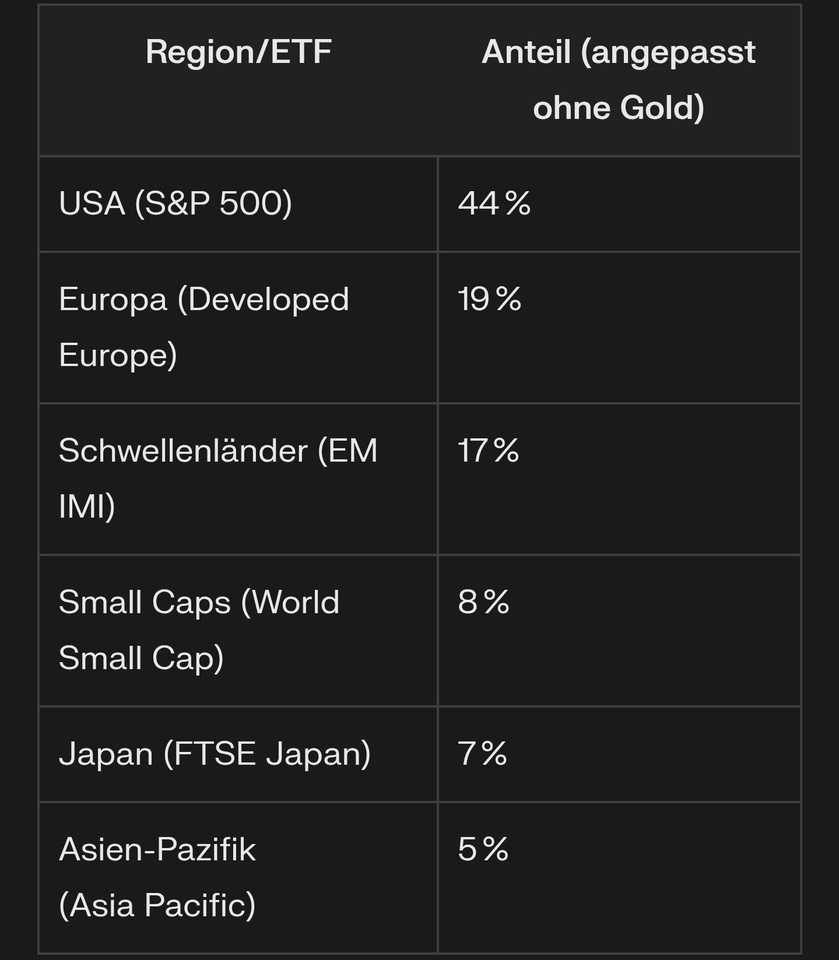

$SPY5 (+0,68 %)

$VWCG (+0,03 %)

$EIMI (+1,69 %)

$WSML (-0,21 %)

$VJPB (+0,49 %)

$CPXJ (+0,67 %)

Which of the three allocations do you think is best for a monthly savings plan? Or would you do it completely differently? If so, how?

I'm 30 and have a long investment horizon.

I already have these ETFs as core and don't really want to sell, otherwise I'll have to pay a lot of tax.