$BTC (-4,89 %)

ETFs vs. $965515 (+3,68 %)

ETFs

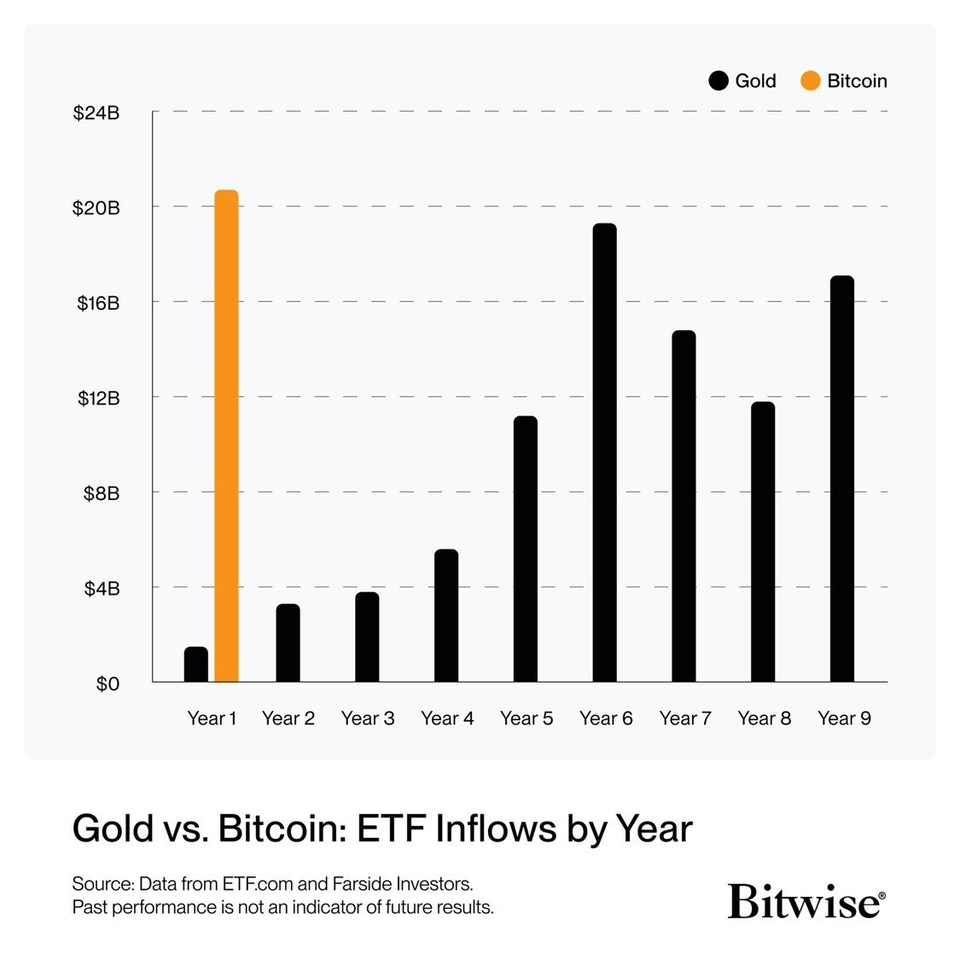

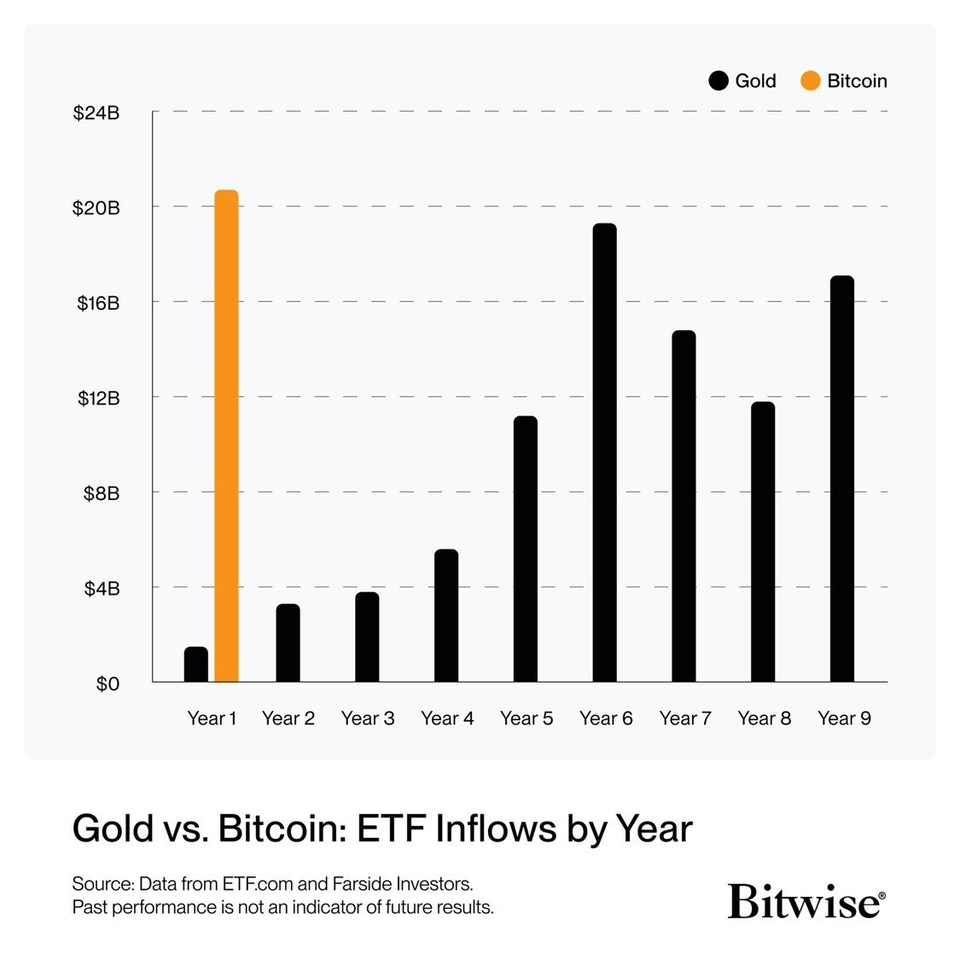

The Bitcoin Spot ETFs have already generated more than 20 billion dollars inflows. That is more than the gold ETFs received after 10 years. That's crazy🤯

$BTC (-4,89 %)

ETFs vs. $965515 (+3,68 %)

ETFs

The Bitcoin Spot ETFs have already generated more than 20 billion dollars inflows. That is more than the gold ETFs received after 10 years. That's crazy🤯