Two more to go on my 2026 conviction list, and the next one is another software name I am heavily exposed to: Constellation Software.

I will admit it openly, I bought too early. Way too early. My first position was opened at $3,600 CAD, and I added a few times after that. But my conviction does not depend on whether the stock trades at $4,000 or $2,500. The thesis remains intact.

Yes, Mark Leonard, arguably the Gandalf of software capital allocation, stepping down due to health concerns was a blow. Leadership transitions always create uncertainty. But what made Constellation exceptional over the years was never just one individual. It was the culture. That decentralized, disciplined, acquisition-driven culture remains firmly in place under the new CEO.

Constellation’s strategy is simple in theory and incredibly hard to replicate in practice. The company acquires niche vertical software businesses, leaves them largely autonomous, and deploys capital with extreme discipline. It focuses on mission-critical, often boring software providers that serve small and mid-sized businesses in very specific industries. These are not flashy AI startups chasing headlines. These are companies that run payroll systems, industry-specific ERP tools, or highly specialized workflow software.

The recent selloff, like with many other software names, has largely been attributed to AI fears. I think those concerns are massively exaggerated, just as they are for Microsoft or ServiceNow. In Constellation’s case, the insulation might even be stronger. The customers they serve are exactly the types of businesses that will not have 16-year-old math prodigies building custom AI tools in a storage closet. They rely on stable, purpose-built systems, and switching is expensive and risky.

Even if AI-native competitors eventually emerge in some of these vertical niches, nothing prevents Constellation from acquiring them. That is the beauty of its model. It adapts by buying, not by trying to reinvent itself from scratch.

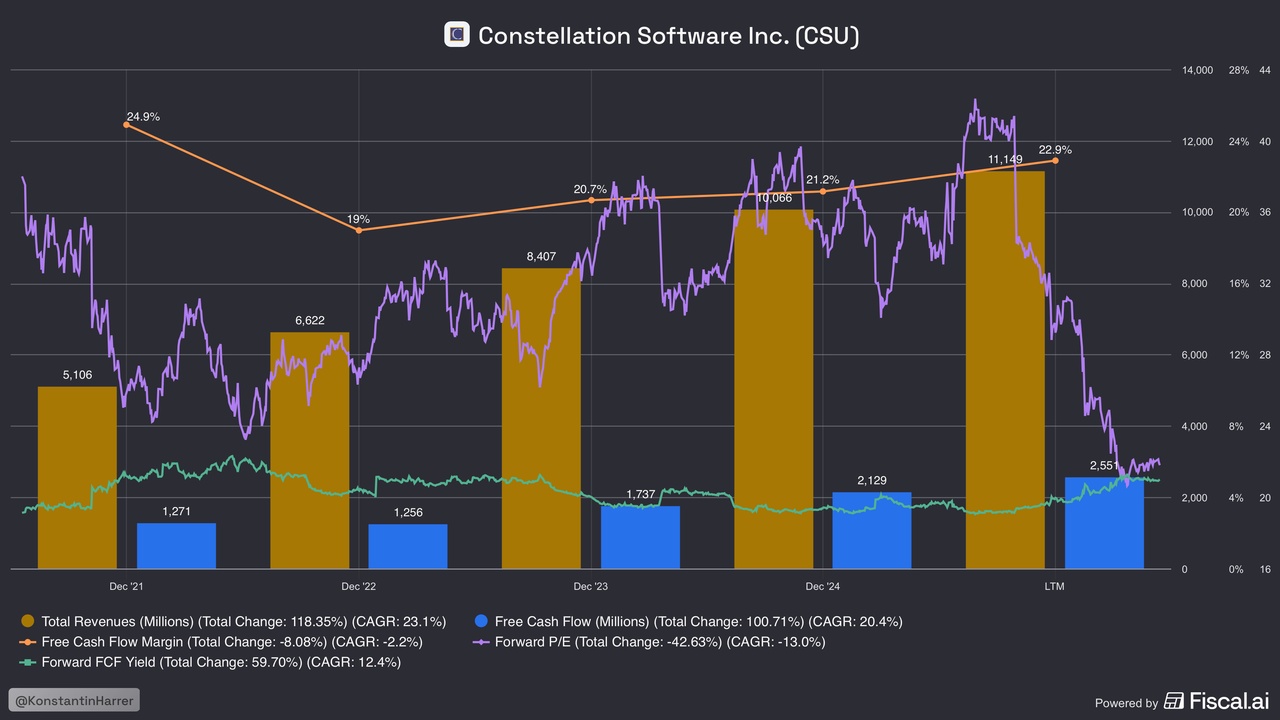

Looking forward, revenue and cash flow are projected to grow in the mid to high teens. At current levels, the stock trades at roughly a 6.6% free cash flow yield, which is historically elevated. On FY27 cash flow estimates, that yield approaches 10%. For a business with this track record of capital allocation, that is compelling.

The only reason I am not aggressively adding at the moment is allocation discipline. I already hold a considerable position, and I see other opportunities that may offer higher short-term upside. But in terms of quality, culture, and long-term capital compounding, Constellation remains one of the most unique businesses in my entire portfolio.