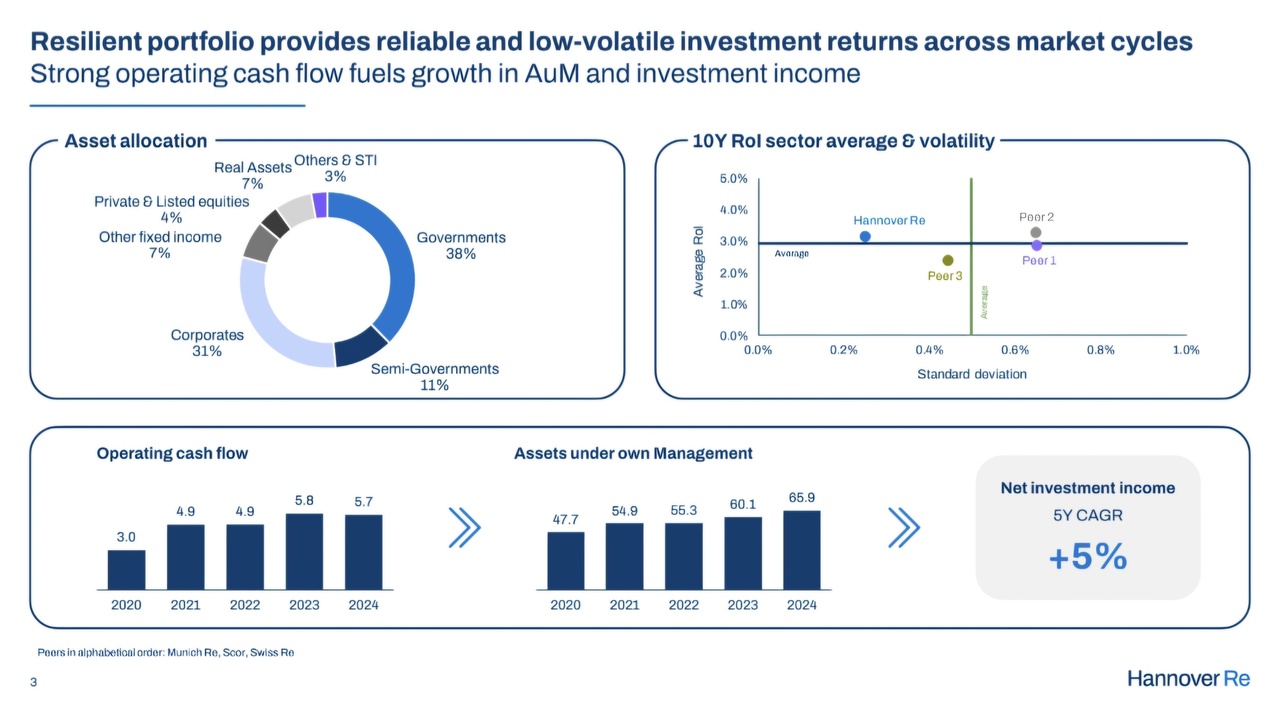

Hannover Re $HNR1 (+2,42 %) is well above its medium-term targets for 2024-2026. The company had set itself a return on equity of over 14% - it already reached 21.2% in 2024 and even 23% in the first half of 2025. The EBIT target of more than 5% growth was also far exceeded.

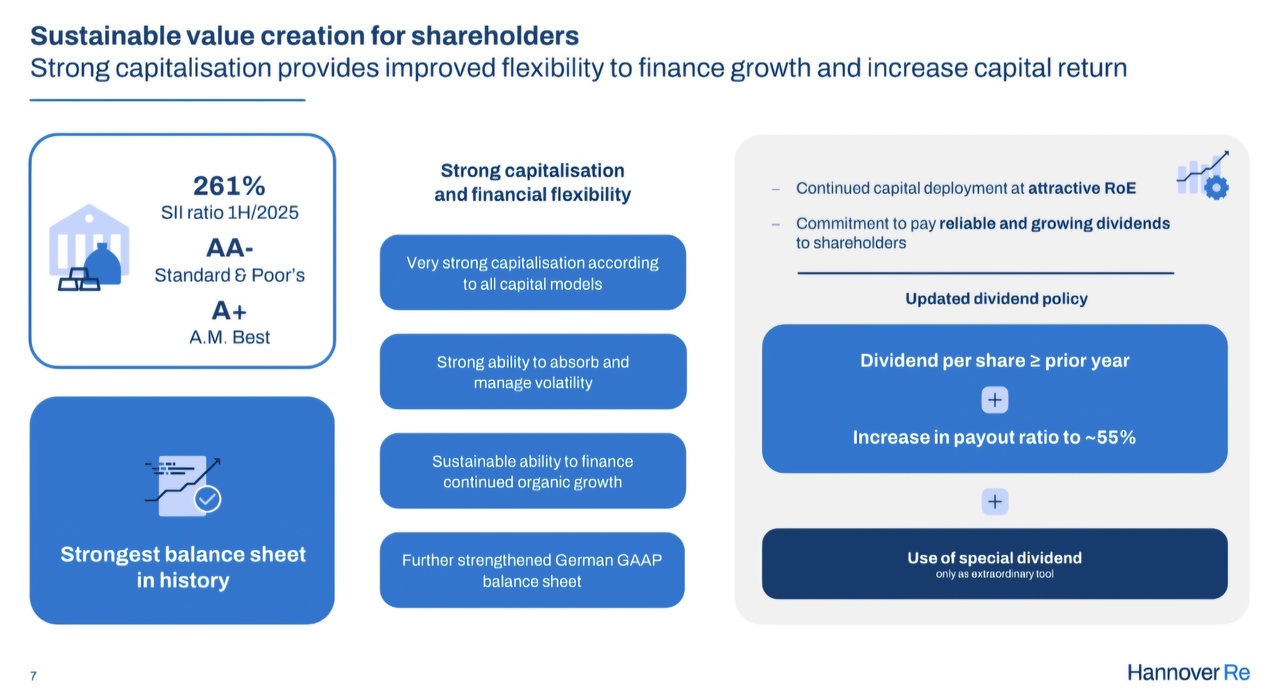

Hannover Re intends to continue this strong development until 2026 and at the same time ensure stability: At over 260%, the solvency ratio remains well above the target of 200%, while the CSM result (underwriting margin) continues to grow. In addition, the dividend is to continue to rise annually in the future; there is no information yet on the amount of the dividend.