to improve everything. It will be in everything… I guarantee there is not a single application that you can think of, that is not going to be made better by AI.”

- Jeff Bezos

AI advancements (like Claude Code) will surely introduce new competitors to the software industry. Many of which may not even exist today.

But as a “horizontal enabling layer”, it can also benefit incumbents.

The Salesforce’s, Adobe’s, and ServiceNow’s of the world will likely improve their product velocity and ship new features at a faster cadence to their already massive installed bases.

Let’s take a look at a few software companies investors think are on the wrong side of the innovator’s dilemma.

AI Threat: Adobe is perhaps the biggest battleground stock in the software space today.

They’ve been the leader in creativity software (Photoshop, Illustrator, Premiere Pro, etc.) for nearly 40 years, and are now facing pressure from not only text-to-image and text-to-video models, but heightened competition from the likes of Canva and Figma.

Rebuttal: While the two-sided pressure here has likely been a headwind to new customer growth (they don’t disclose it), Adobe’s stickiness within Enterprises shouldn’t be underestimated. There are high switching costs to learning a new system in the creative space, which is why Adobe has been able to flex its pricing power over the years.

Additionally, while competitors can replicate an individual point solution, it’s hard for anyone to replicate the value of Adobe’s full bundle. Even if a marketing department churns off of one Adobe product, there are other solutions in the Creative Suite likely getting used.

- Current Drawdown: -57%

- 5yr Revenue CAGR: +13%

- Forward P/E: 12.5x

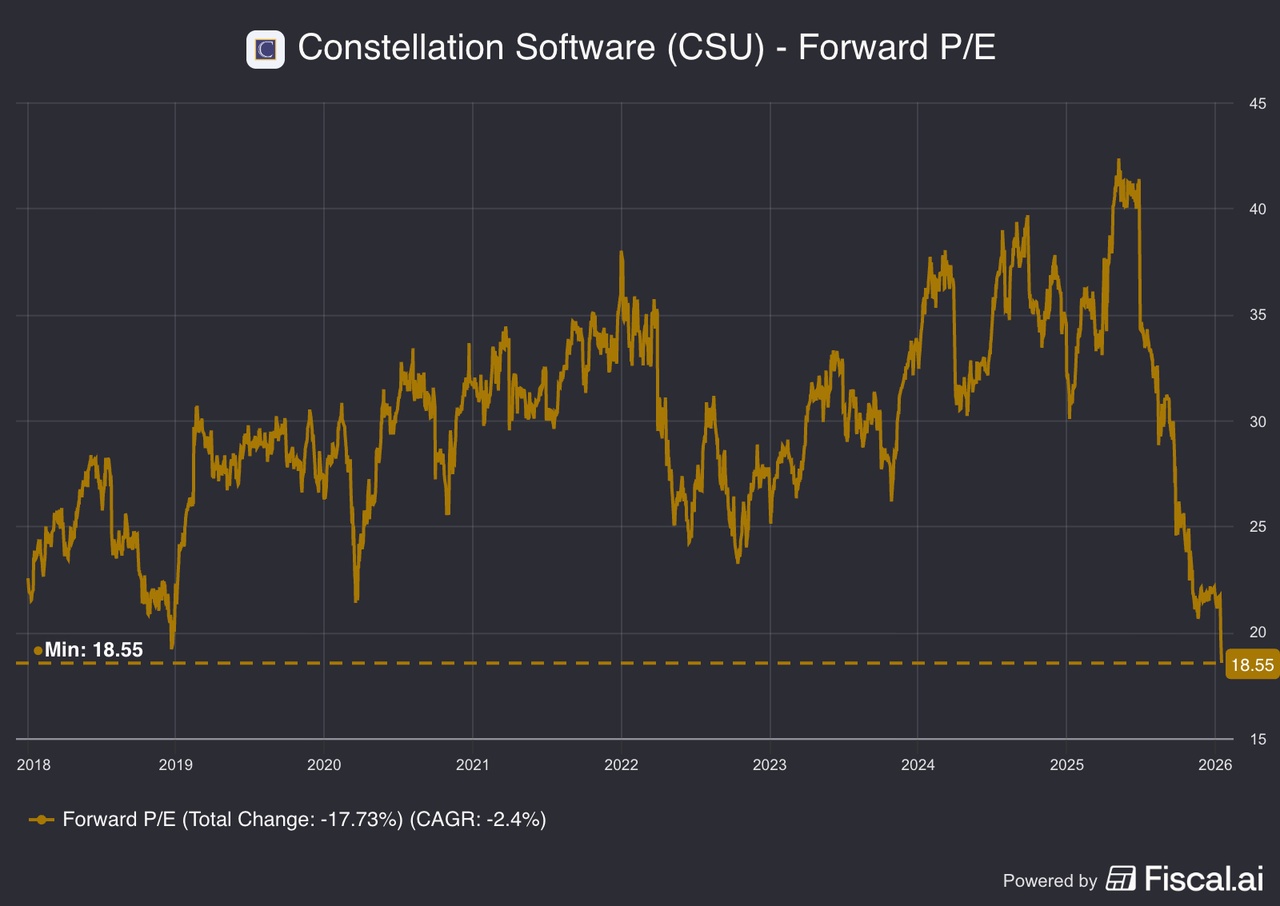

AI Threat: Constellation Software is in its largest drawdown ever.

While their sell-off was also impacted by the sudden resignation of their founder and long-time President Mark Leonard due to health reasons, the serial acquirer of vertical market software companies is perceived to be one of the most at risk to AI disruption.

Investors fear that Constellation’s niche, more specialized software systems could more easily be replicated by AI.

Rebuttal: Constellation’s products cater to clients that are highly risk averse (water billing utilities, cemeteries, banks, etc.) so sticking with existing systems is usually the safe play.

Constellation’s products also primarily provide value thanks to specialized industry-specific data that’s hard to replicate for new providers without experience in the industry.

- Current Drawdown: -45%

- 5yr Revenue CAGR: +24%

- Forward P/E: 18.6x

AI Threat: Atlassian is the parent company of Jira, one of the largest IT ticketing management platforms in the world.

Over the last few months, fears have risen that AI will allow companies to build lightweight task management platforms that can mirror certain functions in Jira.

Additionally, AI presents the risk of “seat compression”. In other words, if companies can gain efficiencies through AI, they won’t need as large of a team. Since Atlassian charges on a per-seat model, this would be a headwind to growth.

Rebuttal: For many enterprise customers, Jira is the system-of-record. Teams have poured years (or even decades) of data, bugs, and tasks into the software. Compliance, Auditing, the C-Suite, and other departments across an organization use Jira as a source of truth. Getting a whole organization to switch away would be difficult.

Additionally, Atlassian themselves are being proactive in layering on AI agents within their use experience so customers can benefit from the AI advances while remaining on the software they already know so well.

- Current Drawdown: -74%

- 5yr Revenue CAGR: +26%

- Forward P/E: 23.4x

Persönlich beobachte ich ausgewählte Softwareaktien gerade sehr genau, teilweise bin ich investiert, und plane Einstiege bzw Aufstockungen. Ein panikartiger Abverkauf wäre noch das i Tüpfelchen :)

Was denkst du? Frisst AI Software? Ist es die Jahrhundertchance zum Einstieg in Software Outperformer?

Schreib es in die Kommentare!

Quelle: fiscal.ai