For the contrarian investors only. My strategy is simple, buy good companies based on fundamentals that are selling at a low valuation due to bad sentiment and FUD. It’s a low risk, high reward strategy. It’s has done well for me.

I started the year strong in march buying ULTA and GOOG in April. Both went up so fast in a short amount of time, that I decided to take big profits. Also bought UNH and took smaller profits after seeing a better investment. Wallstreet finally showing some love to BABA helped my portfolio perform very well.

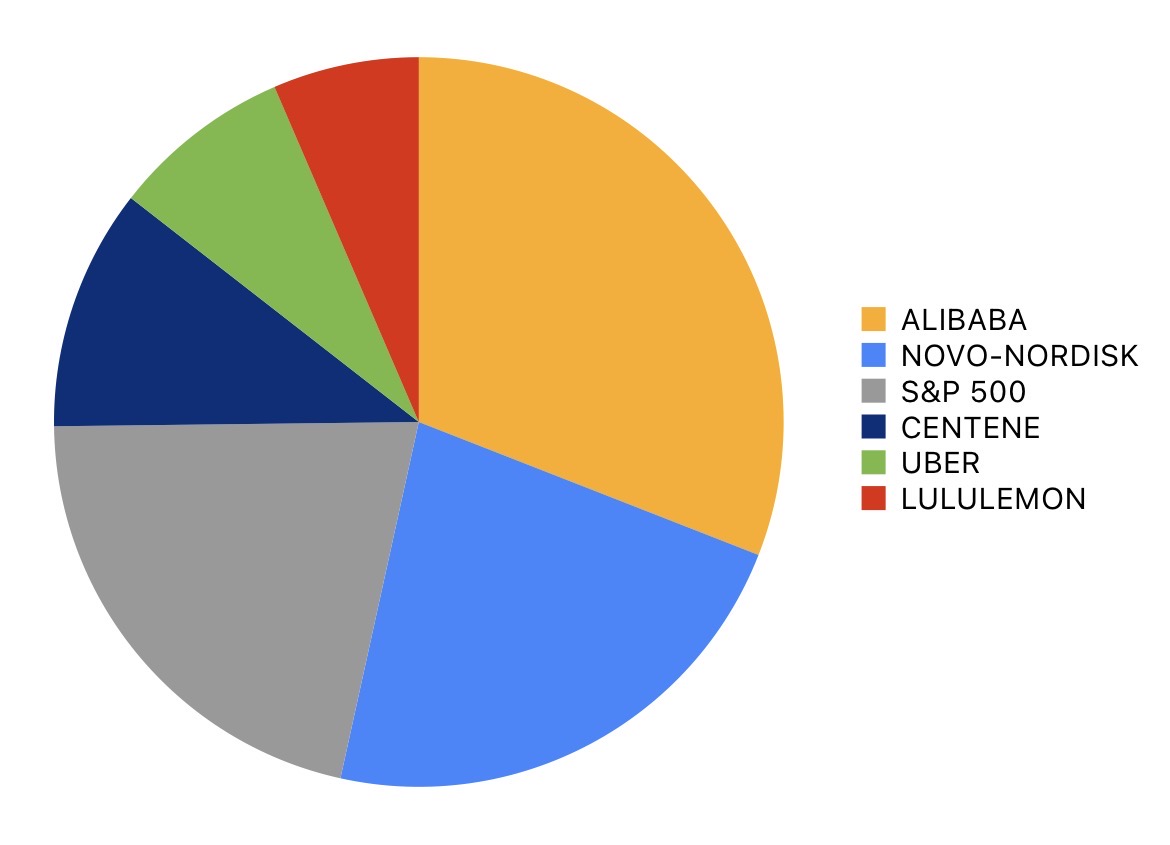

Now for the main portfolio I’ll take into 2026:

$BABA (+0,17 %) : I’ve bought and held for many years, it’s definitely not an investment for everyone. This is my China tech, AI and e-commerce play. I will always have 12-15% of my portfolio in China, which means I’m ready to trim it down the next few years.

$NVO (+2,85 %) : a newer position I added at the end of October. The sentiment is so bad for this stock that it presents a golden opportunity to buy a fast growing wide moat company at a huge discount. I’m not gonna say much more about novo because I’m sure you’ve seen thousands of people talk about it. This is a 5-10 year hold, but will trim if it pulls a quick recovery

S&P 500: The anchor. Forever hold.

$CNC (+0,12 %) : Added at the end of July, part of the healthcare rebound play. Their earnings are expected to normalize and get back to good cashflow generation in 2026-27. This is a valuation play, but if they execute on FCF generation, this can turn into longterm hold!

$UBER (+0,49 %) : New position added using the funds from UNH, they went from being a cash burner to a cash generator. Extremely undervalued. This is a 5-10 year hold, and will continue to DCA especially below 80.

$LULU (+0,11 %) : Added this late September, but held off buying more because I thought NVO was even lower risk and higher reward. Because I wasn’t able to build a full position I will look to close it when it reaches my target price of 300-320. pure valuation play.

$MNDY (+1,75 %) : this stock I don’t own, but will start accumulating shares this year. SaaS companies has been beaten down recently. Monday has strong cashflow generation and it’s a fast growing company. I believe it’s very undervalued based on their growth 🙂

Good lucky to all