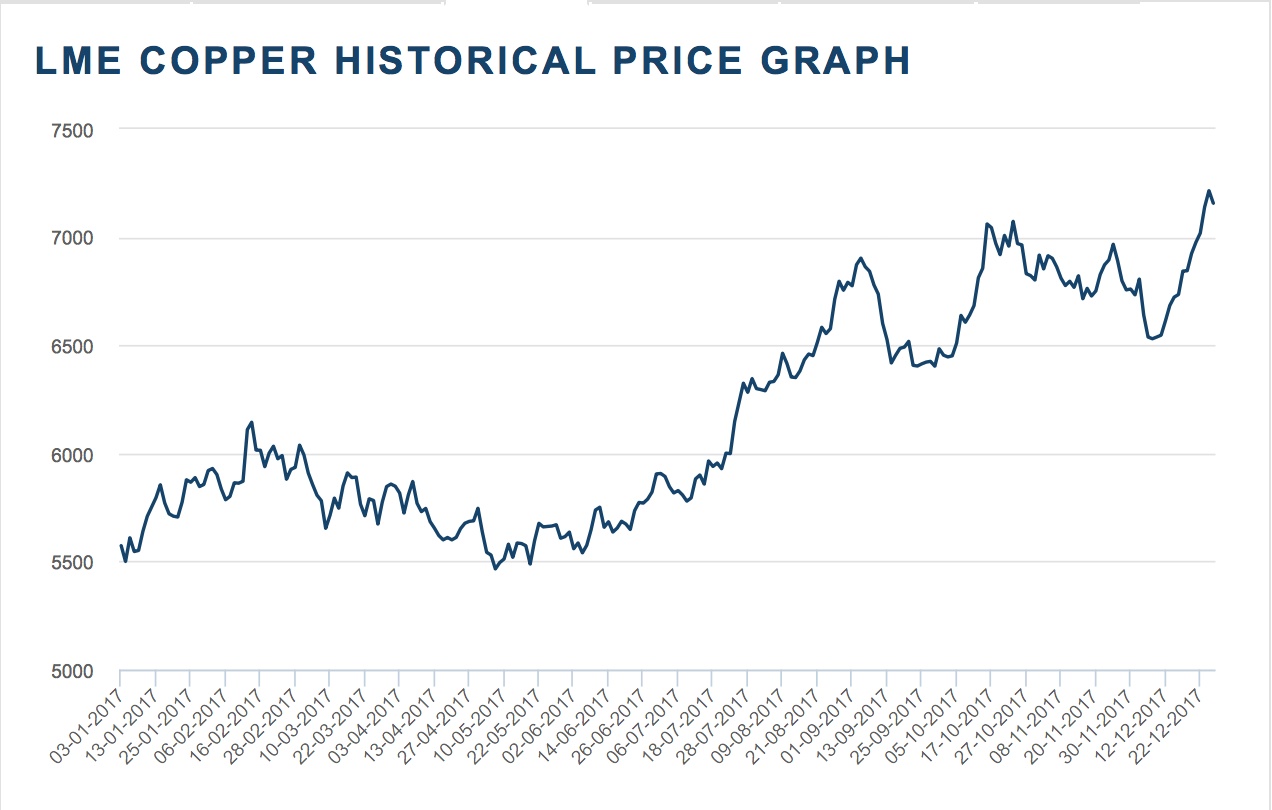

Copper performed strongly last year 📈. Accordingly, the question often arises as to whether it is too late to enter the market now. In my view, this concern is understandable, but falls short of the mark. The decisive factor is not so much past performance, but whether the fundamental drivers are still intact and, in my opinion, this is precisely the case with copper.

Why copper is benefiting structurally

Copper is one of the most important commodities in the global transformation. The current increase in demand is not based on short-term speculation, but on long-term developments:

- 🔌 progressive electrification of the economy

- ⚡ massive expansion and modernization of electricity grids

- 🚗 Increasing demand due to e-mobility (significantly higher copper demand than for combustion engines)

- 🌬️☀️ Expansion of renewable energies

- 🧠 Growing data center and AI infrastructure

These trends are politically desired, anchored in regulation and set to continue for years. Copper is physically required for this. There is hardly any way around it.

Supply side remains the limiting factor ⛏️

While demand is growing in the long term, supply is hardly flexible. New production capacities cannot be built up quickly:

- long lead times for new mines (often 10-15 years)

- Falling ore grades and rising extraction costs

- geopolitical risks in important producing countries

- stricter environmental and licensing requirements

Even higher prices will not solve these structural bottlenecks in the short term. This indicates that the market situation will remain tense.

Strong performance does not automatically mean "too late" 📈

Copper has already performed well, that is undisputed. For me, however, this is not an exclusion criterion. Above all, the price performance reflects

- a reassessment of long-term demand

- increasing supply shortages

- geopolitical and structural risks

As long as these factors persist, I believe it is plausible that copper will continue to play an important role in the future, despite the previous rally.

Copper as part of the portfolio strategy 🧱

I don't see a copper ETF as a short-term trade, but as a strategic addition:

- 🪙 real tangible asset with physical demand

- 🛡️ potential hedge against infrastructure and energy inflation

- 🌍 direct beneficiary of global megatrends

In my view, copper can help to make the portfolio broader and more robust, especially in the long term.

Timing is important - but not everything ⏳

Short-term setbacks are possible at any time ⚠️. However, those who wait for the perfect entry often remain on the sidelines permanently. A gradual entry can help or, as I do, simply invest a portion to position yourself and then take advantage of price fluctuations by making monthly deposits (€150) to reduce timing risks and still participate in the long-term development.

Conclusion

Despite the strong performance last year, I still consider copper to be an attractive investment 🔋🌍. The structural drivers are intact, supply remains limited and the importance of copper for energy, infrastructure and digitalization is likely to increase further. For me, copper is not hype, but a long-term portfolio building block.

Not investment advice - just my personal opinion.

Lg

Don