1.brief overview

2.luxury market

3.introduction

3.Prada

4.Miu Miu

5. versace

6. holding structure

7.Valuation

8.Competition (peers)

9.opportunities - risks

10.conclusion

Brief overview

Market capitalization: 14 billion euros

P/E ratio: 17/15

Annualized return: 11% p.a.

Analyst rating: Buy

Luxury market

The luxury market is currently going through a difficult phase: many companies are experiencing stagnating sales and declining profits. The sector still seems to be far from bottoming out. This makes it all the more exciting to see which companies are performing well despite this tense market environment. In addition to Hermès and Ferrari, another luxury company stands out. Prada. The company recently reported double-digit growth. The Prada Group is also not affected by customs duties due to its small presence in the USA. In addition, the luxury sector as a whole is expected to provide a tailwind in the long term with annual volume growth of 4%. A closer look therefore seems to make sense.

Introduction

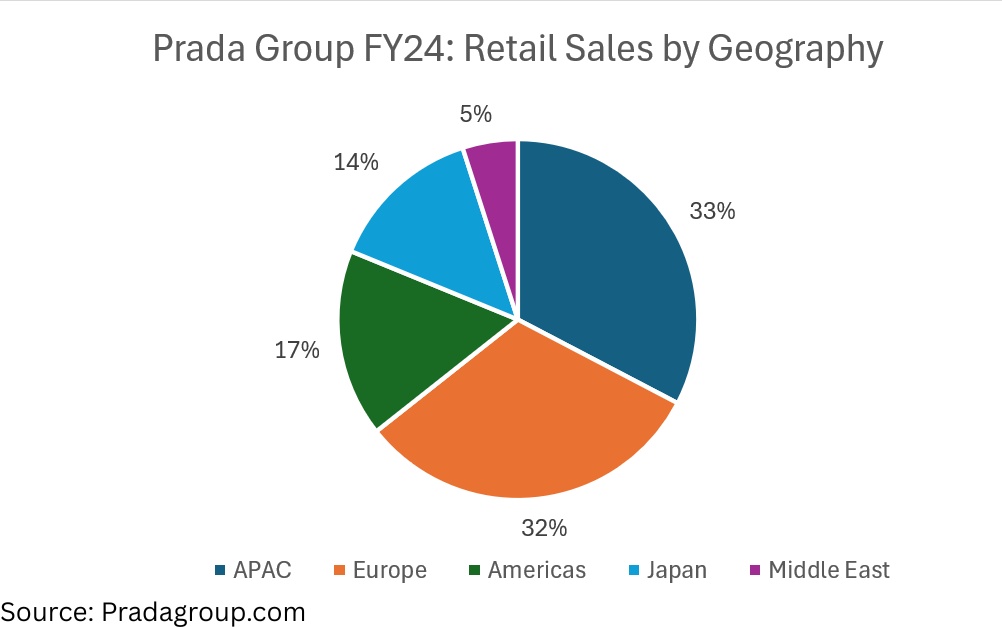

The Prada Group $1913 (+3,48 %) is an Italian luxury fashion company. Prada was originally founded in 1913 by Mario Prada as a leather bag manufacturer in Milan and has since expanded into more and more business areas and countries. Over the years, other brands have been founded and acquired in addition to the Prada brand, including Miu Miu in 1993 and most recently the announced purchase of Versace. Prada Group operates a total of 609 of its own stores, 35% of which are in Asia, followed by Europe with around 32%. The fashion company also has 26 production facilities, 21 of which are located in Italy. The CEO is Andrea Guerra, a former employee of competitor LVMH. Most of the company's turnover of 5.42 billion euros (+15%) is generated through retail sales. The profit margin was 15% in the same year.

Prada

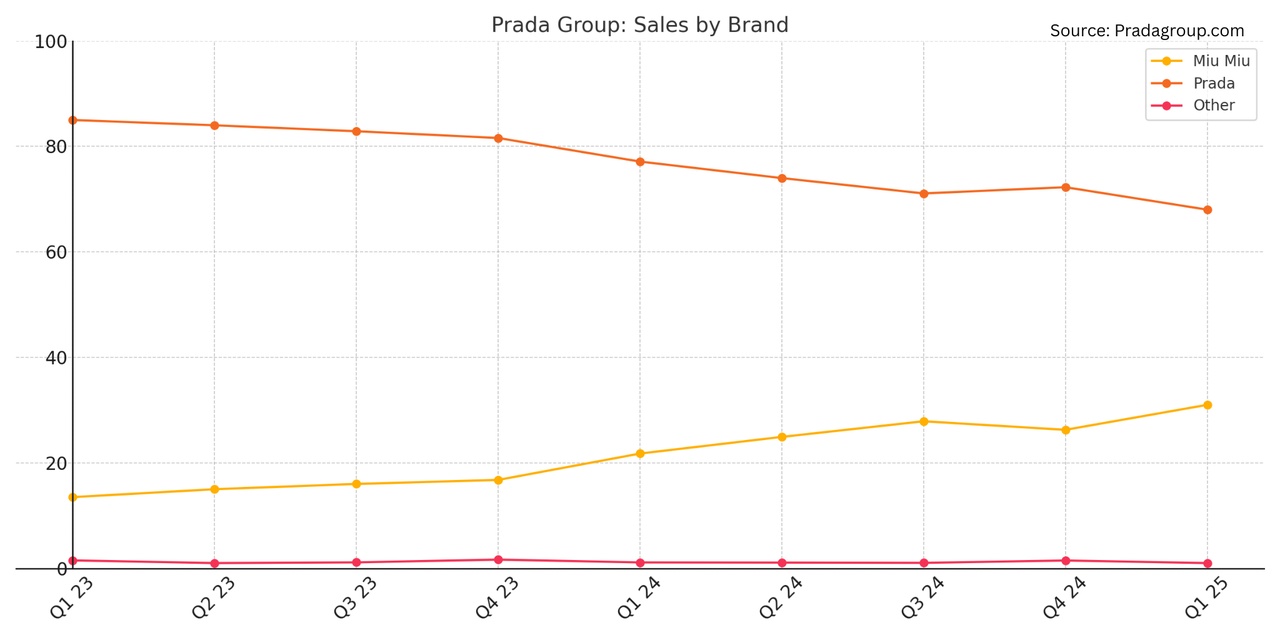

The Prada brand is the most relevant for the company, accounting for 68% of total sales in the first quarter. From dresses to scented candles, there is a wide range of accessories and clothing. The fashion label operates 425 of its own stores and 17 franchises. In the last financial year, Prada increased its turnover by 3.8%. In the first quarter of 2025, however, sales remained constant. A major growth story is therefore not to be expected here. Nevertheless, Prada remains an icon of the fashion industry and a flagship for luxury clothing. Mid-single-digit growth is certainly feasible in the future.

Miu Miu

"Designed as the playful counterpart to Prada, Miuccia Prada used the brand as a creative playground, a space to contrast the minimalist, refined aesthetic of Prada with something more rebellious and free-spirited."

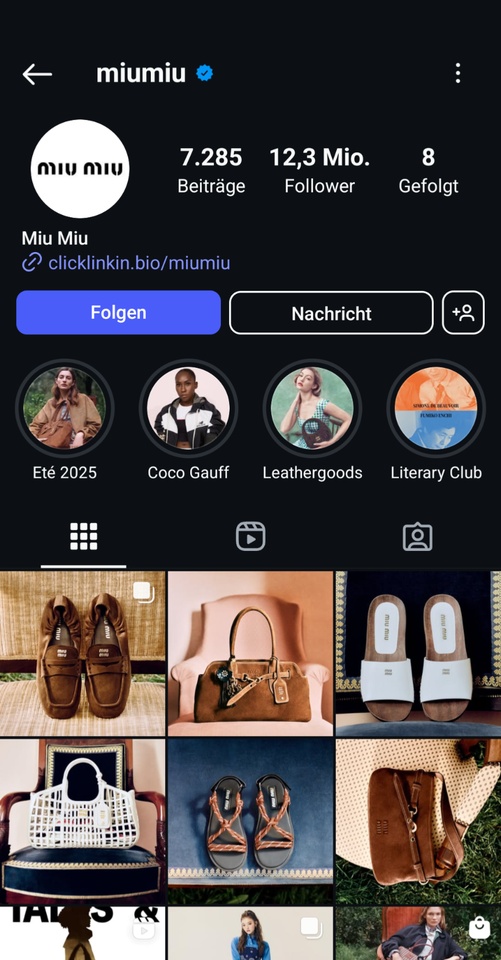

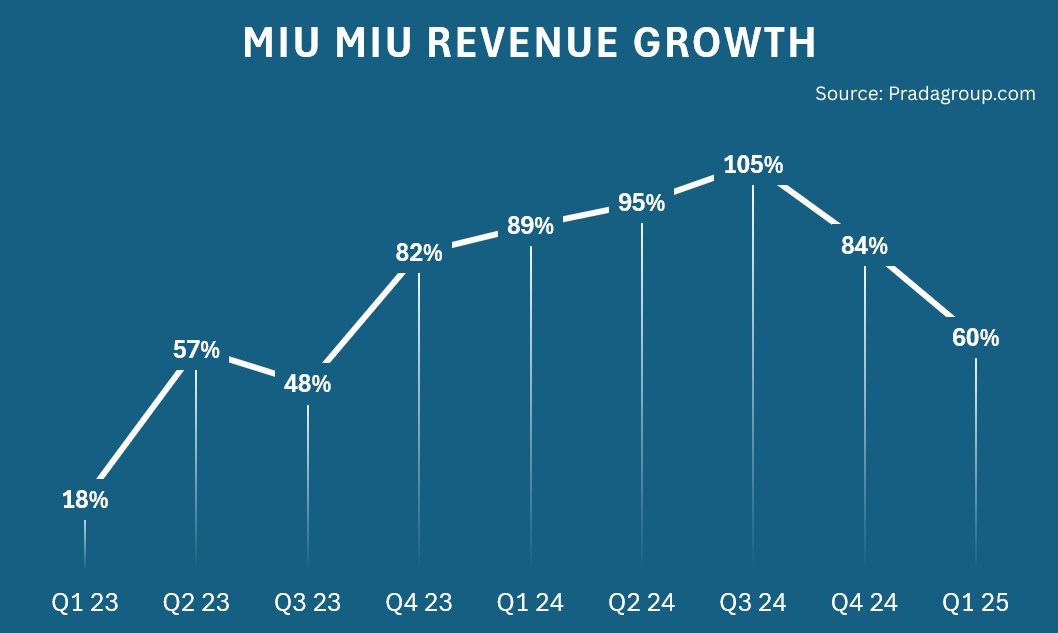

Miu Miu was launched by Miuccia Prada in 1993 and, with 147 stores worldwide, is no longer overshadowed by Prada. The impressive explosive growth in sales began in 2023 with 58% and continued with a further acceleration in the following year. The fashion appeals to young women in particular. Miu Miu stands out from the crowd with extravagant designs. This was fueled by TikTok trends, which increased the brand's popularity worldwide. This enormous popularity is also reflected in the figures: 86% sales growth in 2024 and 12 million followers on Instagram. Despite a slowdown in growth, most recently to 60% in the first quarter of 2025, the potential remains huge.

Furthermore, the rise of Miu Miu does not mean declining margins for the parent company. Although Prada Group does not have the specific margins of Miu Miu, the fact that profits have been rising disproportionately to sales for 4 years means that Miu Miu is probably even slightly more profitable than Prada itself. Miu Miu will therefore become increasingly important for the Prada Group. In 2023, the share of sales was still relatively low at 15%. At the beginning of this year, it was already at 31% and will increase further because the Prada brand is not growing strongly. In the long term, however, Miu Miu's sales growth is likely to level off at between 10-20%. Are there already plans to change the name to Miu Miu Group?

Versace

On April 10, 2025, Prada Group announced that it would acquire Versace, another Italian company, for an enterprise value of 1.25 billion euros. As Versace aims to achieve a turnover of 810 million this year, I think this is a relatively favorable deal. Ultimately, however, it remains a bet on increasing profitability, as Versace has a negative single-digit EBIT margin. Despite everything, the brand will account for around 13% of total sales in future, so I wouldn't attach that much importance to this acquisition. The share price did not react on the day of the announcement.

Holding structure

Prada Holding has almost complete control over the family business with an 80% stake. Miuccia Prada (granddaughter of founder Mario Prada and creative director of Miu Miu) and her husband Patrizio Bertelli (ex-CEO of Prada) are behind the holding company. The remaining shares are in free float. The shares are listed on the Hong Kong Stock Exchange. The number of shares remains constant at 2.56 billion outstanding shares.

Disclaimer

This is not investment advice. These are personal assessments that cannot replace professional advice. If you don't want to miss any further stock analyses from me, please subscribe to my free sub-subscription (link in profile).

Opportunities/risks

Miu Miu is both an opportunity and a risk. On the one hand, if Miu Miu can consolidate its popularity, it will replace Prada as the main source of sales and provide investors with many years of high single-digit profit growth. On the other hand, Kering shows what mismanagement can cause. Gucci is now shrinking for the third year in a row and there is no end in sight. The share price has fallen 77% from its high. However, the takeover of Versace means that Prada Group is continuing to diversify and its dependence on a single brand is decreasing.

Conclusion

Miu Miu's performance should be watched for future quarterly figures. If growth settles between 10 and 20 % in the long term, the share will remain interesting. Caution should be exercised if Miu Miu's figures show that the brand was just a hype that will disappear as quickly as it came.

(I am invested)