Hello my dears,

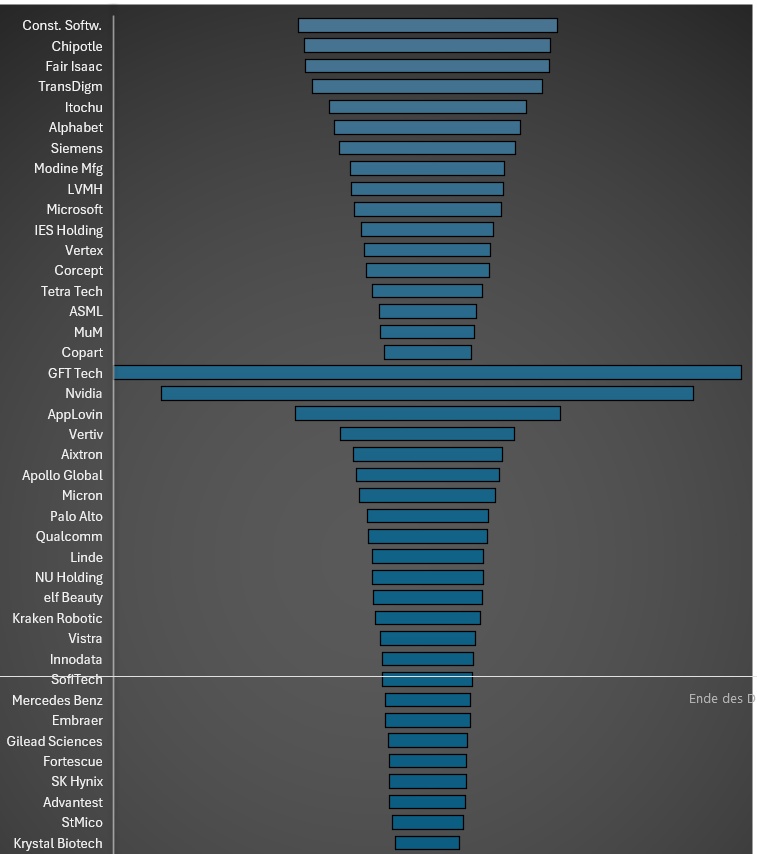

Today I'd like to give you a brief analysis of my portfolio in funnel form.

The upper funnel represents the core and the lower funnel the satellites.

What is striking here is the high cluster risk in Nvidia $NVDA (+2,11 %) and GFT technology $GFT (+1,86 %)

However, as I am still convinced of the two stocks, I am sticking with the large position. Nvidia is one of the largest positions in many ETFs, so I would almost include it in the core.

In the crypto area, I am still 0.89% in Defi Tech $DEFI (-4,27 %) and0.88% in Bitcoin $BITC (-1,91 %) which I will increase. Unfortunately, these positions were cut off at the bottom of the funnel.

I look forward to opinions and comments.