Hello my dears,

Recently I have presented a lot of stocks from the growth sectors.

So now it's time for me to introduce you to a stock from the boring consumer goods sector. But I don't find this share boring at all.

And for me it's a good alternative to the many boring consumer goods stocks.

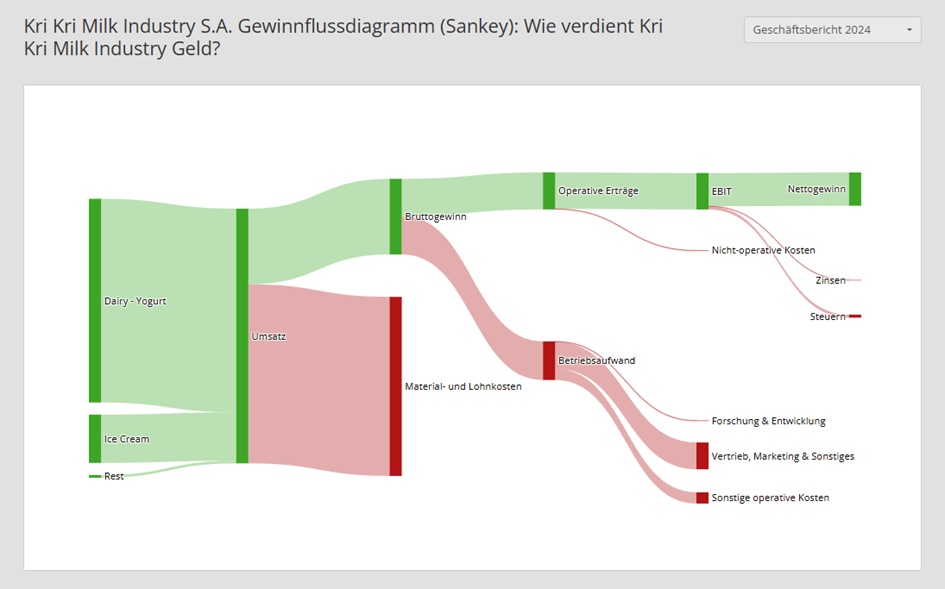

Kri Kri is a producer of yogurt, dairy products and ice cream. Food manufacturers are generally one of the more stable, less cyclical sectors. People eat even during recessions.

👍Kri Kri is storm-proof because:

- defensive sector (food)

- strong balance sheet

- strong long-term growth

- solid valuation

Ladies and gentlemen, I have seen in the forum that the company has already been presented several times. But due to the uncertain times, I wanted to remind you of the share once again.

What do you think of the company and are you perhaps already familiar with its products?

Does the rabbit @TradingHase like Greek yogurt?

Kri Kri Milk Industry SA is a company based in Greece that is mainly involved in the production and trade of ice cream, yogurt and milk. The ice cream production includes five product lines: Wafers, sundaes, ice cream scoops, sticks and ice cream sandwiches. Yoghurt production comprises five product lines: Natural, Traditional, Catering, Fruit and flavored yogurt for children under the brand name Scooby Doo. Milk production comprises four products: Pasteurized whole milk with 3.5% fat, Pasteurized semi-skimmed milk with 1.5% fat, Chocolate skimmed milk with 0% fat and AYRAN (KEFIR) KRI-KRI. The company also offers some of its products in family packs. KRI-KRI Milk S.A. also operates in the Balkan region through its 71%-owned subsidiary KRI-KRI DOO Kumanovo in Macedonia, which has its own production line for ice cream and yogurt, warehouses and refrigerated chambers. In February 2013, the company dissolved its subsidiary in Bulgaria, KRI KRI BULGARIA A.D.

Number of employees: 459

Investors presentation November 2025

Our story begins in 1954... when George Tsinavos, the founder of the company, opened a small pastry shop in Serres, producing and selling ice cream and confectionery in the town. Ice cream was first sold by street vendors with handcarts who used ice and salt to cool it. Kri Kri ice creams and especially cassata, a "special" ice cream made from sheep's milk with a very rich flavor, began to become popular outside the town of Serres.

In the 1960s, the first electric freezers for ice cream appeared on the market in Serres. At the same time, the facilities of the small local company were moved to new, privately owned premises and a few years later the company acquired its first automatic production line for ice cream, heralding the beginning of a new era, as it had been made by hand until then.

The 1980s and 90s marked the further development of the company, on the one hand with the construction of the new factory (1987) and on the other hand with the production of yogurt, when traditional sheep's and cow's milk yogurt made from fresh milk from the Serres prefecture went into production. In the mid-1990s, Kri Kri set up a branch in Attica and gradually built up a distribution network for its products throughout Greece.

In 2000, Kri Kri launched family yogurt under the brand name "Spitiko" and received its first market research ratings.

Today, after a successful 70-year career and continuous investments, Kri Kri ranks among the most dynamic sectors of dairy products and aims to further strengthen its growth prospects both in Greece and abroad.

Performance

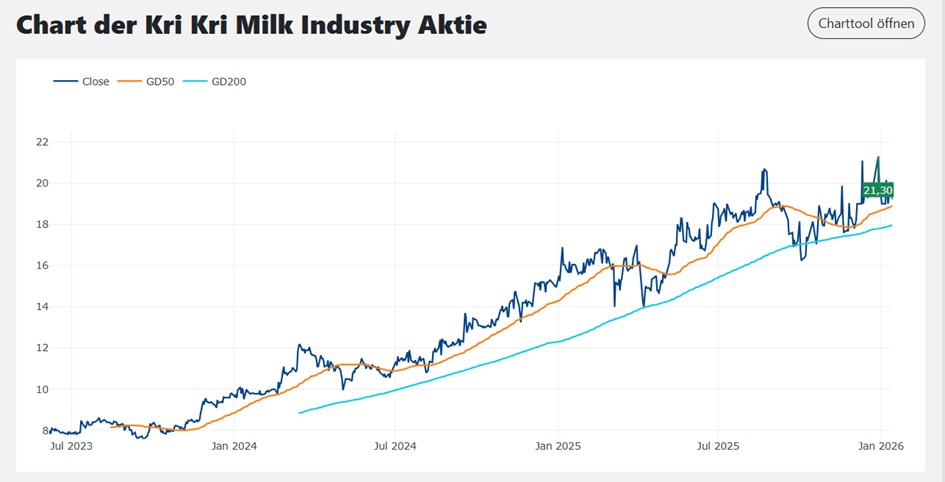

20 years +1,628.45 %

15 years +2,345.12 %

10 years +1,020.11 %

5 years +203.79 %

1 year +26.10 %

Current year +5.53 %

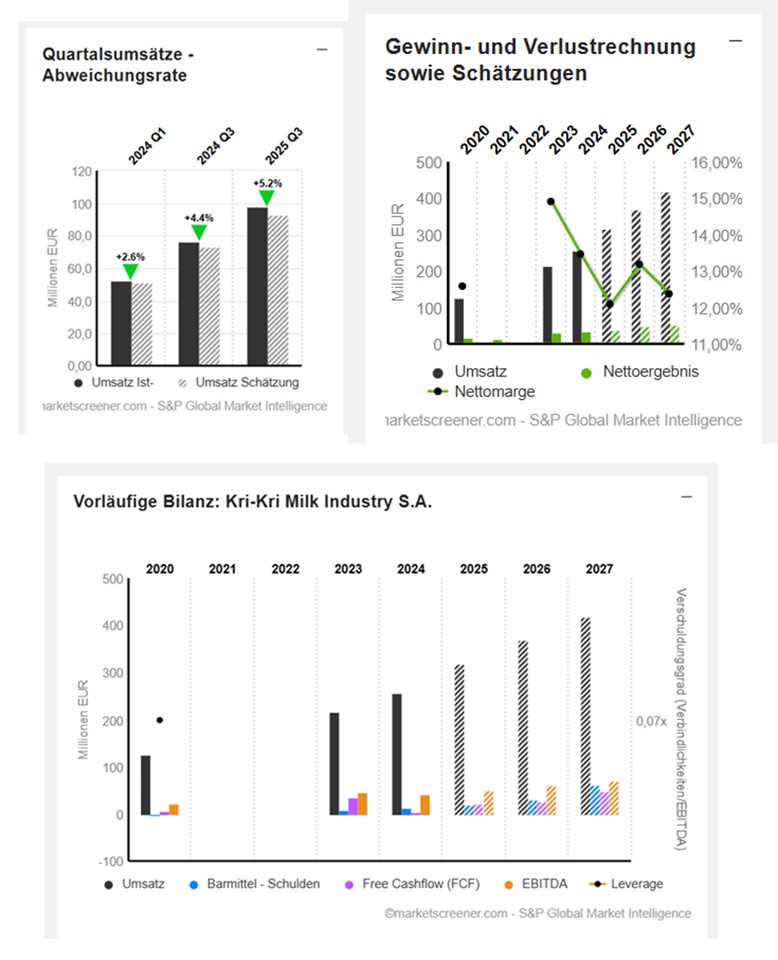

EUR in millions

Estimates

Year Turnover Change

2024 256,4 18,52 %

2025 317,7 23,91 %

2026 369,6 16,35 %

2027 419 13,35 %

Year EBIT change

2024 37,25 -7,52 %

2025 43,4 16,51 %

2026 53,97 24,35 %

2027 61,97 14,82 %

Year Net result Change

2024 34,55 7,06%

2025 38,4 11,15 %

2026 48,7 26,82 %

2027 51,9 6,57 %

Year Net debt CAPEX

2024 -12,2 26,66

2025 -18,9 23,1

2026 -31,6 25,05

2027 -62,6 17,05

Year Free cash flow Change

2024 3,316 -90,62 %

2025 20,7 524,17 %

2026 25,8 24,64 %

2027 49,4 91,47 %

Year EBIT margin ROE

2024 14,53 % 29,76 %

2025 13,66 % 27,4 %

2026 14,6 % 28,6 %

2027 14,79 % 25,5 %

Sector comparison EBIT margin 2026

Nestle 16.13 %

Unilever 19.48 %

Year Dividend Yield

2024 0,4 2,67 %

2025 0,45 2,25 %

2026 0,56 2,81 %

2027 0,6 3,01 %

Year P/E ratio PEG

2024 14.3x 2.03x

2025 16,22x

2026 12,89x

Sector comparison P/E ratio 2026 Earnings growth 2026

EMMI AG 17.1x +5.54 %

Nestle 18.26x +2.39 %

Unilever 17.51x +7.67 %

Magnum 24.21x -19.05 %

KRI-KRI 12.89x +26.82 %

KRI-KRI

Market value 658

Number of shares (in thousands) 32,966

Date of publication 15.04.2025