Everyone only ever shows their winners, but let's be honest - that's boring.

I'm going to turn the tables and present you with my own personal financial disasters. Because who diamond hands need a thick skin.

My investment strategy?

- Hold for at least Hold for 5-10 years (i.e. enough time to ride out a complete market crisis).

- A maximum of 1% of the portfolio in speculative stocks (haha, if only that were the case).

- No stop loss, because I prefer to look straight into the abyss.

Here are my highlights from the "Let's burn down the portfolio!"-category:

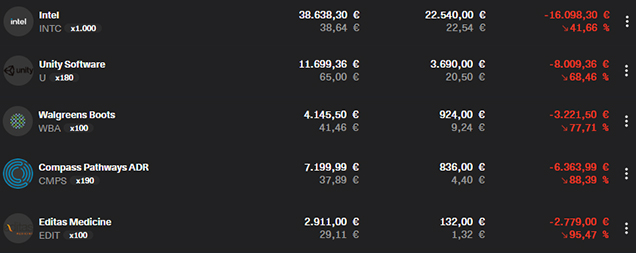

Intel (-41%) $INTC (+2,73 %)

I thought I was buying a solid chip giant. Turns out: I bought a museum walk through the glory days of 1995. While Nvidia is flying to the moon, Intel is barely keeping its head above water like an old Windows 98 computer.

Unity Software (-68%) $U (+1,09 %)

"Gaming is the future! Unity is THE platform for developers!" - At least that's what I thought. In reality, Unity has bugged itself so badly that not even a game patch would help. At least I have the consolation that my shares are more lag than a mobile game with too much advertising.

Walgreens Boots Alliance (-77%) $WBA

Pharmacies? Safe bet! People always get sick! It's just stupid when a company is managed in such a way that even a pharmaceutical giant looks like it has overdosed itself.

Compass Pathways (-88%) $5Y6A

Psychedelic therapy is the future! Or so I thought. But my investment journey was more like a wild drug trip that ended directly in the financial hole. Instead of astral travel, it was just capital destruction.

Edita's Medicine (-95%) $EDIT (+0,58 %)

Genetic engineering and CRISPR? Technology of the future! It's just a shame that my investment was deleted faster than faulty DNA. Editas has actually managed to edit itself out - and my capital along with it.

And you?

Do you also have a "Loss P0rn" story you want to share?

Or are you smarter than me and use stop losses? 😂