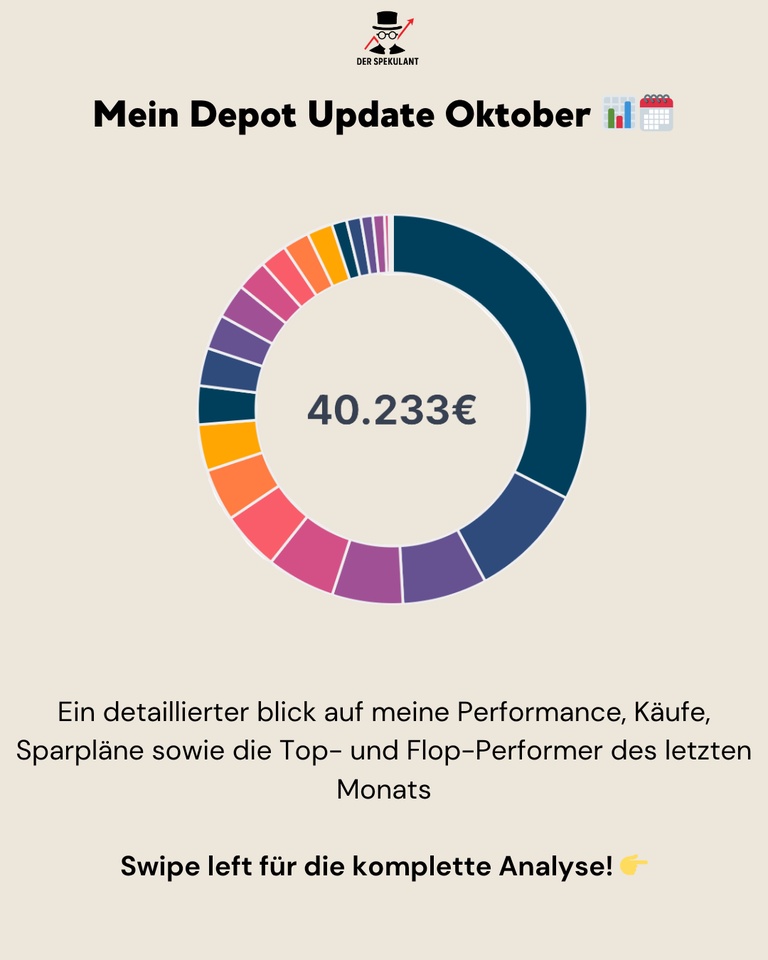

After a volatile September with +6,2% the stabilization continued in October. My portfolio rose to 40.233 € and increased by +2,80 % slightly weaker than the NASDAQ 100 (+6.95 %)but still solidly in the green. While the major indices were driven by big tech, my portfolio once again showed strength in niche and future themes. ⚙️

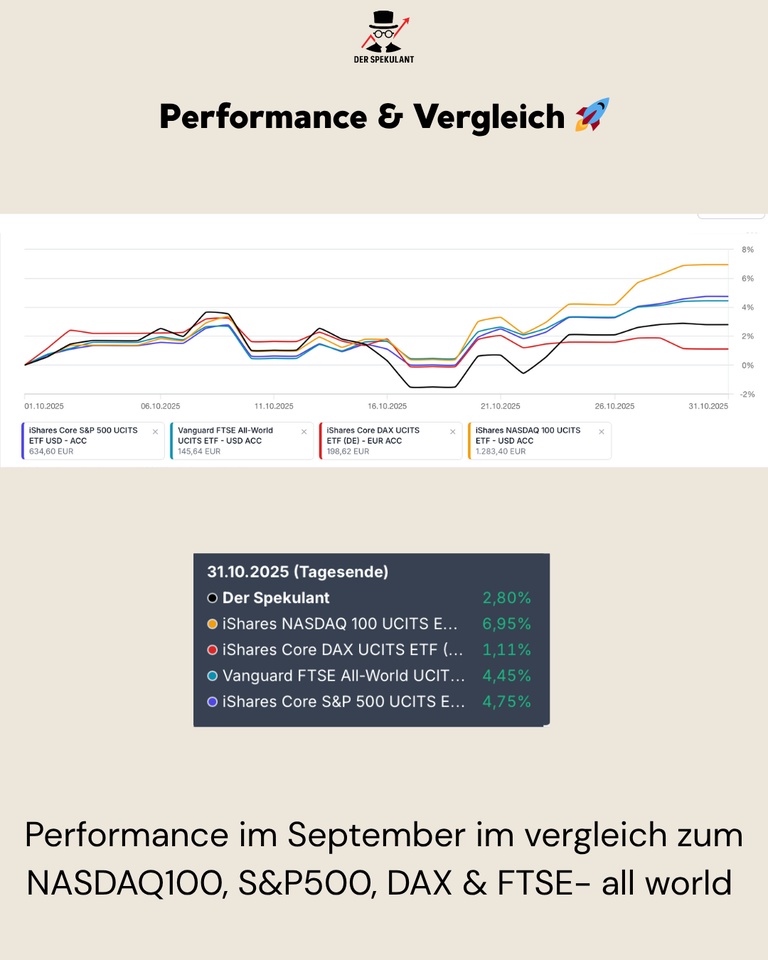

1. performance & comparison 🚀

There was a moderate recovery over the course of the month: while the markets initially fluctuated, momentum returned towards the end.

With +2,8 % my portfolio remained below the NASDAQ 100, but performed better than broader indices such as the FTSE All World (+4.45 %) and DAX (+4.11 %) stable.

Particularly positive: the continued consolidation following the tech rallies of the previous months.

2. my savings plans & allocation 💶

My focus remains clear: managing liquidity and making targeted use of opportunities.

Since October, my new savings plan has been running on the Euro Overnight Rate Swap ETF (€ 500 per month) - as a flexible, interest-bearing "cash parking space" with daily liquidity and currently over 3.9 % return p.a. This allows me to keep capital ready to invest in quality shares in the event of setbacks.

3rd top mover in October 🟢

The month was led by IREN $IREN (+13,23 %)

(+25,8 %)which once again benefited from the massive demand for computing power for AI. Also Snowflake $SNOW (+2,12 %)

(+22,8 %) also made strong gains as investors increasingly focused on data-driven platforms again. The VanEck Uranium & Nuclear Energy ETF (+18.5 %) $NUKL (-4,07 %) rose significantly, driven by the ongoing global reassessment of nuclear energy as a stable and low-carbon energy source. Geopolitical tensions and supply bottlenecks provided an additional boost. While American Lithium (+15.4 %) was supported by positive industry news. Also CrowdStrike $CRWD (+2,19 %)

(+14 %) also impressed with strong demand in the cybersecurity segment and Datadog $DDOG (-0,53 %)

(+12,2 %) benefited from robust cloud spending by large companies.

4th flop mover in October 🔴

On the losing side was Ferrari $RACE (-1,7 %)

(-17,1 %)which was burdened by profit-taking and a more cautious outlook after a strong summer quarter. Tomra Systems $TOM (-2,31 %)

(-15 %) corrected after weaker volume growth, while Rheinmetall $RHM (+3,82 %)

(-14,1 %) suffered from geopolitical uncertainty despite a high order situation. Also Novo Nordisk $NOVO B (-1,05 %)

(-6,8 %) also fell further as regulatory risks surrounding GLP-1 once again came into focus. BYD $1211 (-2,5 %)

(-5,9 %) was volatile, weighed down by price pressure in China, while even Berkshire Hathaway $BRK.B (+0,32 %)

(-2,7 %) closed slightly in the red.

5. conclusion 💡

October showed: Rotation instead of rally. Techs with real profitability are gaining momentum again, while overheated stocks are consolidating.

With the overnight ETF, I am deliberately building up a strategic "interest rate anchor" in order to remain flexible in the coming months.

My focus remains clear: Quality, liquidity and long-term scaling.

❓ Question for the community:

Which stock surprised you the most in October - positive or negative?

👇 Write it in the comments!